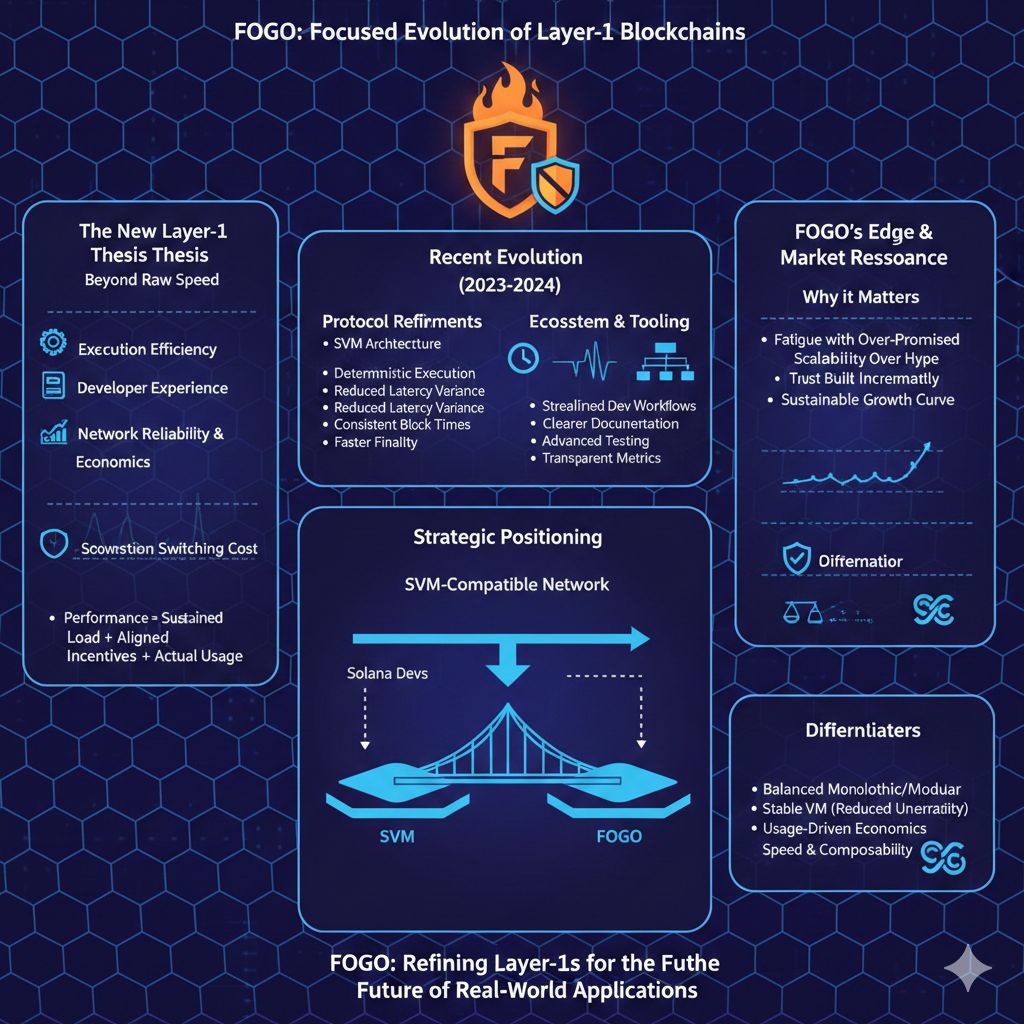

In a market where Layer-1 blockchains are launching faster than narratives can keep up, Fogo is positioning itself not as a loud disruptor, but as a focused evolution of what high-performance chains should already be delivering. Over the last year, the conversation around base layers has shifted from raw transaction speed to a more nuanced mix of execution efficiency, developer experience, network reliability, and economic sustainability. Fogo enters this phase with a clear thesis: performance only matters if it can be sustained under real load, aligned with incentives, and translated into actual usage rather than benchmark screenshots. This mindset is shaping recent updates, its current standing, and the way it compares with other systems competing for the same builders, liquidity, and attention.

Recent changes around Fogo reflect a maturation process rather than a radical pivot. The protocol’s core architecture, built around the Solana Virtual Machine, has been refined to improve deterministic execution and reduce latency variance during peak demand. Instead of chasing ever higher theoretical throughput, the focus has shifted toward consistency. This matters because many high-TPS chains struggle when usage spikes, creating uneven fee markets and degraded user experience. Fogo’s recent optimizations emphasize predictable block times, faster finality confirmation, and smoother fee behavior under congestion. These updates quietly address one of the most under-discussed pain points in crypto infrastructure: reliability is more valuable to users and developers than raw speed that only exists in ideal conditions.

Alongside execution improvements, Fogo has invested in tooling and ecosystem readiness. Developer workflows have been streamlined to reduce friction when deploying SVM-compatible applications, with clearer documentation, better testing environments, and more transparent performance metrics. This may sound unglamorous, but it directly impacts adoption. Chains that win long term are rarely the ones with the flashiest launches; they are the ones where developers can ship, iterate, and scale without constantly fighting the underlying system. Fogo’s updates suggest an understanding that infrastructure maturity is cumulative and that trust is built by removing small frustrations over time.

Looking at Fogo’s current position, it sits at an interesting intersection in the Layer-1 landscape. It is not competing head-to-head with legacy networks on decentralization narratives alone, nor is it purely a niche experimental chain. Instead, it targets the growing segment of builders who want high performance without abandoning proven execution environments. By leveraging the SVM while maintaining its own network identity, Fogo lowers the switching cost for developers already familiar with Solana-style programming while offering an alternative environment that can differentiate itself on governance, economics, and network design. This strategic positioning is subtle but important, because developer mindshare is increasingly fragmented, and ease of transition can be a decisive factor.

From a market perspective, Fogo’s timing aligns with broader fatigue around over-promised scalability. Many users and investors have seen cycles where new Layer-1s boast impressive specs, only to struggle with real adoption or collapse under incentive misalignment. Fogo’s measured approach, emphasizing stability and incremental improvement, resonates with a more cautious audience that values survivability over hype. This does not mean the project lacks ambition; rather, its ambition is expressed through execution discipline instead of aggressive marketing claims.

When compared with other systems in the same performance-oriented category, Fogo’s edges become clearer. Traditional monolithic Layer-1s often face trade-offs between decentralization and throughput, while modular approaches add complexity that can fragment the user experience. Fogo’s design attempts to strike a balance by keeping execution fast and cohesive while avoiding excessive architectural sprawl. In contrast to chains that constantly rewrite their core assumptions, Fogo’s use of an established virtual machine reduces uncertainty for developers and auditors, which in turn can shorten the path from idea to production.

Another differentiator lies in how Fogo approaches economic incentives. Instead of relying solely on aggressive emissions to bootstrap activity, the network emphasizes usage-driven demand and competitive fee dynamics. This approach aims to avoid the boom-and-bust cycles that have plagued many new chains, where short-term rewards attract opportunistic users who disappear once incentives decline. By aligning validator rewards, developer incentives, and user costs more tightly with actual network value, Fogo seeks a more sustainable growth curve. While this may slow initial metrics, it can strengthen long-term resilience.

In comparison with ecosystems that prioritize maximal composability at the expense of performance, Fogo leans into the idea that speed and composability do not have to be mutually exclusive if execution is well designed. Fast confirmation times and low latency enable more responsive decentralized applications, particularly in areas like on-chain trading, gaming, and real-time data protocols. These use cases benefit disproportionately from predictable performance, making Fogo an attractive base layer for builders targeting user experiences closer to traditional web applications.

The benefits of this approach extend beyond developers to end users. Faster and more consistent transactions reduce cognitive load; users do not need to constantly adjust fees or wait uncertain confirmation times. This simplicity can be a hidden growth driver, especially for non-technical users who care less about architectural debates and more about whether an application “just works.” In a market where onboarding friction remains a major barrier, these incremental UX improvements compound over time.

Uniqueness in today’s Layer-1 space often comes from focus rather than novelty. Fogo’s uniqueness lies in its refusal to overextend. By concentrating on being a high-performance, SVM-compatible network with strong reliability guarantees, it avoids diluting its identity. This clarity helps ecosystem participants understand what the chain is optimized for and what trade-offs it is willing to make. Clarity, in turn, attracts aligned participants rather than speculative tourists.

From a competitive standpoint, Fogo does not need to displace dominant networks overnight to succeed. Its path to relevance is more likely incremental, carving out a reputation as a dependable execution layer for specific classes of applications. As these applications mature and attract users, network effects can build organically. This bottom-up growth model is slower but often more durable than top-down liquidity incentives.

Looking forward, the real test for Fogo will be how well it maintains this balance as usage grows. High-performance chains are easy to run when activity is low; the challenge is preserving guarantees under stress without resorting to centralized shortcuts. The project’s recent updates suggest awareness of this challenge, but sustained performance over time will ultimately validate the thesis. Governance decisions, validator diversity, and economic tuning will all play roles in determining whether Fogo can scale without compromising its core promises.

In the broader narrative of blockchain evolution, Fogo represents a maturation phase. The industry is moving past the era of pure experimentation into one where infrastructure must support real businesses, real users, and real expectations. In that context, speed is table stakes, but trust, predictability, and alignment are differentiators. Fogo’s current trajectory indicates an understanding of this shift, positioning it as a serious contender in a field crowded with ambitious but often unfocused projects.

Ultimately, the value proposition of Fogo is not that it reinvents the concept of a Layer-1, but that it refines it. By integrating proven execution technology with a deliberate focus on reliability, developer experience, and sustainable economics, it offers a compelling alternative for those who believe the next wave of adoption will be driven by quality rather than noise. If the project continues to execute with the same discipline reflected in its recent updates, it stands a credible chance of earning long-term relevance in an increasingly selective market.