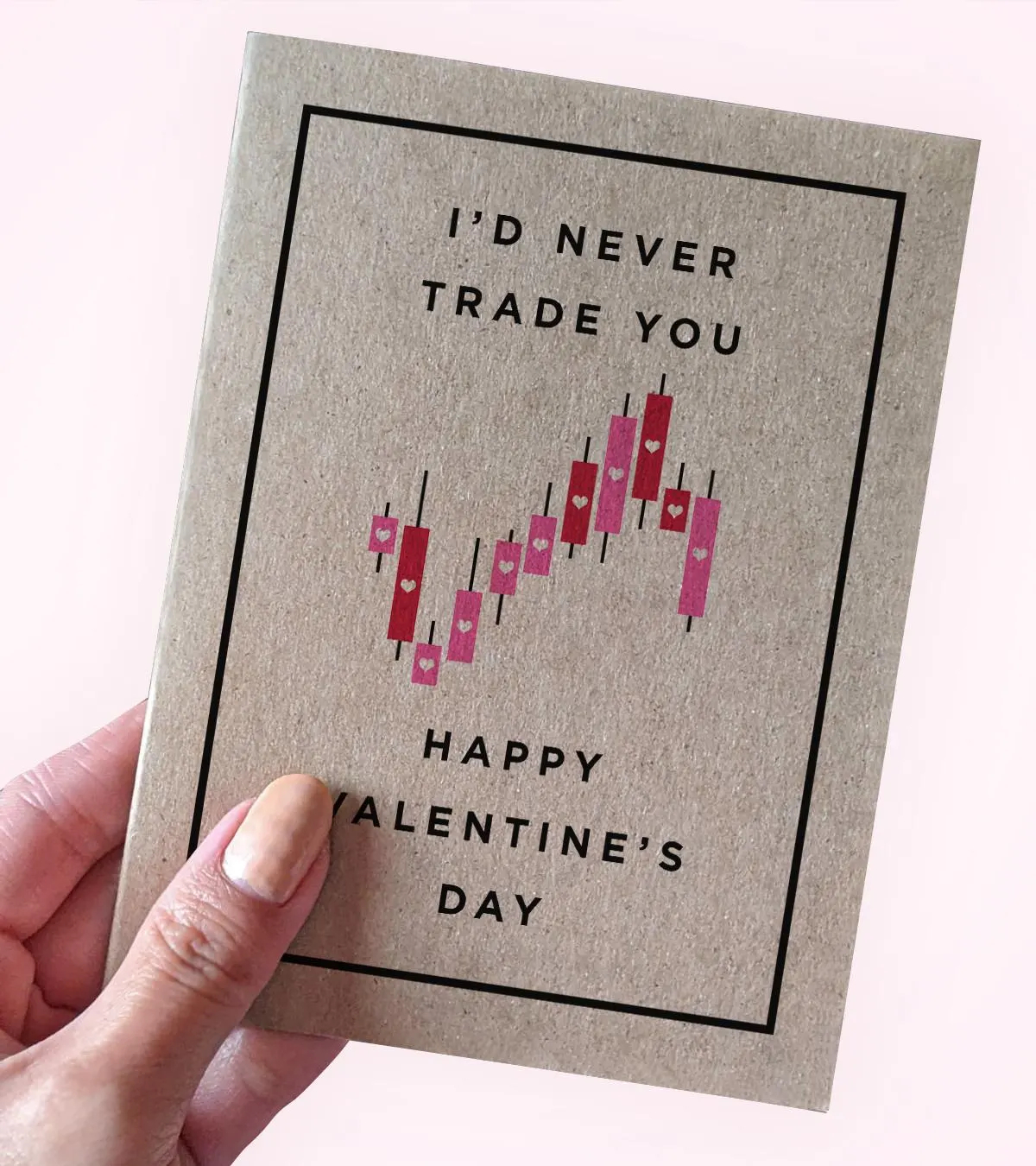

Every year on February 14, millions of people around the world celebrate Valentine’s Day by sending flowers, chocolates, and heartfelt messages. The holiday is named after Saint Valentine, a mysterious Christian figure associated with love, secret marriages, and sacrifice in ancient Rome.

But in 2026, something unusual is happening:

While couples are exchanging gifts, the crypto market is also showing signs of a rebound. Is it just a coincidence, or is market sentiment starting to warm up after a period of fear?

The Origins of Valentine’s Day: From Martyrdom to Romance

Valentine’s Day has roots in both Christian tradition and ancient Roman festivals.

According to legend, Saint Valentine was a priest who secretly married couples after the Roman emperor banned marriages for young soldiers. When his actions were discovered, he was executed on February 14, around the year 270 AD.

Over time, the day evolved:

The Middle Ages linked February 14 with the start of birds’ mating season.

Poets like Geoffrey Chaucer connected the day with romantic love.

By the 18th and 19th centuries, people began exchanging cards, flowers, and gifts.

Today, over 145 million Valentine’s Day cards are sent each year, making it the second-largest card-sending holiday after Christmas.

A Valentine’s Day Surprise: Crypto Market Up 3.4%

Interestingly, this year’s Valentine’s Day is arriving with a market bounce.

Total crypto market cap: $2.38 trillion

24-hour change: +3.4%

Main driver: Bitcoin recovery from extreme fear levels

The market also shows strong macro correlations:

75% correlation with Gold

82% correlation with the Russell 2000

This suggests the move is part of a broader liquidity shift, not just a crypto-specific event.

Bitcoin: The “Heartbeat” of the Market

Bitcoin led the recovery with a 4.8% gain, pushing sentiment slightly higher from extreme fear levels.

With over 58% market dominance, Bitcoin continues to act as the emotional center of the crypto market:

When BTC falls, fear spreads quickly.

When BTC stabilizes, confidence returns.

If Bitcoin holds above key support levels, the current rebound could extend into a broader market recovery.

Institutional “Love”: ETF Inflows Return

Another key factor behind the bounce is renewed institutional demand.

On February 13:

Spot ETFs for Bitcoin, Ethereum, Solana, and XRP

Recorded over $31 million in net inflows

At the same time, the market’s RSI dropped near oversold levels, creating the perfect setup for a technical bounce.

Key Levels to Watch

The next move depends on whether the market can hold critical support.

Resistance: $2.39 trillion

Support: $2.35 trillion

Downside risk: $2.17 trillion

Holding above support could lead to further upside. Losing it could send the market back toward yearly lows.

Is This a Real Love Story or Just a One-Day Crush?

Valentine’s Day is all about emotions—and so is the crypto market.

Right now, we’re seeing:

A Bitcoin-led rebound

Fresh ETF inflows

A technical bounce from oversold levels

But sentiment is still fragile. The next few days will decide whether this is the start of a lasting relationship with bullish momentum or just a short-lived Valentine’s rally.

Big question:

Will this market romance turn into a long-term trend—or end in heartbreak for late buyers?