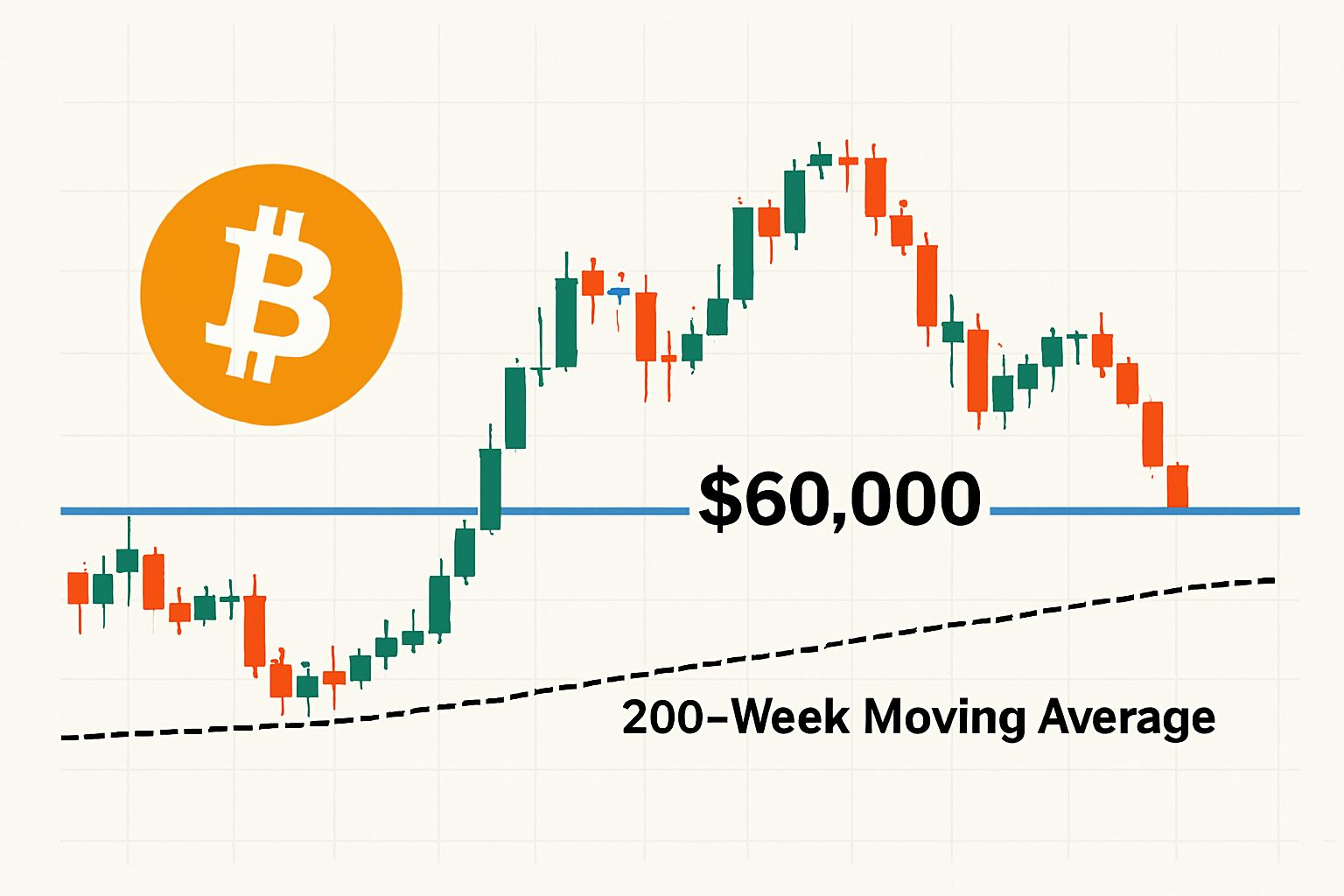

As someone who’s watched Bitcoin evolve from a fringe experiment to a global financial force, the current tension around the $60K level feels like déjà vu with higher stakes. This isn’t just another dip or technical retest. It’s a psychological battleground where conviction meets fear, and where every candle on the chart tells a story of uncertainty.

The $60K threshold isn’t just a number, it’s a mirror reflecting the market’s collective anxiety. When Bitcoin hovers here, it’s not just about liquidity or moving averages. It’s about whether traders believe in the asset’s resilience. I’ve seen markets turn on a dime, and this level is where sentiment can flip from cautious optimism to full-blown panic.

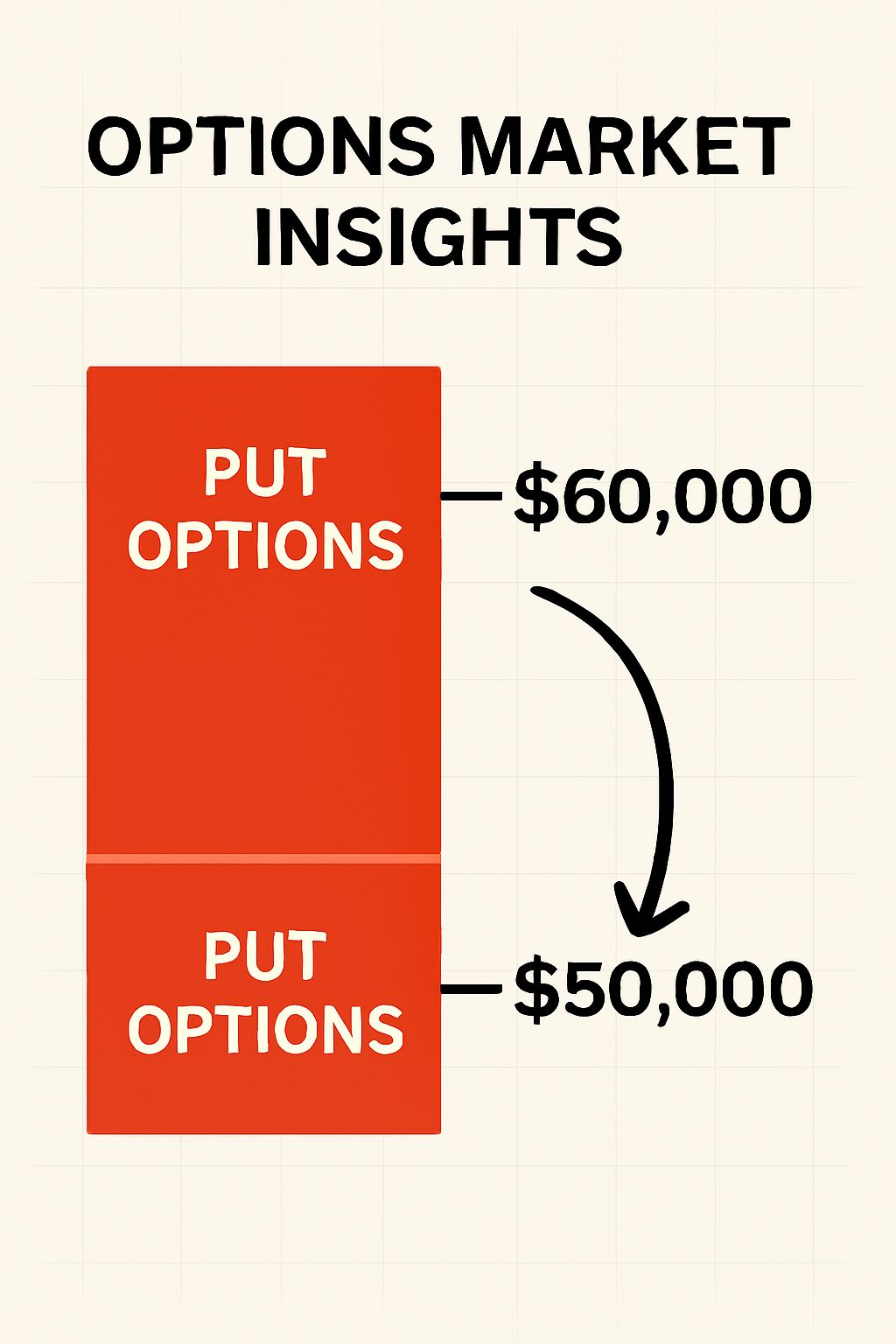

What’s striking is how the options market is telegraphing that fear. With over $1.2 billion in puts stacked below $60K, it’s clear that many are bracing for impact. And when that kind of positioning builds, it often becomes a self-fulfilling prophecy. If Bitcoin slips, the cascade could be brutal.

But here’s the nuance: volatility breeds opportunity. For long-term holders, this moment demands clarity of purpose. Are you here for short-term gains or long-term conviction? If the latter, then these dips while painful are part of the journey. For active traders, risk management is everything. Stop-losses, hedges, and disciplined entries matter more than ever.

The macro backdrop adds complexity. With the U.S. Supreme Court ruling on tariffs looming and global markets jittery, crypto isn’t insulated,it’s amplified. Bitcoin remains a risk asset, and in times of uncertainty, risk assets get punished.

Still, I believe that understanding these dynamics technical, psychological, and macro gives traders an edge. The $60K level is a battlefield. Whether Bitcoin holds or folds here will shape the next chapter of its story. And in this market, stories change fast.