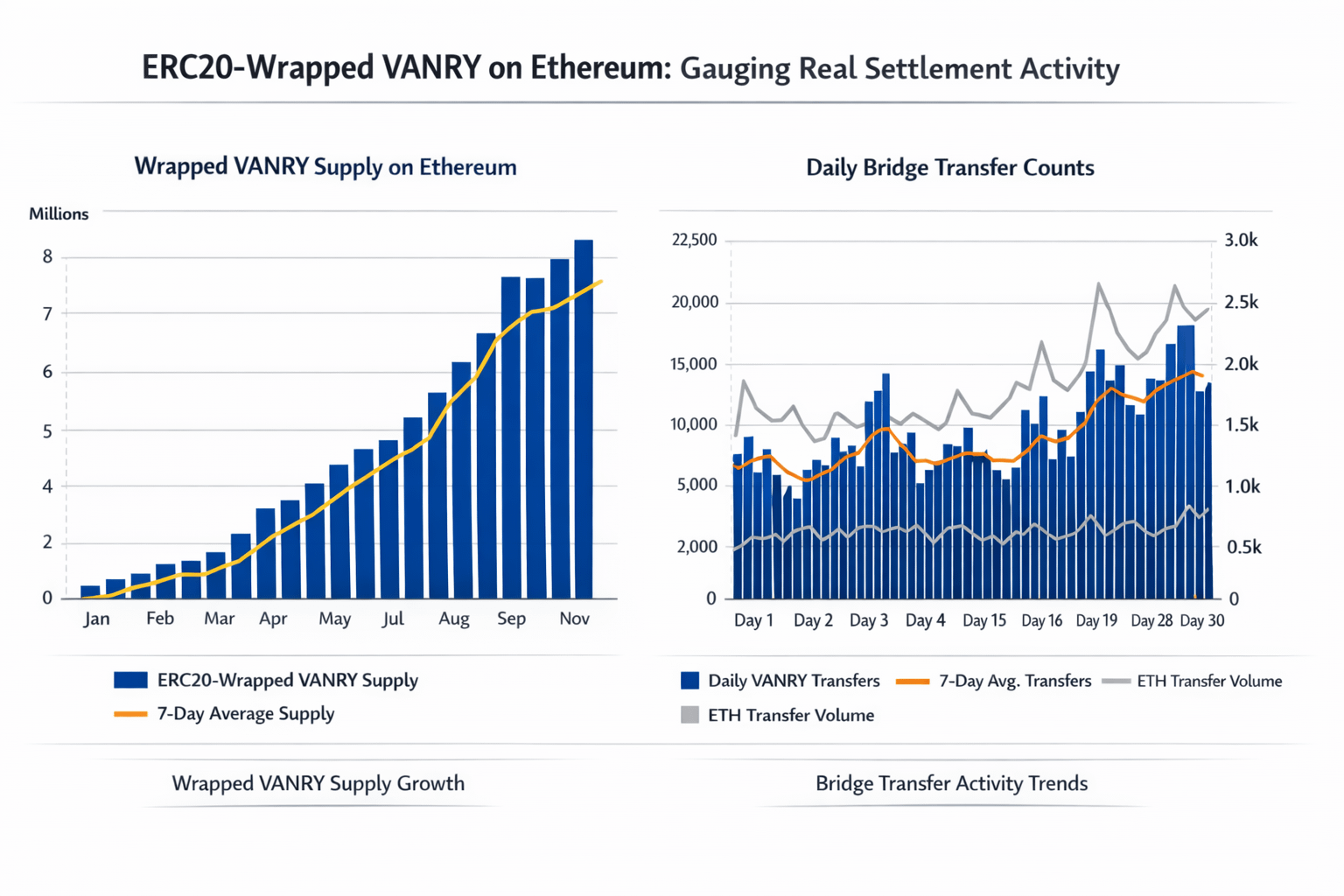

I judge Vanar’s “Ethereum compatibility” claim by two things tied to Bridge Infrastructure and ERC20-wrapped VANRY: how much wrapped VANRY actually exists on Ethereum, and how often it moves. If those signals stay tiny, then the Ethereum angle is mostly talk, even if Vanar runs fast. If those signals grow and keep showing activity, then the bridge boundary is proving it can carry real settlement, not just a demo.

This is an execution versus settlement split, and it matters more than the compatibility label. EVM compatibility mainly helps execution: developers can deploy familiar contracts and users can interact with them in a way that feels normal. Settlement is different. Settlement is where value ends up living, where it can be traded, and where it can exit when people want to move risk. On Vanar, the path into Ethereum venues is not guaranteed by execution speed. It is controlled by whether value can cross the bridge boundary and stay usable on the other side.

Vanar is often priced as if “EVM compatible” automatically means Ethereum liquidity is effectively available. That is the mispricing. Liquidity does not arrive because a chain can run similar contracts. Liquidity arrives when the asset is actually present where the venues are, in enough size, and when moving it is routine. If ERC20-wrapped VANRY barely exists on Ethereum, Ethereum liquidity cannot be more than a small edge case, no matter how clean the developer story sounds.

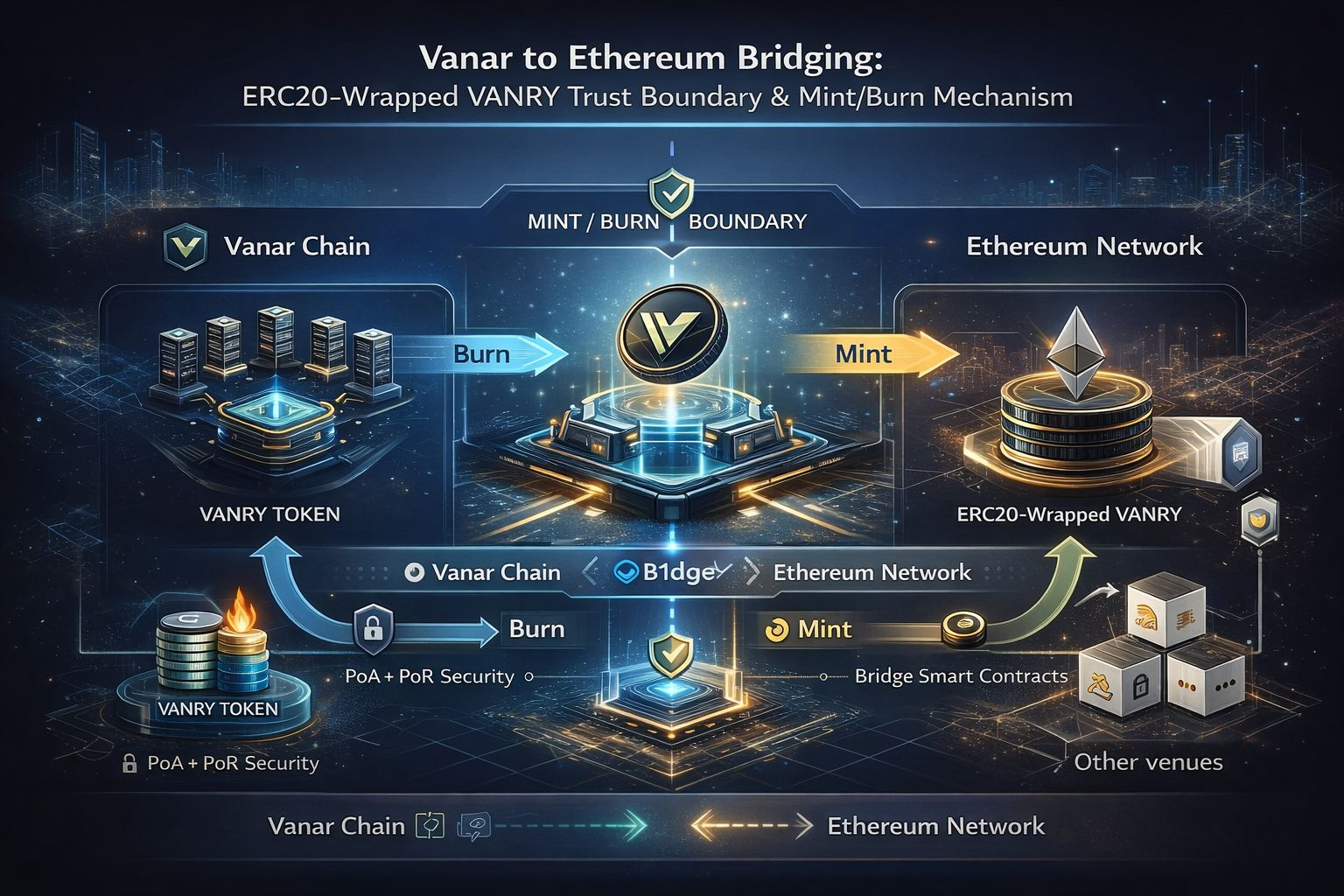

The control-plane is the mint and burn boundary at the bridge. That boundary decides what can settle on Ethereum and what cannot. If the bridge mints wrapped VANRY reliably, supply can build and venues can form around it. If the bridge is paused, attacked, or simply unreliable when demand spikes, then settlement into Ethereum venues is the first thing that fails, even while Vanar keeps producing blocks. The trade-off is straightforward: you gain access to Ethereum venues, but you accept an extra trust boundary that can break in ways Vanar’s own block production cannot repair.

The operational constraint is also clear. This boundary has to support continuous, repeatable movement, including during high-demand windows. A bridge that works only when usage is light does not support the market story people want to believe. The proof-surface is visible: the total ERC20-wrapped VANRY supply on Ethereum and the steady rhythm of bridge transfers. If both stay flat, the honest read is that Ethereum access is not a core settlement path yet. If both expand and remain active, the bridge boundary is doing its job and the “Ethereum compatibility” narrative becomes grounded in observable behavior.

For builders, the practical move is to treat Ethereum access as conditional and design liquidity assumptions around the observed wrapped supply and transfer activity, not around the compatibility label.

This thesis is wrong if ERC20-wrapped VANRY total supply on Ethereum increases week over week and the daily bridge transfer count stays consistently above zero.