From Blocks to Fills in Milliseconds: The Fogo Latency Revolution

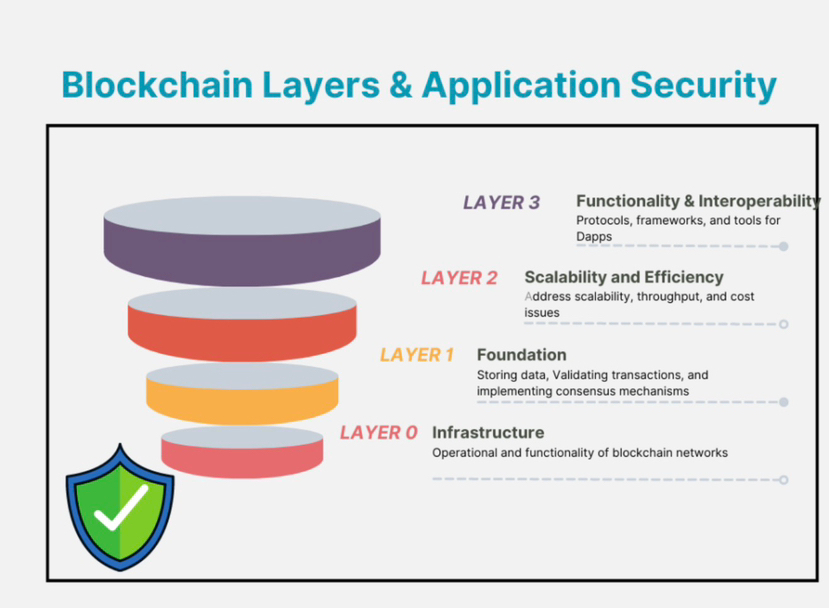

In the high-stakes world of decentralized finance, speed isn’t just a feature — it’s a competitive edge. Traders demand responsiveness, liquidity engines require predictable execution times, and automated strategies thrive only when platforms deliver consistent millisecond-level performance. Enter Fogo — a next-generation Layer-1 blockchain that purpose-builds its entire stack for latency-optimized trading. This article dives into how Fogo’s architecture — especially zoned consensus and SVM execution — aims to shrink the gap between traditional centralized exchanges and on-chain markets.

📉 Why Latency Matters in On-Chain Markets

In conventional blockchains:

• Consensus is global: Validators around the world must agree before a block is finalized.

• Propagation takes time: Geography introduces unavoidable signal delay.

• Execution queues defer responsiveness: High throughput targets often stall at the execution layer.

In markets where every millisecond can impact pricing and fill quality, these delays add friction that deters professional traders from going on chain.

Fogo’s thesis is simple: streamline consensus and execution to cut latency without sacrificing decentralization or security.

🌍 Zoned Consensus: Speed by Design

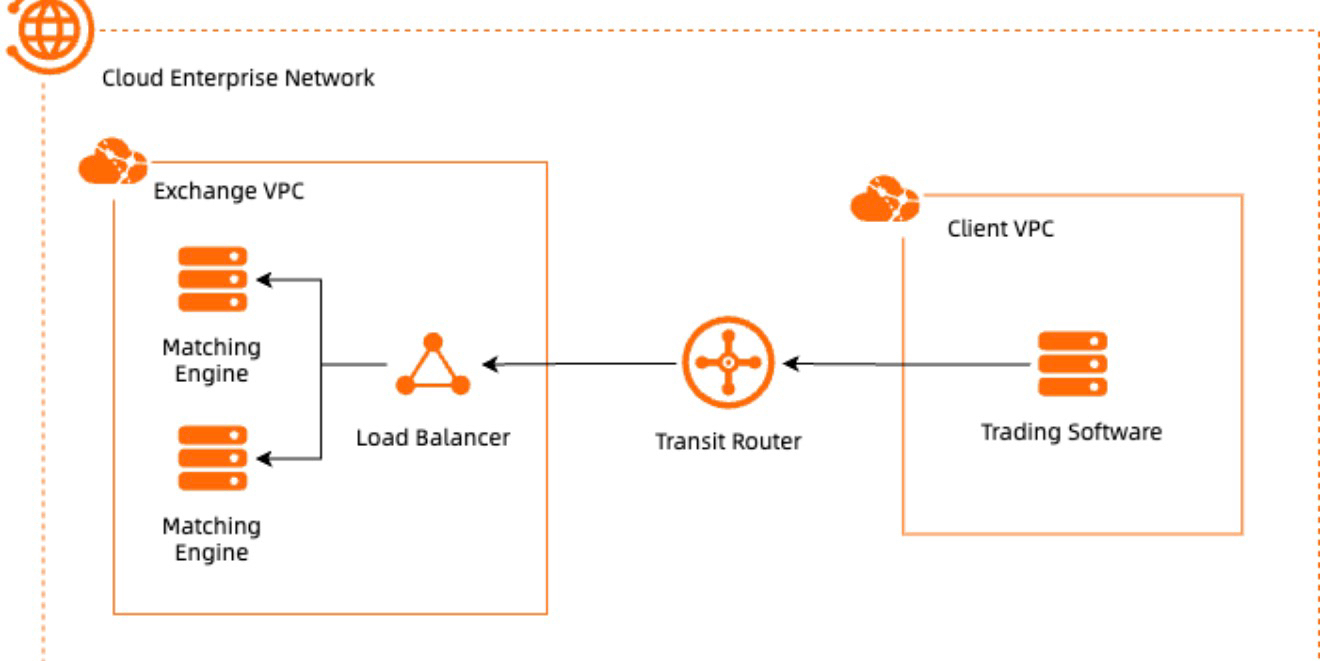

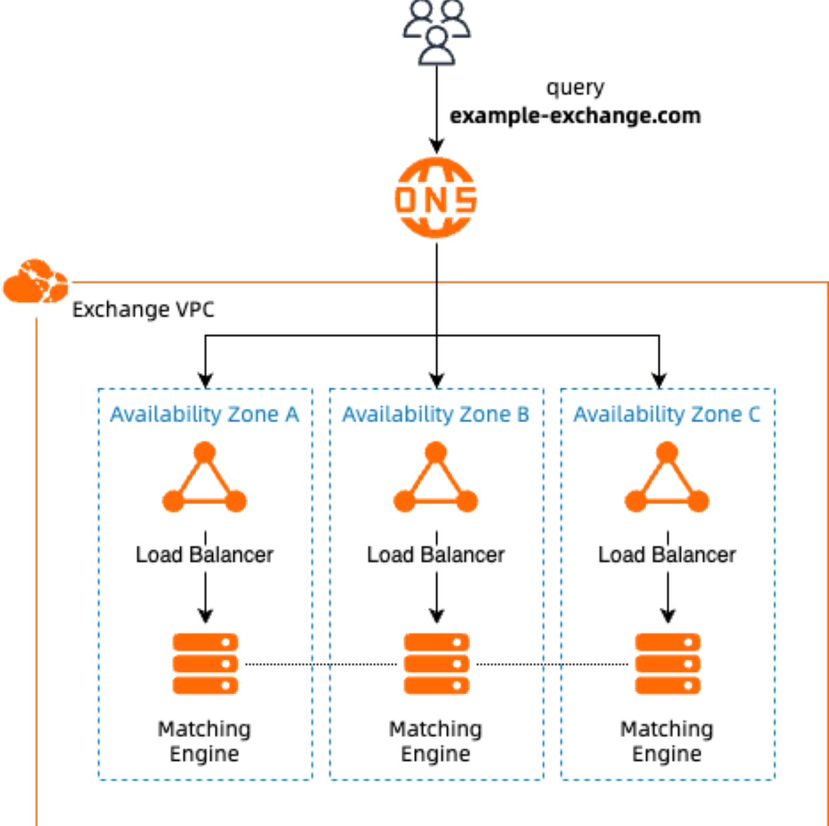

Traditional consensus protocols require validators distributed globally to coordinate before finalizing blocks — which introduces network lag. Fogo’s zoned consensus model changes this dynamic.

🧠 What Zoned Consensus Is

Instead of a single global set of validators all confirming each block, Fogo’s network is divided into geographic zones — clusters of validators co-located in strategic regions. At any given moment:

• One zone is active for producing and finalizing blocks.

• Validators within that zone reach consensus quickly due to lower physical latency.

• The active zone rotates over time to maintain decentralization.

This design dramatically reduces the time it takes for validator messages to propagate, ultimately compressing block confirmation and execution sequencing into a tighter time frame.

⚡ Ultra-Fast Execution with the Solana Virtual Machine (SVM)

Fogo builds on the Solana Virtual Machine (SVM), a high-performance execution environment designed for parallelism and throughput. Here’s how it contributes to speed:

🚀 Fast Block Production

Fogo targets ~40 ms block times — orders of magnitude faster than many existing Layer-1 chains. These rapid blocks mean:

• Transactions are incorporated swiftly.

• State changes propagate quickly.

• Traders get near-real-time feedback.

🧱 High Parallelism

SVM inherently supports parallel processing of transactions, allowing the system to:

• Handle concurrent orders efficiently.

• Reduce contention delays.

• Support high-frequency trading patterns without bottlenecks.

🔁 Finality in Seconds

By combining fast block times with rapid validator agreement, Fogo aims for finality in ~1–2 seconds, meaning transactions are irreversible almost instantly compared to conventional block times.

📊 The Latency Advantage: From Blocks to Fills

So what does all this architectural rigor mean in practice?

✅ Near-Instant Execution Feedback

On centralized systems, traders expect sub-10 ms responses. While on-chain markets historically lag far behind, Fogo’s model brings:

• Comparable responsiveness for order confirmation

• Reduced slippage due to predictable timing

• Lower advantage for latency arbitrage bots

📉 Reduced Market Friction

By shrinking the wall between submitting a transaction and seeing a result:

• Market makers can quote tighter spreads.

• Liquidity providers can adjust positions promptly.

• Strategies can execute with confidence in timing.

🔒 Balancing Speed and Security

High performance must coexist with decentralized security. Fogo achieves this through:

🪩 Rotating Zones

While a single zone may lead the consensus at any moment, rotation ensures that:

• No single region permanently controls consensus.

• Global validator participation still contributes to long-term security.

• Network evolution preserves decentralization goals.

🔐 SVM Provenance

The Solana Virtual Machine has been battle-tested in high-throughput environments, and Fogo builds on that reliability while layering on performance-centric enhancements.

📈 Real-World Impacts

As on-chain markets grow, Fogo’s latency-optimized architecture may lead to:

• Higher institutional participation

• On-chain derivatives and order books that rival CEX latency

• New market design primitives (e.g., low-latency auctions, real-time clearing)

Early adopters in the DeFi ecosystem stand to benefit from the ability to deploy strategies previously feasible only on centralized venues.

🧩 Challenges & Tradeoffs

No system is without tradeoffs. Fogo’s emphasis on speed involves:

• Geographic considerations: Local zones speed up consensus but require careful rotation to ensure fairness.

• Ecosystem growth: Liquidity and tooling must catch up to match the protocol’s performance.

• Developer adoption: New paradigms demand education and optimization for builders.

However, by tackling the fundamental performance barriers to on-chain trading, Fogo represents a meaningful step toward high-performance decentralized finance.

🏁 Conclusion

Fogo’s latency revolution isn’t just about faster blocks — it’s about reimagining every step between block production and trade execution to create an experience that feels instantaneous. Through zoned consensus and high-performance SVM execution, Fogo offers an architecture that could redefine how markets operate on chain — making them feel as responsive as centralized engines, yet as transparent and composable as DeFi.

If you’d like, I can tailor this article for a specific publication, add diagrams explaining zoned consensus more deeply, or include references to academic protocols that influenced Fogo’s design.