Most people assume that blockchain speed is all about cramming more transactions per second into a network, like stuffing a suitcase until it bursts. But what if the real bottleneck isn't raw throughput—it's the jitter, the tiny delays that turn high-stakes trades into gambles? Traders lose edges not because chains are slow in aggregate, but because they're inconsistently fast, leaving orders to the mercy of validators' whims.

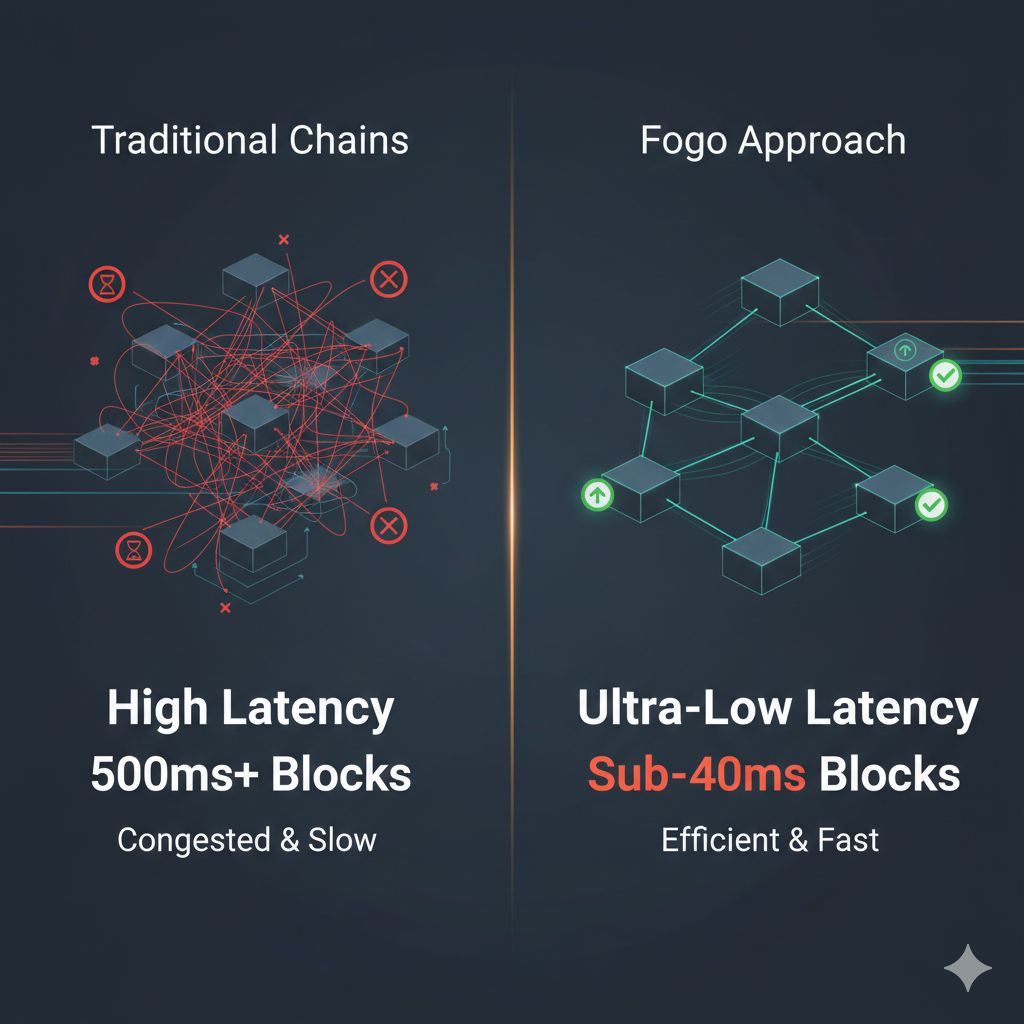

Fogo changes that by rebuilding the Solana Virtual Machine from the ground up, tailored strictly for trading. It strips away general-purpose bloat and injects a validator setup that's curated—not permissionless chaos, but a tight group of pros running Firedancer, Jump Crypto's efficiency beast. Smart contracts here stick to Rust, the language that lets developers craft precise, parallelized logic without the overhead of Ethereum's Solidity. This isn't about enabling every app under the sun; it's about making order matching feel instantaneous, with block times dipping under 40 milliseconds. Costs plummet too—gas fees aren't just low, they're often waived in sessions, shifting the economic model from per-transaction tolls to sustained network health. Builders notice the difference immediately: code deploys without the usual Solana hiccups, and state updates propagate like clockwork.

Yet here's where it gets subtler. Because of this laser focus, Fogo quietly unlocks something chains like Solana or Sui overlook: embedded fairness in execution. Native price feeds and an enshrined DEX mean oracles aren't third-party afterthoughts; they're baked in, reducing the attack surface for front-running. Liquidity providers colocate directly, shrinking the gap between quote and fill. Suddenly, strategies that demand microsecond precision—arbitrage across fragmented pools, for instance—become viable without off-chain crutches. It's not flashy, but it alters the calculus for institutions eyeing DeFi: why hybridize when pure onchain can match CeFi reliability?

That said, Fogo's design carries real flaws that could stall it cold. The curated validators, while speeding things up, flirt with centralization— a handful of operators could collude or fail, echoing the outages that plague even mature networks. Firedancer sounds promising, but it's early; bugs in its pure implementation might expose the chain to exploits that broader testing on Solana avoids. Adoption barriers loom large too: developers accustomed to Ethereum's ecosystem might balk at Rust's steep learning curve, and without a massive liquidity moat yet, traders could stick to established venues. These aren't minor quibbles. If market conditions sour, Fogo's trading-first bet assumes perpetual volume— a shaky foundation if DeFi winters return.

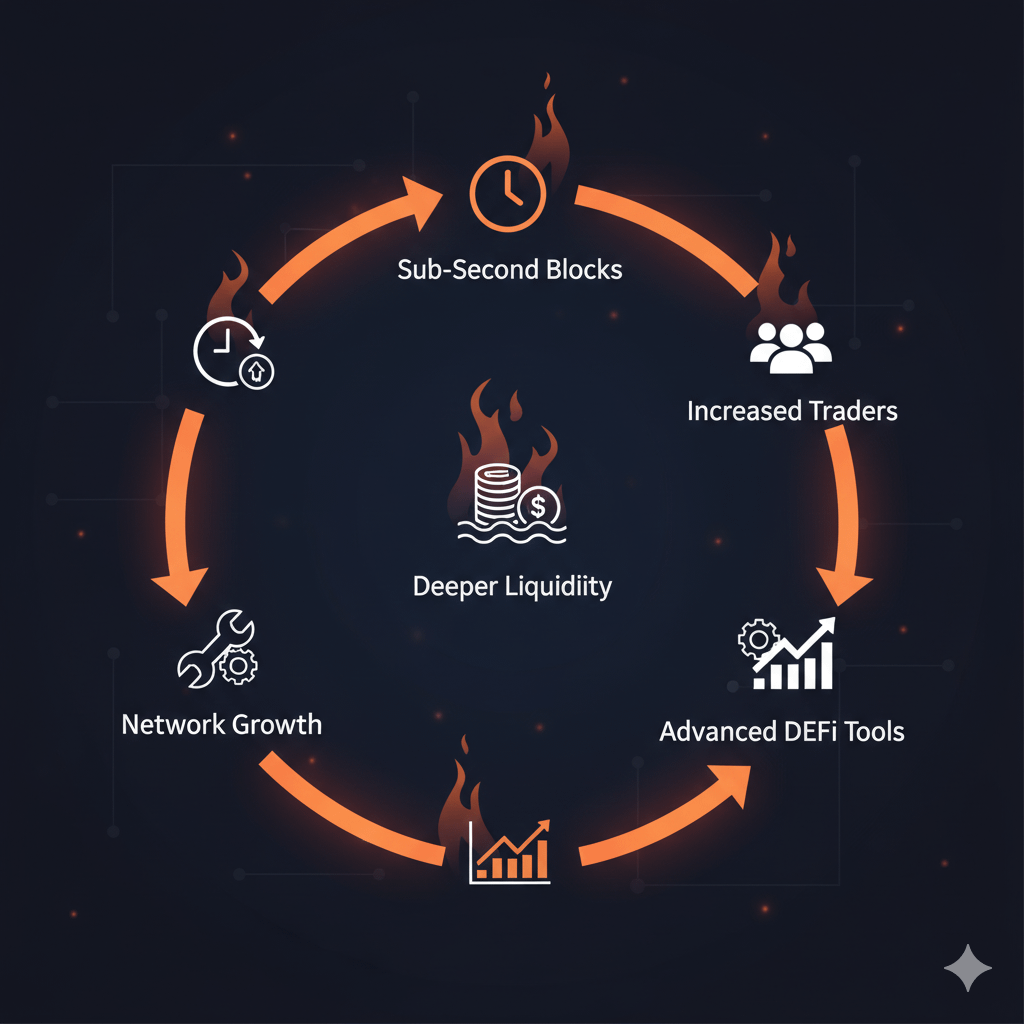

Still, advantages here don't accrue linearly; they snowball. Start with those sub-second blocks: traders flock in, executing complex orders without lag. That influx boosts liquidity, tightening spreads and drawing more sophisticated players—market makers, perhaps, who then integrate native tools like the DEX. Deeper pools enable novel instruments, say perpetuals with embedded leverage, pulling in devs to build atop them. And as the network stabilizes under load, costs per user drop further, creating a retention loop that general chains envy. Over quarters, this could shift entire subsectors: high-frequency trading migrates onchain, eroding CeFi's monopoly.

But why bother with another L1 when Solana already exists? Skeptics ask this first, and fairly. Solana's fine for most, but Fogo addresses the cracks—its validator curation ensures consistent performance where Solana's permissionless model invites spam and downtime. Think of the difference: Solana handles bursts well, but Fogo engineers for steady-state fury, like a server farm optimized for one app versus a cloud juggling thousands. The trade-off? Less decentralization short-term, but potentially more resilience in trading spikes. I've reconsidered this myself—initially, it seemed redundant, but after digging into Firedancer's benchmarks, the latency gains tip the scale for pros.

Picture Fogo as the pit crew in a Formula 1 race. Other chains are the cars, built for any track, any weather. Fogo's the specialized team tweaking tires, fuel, aero for one circuit: trading. Lap times plummet, but only on that course. Readers latch onto this because it cuts through hype— not every project needs to conquer the world; some win by dominating a lane.

This matters now because Fogo's mainnet just went live, fresh off a Binance token sale that injected momentum without overhyping. Markets are thawing post-2025 slump, with DeFi TVL climbing and institutions probing onchain perps. Narratives around speed are peaking too—Sui's hype faded, leaving room for SVM refinements. Launch at this juncture catches the wave: builders seek alternatives to Ethereum gas wars, and traders crave edges amid volatility. Miss this window, and Fogo blends into the noise.

Put simply: Fogo turns decentralized trading from a clunky approximation into a precision tool, proving specialization beats generality in crypto's maturing phase.

If I were watching Fogo closely from here, I would track total value locked in its native DEX as a proxy for trader adoption, the number of active validators to gauge decentralization progress, and average TPS during peak hours to verify Firedancer's promises hold under stress. Within the next 6-12 months, I predict Fogo will capture a noticeable slice of onchain perpetuals volume, say 3-5 percent, as CeFi bleed accelerates and its ecosystem hits critical mass.

@Fogo Official $FOGO #fogo