Polkadot is one of the few blockchain projects that entered the market with a clear long-term vision. It is not just another smart contract platform. Instead, it aims to become an infrastructure layer that connects multiple blockchains into one unified ecosystem. $DOT is the native token powering this network.

Here is a structured overview of Polkadot’s current position, its future potential, the team behind it, and how investors may approach it.

What Is Polkadot and Why Does It Matter?

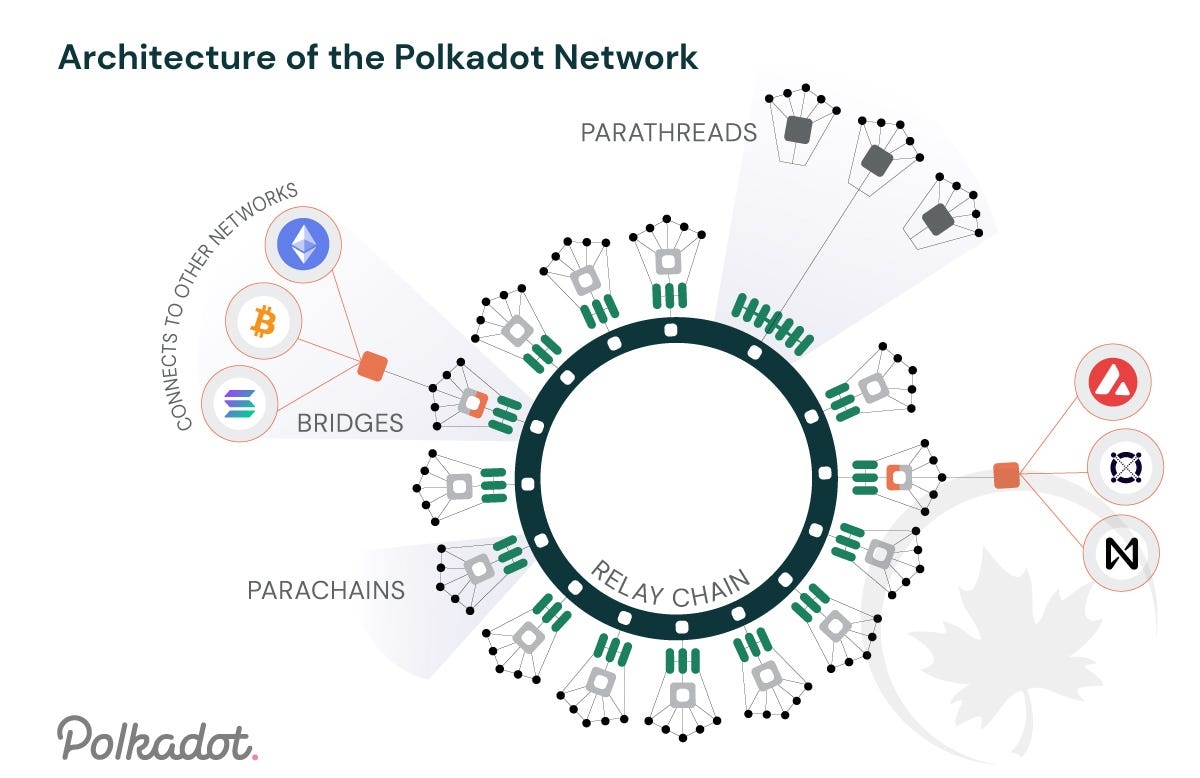

Polkadot is a multi-chain network designed to enable different blockchains to communicate and share data securely. Think of it as a network of networks. Just as the internet connects different computers, Polkadot connects different blockchains.

Key features include:

Parachains – Independent blockchains running in parallel within the ecosystem

Relay Chain – The central chain that provides shared security

Interoperability – Seamless cross-chain communication

Scalability – Parallel processing improves efficiency

This architecture makes Polkadot particularly attractive for developers building specialized blockchains.

Who Is Behind Polkadot?

Polkadot was co-founded by , one of the co-founders of and the creator of Solidity. His technical credibility adds strong weight to the project.

The ecosystem is supported by:

– Oversees research and development

– Core development company

This combination of experienced leadership and institutional backing has helped Polkadot remain relevant even during market downturns.

Current Market Position

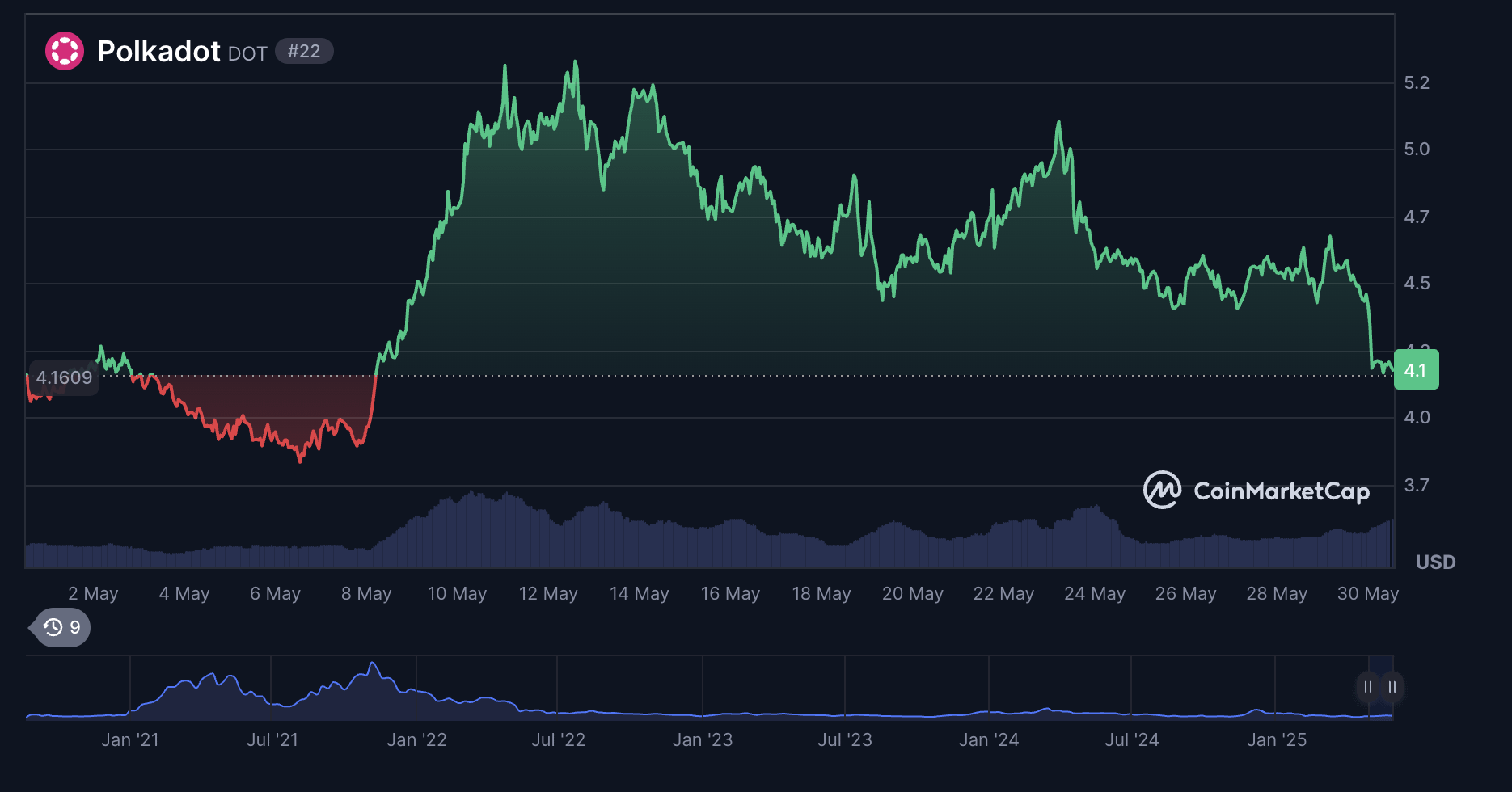

Like most major cryptocurrencies, #DOT experienced significant growth during the 2021 bull run followed by a deep correction. It is currently trading far below its all-time high.

Important points to consider:

Market volatility remains high

Development activity within the ecosystem continues

Staking remains a key utility of DOT

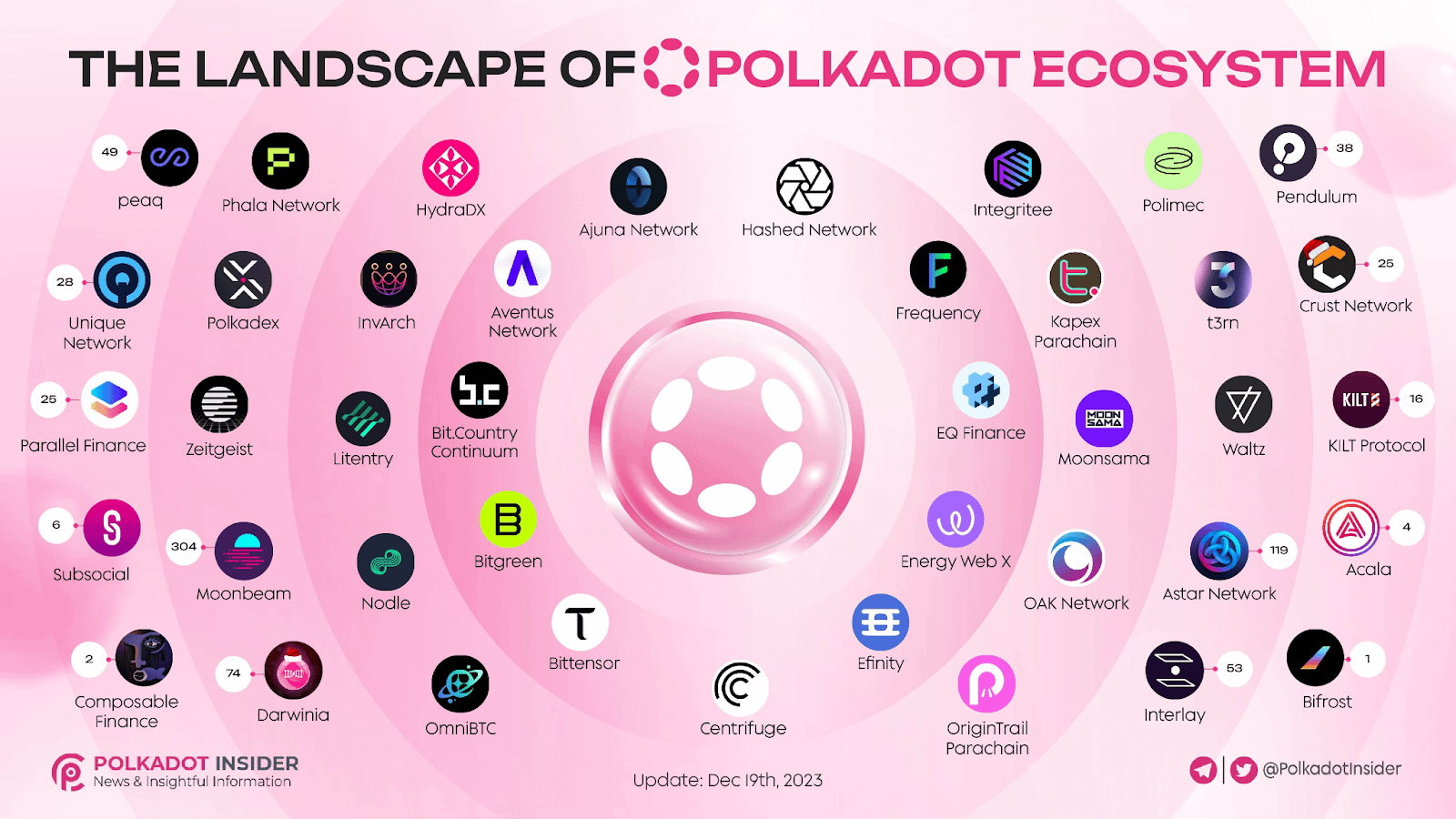

Multiple DeFi, NFT, and Web3 projects operate within the network

Despite price fluctuations, the fundamental development of the network has not stopped.

Future Outlook

Polkadot’s long-term potential depends on several factors:

1. Ecosystem Growth

More parachains and decentralized applications increase network utility.

2. Web3 Adoption

As decentralized internet infrastructure expands, interoperability solutions like Polkadot may gain importance.

3. Competition

Projects such as Cosmos and Ethereum Layer 2 networks are strong competitors.

4. Market Cycles

Historically, fundamentally strong projects tend to perform well during bullish cycles, but timing remains uncertain.

Polkadot positions itself as infrastructure rather than just a token-driven project, which may support long-term sustainability.

How to Approach Investment in DOT

For Binance Square readers considering DOT, here are practical strategies:

1. Use Dollar-Cost Averaging

Instead of investing a lump sum, accumulate gradually to reduce volatility risk.

2. Consider Staking

DOT holders can stake tokens to earn rewards. However, understand lock-up periods and validator risks before participating.

3. Diversify Your Portfolio

Avoid concentrating capital in a single asset. Balance large-cap, mid-cap, and stable assets.

4. Understand Risk

Crypto remains a high-risk asset class. Only invest capital you can afford to lose.

5. Think Long Term

Infrastructure projects often require time for adoption and network effects to materialize.

Final Thoughts

Polkadot stands out as a technically ambitious blockchain project with a credible founding team and ongoing ecosystem development. Its focus on interoperability and scalability addresses real structural challenges in the blockchain space.

However, strong technology does not automatically guarantee price appreciation. Market cycles, macroeconomic conditions, regulation, and investor sentiment all influence performance.

For long-term investors seeking exposure to blockchain infrastructure, DOT may be worth monitoring or gradually accumulating. As always, conduct your own research and build a strategy based on risk management rather than short-term hype.

This article is for informational purposes only and not financial advice.

#BTCFellBelow$69,000Again #OpenClawFounderJoinsOpenAI #VVVSurged55.1%in24Hours #PEPEBrokeThroughDowntrendLine