Bitcoin slipping back under $69,000 isn’t just another dip — it’s a signal that something bigger is happening. In crypto, these round numbers do more than mess with your head; they pull in liquidity like magnets. So when BTC drops below $69K, the real question isn’t just, “Why did it fall?” but, “What’s actually moving the market right now?”

Three big stories usually fight for the spotlight: a liquidity hunt, a leverage flush, or plain old macro fear. Sometimes they all mix together, but usually, one stands out.

1. Liquidity Hunt: Where the Sharks Play

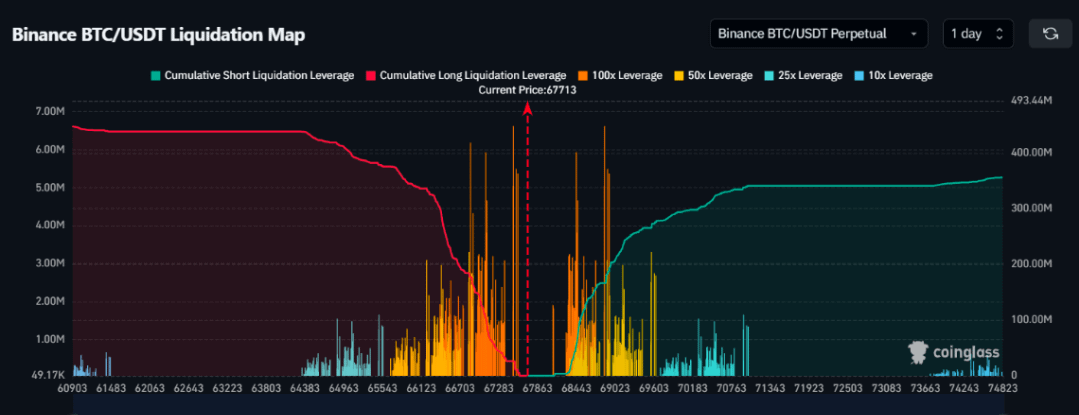

Crypto markets revolve around liquidity. Big players aren’t chasing price — they’re hunting for stop-losses and pools of resting orders. Around $69K, you probably get two big pockets of liquidity: stop-losses just below support, and breakout buyers who got sucked in above $70K. When price sweeps through a key level, it triggers those stops, and forced selling lets bigger players scoop up BTC at a discount.

It’s the old playbook:

Break support.

Trigger stops.

Push the price lower.

If the market’s still bullish, snap back and reclaim the level.

If BTC bounces back above $69K with solid volume, it’s a good hint that this was just a liquidity sweep, not some fundamental breakdown.

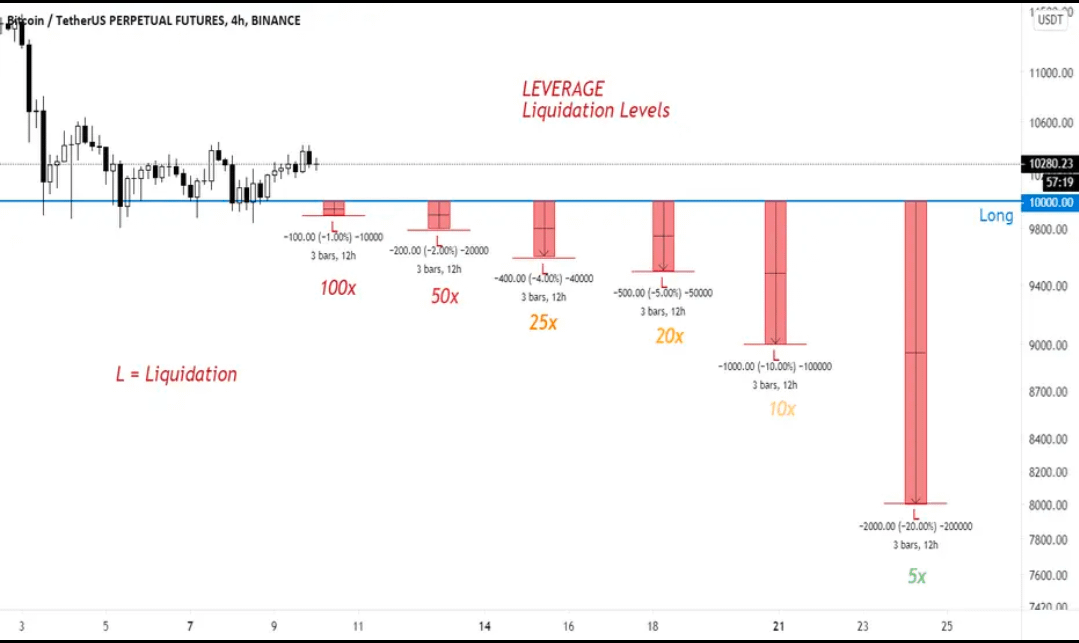

2. Leverage Flush: Clearing Out the Excess

Crypto lives on leverage. When open interest starts climbing and funding rates get too hot, you know the market’s crowded with longs. Dip below $69K, and you’re probably seeing over-leveraged traders getting wiped out, funding rates resetting, and open interest dropping fast.

These flushes are actually healthy when the market’s bullish. They reset the system, cut down on speculation, and set the stage for the next move up. If you see open interest drop while price stabilizes, that’s constructive. But if both price and open interest fall hard, and spot demand vanishes, then there’s more weakness lurking beneath the surface.

3. Macro Fear: When the World Gets Shaky

Bitcoin doesn’t live in a bubble anymore. As more institutions get involved, BTC reacts to big-picture stuff — U.S. Treasury yields spiking, the dollar getting stronger, stocks turning red, or central banks talking tough. If Bitcoin drops in sync with stocks and other risk assets, it’s probably macro-driven selling. Here, it’s not about crypto drama — it’s about global money tightening up.

The big clue: Did Bitcoin fall alone, or did everything take a hit? If everything’s down, blame the macro.

What the Structure Tells Us

Below $69K, you want to watch three things:

Volume: Was it heavy spot selling, or just a wave of liquidations in the derivatives market?

Funding: Did funding rates suddenly flip neutral or negative? That would back up the leverage flush idea.

Speed of the Bounce: Liquidity hunts tend to reverse quickly. Macro-driven moves grind lower.

The Bigger Picture

$69K was a big breakout level in earlier cycles. Losing it — and then reclaiming it — turns into a tug-of-war over the market’s structure.

If BTC:

Stays above key weekly support,

Open interest drops,

Spot buyers step in strong,

Then this was just a healthy shakeout.

If BTC:

Can’t reclaim lost ground,

Spot demand stays weak,

Macro headwinds get worse,

Then we’re probably in for a deeper correction.

What Traders Should Do

Short-term traders: Keep an eye on funding and liquidation data. Don’t chase breakdowns right after big sweeps. Wait for the dust to settle.

Swing traders: Focus on the weekly chart, not the minute-by-minute noise. Look for solid consolidation after the flush.

Long-term investors: Corrections happen, even in bull markets. Structural breaks show up on higher timeframes, not on hourly charts.

Bottom Line

Bitcoin dropping under $69K doesn’t mean it’s game over. Volatility like this usually gets engineered before the next leg up. The key isn’t the exact level — it’s how price acts around it. Are we just flushing out excess, or is this the start of a bigger risk-off move? In these markets, the first move often tricks you. The second move tells the real story.#BTCFellBelow$69,000Again