Bitcoin is bleeding and one of Wall Street's loudest bears thinks the worst is far from over.

Bloomberg Intelligence senior commodity strategist Mike McGlone dropped a stark warning on February 15, arguing that BTC could eventually collapse to $10,000 as the broader risk-asset machine grinds to a halt. His thesis connects crumbling crypto prices to deeper cracks forming across equities, volatility cycles, and macro liquidity. According to McGlone, the "buy the dip" mentality that propped up markets since 2008 may finally be dying.

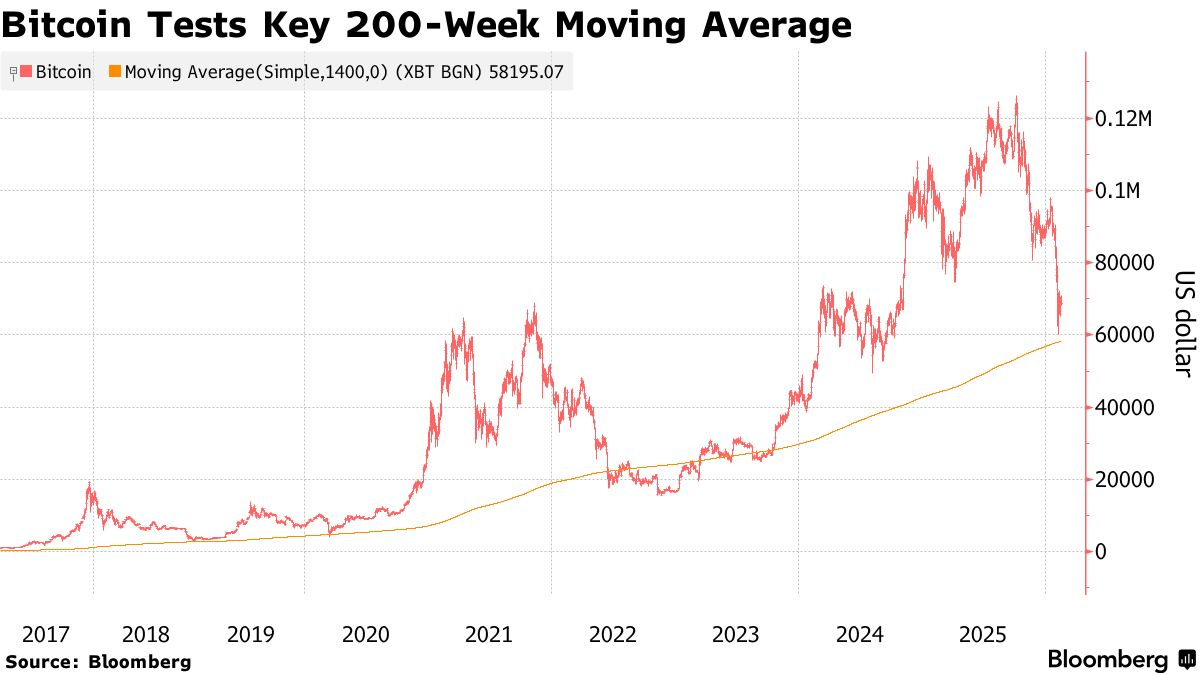

The numbers paint a painful picture. Bitcoin has shed roughly 28% in the past month and sits nearly 50% below its 2025 high above $126,000. The Fear and Greed Index collapsed to 8, matching the panic seen during the FTX meltdown. CryptoQuant data reveals that 43% of circulating BTC supply is currently underwater, amplifying the sense that capitulation is gaining momentum.

McGlone's framework maps BTC divided by ten against the S&P 500 and notes both were sitting below 7,000 on February 13. His logic is straightforward: if equities revert toward 5,600 on the S&P, Bitcoin tracks to roughly $56,000. If stocks actually peak at these levels and roll over, he sees a much steeper plunge into five figures. He calls the current environment comparable to 2008, pointing to U.S. stock market cap relative to GDP at century highs, suppressed equity volatility, and gold surging at speeds not seen in half a century.

Not everyone agrees with the doomsday scenario. Market analyst Jason Fernandes pushed back sharply, calling McGlone's thesis "false equivalence and single-path bias." Fernandes argues that markets can resolve excess through consolidation and rotation rather than outright collapse. A drop to $10K would require a genuine systemic event including credit spreads blowing out, forced fund deleveraging, and a disorderly equity drawdown. Absent that kind of crisis, he views it as a low-probability tail risk.

And beneath the surface panic, accumulation data tells a different story. CryptoQuant reports that long-term accumulator addresses are absorbing around 372,000 BTC monthly, up from just 10,000 in September 2024. Binance converted its entire $1 billion SAFU insurance reserve into Bitcoin, now holding roughly 15,000 BTC. Goldman Sachs filings show exposure to 13,740 BTC through spot ETFs despite the drawdown.

The divergence between retail fear and institutional conviction is the real story here. Whether McGlone's extreme target materializes depends entirely on whether equities hold their ground or crack under the weight of decade-long excess.