@Fogo Official I was posted up in this quiet coworking spot near dusk — the kind where the loudest thing is the air conditioner and the communal table has exactly one sad, cracked mug. I watched an on-chain trade slide away by a tick because my confirmation arrived late. It didn’t ruin my day… but it absolutely got under my skin.

Why does doing it “the right way” still feel like it comes with a delay?

Lately, I keep seeing the same question surface in trader chats and builder threads: can DeFi finally handle the pace people take for granted on centralized exchanges? A lot of the attention is landing on trading-first chains, and Fogo L1 has become part of that conversation as its public mainnet went live and its token mechanics and early distribution plans became clearer.

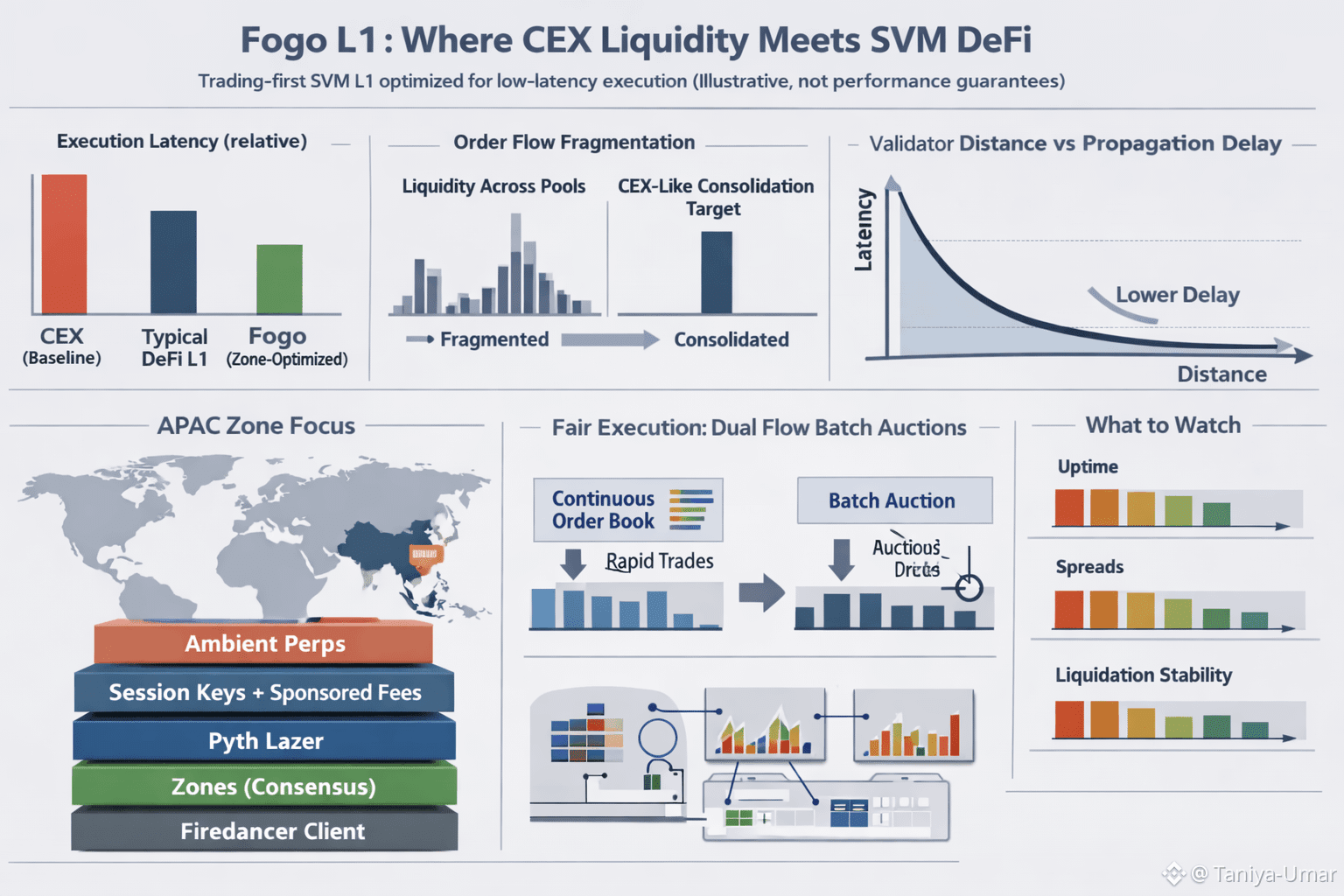

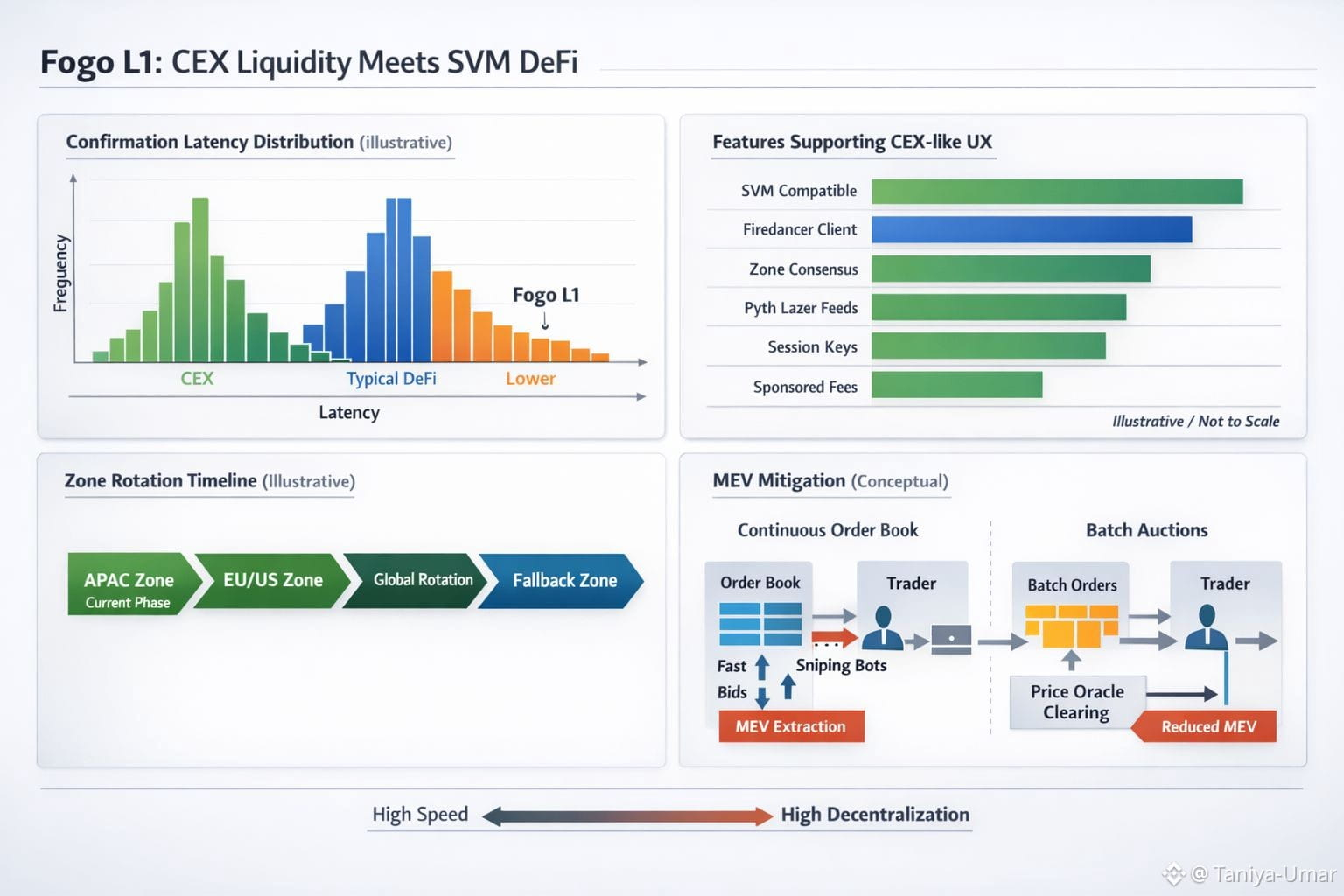

When I look past the slogans, the core idea is pretty concrete. Fogo is an SVM-compatible Layer 1 that leans hard into performance as a design constraint. It standardizes around a Firedancer-based client and a zone-style approach to consensus, where validators can run in close physical proximity to shave away network delay. Right now, the mainnet configuration is explicitly a single active zone in APAC, which is a bold admission that geography matters for trading latency.

The “CEX liquidity meets SVM DeFi” framing starts to make sense when I think about where CEXs win. They don’t just have fast matching engines; they have consolidated order flow and a single place where prices form. On-chain, liquidity often splinters across pools, routes, and apps. Fogo’s approach is to move some of the trading plumbing closer to the chain itself, pairing low-latency execution with native-style data feeds such as Pyth Lazer and pushing a smoother login-and-trade flow through session keys and sponsored fees.

I’m also paying attention to the execution experiments happening on top. Ambient, positioned as a native perps venue in the ecosystem list, is built around Dual Flow Batch Auctions, which batch orders per block and clear them against an oracle price instead of rewarding whoever is physically closest to the leader. That’s a very specific attempt to reduce the “speed wins” dynamic that fuels MEV and toxic flow on continuous order books.

None of this magically creates deep liquidity. Liquidity isn’t just a tech problem — it’s a people problem. Market makers show up when they trust the game won’t change halfway through, and when they believe the pipes won’t burst the moment volume spikes. Still, there’s real progress in seeing a chain talk openly about validator requirements, curated participation, and how it plans to rotate zones over time while keeping a fallback path if a region goes dark. Those are the unglamorous details that decide whether “low latency” holds up outside a demo.

Another reason it’s getting attention is that it doesn’t ask builders to abandon familiar tooling. The docs emphasize full SVM execution compatibility, so existing Solana programs and workflows can move over without a rewrite, while the network pushes a unified client approach—starting with a hybrid Frankendancer setup and aiming to transition toward full Firedancer as it matures. Familiar code, new constraints, and trading focus is easy to test.

The trade-off I can’t ignore is that chasing physical limits pulls you toward smaller, better-equipped validator sets and tighter coordination. That may be acceptable for a network whose primary job is trading, but it raises questions about governance, censorship resistance, and how quickly the system can widen without losing its edge. I’m cautiously optimistic because the architecture reads like someone has actually measured cables, not just drawn diagrams, yet I’m wary of any design that depends on constant operational perfection.

For me, the point isn’t to “beat” a CEX. It’s to close the gap enough that choosing self-custody doesn’t feel like a performance penalty. If Fogo can keep confirmations tight, keep data feeds honest, and make trading apps feel routine instead of brittle, it could mark a practical step toward that. I’ll be watching the boring metrics—uptime, spreads, liquidation stability—because that’s where this idea either becomes ordinary, or quietly falls apart.