There’s a moment in every technology cycle when the conversation matures. The slogans fade. The tribal debates cool down. And the builders start asking harder questions. Fogo belongs to that moment.

For years, blockchains competed on ideology and scale—who was more decentralized, who processed more transactions, who attracted louder communities. But finance doesn’t care about slogans. Markets care about precision. They care about how long it takes for an order to confirm. They care about whether execution is predictable. They care about whether a system behaves the same way under stress as it does during calm.

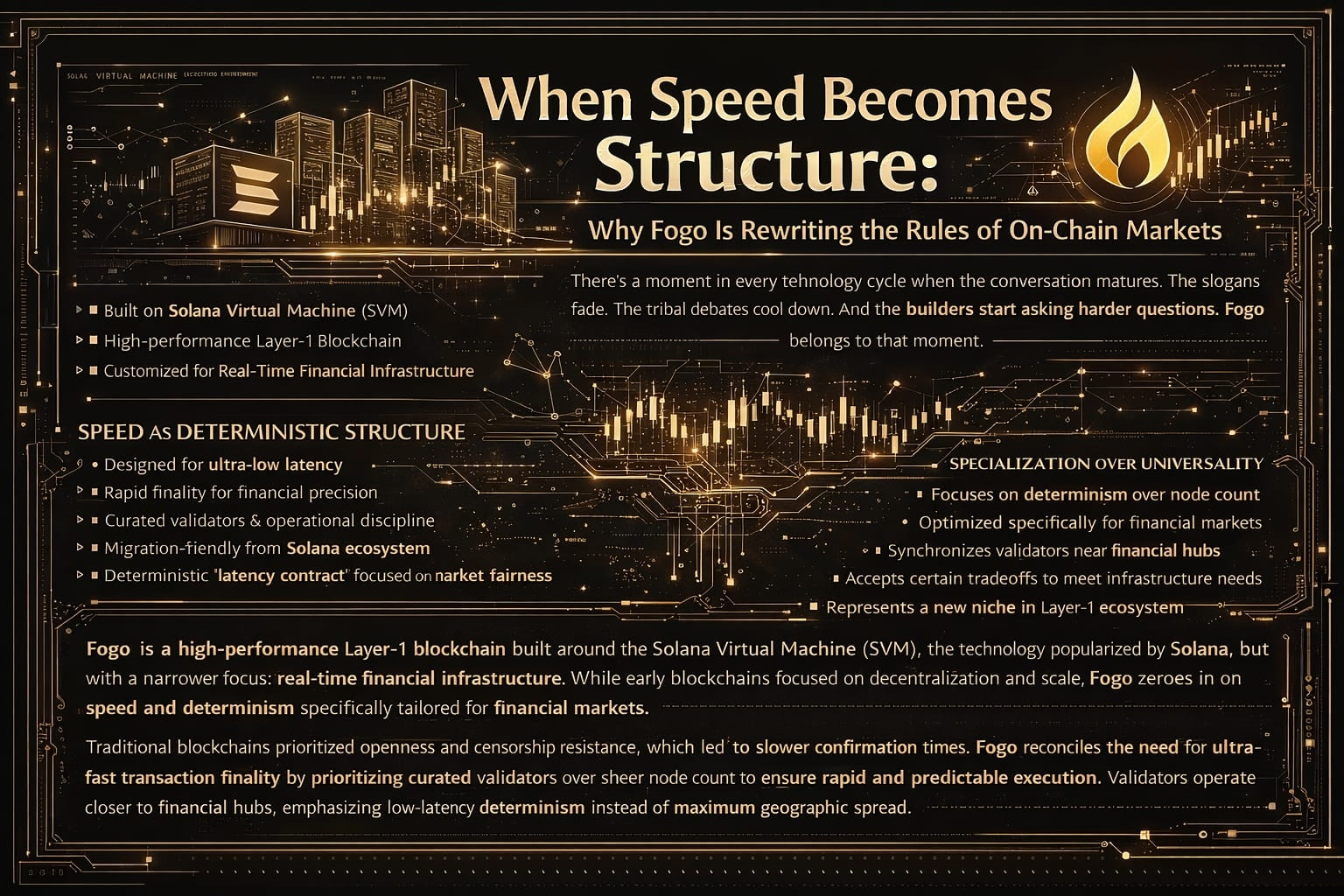

Fogo enters this landscape with a very specific intent. It is a high-performance Layer-1 built around the Solana Virtual Machine, the execution environment popularized by Solana and originally developed by engineers associated with Solana Labs. That detail matters, but not in the way people usually think. This isn’t about copying another chain. It’s about inheriting a philosophy of parallel execution and then bending it toward a narrower purpose: real-time financial infrastructure.

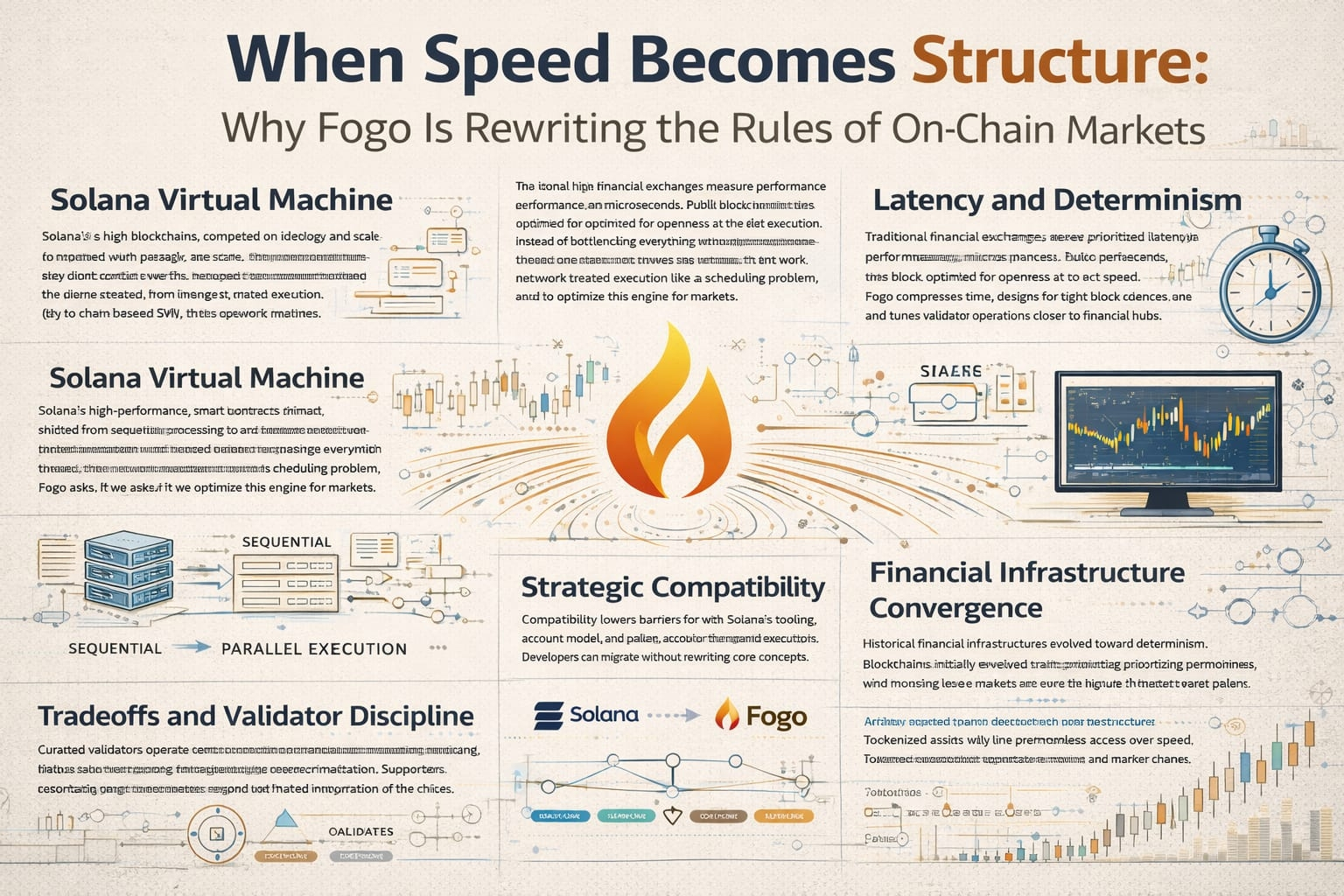

To understand the significance, it helps to remember what made the Solana execution model unusual in the first place. Most early smart contract platforms processed transactions sequentially. One after another. It was safe, but slow. Solana introduced a system where transactions could execute in parallel as long as they didn’t conflict over the same state. Instead of bottlenecking everything through a single thread, the network treated execution like a scheduling problem. That shift alone redefined what was possible in throughput.

Fogo takes that engine and asks a more focused question: what happens if we optimize this specifically for markets?

Traditional financial exchanges are obsessed with latency. They measure performance in microseconds. Trading firms colocate servers next to exchange data centers to shave off fractions of a millisecond. Fiber routes are mapped with surgical precision. Every technical decision reflects the belief that time is not just money—it is structure.

Public blockchains historically moved in the opposite direction. They optimized for openness and censorship resistance, even if it meant slower confirmation times. Fogo attempts to reconcile these worlds. It accepts that certain financial applications—derivatives clearing, liquidation engines, algorithmic trading—cannot function comfortably in multi-second environments. So it compresses time. It designs for tight block cadences and rapid finality. It tunes validator operations for determinism rather than maximum geographic spread.

That tradeoff is deliberate. And it is honest.

The architecture leans toward curated validators and operational discipline. Instead of celebrating sheer node count, it emphasizes predictable behavior and professional-grade uptime. Validators are encouraged to operate in environments closer to financial data hubs, reducing network jitter and propagation delays. Critics might argue that this sacrifices a degree of decentralization. Supporters would respond that decentralization is not a single dial you turn to maximum—it’s a matrix of choices. Geographic distribution, governance openness, economic participation, and execution fairness are separate axes.

What Fogo does is make those axes visible.

The choice to remain compatible with the Solana Virtual Machine is not just a developer convenience. It’s a strategic bridge. Builders familiar with Solana’s tooling, account model, and parallel execution patterns can migrate without rewriting their entire mental model. This continuity lowers barriers and allows innovation to focus on infrastructure, sequencing logic, and market design instead of basic contract rewrites. In a field where developer migration often stalls ecosystems, compatibility becomes a quiet advantage.

But technology alone doesn’t define a chain. Culture does.

Fogo’s culture feels less like a social platform and more like a trading desk. There’s an implicit understanding that participants will care about session management, deterministic execution, and fee predictability. Even the user-experience experiments—like session-based interactions that reduce repeated gas friction—signal that this network is courting serious, high-frequency engagement rather than casual experimentation.

Speed, however, is not automatically fairness.

When execution windows shrink to tens of milliseconds, the competitive arena intensifies. Micro-advantages matter more. Proximity to validators matters. Infrastructure quality matters. A faster system can reduce certain forms of front-running, but it can also reward those best positioned within the latency landscape. In that sense, Fogo doesn’t eliminate market microstructure challenges—it relocates them.

This is where the idea of a “latency contract” becomes useful. Every high-performance network implicitly defines a social agreement about what users are trading in exchange for speed. On Fogo, participants are accepting that validator professionalism, infrastructure discipline, and governance mechanisms will collectively uphold fairness at high velocity. The network’s security is not just cryptographic—it is operational.

Historically, financial infrastructure evolved toward determinism. Open outcry pits gave way to electronic matching engines because machines could timestamp and sequence orders without ambiguity. Blockchains initially evolved in the opposite direction, prioritizing permissionless access over deterministic speed. Fogo represents a convergence of those paths. It attempts to make a blockchain behave like a matching engine while retaining programmability and transparent settlement.

That convergence carries regulatory implications. As tokenized assets and derivatives move onto faster chains, the line between decentralized protocol and market venue blurs. If execution quality begins to resemble that of traditional exchanges, questions about compliance, oversight, and market integrity naturally follow. Fogo’s design does not avoid those questions; it accelerates them.

There is also a broader ecosystem implication. For years, Layer-1 chains chased universality—the dream of being the one chain for everything. Increasingly, specialization appears more realistic. Some networks may optimize for governance experiments. Others for gaming. Others for social identity. Fogo’s bet is that financial microstructure deserves its own optimized environment.

If that bet pays off, the ripple effects could reshape expectations across crypto. Developers may begin thinking less about “maximum decentralization” as a slogan and more about precision engineering for specific economic functions. Investors may evaluate chains based on operational reliability under stress rather than headline TPS numbers. Regulators may engage with protocols not as abstract codebases, but as emerging financial infrastructure.

In the end, Fogo is not trying to win a popularity contest. It is trying to solve a physics problem. Markets move fast. Risk compounds quickly. Liquidations cascade. A chain that aspires to host serious financial volume must respect those realities. By building around the Solana Virtual Machine and refining the surrounding infrastructure for low-latency determinism, Fogo steps into that challenge.

Whether it becomes a dominant venue or a specialized niche, its existence signals something important: blockchain architecture is growing up. The conversation is shifting from ideology toward calibration—from asking how decentralized something can be, to asking how precisely it can serve its intended function.

And in a world where milliseconds can shape entire markets, that calibration may prove more transformative than any marketing claim ever could.