I have spent two weeks reading the architecture documents by Fogo, followed through block-production flows, and a comparison of its settlement model with the multi-client chains. The implication not evident: It is not a simplification to ship a single validator client, Firedancer only. It is a gamble that predictable settlement is more important than client diversity and the effects are felt even farther than most summaries indicate.

The Leak Nobody Talks About

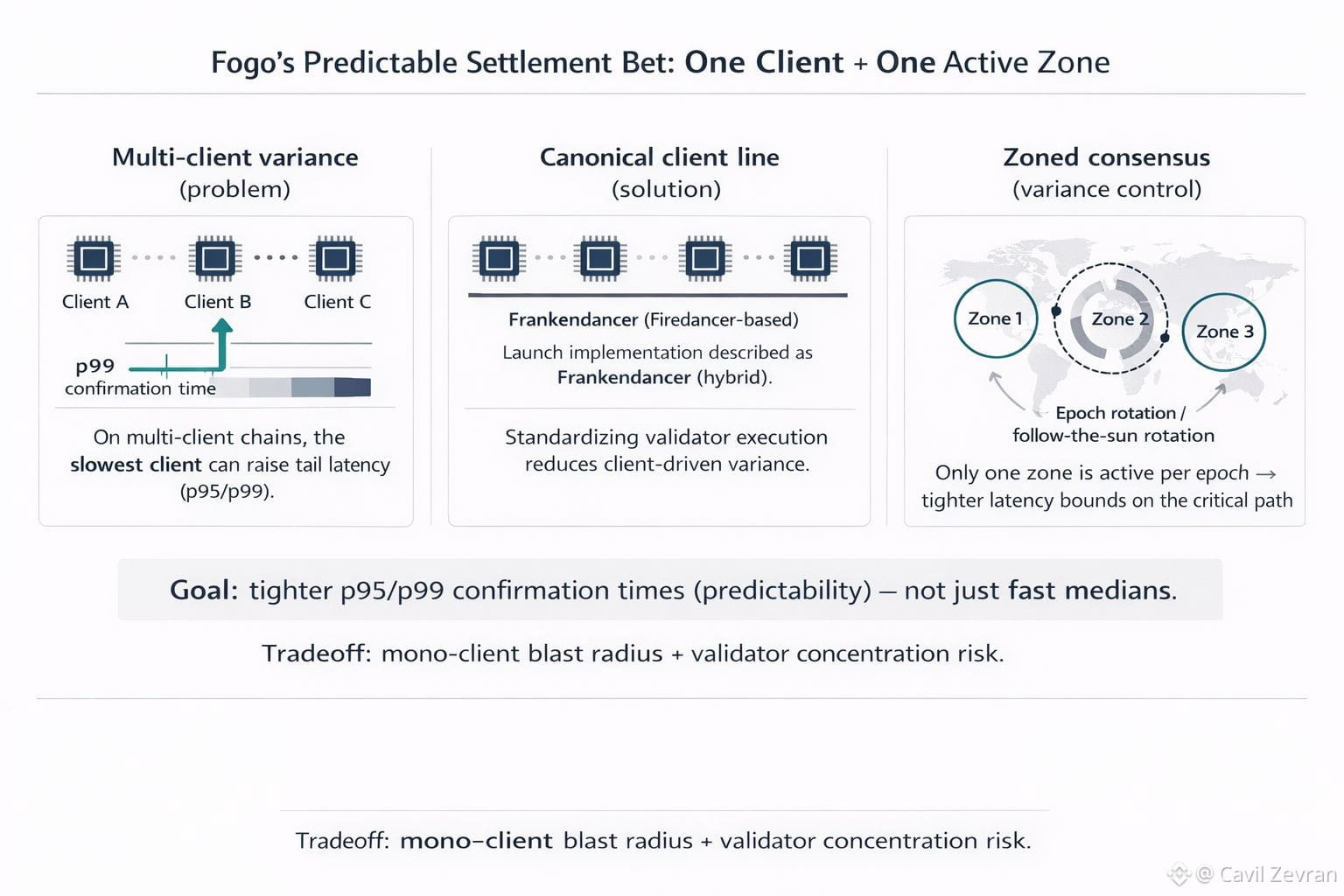

The arguments of the majority of Layer 1 discussions are obsessed with throughput, transactions per second, headline block times. There is a less obvious issue behind those figures, that is tail latency, the delay of the slowest portion of transactions in the 95th or 99th percentile of confirmation time. On chains with a number of validator clients, the slowest client is the flooring effective. When there is a congestion, that floor does rise. Traders miss fills. Liquidations fire late. The price is a fact but will not be shown on a dashboard very often.

One Client, One Clock

This is solved by @Fogo Official through the implementation of mono-client architecture. All the validators execute Firedancer, identical binary, identical memory layout, identical scheduling logic. The initial order effect: the elimination of the slow-client bottleneck reduces the difference between the median and p99 block times. Fogo focuses on sub-40ms blocks, but what is more significant to say is that the difference between the fastest and slowest confirmations remains small.

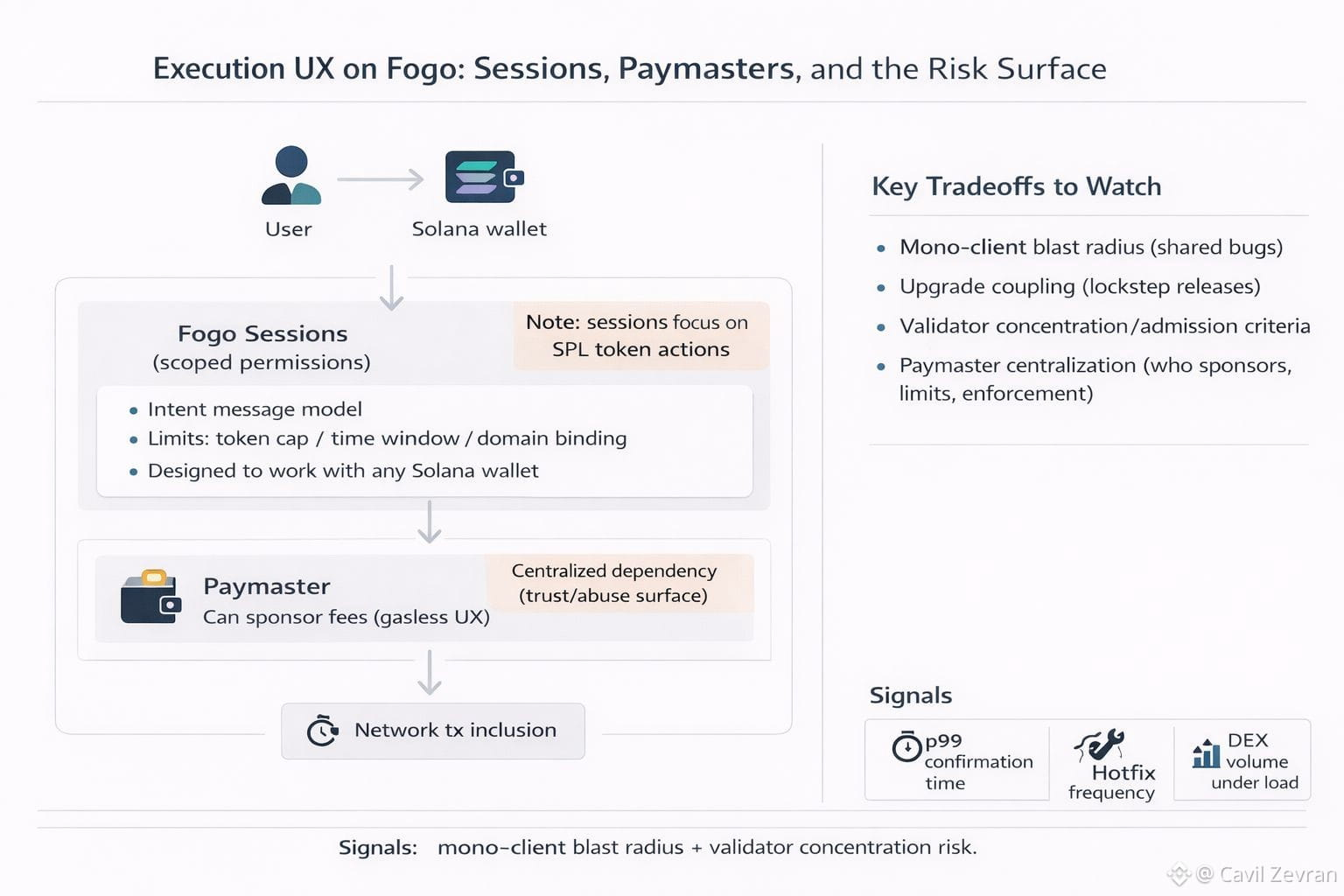

The second-order effect is less apparent. The protocol designers are able to make more powerful assumptions with regard to when settlement has arrived when all nodes are processing state transitions identically. That opens primitives of enshrined trading, batches, MEV-resistant logic, gasless session, which is unsafe to code on a chain in which confirmation time is stochastic. The single client is not simply a performance choice, it is a requirement of the execution layer that Fogo would like to implement.

Builders are affected by the third-order effect. Programmers operating on a chain with small latency factors are able to reason more confidently about state contention and ordering, which is claimed to reduce the testing surface as well as ease the design of liquidation engines of the already extant lending protocols and DEXs on the current network.

Where This Design Breaks

Predictability is not free. The following are the tradeoffs that can be monitored:

Mono-client risk. An error in Firedancer is an error in each of the validators. The existence of multi-client chains is the only way that they can survive some faults in that clients can fail independently. It is the resilience which Fogo exchanges with speed.

Curated validator set. The described number of nodes 20-50 narrows performance but increases concentration of consensus. The criteria of selection are still rather obscure.

Upgrade coupling. A client update implies that the whole network is updated simultaneously, there is no fallback of a slow-client to absorb a bad release.

Firedancer maturity. The client is more recent than legacy client of Solana; adversarial experience is getting piled up.

Reliance on the continuity of the engineering of Jump Crypto. Any change in their priorities would decelerate improvements in upstream Firedancer.

Signal That Notify You Whether it is working

Follow these, to shape your own judgment as to the settlement thesis:

p99 block confirmation time: must be kept within a close range of the sub-40ms target and not only the median.

Standard deviation of block-time (rolling 24 -hour) best, less faked.

The number of validators curve and the publication of admission criterion appear.

Volume On-chain DEX On native venues real trading load stress-tests settlement.

Occurrence and magnitude of post-mainnet client hotfixes.

Participation rate in the staking of the contract even in the form of $FOGO as an indicator of operator confidence.

Teams that postmortem incidences are more trusted than those who remain silent.

Ratio of organic activity to airdrop activity when incentive programs come to a halt.

The Coherent Bet

A constraint experiment that is intentional in nature is known as #fogo . Pre-attach the validator set of one client, reduce the number of nodes, narrow the latency constraints, and then construct a trading-grade use of the predictability that you have created. Assuming that the constraint is met, the chain is a type of infrastructure that could not be recreated through the DeFi protocols on less strict networks. When broken it breaks more than a multi-client chain would break. It is the asymmetry that is the key thing to observe.

DYOR. Not financial advice.