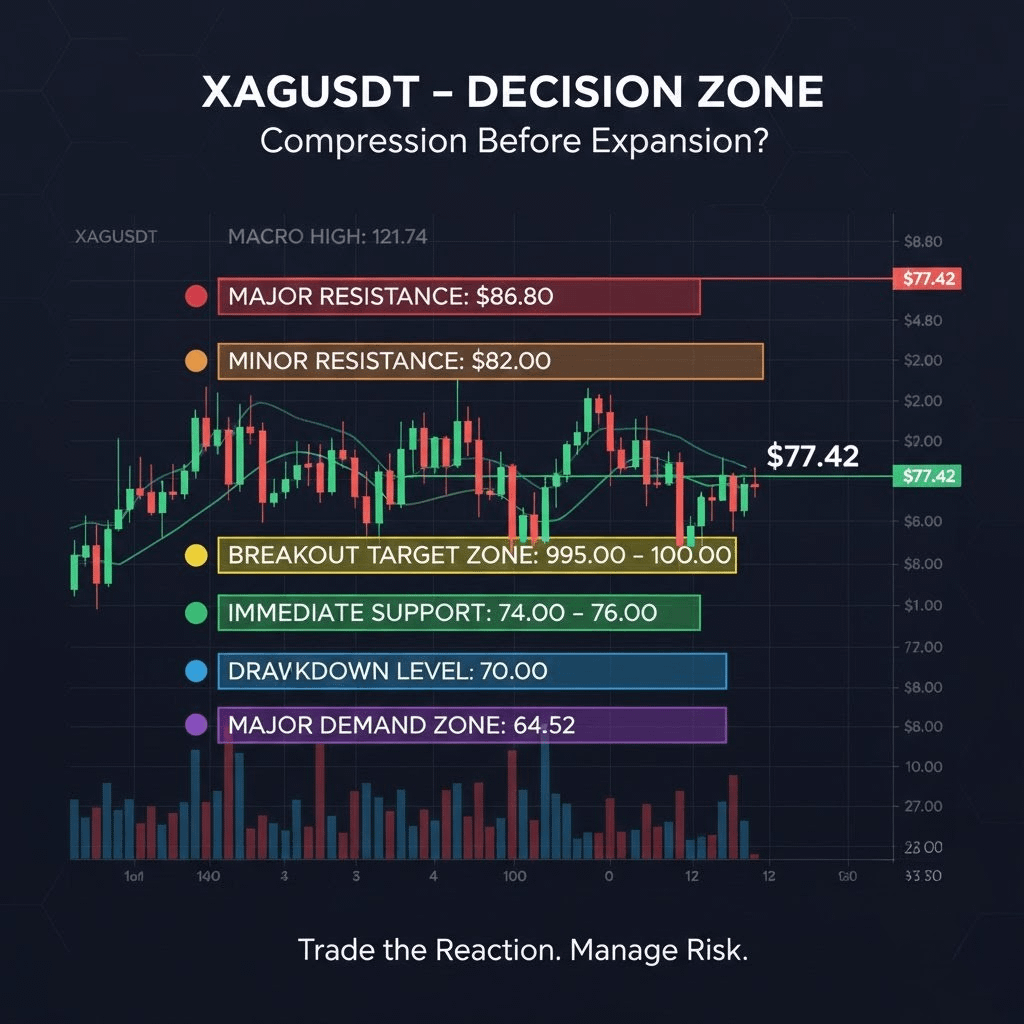

$XAG XAGUSDT is currently trading near $77.42, consolidating after a strong rejection from the $86–$88 resistance zone. On the 4H timeframe, price structure shows a clear macro high at $121.74 followed by an aggressive selloff into the major swing low at $64.52. That low now acts as a key higher-timeframe demand zone. Since bouncing from $64.52, price has been forming a medium-term range between $74 support and $86 resistance, indicating accumulation or distribution before the next expansion phase.

Key Support Levels: $XAG

$74.00 – $76.00 → Immediate support (short-term demand)

$70.00 → Breakdown trigger level

$64.50 → Major structural demand (macro support)

Key Resistance Levels:

$82.00 → Minor intraday resistance

$86.80 → Major range resistance

$95 – $100 → Breakout expansion targets

As long as price holds above $74, bulls maintain short-term control, with upside liquidity resting above $86. A strong 4H close above $88 could trigger momentum continuation toward the $95–$100 zone. However, a confirmed breakdown below $74 would likely accelerate selling toward $70 and possibly retest the $64.50 demand base.

Volume compression suggests volatility expansion is approaching. This is a reaction zone — traders should wait for confirmation rather than anticipate. Risk management is essential.

Watch the levels. Trade the reaction. Let the market confirm direction.

📌 Not financial advice. Trade with proper risk management.

Disclaimer: I am not your financial advisor.

#BinanceSquare #TechnicalAnalysiss #altcoins