5 Hard Truths About the Global Debt Trap

The view from Madrid this morning offers a chillingly precise metaphor for the global macro landscape. The skies are only partially covered, the temperature is rising, and on the surface, things seem pleasant enough. But beneath this atmospheric haze lies what I can only describe as a "systemic malice"—a structural breakdown of the global monetary order. While the current trajectory is devastating for the "citizen of good" who plays by the old rules, it provides a clear, albeit dark, roadmap for the "speculator of good."

We are no longer looking at a cyclical downturn. We are witnessing the mathematical surrender of the world's reserve currency.

1. The Arithmetic of Ruin: Why 4% Growth Can’t Save the Treasury

The recent liquidation data for the first four months of the US federal fiscal year isn't just a red flag; it is a tombstone for fiscal sanity. The numbers present a terrifying paradox that should haunt every bondholder.

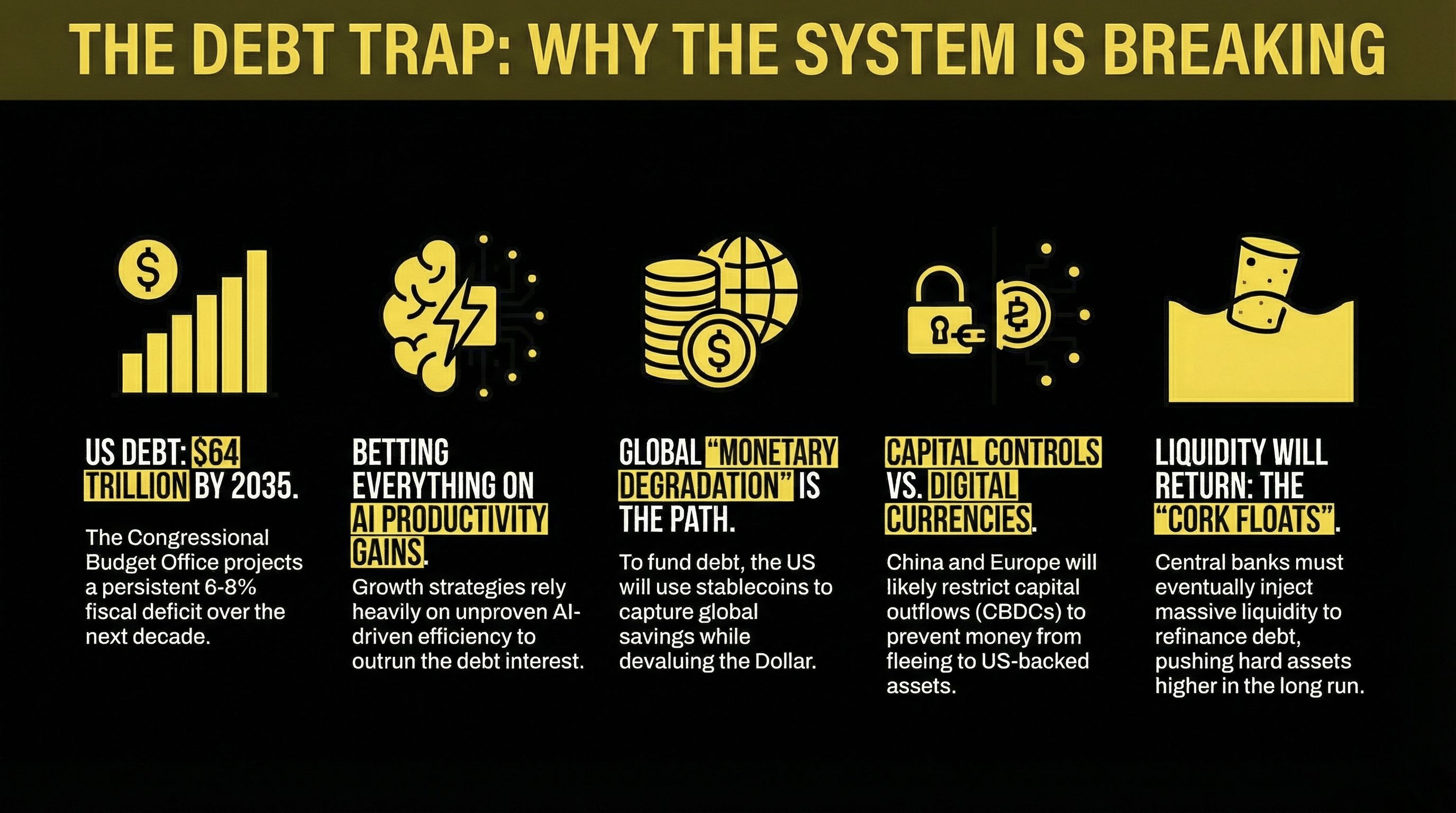

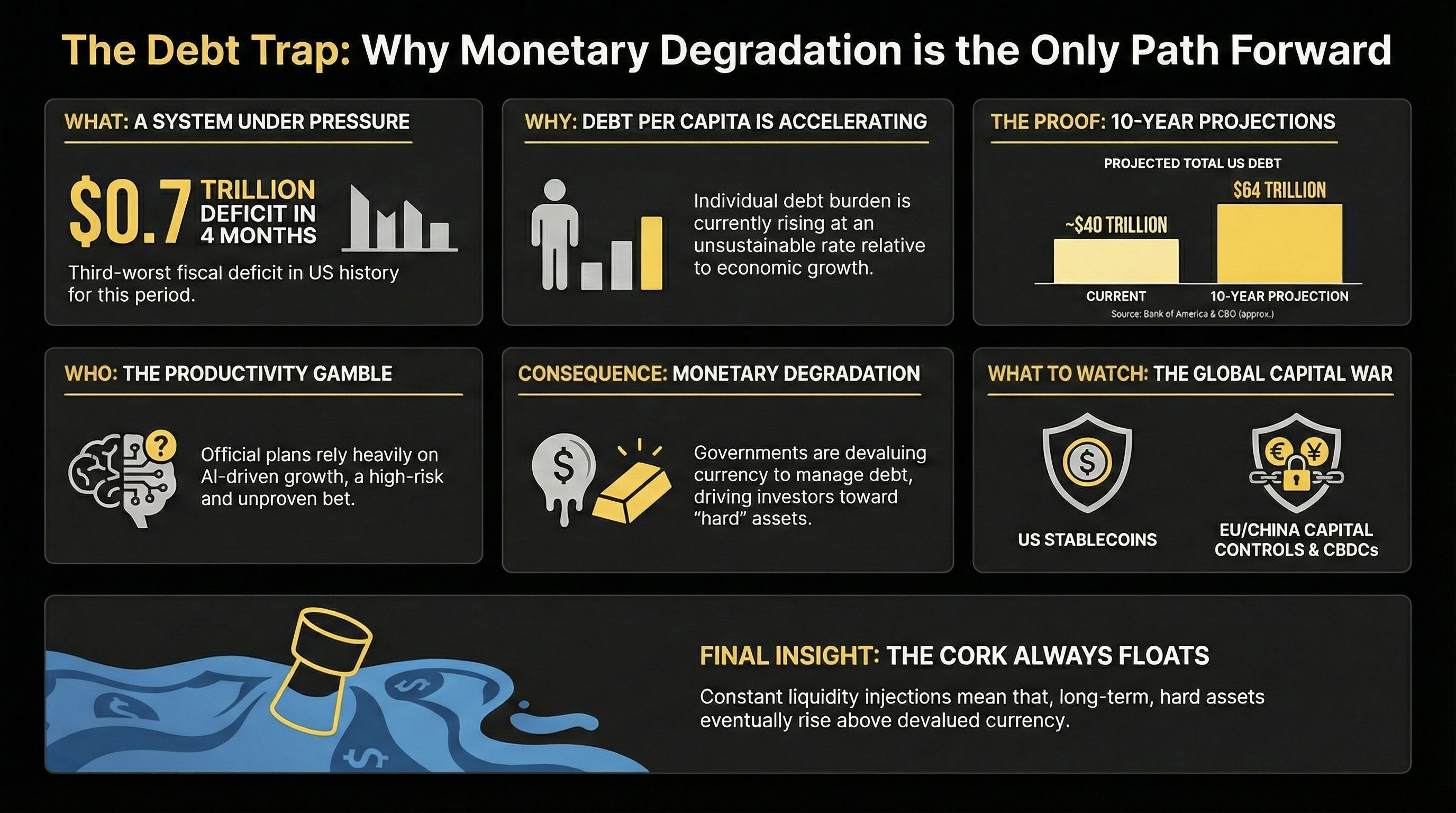

Despite a massive surge in tax revenue—driven largely by an aggressive increase in tariffs—and an economy screaming along at nearly 4% GDP growth, the federal deficit has hit $0.7 trillion. This is the third-worst deficit in American history for this period. Let that sink in: during a period of peak employment, record revenue, and robust growth, the engine is still melting down.

If the government cannot narrow the gap under these "perfect" conditions, the conclusion is inescapable: the deficit is structural, terminal, and unsolvable. As the data suggests:

"Este hecho revela que no hay solución." (This fact reveals there is no solution.)

The Congressional Budget Office (CBO) is already waving the white flag, projecting deficits of 8% for 2026. Bank of America predicts total US public debt will balloon from $40 trillion to $64 trillion within a decade. The system isn't just "strained"—it is fundamentally broken.

2. The 8% Delusion: Why AI is a Productivity Mirage in a Debt Desert

To counter this mathematical gravity, the incoming economic guard—figures like Donald Trump and Scott Bessent—are peddling a "Hail Mary" strategy. They aim to accelerate GDP growth to an unprecedented 8% to dilute the debt-to-GDP ratio. It is a bold vision, but it is built entirely on the shifting sands of an Artificial Intelligence miracle.

Wall Street remains a house divided: one side sees AI as a speculative bubble destined to pop, while the other sees it as a job-destroying force that will hollow out the tax base. Betting the stability of the global financial system on 8% productivity growth is a high-stakes gamble with no historical precedent. While 8% growth is a fantasy, the alternative—monetary degradation—is a mathematical certainty.

3. The Digital Vacuum: Exporting Debt Through "Garbage-Backed" Stablecoins

Since the traditional bond market is losing its appetite for Treasury "risk," the US is pivoting toward a more predatory financing model—a digital vacuum designed to suck up global liquidity.

This "triple-threat" plan involves:

The Stablecoin Capture: Emitting massive amounts of stablecoins backed by what the market is beginning to recognize as "garbage"—US Treasuries. This effectively turns the global crypto ecosystem into a captive audience for US debt, extracting savings from every corner of the globe to fund the $64 trillion mountain.

Controlled Demolition of Yields: Many wonder why the 10-year bond yield isn't exploding given the deficit. The answer is simple: the market is being manipulated. We are seeing a "controlled demolition" of market signals to prevent a systemic collapse.

Gold Stabilization: There is a concerted effort to suppress or "stabilize" gold prices. This isn't a sign of gold's weakness; it’s a tactical maneuver to keep the "exit door" affordable for central banks as they quietly swap failing paper for hard metal.

4. The Artists of Theft: Europe’s Descent into Fiscal Hell

While the US exports its debt via digital assets, Europe is opting for raw fiscal "voracity." The Netherlands has become the grim laboratory for this new "Fiscal Hell," a model that combines rigid spending controls with a level of tax creativity that borders on the criminal.

The most "desoladora" (devastating) development is the tax on unrealized gains. European politicians have become "artists" at taxing the very inflation they created. If your home "value" increases because the Euro lost 10% of its purchasing power, you haven't made a profit—you’ve merely stood still while the currency sank. Yet, the government now demands a cut of that "phantom gain." This is effectively a wealth tax on currency devaluation. To ensure the victims don't flee, they are implementing "exit taxes," turning the continent into a gilded cage for capital.

5. The Great Wall of Savings: The Impending War of Capitals

The US plan to vacuum up global savings via stablecoins has not gone unnoticed. We are entering a "War of Capitals" where the individual is the primary casualty.

China’s response is predictable: a total ban on US-backed stablecoins to protect its domestic savings from being exported to finance its rival's deficit. Meanwhile, both Europe and China are accelerating Central Bank Digital Currencies (CBDCs). Make no mistake—these are not "convenience" tools. They are digital enclosures, "exhaustive controls" designed to prevent citizens from moving their wealth into US-backed digital assets or hard money.

Conclusion: The "Cork" Theory

We are currently watching a piece of high-stakes theater. Figures like Kevin Warsh are being cast in a role—much like a Kevin Costner character in a Western fiction—pretending they can actually reduce the Federal Reserve's balance sheet.

It’s a bluff. They have no choice but to inject liquidity to renew existing debt and finance the new trillions. We are seeing a temporary "brake" on liquidity right now, which explains the stagnation in the S&P 500 and the recent tremors in Bitcoin. But don't be fooled by the volatility.

In a world of infinite debt and systematic currency degradation, the fundamental law of financial physics remains: "In the long run, the cork floats."

The "cork" represents hard assets—gold, Bitcoin, and real estate. As the sea of fiat currency rises and loses its value, these assets will inevitably move higher. The only question that matters for the "speculator of good" is this: How are you positioning your savings to survive a world where governments have weaponized the very definition of money?