Lately I have been paying close attention to Fogo, not because it is exploding on the charts, but because it is not. And strangely, that is exactly what makes it interesting to me.

In a market where most coins are either pumping aggressively or fading into silence, Fogo’s price action feels calm. It is not trying to impress anyone. It moves, pauses, consolidates, and then moves again. That rhythm matters to me. I have learned that when a chart breathes naturally, it often reflects healthier participation.

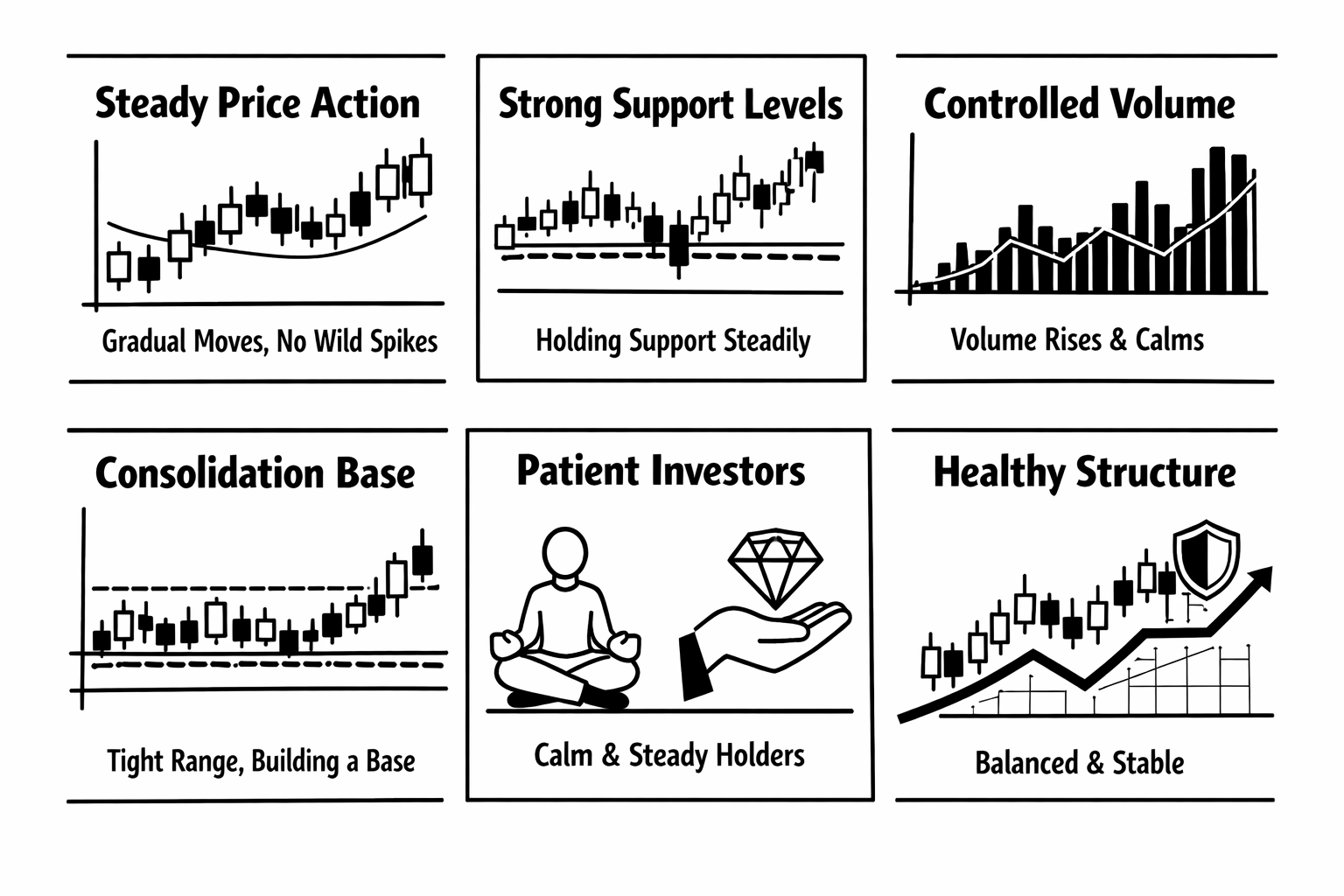

The first thing I noticed was how controlled the candles look. There are no wild spikes followed by immediate collapses. Instead, there is gradual progression. When price pushes up, it does not feel like panic buying. When it pulls back, it does not look like fear. It feels balanced. That balance usually suggests that buyers and sellers are interacting in a more stable way.

From my own experience, I have been caught in coins that move too fast. At first, it feels exciting. You see a huge green candle and think you are early. But then comes the sharp correction. That kind of volatility creates emotional decisions. With Fogo, I do not feel that emotional pressure. I feel space to observe.

Another detail that stands out to me is how Fogo respects its levels. Support zones are not breaking easily. When price dips into a range, it often finds buyers stepping in quietly. There is no dramatic reversal, just steady absorption. That type of behavior usually means accumulation is happening in the background.

I also look at how long price can hold within a range without collapsing. Weak projects usually drift lower over time. Stronger ones build a base. Fogo seems to be building. The longer a base forms, the more meaningful a breakout can become later. That is something I keep in mind while watching it.

Volume plays an important role in my analysis too. With Fogo, volume is not constantly spiking. It increases during key movements and then cools down during consolidation. That is healthy. It shows participation when it matters, but not unnecessary noise. When volume and price move together in a logical way, it gives me more confidence in the structure.

What I personally appreciate the most is the lack of chaos. The crypto market can be extremely reactive. News, rumors, or even a single large order can shake weaker structures. Fogo, so far, does not seem overly sensitive. It reacts, but it does not overreact. That difference might seem small, but for me it changes the entire feel of the chart.

Steady price action also attracts a different kind of trader. Instead of pure momentum chasers, it brings in people who are willing to wait. That often leads to stronger hands holding positions. When holders are patient, volatility decreases. And when volatility decreases, the foundation becomes stronger.

Of course, steady does not mean guaranteed success. The broader market still influences everything. If Bitcoin makes a strong move, Fogo will respond. But what matters to me is how it responds. Does it hold structure, or does it lose control? So far, it seems to be handling pressure reasonably well.

I am not approaching Fogo with unrealistic expectations. I am not waiting for an overnight explosion. Instead, I am observing how it builds layer by layer. Sometimes the most sustainable growth comes from consistency rather than speed.

There is something psychologically reassuring about a calm chart. It allows me to think clearly. I can plan entries and exits without feeling rushed. That alone makes a difference in how I manage risk.

Right now, my focus is simple. I am watching whether Fogo continues respecting its range and gradually stepping higher. If that pattern continues, it could signal a mature trend forming. If it breaks down and loses structure, I will reassess without emotion.

For me, Fogo’s steady price action is not boring. It is disciplined. And in a market driven by emotion, discipline often becomes the hidden advantage.

$FOGO #fogo @Fogo Official