When I first took a close look at Fogo, it wasn’t the speed claims or performance stats that caught my eye. What really stood out was how unconcerned it seemed about explaining every technical layer to me. At first that felt strange, almost like something was missing. Then it clicked. Maybe the goal isn’t to impress with complexity, but to make the experience simple enough that the mechanics don’t need constant attention.

fogo is still early, and the market is treating it that way. Price swings have been sharp, volume has been inconsistent at times, and sentiment shifts quickly between optimism and caution. That is normal for a young Layer 1 trying to establish itself. What matters more than daily price movement is whether fogo can translate its technical pitch into real, sustained usage.

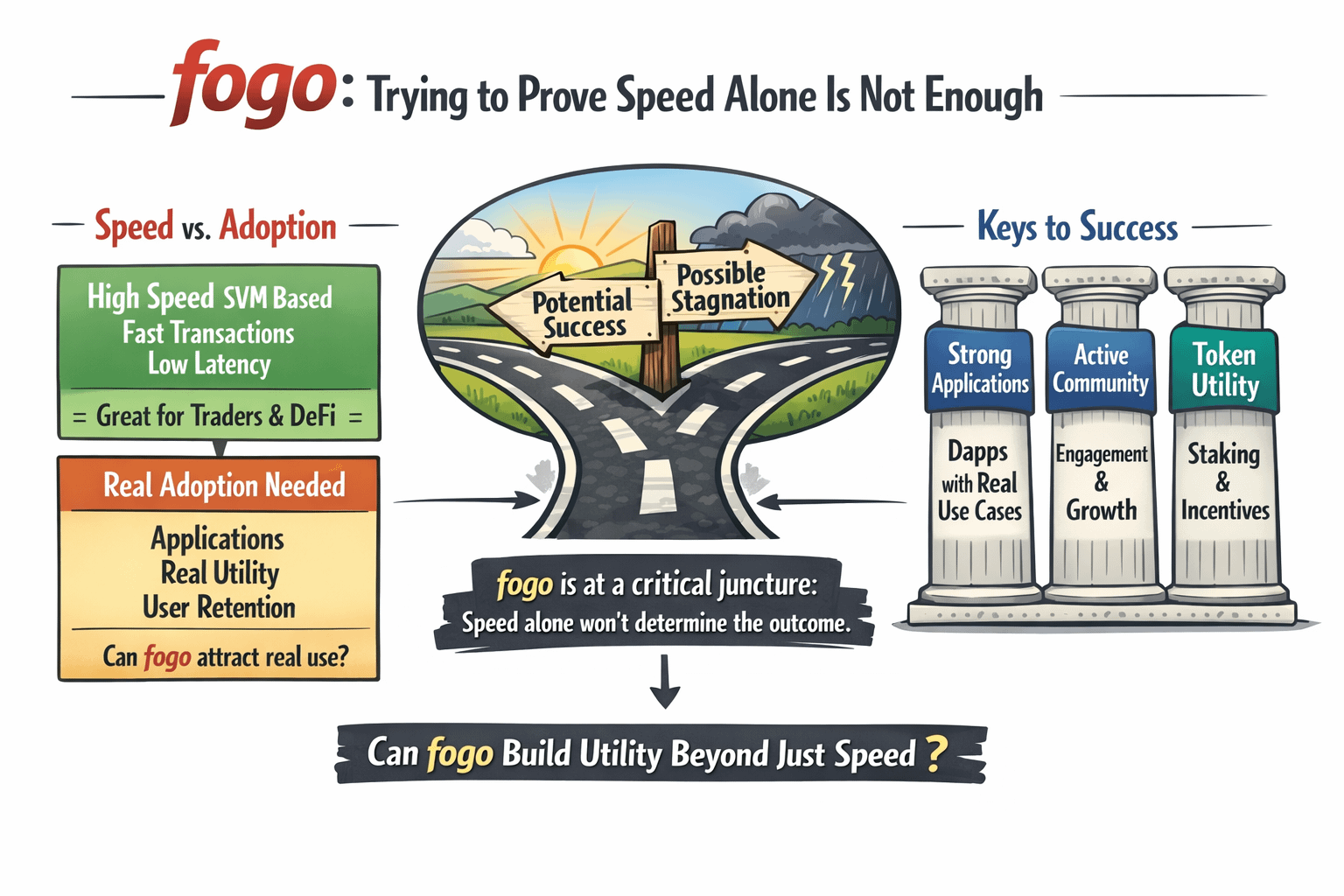

At its core, fogo is built around the Solana Virtual Machine. That choice immediately signals its ambition. Instead of inventing an entirely new execution environment, fogo leverages SVM compatibility to deliver high-speed performance with very low latency. Block times are designed to be fast, and finality is intended to feel close to instant. For traders, gaming applications, and real-time decentralized finance, that kind of responsiveness matters.

But speed alone does not guarantee adoption. Many chains promise fast execution. What separates them is whether developers actually build on top of that performance and whether users find a reason to stay. fogo’s challenge now is not proving that it can process transactions quickly. It is proving that there are compelling applications that need that speed.

Recent price action reflects this tension. fogo has seen short bursts of upward movement supported by strong daily volume, but it remains well below earlier peaks. Weekly performance has shown noticeable drawdowns, indicating that short-term enthusiasm has not yet converted into sustained conviction. Liquidity is present, which means the market has not abandoned the asset. At the same time, volatility suggests participants are still testing the waters rather than committing long term.

One of fogo’s more distinctive early moves was its decision to pivot away from a traditional presale model in favor of a broader token distribution approach. By canceling a large planned presale and shifting toward an airdrop-focused model, the project signaled that it wanted wider community ownership rather than heavy concentration among early investors. Whether this strategy leads to stronger decentralization over time remains to be seen, but it set fogo apart from many projects that prioritize upfront capital over long-term distribution balance.

From a technical standpoint, fogo’s SVM foundation lowers the barrier for developers already familiar with Solana tooling. This compatibility means builders do not need to relearn everything from scratch. In theory, this should accelerate ecosystem growth, as teams can port concepts and applications more easily. The real test will be how many actually do so and whether those applications generate meaningful on-chain activity.

Community engagement efforts have also played a role in fogo’s early trajectory. Incentive programs and creator campaigns have helped increase visibility and participation. These initiatives can spark attention and drive initial usage, but they are only sustainable if they evolve into genuine activity. Incentives may bring users in the door, but lasting ecosystems are built on utility.

In terms of market structure, fogo currently sits in a phase common to emerging Layer 1 networks. Market capitalization is moderate relative to established chains, daily volume fluctuates but remains active, and price action is sensitive to sentiment. This is neither a collapse nor a breakout. It is consolidation mixed with uncertainty.

The broader Layer 1 landscape makes fogo’s path more complicated. Competition is intense. There are already multiple high-performance chains claiming fast execution and low latency. fogo will need to demonstrate clear differentiation, whether through ecosystem design, developer support, token economics, or user experience. Without that, speed becomes a commodity rather than an advantage.

Token utility and economic design will also play an important role in fogo’s long-term relevance. For any Layer 1, the native token must serve a clear purpose within the network. Transaction fees, staking, validator incentives, and governance all contribute to this structure. If network activity grows, token demand tends to follow naturally. If usage remains limited, speculative interest eventually fades.

Looking ahead, the most important signals to watch are not price spikes but structural growth. Are developers deploying meaningful applications? Is transaction volume increasing because of real usage rather than trading bots? Are users returning after initial incentive campaigns end? These questions matter more than short-term charts.

fogo is still defining itself. It has a technically credible foundation, a distribution story that appeals to community-minded participants, and liquidity that shows it has not been ignored. At the same time, it has not yet proven that it can compete sustainably in a crowded Layer 1 market.

The next phase for fogo will likely determine its trajectory. If performance translates into active ecosystems and consistent on-chain activity, its valuation narrative could shift. If not, it risks becoming another technically sound but underutilized network. #FOGO

For now, fogo sits at a crossroads. It has speed, early engagement, and visibility. What it needs next is sustained utility. In the long run, infrastructure is not judged by how fast it moves in ideal conditions. It is judged by whether people rely on it repeatedly. That is the standard fogo will have to meet.