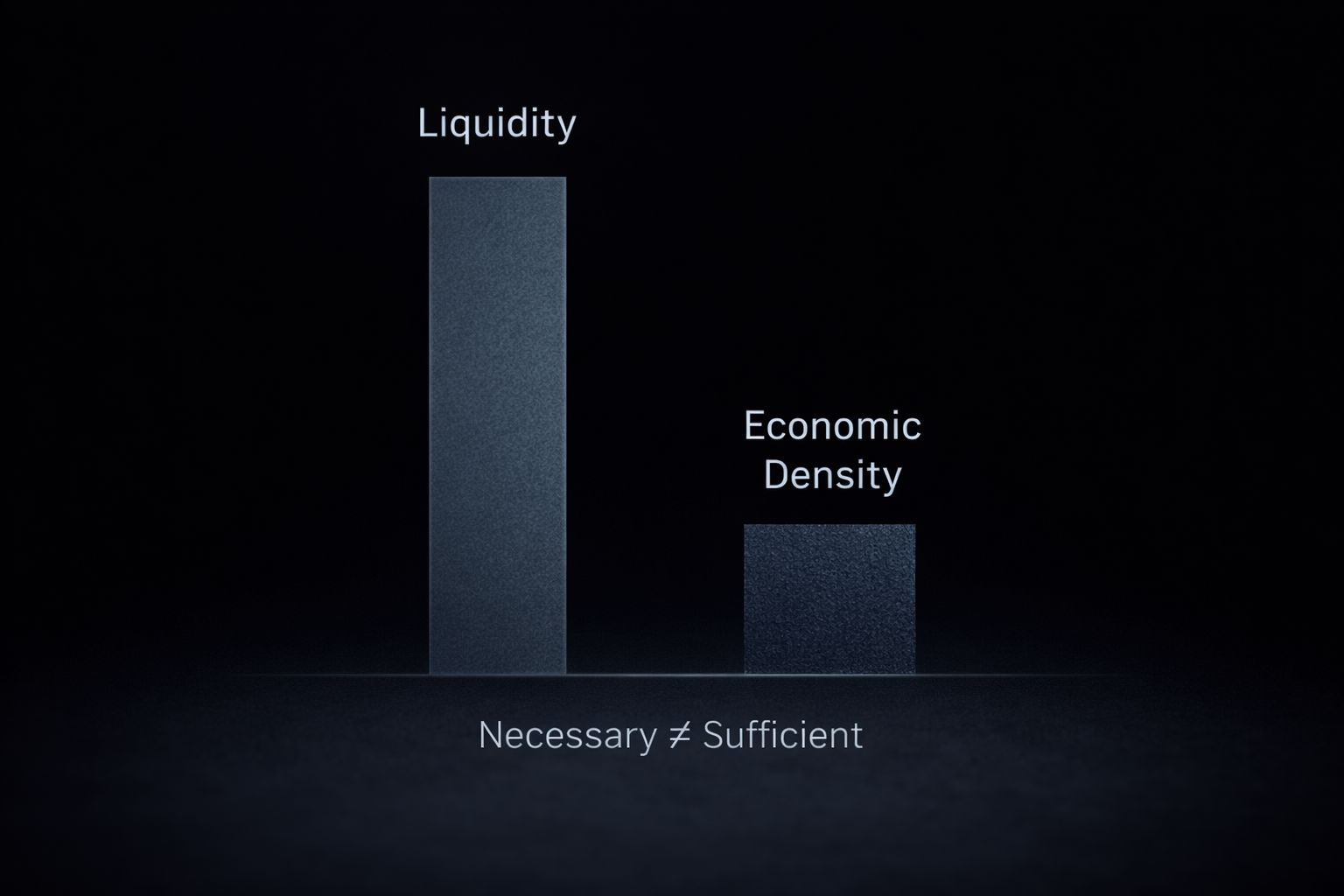

Liquidity is frequently treated as a proxy for strength in digital asset markets. Deep pools, high TVL, and tight spreads are often interpreted as evidence of resilience. However, liquidity is a market condition - not a structural guarantee.

At a technical level, liquidity reflects the ability to execute transactions with minimal price impact. It describes trading depth and short-term market efficiency. It does not, by itself, measure demand durability, capital stickiness, or economic integration within a network.

In early-stage ecosystems, liquidity is commonly bootstrapped through incentives, capital migration from other chains, or structured yield mechanisms. These approaches can be effective in accelerating market formation. They reduce initial friction and attract participants who might otherwise wait for deeper markets.

Execution-oriented networks - including newer infrastructures such as Fogo - often emphasize speed and low-latency settlement as mechanisms to attract early liquidity. This is a rational growth strategy. Faster execution can improve trading conditions and lower slippage, which in turn draws capital.

However, liquidity attraction and liquidity retention are analytically distinct.

Incentive-driven liquidity is yield-sensitive. When emissions normalize, allocation decisions adjust accordingly. Bridged or externally sourced liquidity increases depth but remains inherently mobile. It is influenced by comparative opportunity across ecosystems.

For this reason, liquidity should be viewed as enabling infrastructure rather than as an endpoint metric.

The more durable signal is conversion:

Does liquidity translate into sustained trading activity?

Does it support protocol-level utility beyond passive parking?

Does it remain when external incentives decline?

A network’s structural strength is better reflected in economic density — capital that is repeatedly utilized within the system because there is endogenous demand.

This distinction becomes most visible under stress conditions. Volatility, yield compression, and capital rotation test whether liquidity is embedded or contingent. If it persists without subsidy, it likely reflects genuine integration. If it exits rapidly, it was transient by design.

Liquidity is necessary for efficient markets. But it is not synonymous with resilience.

Sustainable ecosystems are not defined solely by how much liquidity they attract, but by how effectively that liquidity becomes economically productive.

In that context, liquidity is not irrelevant.

It is simply not sufficient.

@Fogo Official #fogo $FOGO