Vanar Chain is a Layer-1 blockchain built with a very specific end goal: make Web3 feel normal for everyday users. Instead of designing for crypto-native power users first, Vanar is engineered around mainstream adoption—especially in sectors where scale, speed, and consistent user experience matter most, like gaming, entertainment, digital collectibles, and brand-driven experiences. The project’s edge isn’t just “another fast chain” claim; it’s the insistence that real-world adoption depends on predictable costs, familiar developer tooling, and an ecosystem that already understands consumer distribution.

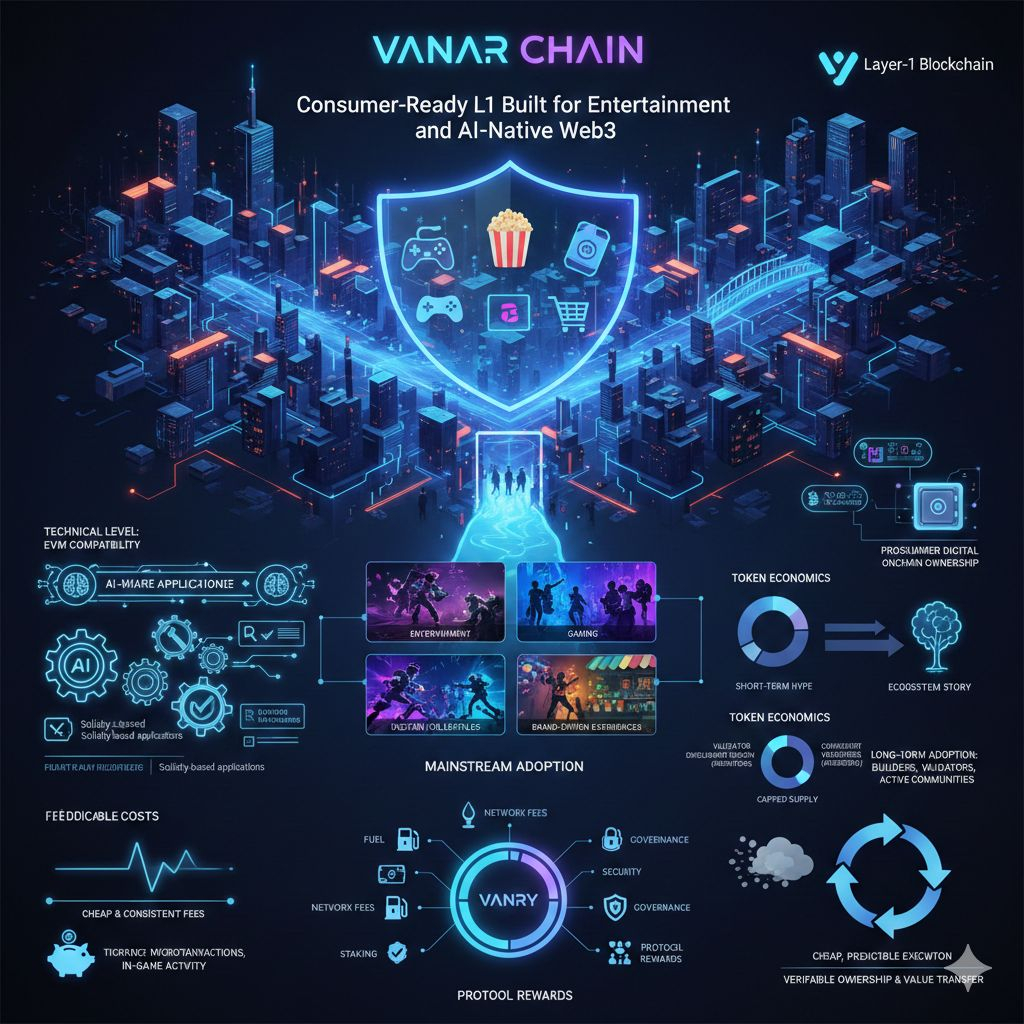

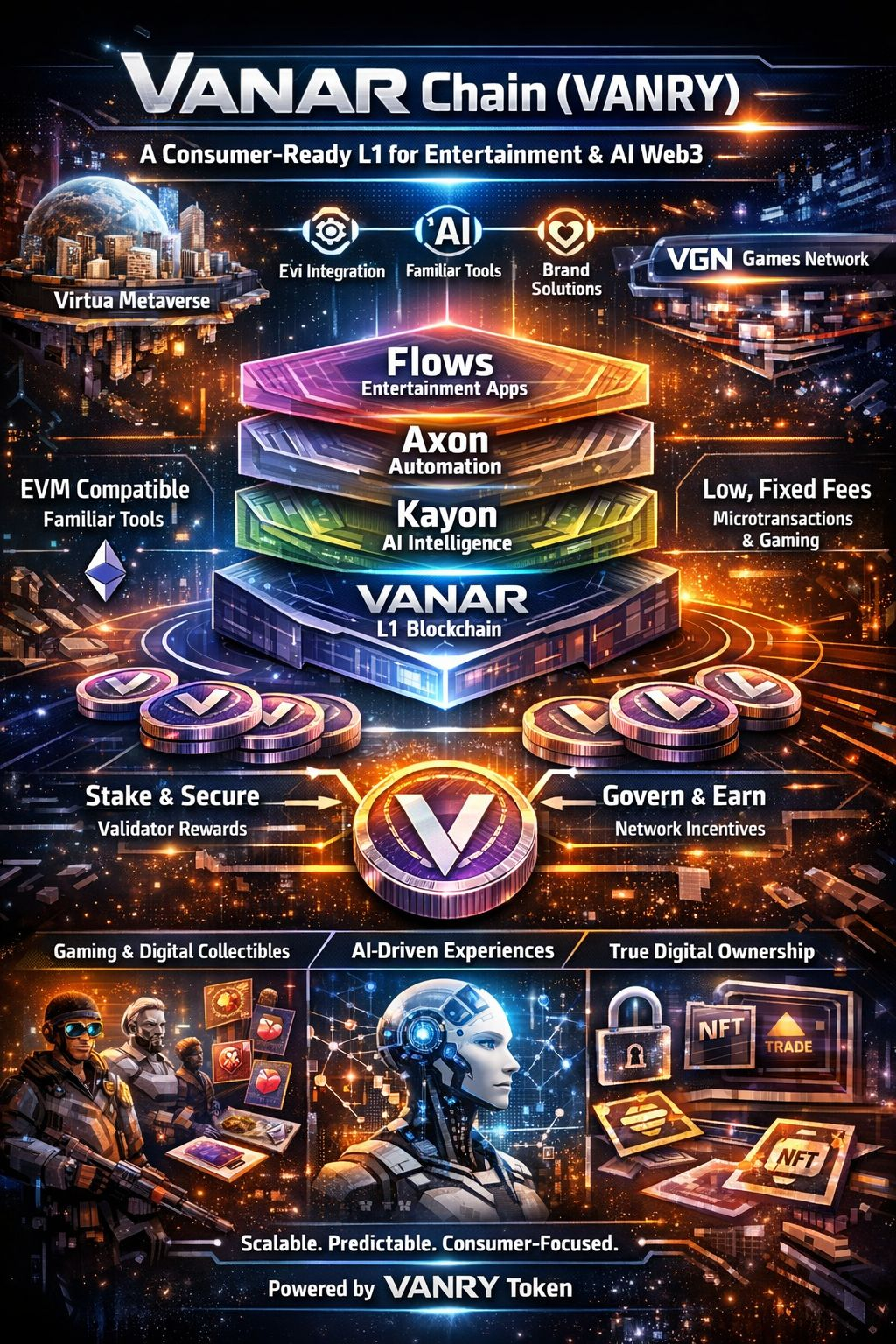

At the technical level, Vanar is shaped to be practical for builders who don’t want to reinvent everything. By emphasizing EVM compatibility, Vanar aligns with the largest developer base in crypto and reduces the friction of deploying existing Solidity-based applications. That matters because ecosystems grow through replication: studios, platforms, and teams move faster when they can reuse known tooling, wallet standards, and infrastructure patterns. Vanar’s architecture narrative then extends beyond basic execution into a broader stack that frames the chain as the foundation for richer, AI-aware applications—positioning “context, automation, and intelligence” as core parts of what future consumer apps will require.

A central adoption choice in Vanar’s design is the way it treats fees. Consumer apps fail when costs are unpredictable, and gaming economies break when transactions become expensive or volatile. Vanar’s approach is aimed at keeping interactions cheap and consistent, aligning the network’s economic model with everyday usage rather than occasional high-value transfers. In practice, that’s a direct attempt to make onchain actions viable for microtransactions, in-game activity, and frequent user interactions where even small fee spikes can ruin retention.

The VANRY token is the fuel and the incentive layer that keeps this system functioning. VANRY is used to pay network fees, which ties real usage directly to token demand. It also plays a security and governance role through staking—holders can stake or delegate to validators, strengthening the network while earning protocol rewards. This matters because it connects the long-term health of the chain to participation: the token isn’t only a speculative asset, it’s the resource that funds execution, secures consensus, and aligns validator incentives with network reliability.

Vanar’s token economics are designed to emphasize ecosystem growth and network security over insider-heavy allocations. The structure is framed around a capped supply with distributions oriented toward validator rewards, development incentives, and community growth mechanisms like airdrops. That distribution philosophy fits the project’s broader identity: Vanar wants to be a chain where long-term adoption is powered by builders, validators, and active communities—not by short-term hype cycles or constant sell-pressure from large internal unlocks. For participants evaluating VANRY, this is one of the more relevant signals: the token model is trying to reinforce network expansion and sustained operation, not just initial marketing.

The ecosystem story is where Vanar becomes more than a technical thesis. The project is strongly linked to consumer-facing verticals through products and networks associated with its team’s background—most notably Virtua (metaverse and digital experiences) and VGN (a gaming network direction). That matters because adoption is rarely won by infrastructure alone. Chains that break out typically have distribution engines: applications that bring users first, then keep them by delivering utility that doesn’t feel like “using a blockchain.” Vanar’s positioning suggests it wants to build that distribution loop through entertainment-grade experiences, where ownership, identity, and digital goods can be made intuitive instead of intimidating.

Vanar’s future direction makes the most sense when you view it as a bridge between two worlds: consumer digital experiences and programmable onchain ownership. Gaming and entertainment provide scale and repeat behavior; AI-native primitives aim to make onchain applications feel smarter, more personalized, and more automated without increasing complexity for the user. If Vanar succeeds, it won’t be because it claims to be faster than everyone else—it’ll be because it makes blockchain disappear into the background while still delivering the one thing Web2 can’t: verifiable ownership and value transfer that works across platforms.

The clearest way to judge Vanar going forward is simple: does it turn “cheap, predictable execution + EVM familiarity + consumer distribution” into a self-reinforcing network? If the chain keeps costs stable, supports builders with real tooling and liquidity, and ships experiences that people actually use (not just hold), VANRY becomes structurally important rather than merely tradable—because it’s the metered resource that powers the activity, secures the network, and rewards the participants who expand the ecosystem. That is the difference between a token that follows attention and a token that follows usage, and Vanar’s entire strategy points toward trying to earn the second one.