Blockchains are frequently introduced as neutral infrastructure, yet most users encounter them as products. They notice waiting time, transaction cost, and whether the interface interrupts their activity. If any of these feel uncertain, confidence fades quickly. In that sense performance is not merely engineering. It is user experience translated into mathematics.

Fogo appears to recognize this shift and organizes its design around operational dependability.

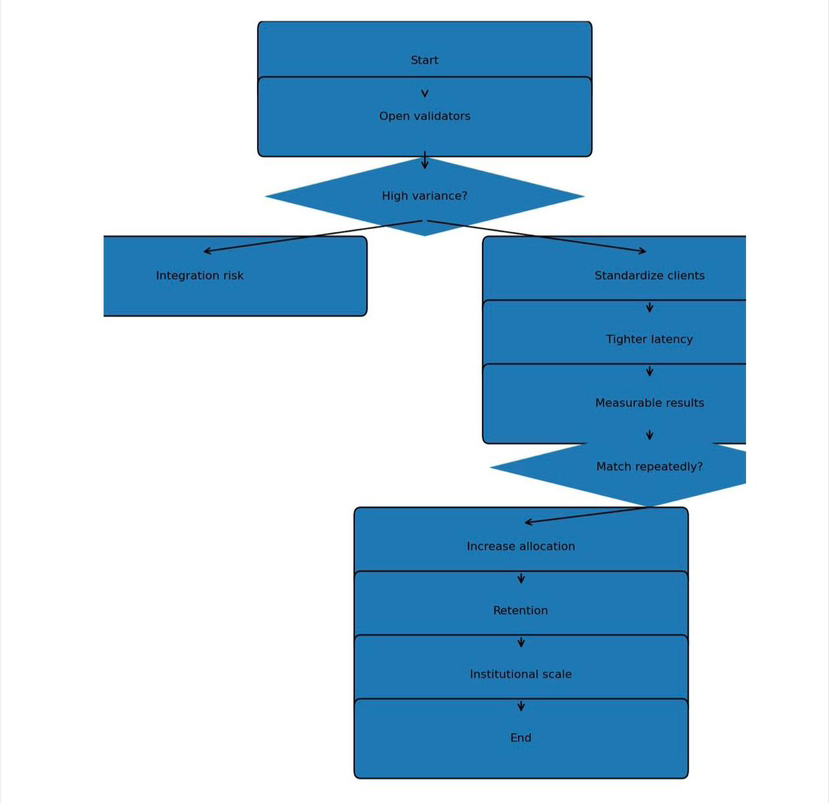

Consider how institutions approach new rails. They begin with small allocations. They measure settlement times. They evaluate how often behavior deviates from expectation. If variation remains narrow, exposure grows. If not, expansion pauses. Adoption therefore accumulates through evidence.

From this perspective, the emphasis on standardized high performance validators becomes logical. When hardware, networking, and client structure follow strict expectations, the distribution of outcomes tightens. Participants can price risk more accurately. Furthermore developers gain confidence that edge cases will be rare rather than routine.

Compatibility with the SVM ecosystem also plays a pragmatic role. Instead of inventing a separate universe, Fogo allows existing knowledge to travel. Wallets, explorers, analytics pipelines, and developer habits migrate. Time to deployment shrinks. The environment feels familiar from day one, which is critical when teams operate under commercial timelines.

However the more distinctive move may be the zoned consensus model. By activating only a portion of validators for each epoch, the network reshapes the geometry of communication. Messages travel shorter routes, quorum formation accelerates, and variance falls. Validators outside the active set continue observing, which means global integrity is maintained without slowing local agreement.

This arrangement resembles how real industries operate. Responsibility rotates, yet standards remain common. Performance can therefore improve without sacrificing openness.

Sessions add another dimension. Modern applications compete on smoothness. Repeated signatures or unpredictable fees discourage return visits. By letting users grant bounded authority once, Fogo enables continuous interaction while preserving control. In addition, sponsors can absorb costs according to policies that match business goals. The result is flexibility without confusion.

When these layers combine, the chain begins to feel like dependable plumbing. Transactions move. Programs execute. Records persist. Attention can remain on the service rather than the substrate.

Economic design then reinforces continuity. Validators earn through participation. Delegators align with operators who demonstrate uptime and correctness. Burns offset supply while emissions maintain incentive. None of this is exotic, yet stability often beats novelty when real capital is involved.

There is also a strategic patience visible here. Instead of chasing spectacular metrics detached from daily use, the focus is on creating conditions where growth can compound. If each new participant experiences predictable settlement, they are more likely to stay. Retention gradually becomes the strongest advertisement.

My take is that this orientation may prove decisive. Markets expected to approach sixteen trillion dollars will not be captured through slogans. They will migrate toward venues where operational history shows resilience. By treating reliability itself as a deliverable, Fogo is attempting to position its network as a place where scaling feels safe.