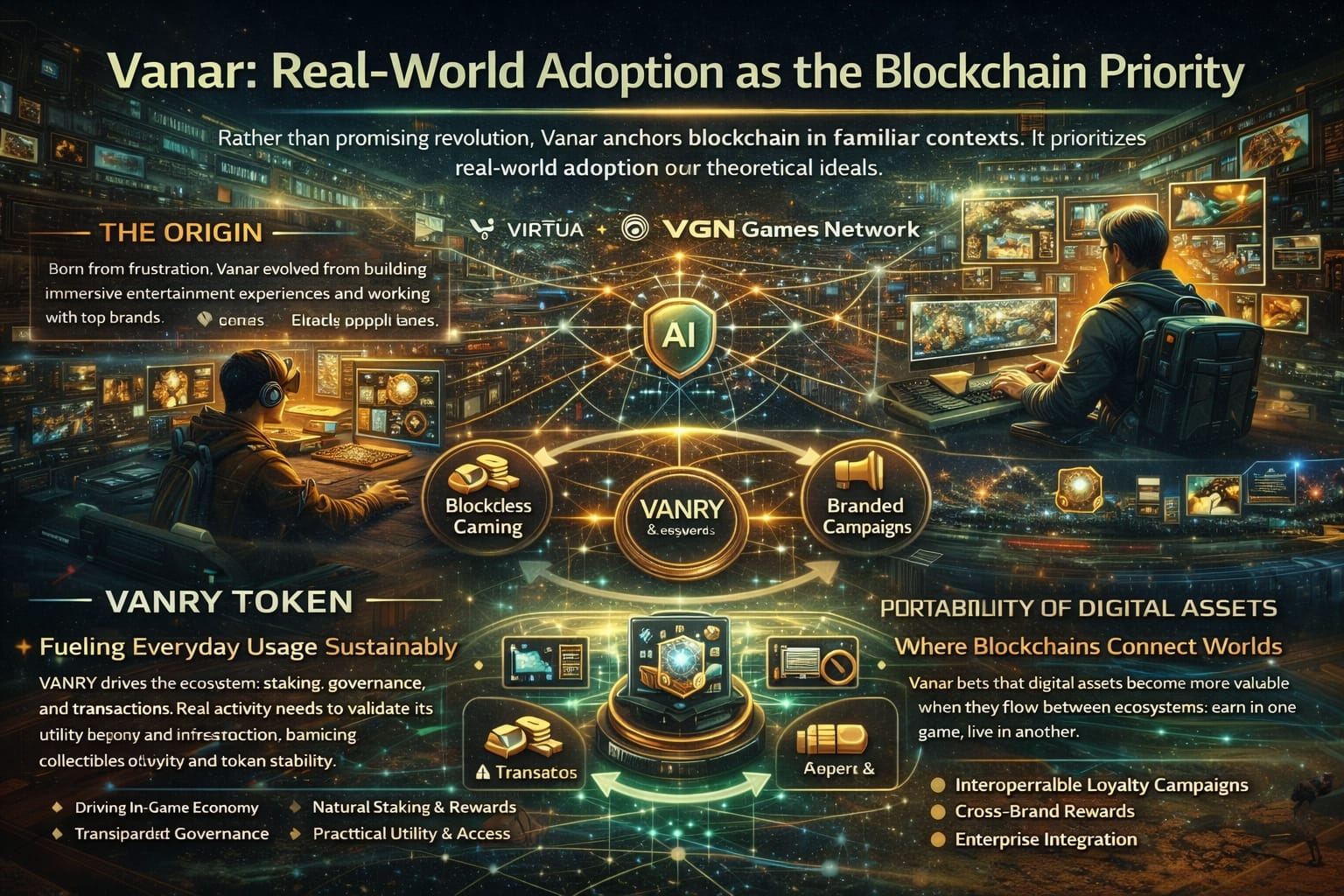

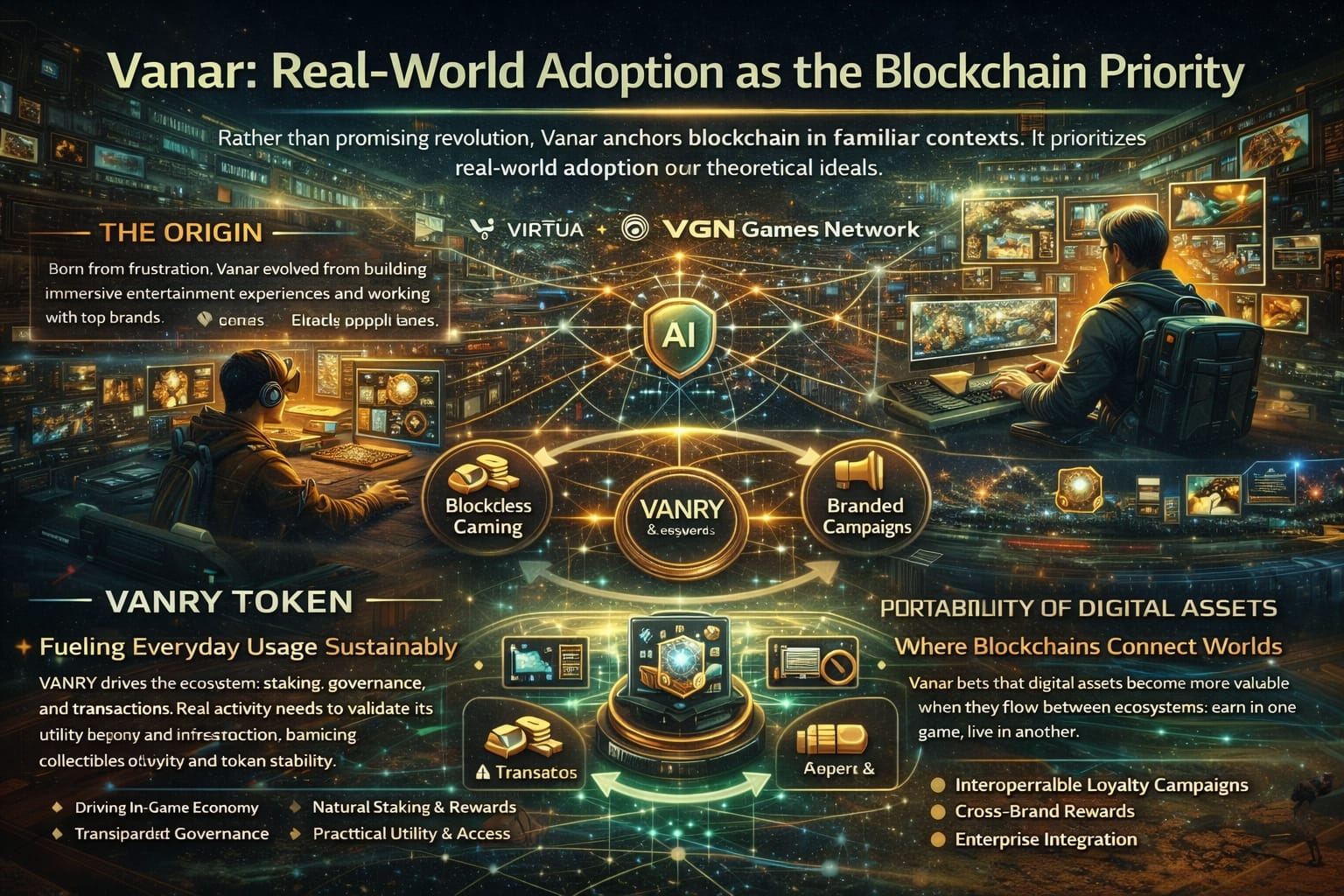

If you strip away the crypto vocabulary, Vanar’s story feels less like a protocol launch and more like a frustration that turned into a blueprint.

The people behind Vanar didn’t begin by obsessing over consensus models or whitepaper theory. They were building digital worlds. Through Virtua, they were already experimenting with immersive environments, branded collectibles, and interactive fan experiences. They were talking to entertainment companies, gaming studios, and global brands long before “Web3 adoption” became a marketing slogan. And in those conversations, one reality kept surfacing: blockchain sounded exciting in boardrooms, but it felt impractical in product meetings.

Wallet friction. Unpredictable fees. Users who just wanted to play a game but were suddenly asked to manage private keys.

That tension shaped Vanar’s evolution.

Instead of forcing consumer products to adapt to existing chains, the team decided to build infrastructure that behaved more like the apps people were already comfortable with. Vanar emerged as a Layer-1 blockchain designed with a specific kind of user in mind — not the crypto trader refreshing charts, but the gamer buying a skin, the fan collecting a digital asset, the brand running a loyalty campaign.

There’s something deeply pragmatic about that origin. It didn’t start with ideology. It started with product pain.

The continuation of Virtua and the launch of VGN Games Network weren’t side projects orbiting a chain. They were proof-of-concept ecosystems — living environments where blockchain either worked invisibly or failed publicly. If a player hesitated because a transaction took too long, that wasn’t a theoretical issue. It was churn. If a brand worried about exposing its customers to volatility, that wasn’t philosophical. It was reputational risk.

So Vanar’s infrastructure philosophy became simple: blockchain must disappear.

Technically, the network is EVM-compatible, meaning it speaks the same language as much of the existing Web3 world. But the ambition goes further. The architecture is framed as AI-enabled, designed to support more intelligent on-chain processes. Not just static smart contracts, but systems that can react, optimize, and automate.

Imagine loyalty programs that adjust rewards dynamically. Digital marketplaces that auto-settle royalties in real time. AI agents that execute conditional payments without manual oversight. Those possibilities are the narrative Vanar leans into — a blockchain that behaves less like a ledger and more like a responsive backend for consumer platforms.

Of course, ambition is easy. Execution is where the real story unfolds.

The VANRY token sits at the center of this ecosystem. It fuels transactions, staking, governance, and utility across applications. But tokens live double lives. On one hand, they are infrastructure. On the other, they are speculative assets. The challenge for Vanar — like every Layer-1 — is ensuring that real activity outpaces hype cycles. If games, metaverse experiences, and brand integrations generate steady usage, the token’s role becomes organic. If not, volatility overshadows utility.

What feels different here is the team’s consistent anchoring in consumer experiences. They talk less about disrupting global finance and more about embedding blockchain inside places where people already spend time. Gaming is an obvious entry point. For decades, players have understood digital value — skins, currencies, unlockables. Blockchain doesn’t introduce the idea of digital ownership; it formalizes and makes it portable.

But portability only matters if users care.

Vanar’s long-term bet seems to be that ownership becomes more meaningful when it crosses boundaries — when a digital asset isn’t trapped inside one ecosystem. That’s where infrastructure matters. If a brand runs a campaign inside a virtual world today, could that asset live elsewhere tomorrow? If a player earns something in one game, can it connect to a broader identity layer?

Those are quiet but powerful shifts.

There’s also a broader economic angle. Payments infrastructure remains one of Web3’s biggest bottlenecks. For mainstream adoption, blockchain must coexist with traditional financial rails, not pretend they don’t exist. Enterprise partnerships and compliance-focused architecture suggest Vanar understands that adoption is incremental. Brands won’t leap into decentralized systems without guardrails. Consumers won’t abandon familiar payment flows overnight.

So instead of promising revolution, Vanar seems to promise integration.

That doesn’t eliminate risk. Building for enterprises can invite centralization pressures. AI integration introduces governance complexity. Scaling infrastructure to support potentially billions of interactions demands resilience that few networks have proven under sustained consumer load.

And then there’s the human variable. Three billion new users don’t arrive because of throughput metrics. They arrive because something feels useful, intuitive, or emotionally compelling.

That’s why Vanar’s origin in entertainment matters. Entertainment understands engagement. It understands loyalty, narrative, and community. If blockchain becomes the invisible layer enhancing those experiences rather than overshadowing them, adoption stops being a campaign and starts being a habit.

There’s something almost understated about that ambition. Vanar isn’t positioning itself as the loudest Layer-1 or the most ideologically pure. It’s trying to be the most quietly embedded.

If it succeeds, most users interacting with Vanar-powered applications may never describe themselves as “using blockchain.” They’ll say they’re playing a game. Collecting a digital item. Participating in a brand experience. The chain will hum in the background, doing what infrastructure is supposed to do: enabling without demanding attention.

That possibility — blockchain as invisible plumbing rather than visible spectacle — might be the real shift Vanar represents.

Not a louder Web3.

A softer one.