When I first saw that Fogo integrated Wormhole, I viewed it as a standard infrastructure move — almost every new chain needs a bridge. But the more I thought about it, the more it felt less like a technical integration and more like a structural choice for a trading-focused chain like Fogo.

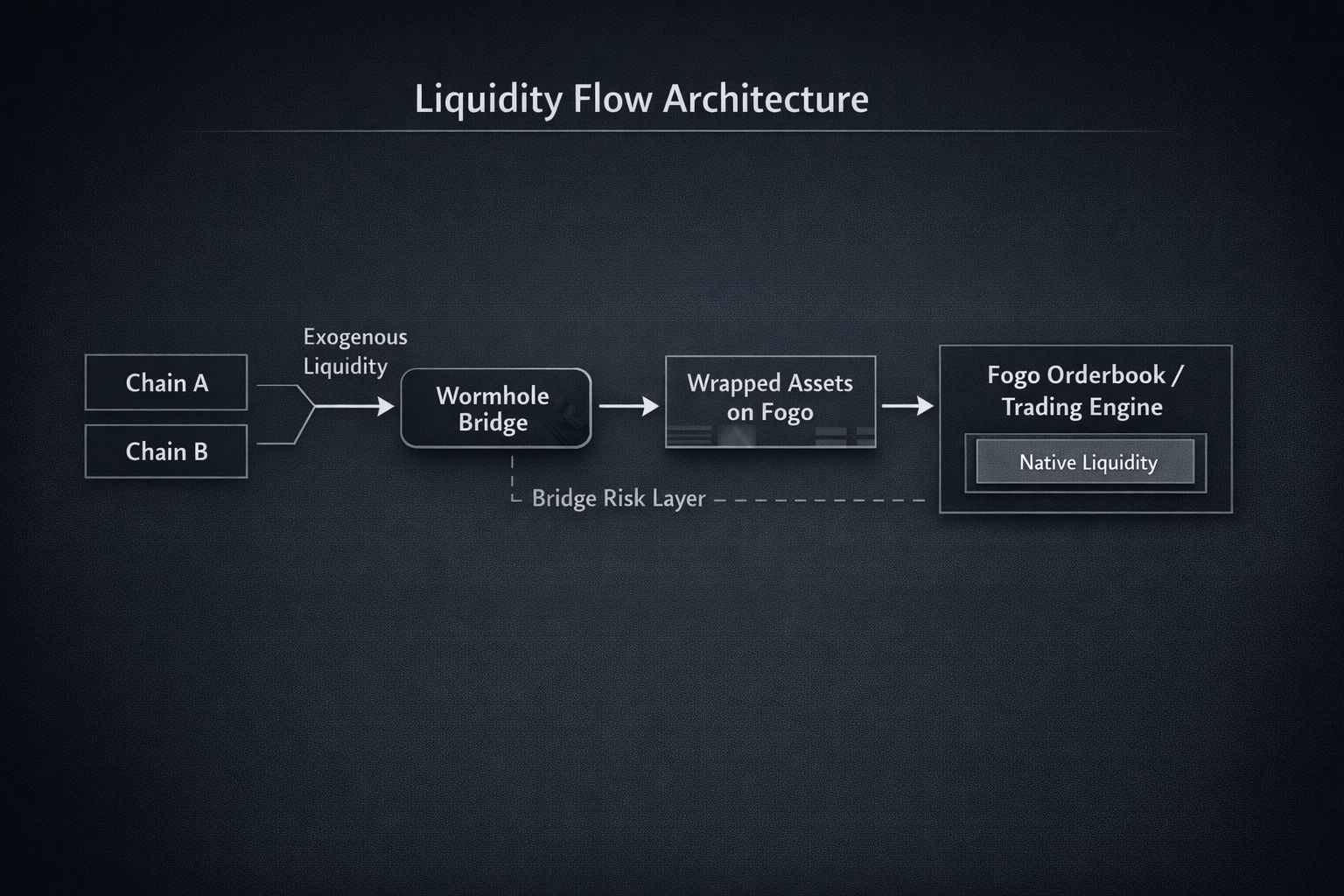

Fogo positions itself around high-performance execution and smoother trading UX. However, trading cannot function without deep liquidity. Wormhole allows Fogo to access capital from multiple ecosystems without having to bootstrap liquidity entirely from scratch. From a growth perspective, that makes sense, especially in early stages. But bridged liquidity is exogenous liquidity — it exists based on trust in an external system.

When a significant portion of circulating assets are wrapped, bridge risk becomes part of Fogo’s structural risk profile.

Is Fogo building strong native liquidity, or is it operating on imported capital to sustain its orderbooks?

Another point worth considering is latency in a multi-chain environment. Fogo may optimize internal execution effectively, but capital still needs to move through interoperability layers before entering the trading ecosystem. If capital mobility depends on the bridge’s validation and security model, then execution speed at the chain level may not fully translate into real-world trading efficiency. Fast execution does not automatically mean fast liquidity reaction.

If a bridge incident occurs or market confidence in wrapped assets declines, how exposed would Fogo’s liquidity structure be?

For a trading chain, orderbook depth and market confidence matter more than headline TPS. If most liquidity is not native, Fogo needs a clear path toward developing endogenous liquidity to gradually reduce structural dependence on external capital.

Wormhole can act as a growth catalyst for Fogo, but the long-term question is whether the ecosystem can reach a self-sustaining liquidity equilibrium.

From my perspective, Wormhole itself is not the issue. Dependency is. For a project like Fogo — where trading is core — sustainable liquidity architecture will ultimately matter more than execution speed alone.

@Fogo Official #fogo $FOGO