If you’ve been staring at the charts feeling uneasy, take a deep breath. The market isn’t screaming “bearish collapse” it’s quietly resetting. Understanding this distinction can completely change how you trade and manage risk.

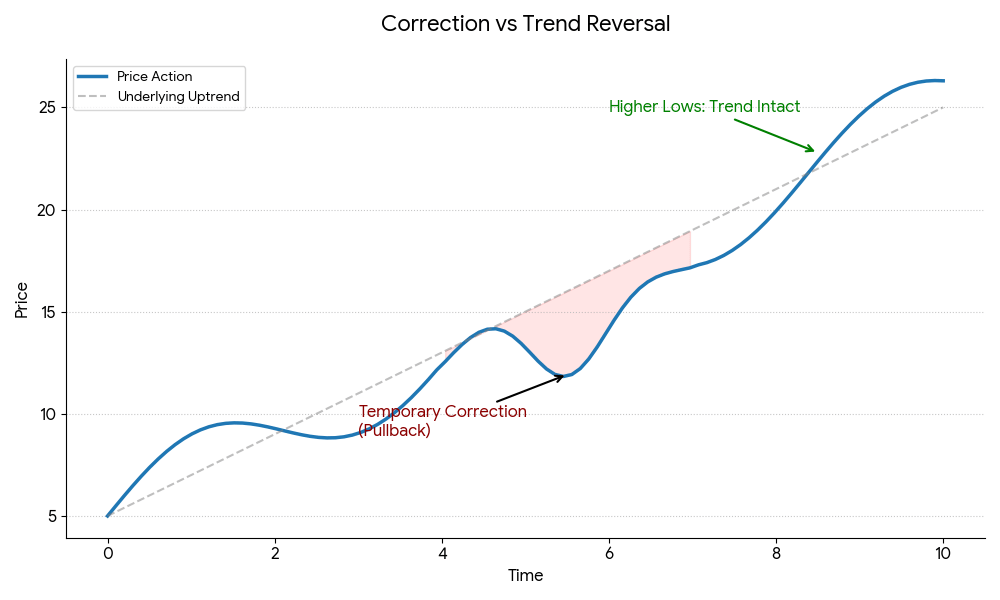

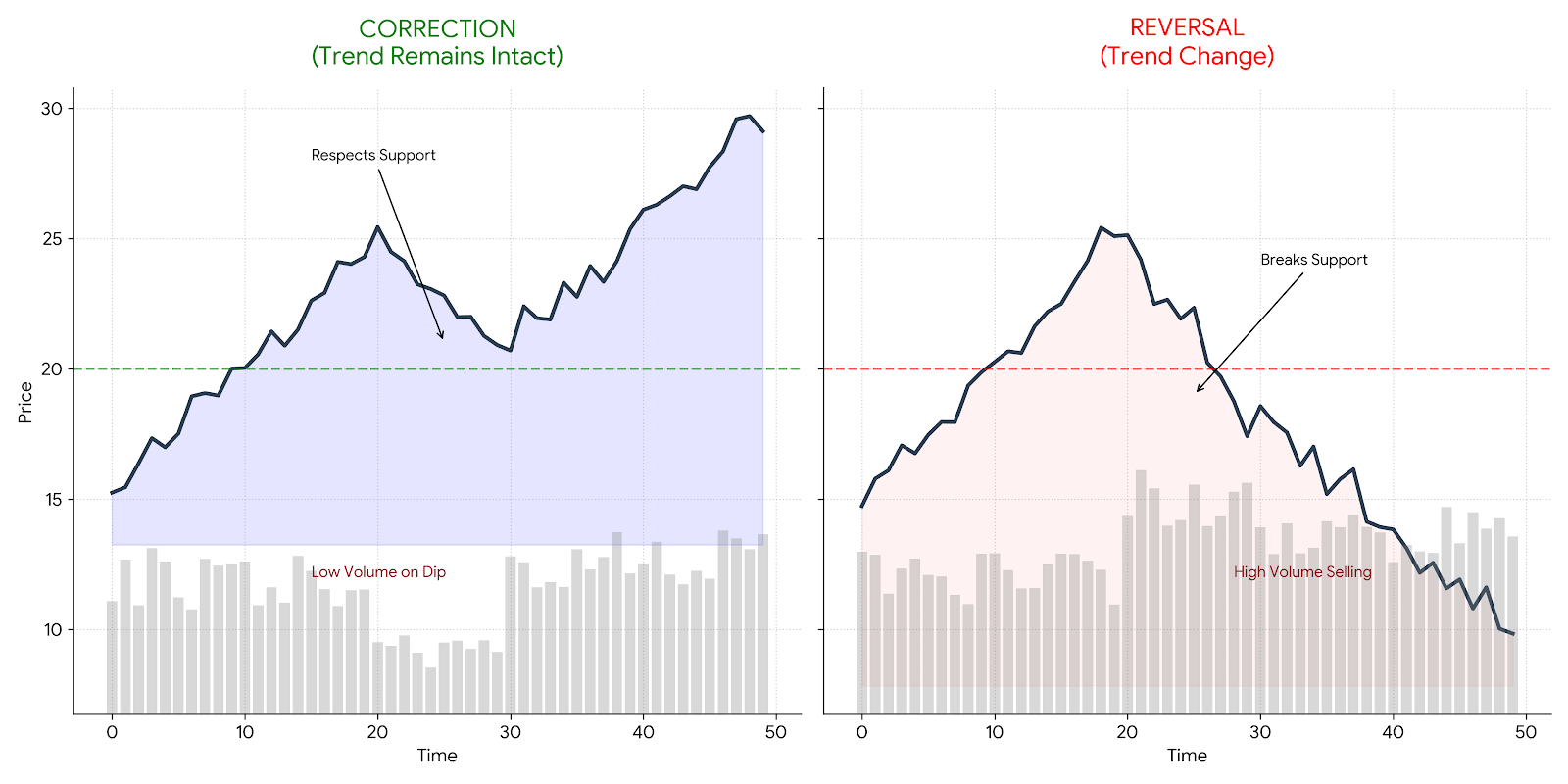

Correction vs Trend Reversal

Not all price drops are created equal. A correction is a temporary pullback in an existing uptrend think of it as the market taking a breather. It shakes out weak hands, tests support levels, but the larger trend remains intact.

A trend reversal, by contrast, is a structural shift where the market actually changes direction. Prices break key supports, selling persists over multiple timeframes, and momentum turns negative.

How can you tell the difference? Watch depth, duration, and structure:

Corrections often hold above major support zones and occur on lower volume.

Reversals break those supports decisively and see higher selling pressure sustained over time.

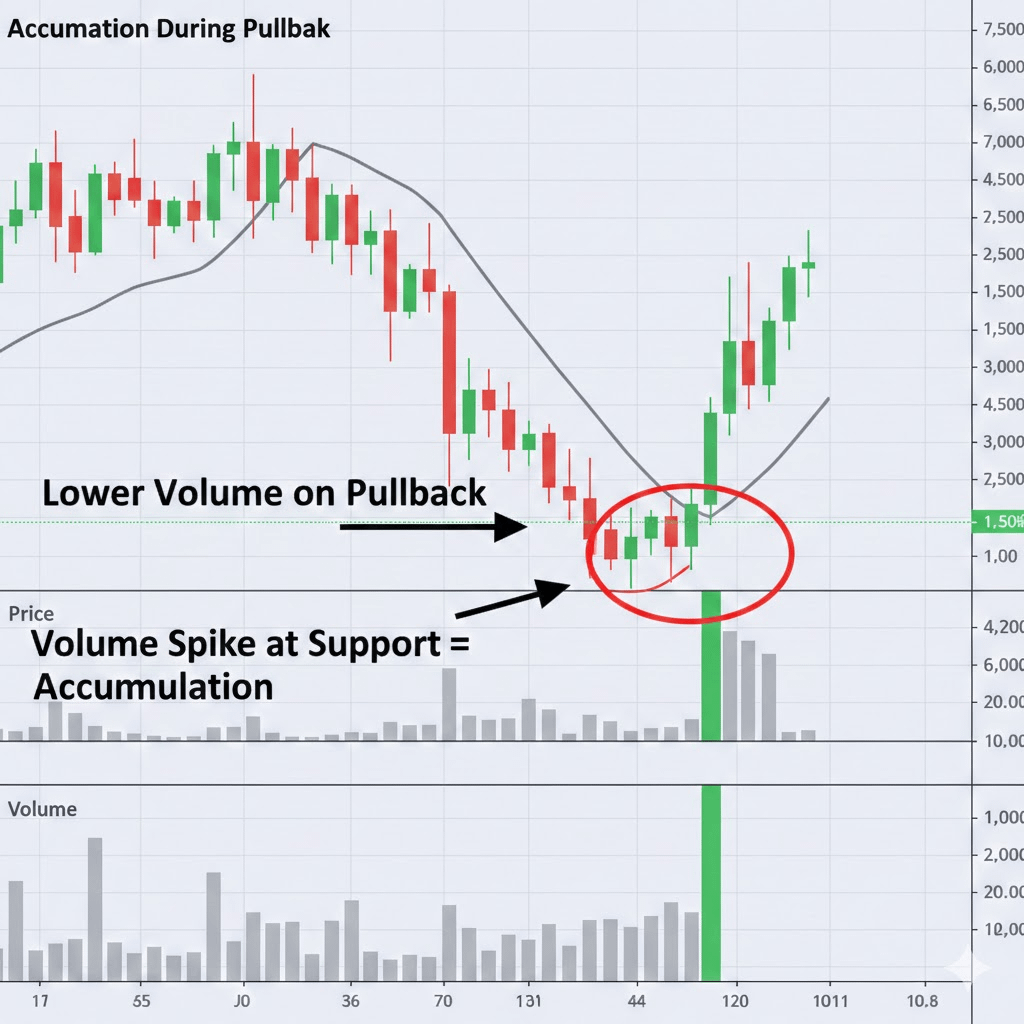

Volume: The Truth Behind Price Moves

Volume is the market’s voice. During a reset, prices might dip, but notice how volume behaves:

Lower volume on pullbacks → suggests the market is shaking out weak hands, not surrendering trend control.

Volume spikes near support zones → indicate smart money is likely accumulating.

This behavior tells a story far beyond what candlesticks alone can show. Volume is a trader’s most honest signal.

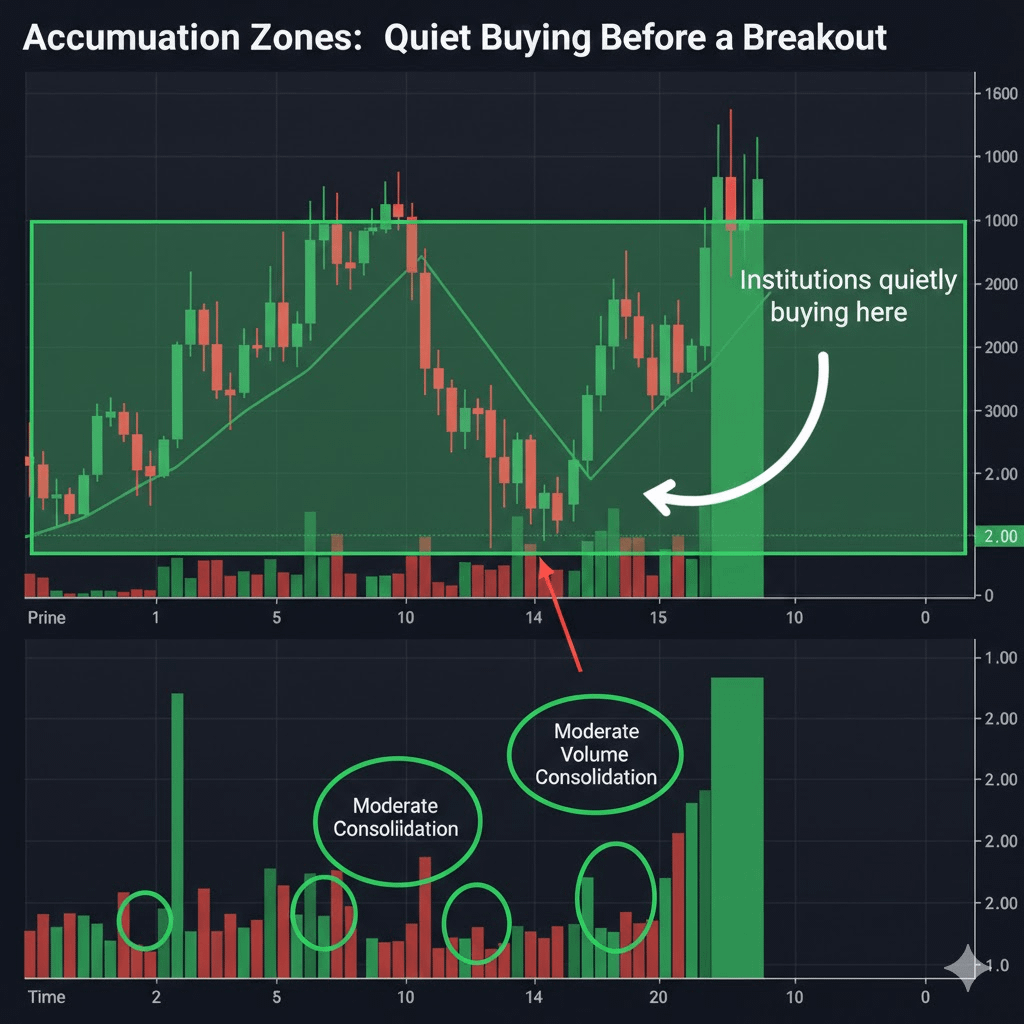

Institutional Accumulation

While retail traders panic, institutions often quietly buy the dip. Historical cycles show that these accumulation phases usually precede strong upward moves. Unlike hype-driven rallies, this buying happens under the radar a calm, patient foundation for the next bull leg.

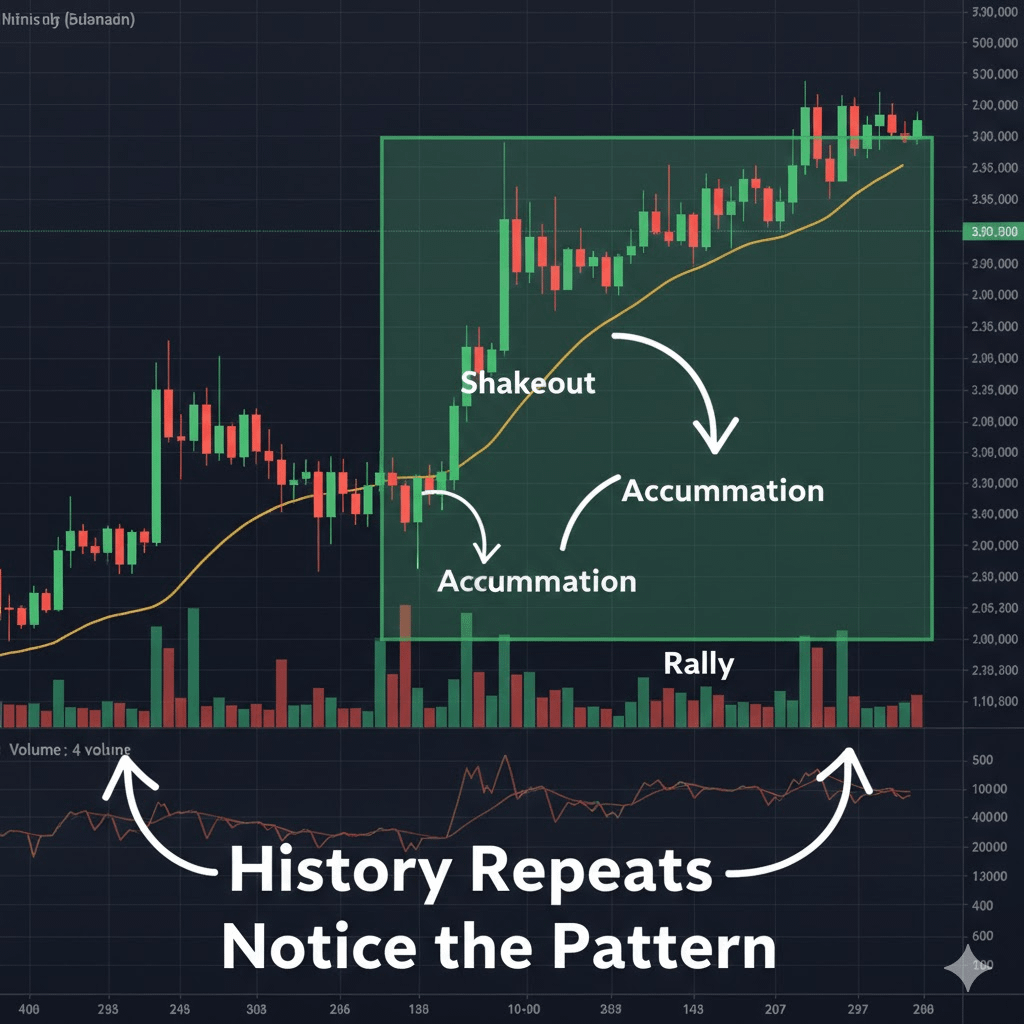

Historical Perspective

Looking at past market cycles provides context. During pullbacks of 30–50% in previous bull markets:

The market consolidates in a range.

Weak hands are shaken out.

Institutions accumulate.

A renewed rally follows, often stronger than before.

Recognizing these patterns builds conviction, allowing you to act strategically instead of emotionally.

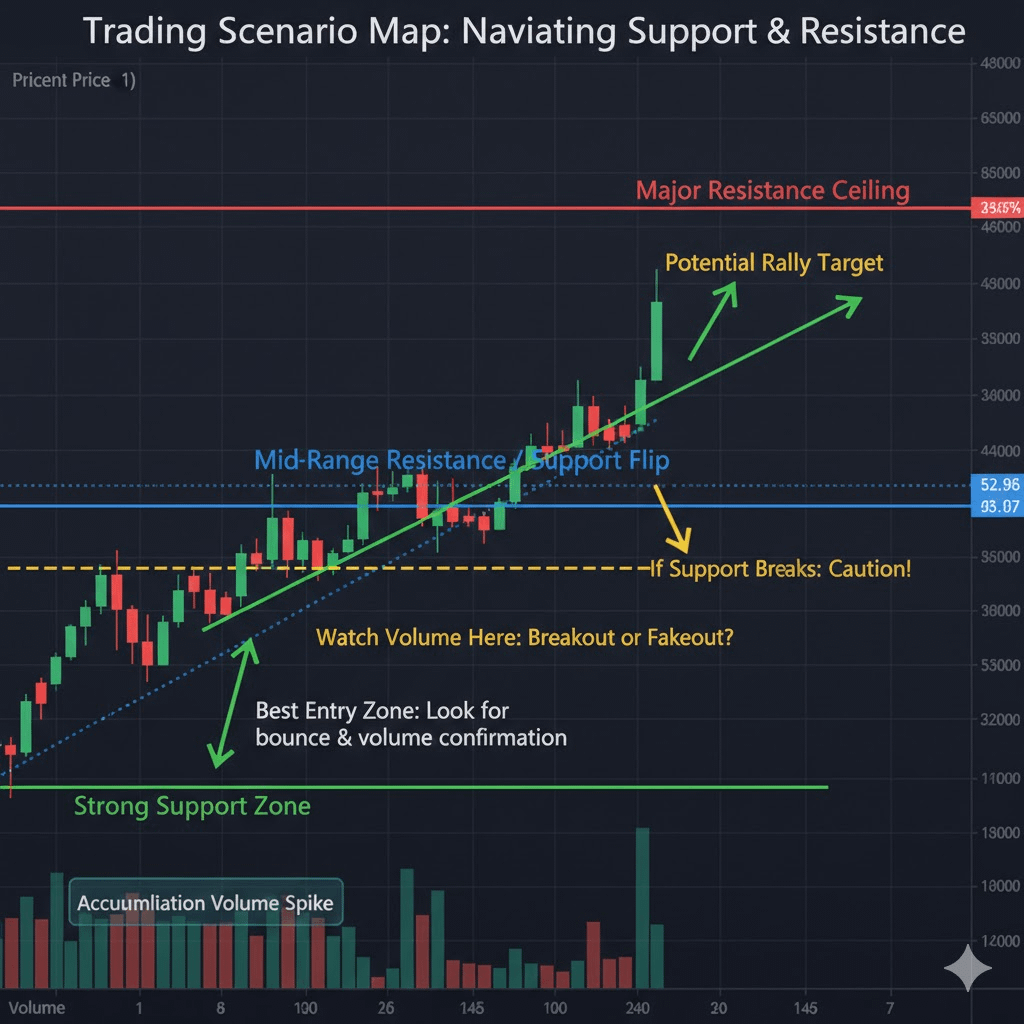

Planning Your Next Moves

Instead of asking, “Is this the end?”, approach it like a trader:

Where is the next support zone?

How is volume behaving during pullbacks?

Are institutions quietly accumulating?

What historical patterns mirror today’s action?

This kind of analysis turns fear into opportunity. Set clear levels, plan scenarios, and trade with awareness not panic.

Bottom Line

The market isn’t collapsing it’s resetting. Traders who understand corrections, watch volume closely, and spot institutional accumulation can position themselves for the next leg up. Fear is temporary, opportunity is structural.

Remember: Markets reset to rise. The difference between a shakeout and a reversal can make all the difference in your trades.