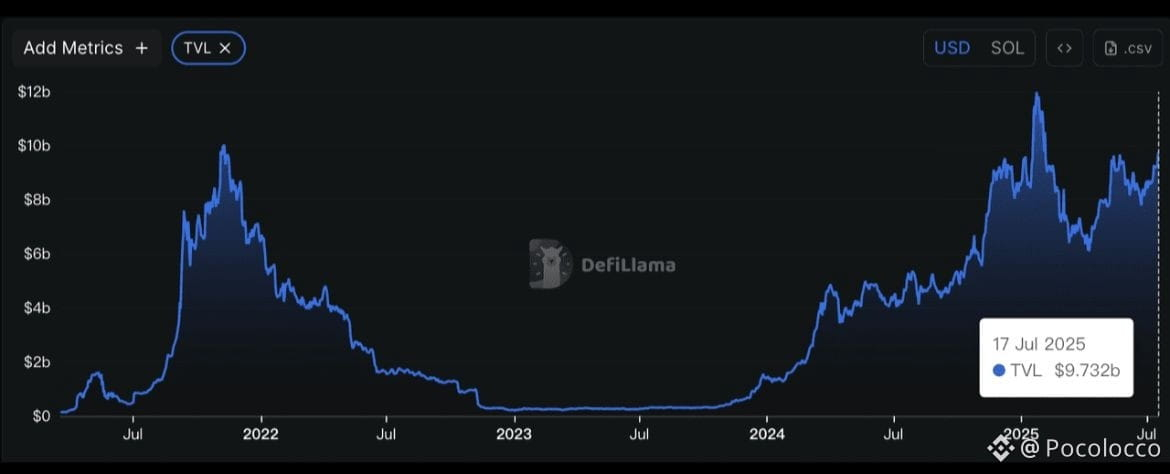

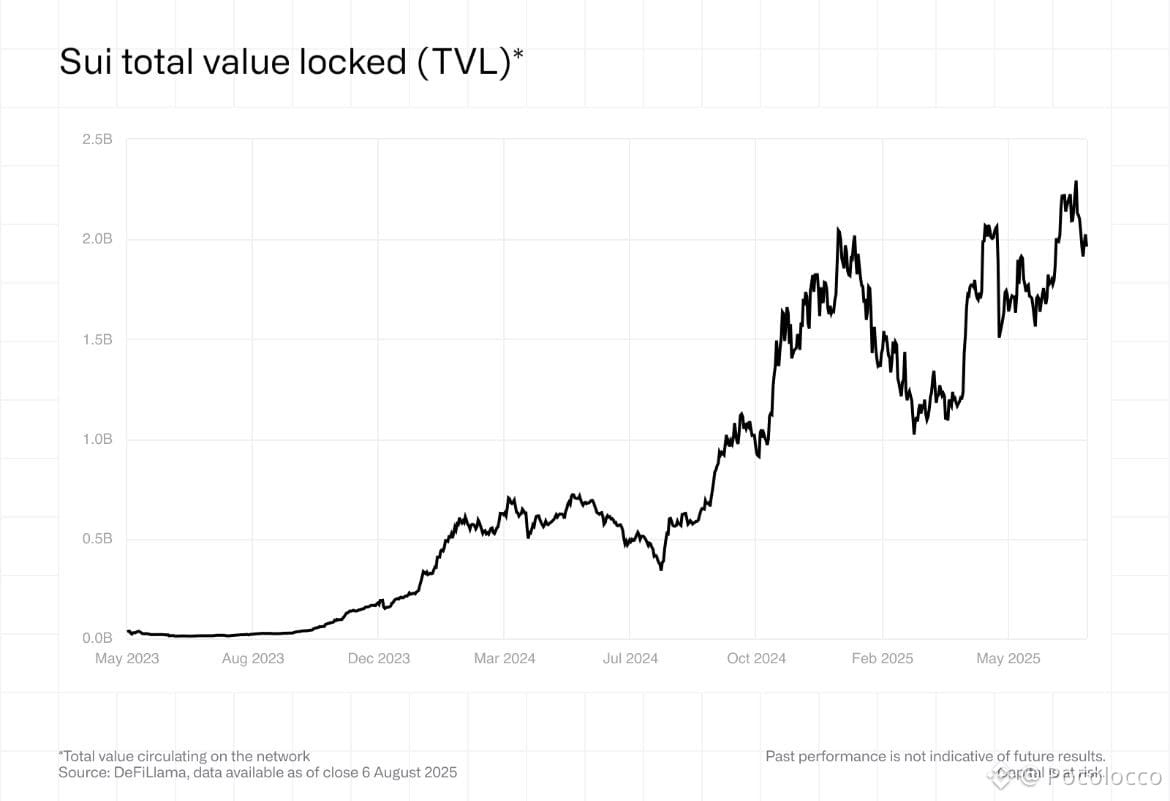

Let’s be honest ,while everyone was screaming about $SOL hitting new levels last year, $SUI has been quietly putting in the work. I’ve spent the last few days digging into the on-chain metrics, and what I found is a massive disconnect between the Price and the Network Utility. We are currently sitting in a $0.85–$1.10 range, and the "weak hands" are getting bored. But in my experience, boredom is exactly when the smart money builds their position.

The "Real-Life" Reason SUI is Holding the Line

The biggest mistake people make is treating SUI like a 2021-era altcoin. In 2026, SUI isn't just a "fast blockchain"—it’s an institutional infrastructure play.

* The "WaaP" Revolution: Just yesterday, Wallet-as-a-Protocol (WaaP) launched on Sui. This allows developers to onboard users via FaceID or Google without seed phrases. My take? This is the "Holy Grail" of mass adoption that we’ve been waiting for.

* Institutional Yield: SUI Group just launched the suiUSDe Vault with Ethena. We aren't just talking about degen farming anymore; we are seeing institutional-grade stablecoin yields being settled on-chain.

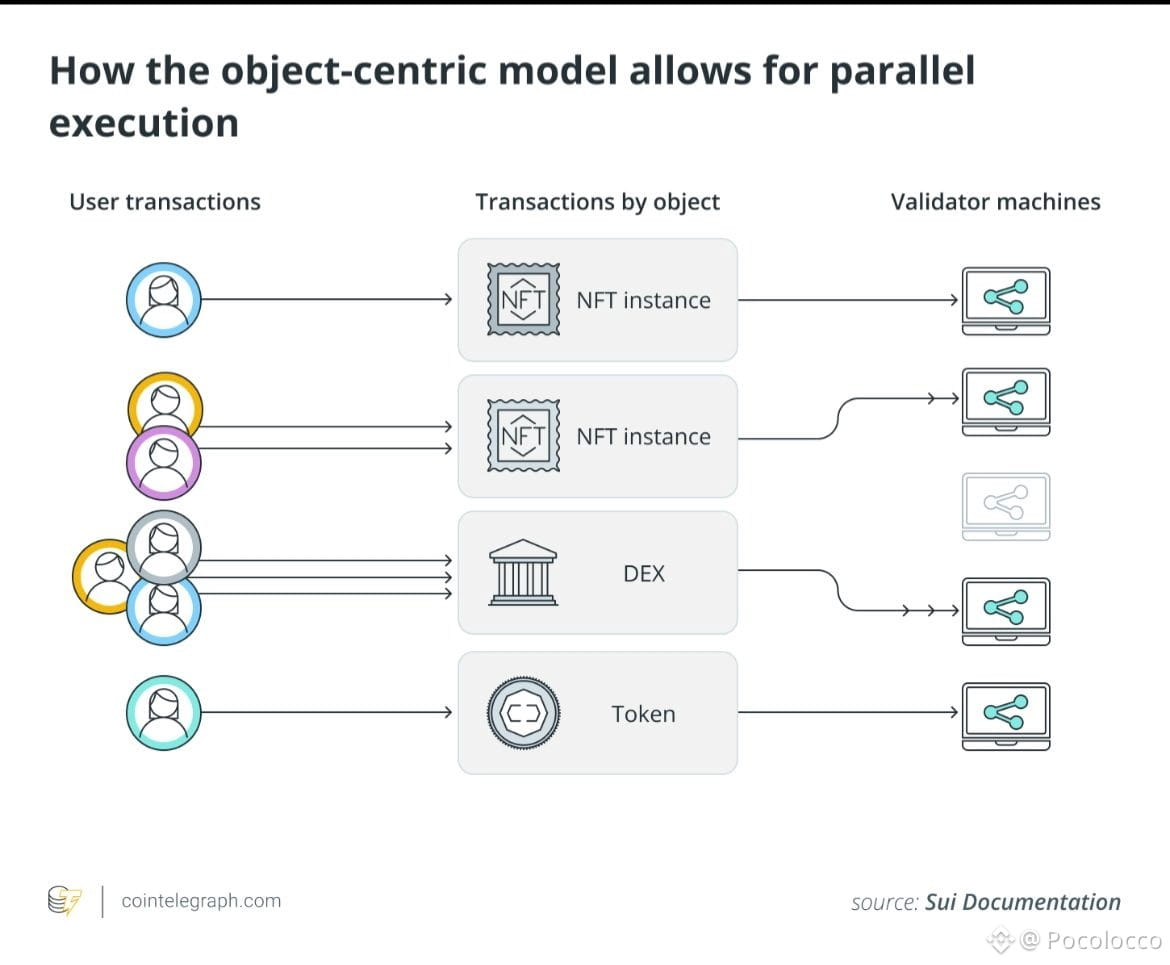

* The "Object" Advantage: Unlike Solana’s account-based model, Sui’s Object-Centric architecture allows it to handle 297,000 TPS without the network "hiccups" we see elsewhere.

🚀 The 2026 Roadmap: Why "Q2" is the Target

We are currently in the "Accumulation Phase" before two massive catalysts hit the mainnet:

* Protocol-Level Privacy: Later this year, SUI is baking privacy directly into the base layer. No more mixers or external tools. This is what regulated banks have been demanding before moving serious capital.

* DeepBook v3: The native central limit order book is getting an institutional upgrade. This will turn SUI into the most liquid DeFi hub for high-frequency traders.

💡 The "Narrative Hunter" Tip: I’m watching the $0.91 support level like a hawk. As long as we hold above that, the bearish structure is just a "liquidity grab" before a move toward the $1.64 resistance.

📉 My Personal $SUI Strategy (No Hype, Just Facts)

I’m not looking for a 100x overnight. I’m looking for the Infrastructure Flip. Here is how I’m positioning my bag:

* The Staking Play: I’m staking my SUI through the Bluefin ecosystem to earn native yield + ecosystem points. If you aren't earning while you wait, you're losing.

* The xBTC Bridge: I’m using the new xBTC on Sui to put my Bitcoin to work in DeFi. SUI is making BTC "active" capital for the first time in a meaningful way.

🚦 The February "Hunter" Playbook for $SUI

Trading Scenarios & My Actions

1. The Bounce ($1.28 – $1.40)

• Take initial profits.

• Wait for the price to retest before making the next move.

2. The Chop ($0.92 – $1.05)

• Use a standard DCA (Dollar Cost Averaging) approach.

• Gradually accumulate positions without rushing.

3. The Flush ($0.75 – $0.82)

• Look for a “sniper” entry , buying aggressively at strong support.

• Increase position if the opportunity is right (“back up the truck”).

🏁 The Bottom Line: Don't Get Shaken Out

My final judgment? SUI is technically superior to almost every other L1, but its price is currently suppressed by a "hidden tax" of vesting unlocks. However, with Grayscale and 21Shares now launching SUI-based products, the institutional "absorption" is finally beginning.

I’m not trading the daily candles; I’m trading the 2026 Stack. Are you a "Sui-nami" believer or are you waiting for $2.00 to buy the FOMO?

Let’s talk strategy: Drop your SUI average entry price below!