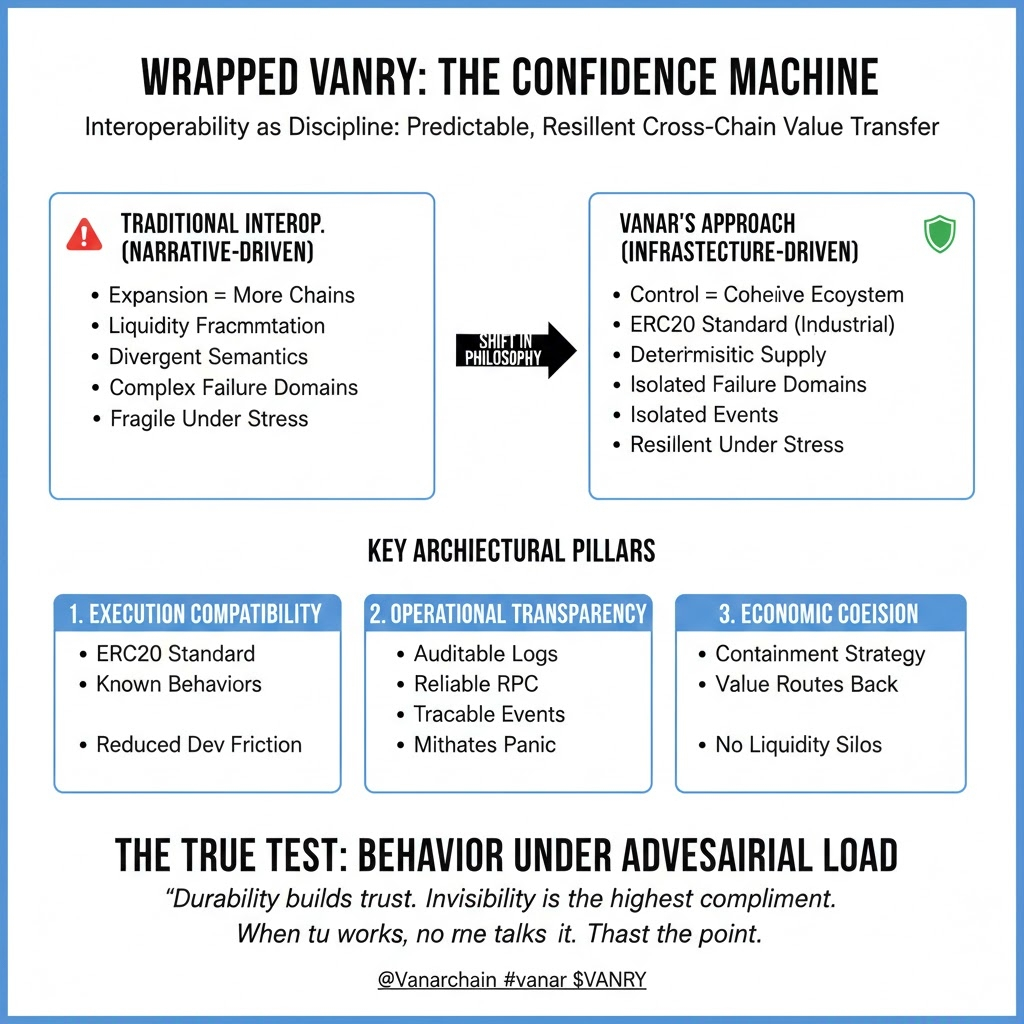

The dominant crypto narrative treats interoperability as expansion. More chains supported. More liquidity venues. More endpoints. The implicit assumption is that broader distribution automatically strengthens a token’s position.

From an infrastructure perspective, that assumption is incomplete.

Interoperability is not primarily about reach. It is about control. Every time an asset is extended across chains, complexity increases. Failure domains multiply. Finality assumptions diverge. What looks like expansion at the surface can become fragmentation underneath.

Wrapped VANRY as an ERC20 representation is best understood not as a marketing bridge, but as a containment strategy. The goal is not simply to move value. It is to do so without multiplying semantic ambiguity or weakening the economic center of gravity.

Real adoption does not depend on how many chains an asset touches. It depends on whether builders can rely on predictable behavior under stress.

In traditional finance, clearing systems do not collapse because assets settle across multiple banks. They rely on standardized settlement logic and reconciliation protocols. Similarly, interoperability across EVM chains only works when execution semantics remain consistent and supply accounting is deterministic.

The first layer of discipline is execution compatibility. ERC20 is not innovative. It is industrial. It provides known behaviors: transfer semantics, allowance logic, event emissions, wallet expectations.

A wrapped asset depends on bridging infrastructure. That infrastructure introduces additional trust boundaries: relayers, validators, event listeners, and cross chain confirmation logic. Each component must assume that the other side may stall, reorganize, or temporarily partition.

A mature bridge treats both chains as independent failure domains. It isolates faults rather than propagates them. If congestion spikes on one side, the other should not inherit ambiguity. Confirmation depth thresholds, replay protection, and rate limiting are not glamorous features. They are hygiene controls.

Consensus design matters deeply here. Cross chain representation depends on finality assumptions. If one chain treats blocks as effectively irreversible after a short depth, while another tolerates deeper reorganizations, the bridge becomes the weakest link.

Another aspect of building trust is confidence in the node quality, as well as the operational standards. Wrapped assets depend on: accurate indexing, the reliable issuance of events, and a solid RPC infrastructure. Issues like configuration drift, latency spikes, and lack of proper observability can lead to differences between how we perceive an asset's state vs. how it actually exists. Opacity is inherently destabilising in a financial environment. Transparent logs, block explorers, and traceability help mitigate panic when there are anomalies.

Upgrade discipline is another axis often overlooked. In speculative environments, upgrades are framed as progress. In infrastructure, they are risk events. A change to gas accounting, event ordering, or consensus timing on either side of a bridge can ripple through the interoperability layer.

Mature systems assume backward compatibility as a default. Deprecation cycles are gradual. Rollback procedures are defined in advance. Staging environments simulate edge cases. This approach does not generate excitement, but it prevents cascading failures.

Trust in wrapped assets is not earned during normal conditions. It is earned during congestion, validator churn, and adversarial load. Does the wrapped supply remain synchronized? Are mint and burn operations transparent and auditable? Can operators trace discrepancies quickly?

Global manufacturing of aircraft components has a very established standard. All replacement components must be compatible in addition to performing the same under load. No one is going to try to redesign the bolt threads in order to make them look new. Safety is preserved through standards established by the respective manufacturers through the entire distribution chain.

Wrapped VANRY takes on very similar reasoning if looked at seriously, however, the ERC20 offering extends accessibility to use W VANRY without having to redefine any rules of economics. The process of supplying both native and wrapped forms of VANRY must provide for deterministic identically in the manner of performing and reporting. Minting and burning must include an audit roll and be limited to a specific number of times based on an explicit cross chain proof event.

Economic cohesion is a very significant factor in interoperability without fragmentation. If wrapped liquidity drifts into disconnected silos without routing value back to the core network, fragmentation occurs not technically but economically. Infrastructure discipline demands that interoperability preserve alignment between usage, security, and value capture.

None of this produces viral attention.

Success will look uneventful. Tokens moving across chains without incident. Bridge events visible and traceable. Congestion absorbed without supply inconsistencies. Upgrades rolled out without semantic breakage.

The highest compliment for interoperability is invisibility.

When builders integrate wrapped VANRY into contracts without reinterpreting semantics, when operators monitor cross chain flows without guesswork, when incidents are diagnosed procedurally rather than emotionally, interoperability transitions from speculative feature to foundational layer.

In the end, wrapped assets are not growth hacks. They are coordination mechanisms. If designed and operated with discipline, Wrapped VANRY becomes an extension of reliability rather than an expansion of fragility.

That is what serious infrastructure becomes, a confidence machine. Software that quietly coordinates across domains, reduces variance, and allows builders to focus on application logic instead of risk containment. When it works properly, no one talks about it.

And that is precisely the point.