Markets are on edge today, February 13, 2026, as the U.S. government releases the inflation (CPI) data for January. While most people just look at one big number, there are three hidden things actually driving the market.

1.The "Hidden" Inflation Number

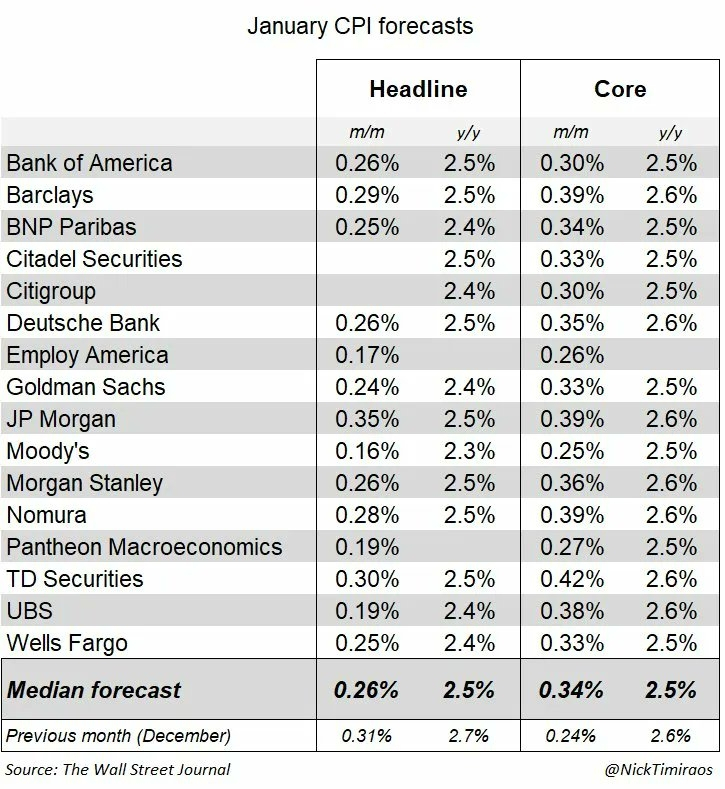

The headline number is expected to drop to 2.5% (down from 2.7%). This sounds like good news, but experts are worried about "Core CPI." This is the price of things like clothes and services, excluding food and gas. Banks like JP Morgan and Goldman Sachs expect this to stay "sticky" at around 0.34% for the month. If this number doesn't drop, it means inflation isn't really gone, and the Federal Reserve will likely keep interest rates high for longer.

2.The January Price Jump

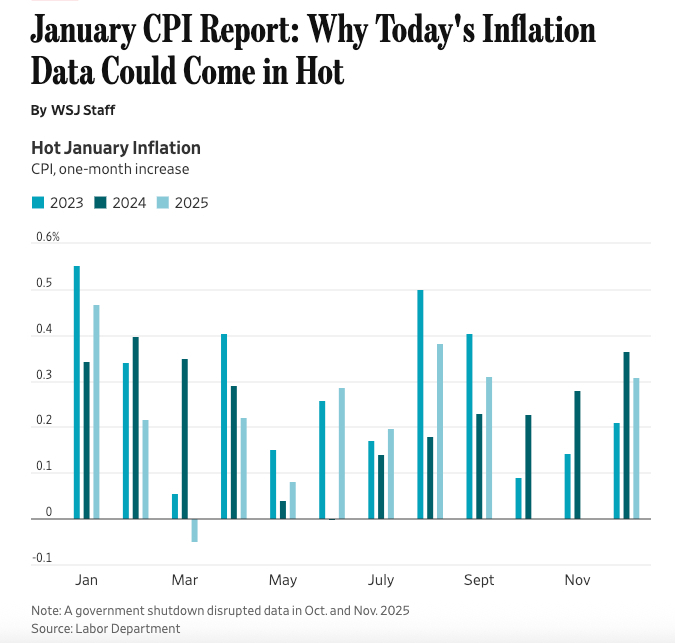

History shows that companies often raise their prices right at the start of the new year. This "January Effect" has caused inflation to spike in each of the last three years (2023–2025).

With new tariffs also starting to push up the cost of imported goods, there is a real chance today’s report could be "hotter" (higher) than the experts predicted.

3.Government Data vs. Real Life

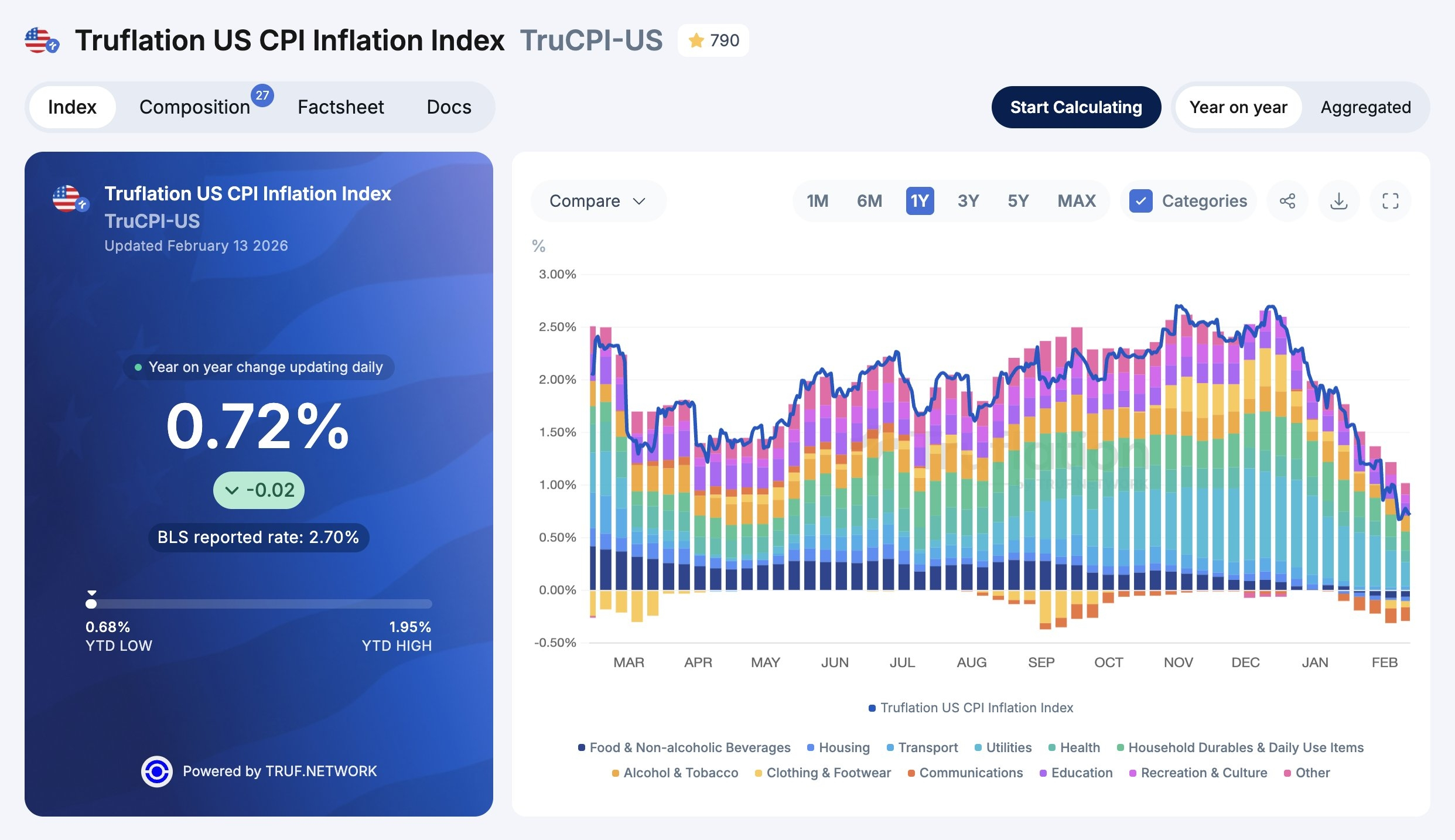

The most interesting part? Independent, real-time data from Truflation shows inflation is actually way lower—around 0.72%.

The government's official data is slow and relies on old housing math. Truflation looks at millions of price points in real-time. This suggests that while inflation might actually be dead in the real world, the government's "lagging" report might still show it's high, potentially tricking the Fed into keeping the economy under too much pressure.