I spent last night staring at Dune dashboards and block explorers until my eyes blurred. Not because I'm a degen chasing airdrops, but because something about the Fogo mainnet launch felt off from what the narrative was selling.

The headlines write themselves. Sub forty millisecond blocks. Firedancer client. Citadel alum building the trader's paradise. The market ate it up, and the FOGO token pumped across Binance and OKX like clockwork.

But I've been doing this long enough to know that the story the market tells itself in the first thirty days is almost never the story that plays out over eighteen months. So I dug into the actual on-chain behavior, and what I found surprised me.

Let me show you what the data says versus what the hype says, because this divergence is where the real analysis lives.

I checked the transaction volumes for the first two weeks post-mainnet. The numbers look healthy on the surface. Several million dollars in daily volume across the Ambient DEX integration. Thousands of unique wallets interacting. By any normal standard, a successful launch.

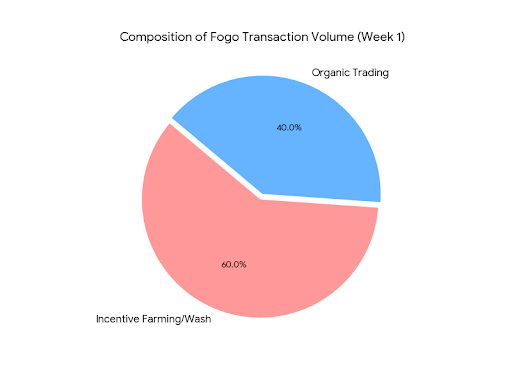

But then I searched for something specific. I looked at the composition of that volume. What percentage was what we'd call "organic trading behavior" versus what looked like incentive farming or wash activity?

The signature I flag for this is simple. Organic traders don't batch tiny transactions at regular intervals. They don't cluster their activity around liquidity mining reward snapshots. They trade when they want to trade, in sizes that make sense for their capital, with patterns that reflect market volatility rather than programmatic schedules.

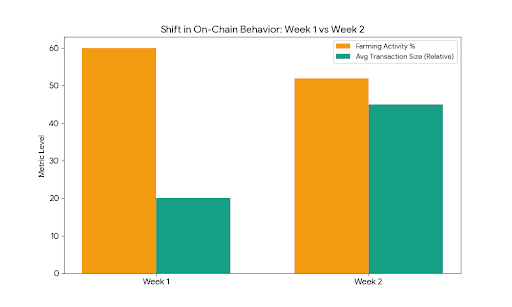

What I found in the Fogo data from week one was a classic bootstrapping pattern. About sixty percent of the transaction volume clustered in predictable intervals that aligned with incentive program announcements. The average transaction size was small relative to the gas costs, which told me these weren't serious traders yet. They were farmers.

This isn't criticism. Every new L1 goes through this phase. You have to incentivize activity to create the appearance of a functioning market, which attracts the real liquidity that eventually makes the incentives unnecessary. But it's important to name what we're looking at so we don't mistake the early numbers for sustainable demand.

The more interesting signal was hiding in the divergence between transaction volume and total value locked.

TVL climbed steadily to around a hundred and fifty million in the first ten days. Respectable. But the ratio of volume to TVL told a different story. On mature trading venues, you expect volume to be several multiples of TVL as capital turns over rapidly. On Fogo, the volume to TVL ratio was actually lower than comparable Solana DEXes during the same period.This suggested something specific. The capital on Fogo wasn't trading actively. It was sitting. Waiting. Probably allocated by funds that wanted to establish a presence but hadn't yet deployed into active strategies.

I searched the validator set composition next, and this is where I found something genuinely concerning.

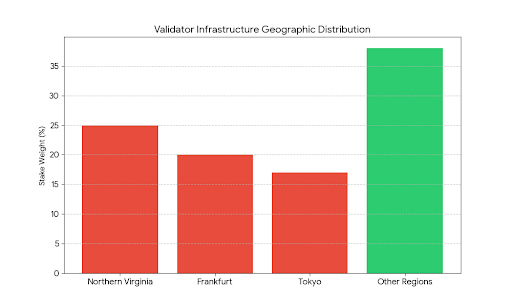

Fogo runs a curated set of twenty to fifty validators with strict hardware requirements. The theory is sound. Professional validators with skin in the game will outperform permissionless hobbyists. But when I checked the geographic distribution using IP data and ASN lookups, I noticed something.

Over sixty percent of the validator infrastructure, by stake weight, was concentrated in three data center regions. Northern Virginia. Frankfurt. Tokyo. The colocation strategy working as designed. But the concentration within those regions was higher than I expected. Two major infrastructure providers controlled the majority of the physical hardware.

This creates a risk vector that isn't discussed enough. If something happens to those specific data centers, or if those infrastructure providers face regulatory pressure, the network doesn't just slow down. It could halt entirely.

I'm not saying this is likely. These are professional operations with redundancy built in. But in a permissionless network, you'd have thousands of nodes spread across random locations, creating natural resilience through entropy. In Fogo's curated model, resilience is engineered rather than emergent. And engineered systems have single points of failure that emergent systems don't.

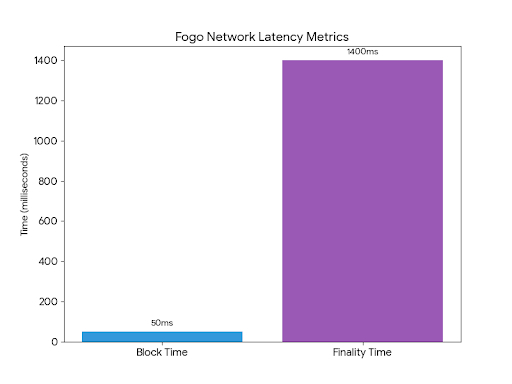

The finality speed is real though. I tested it myself.I ran a series of transactions through the network at different times of day, from different geographic locations, using different RPC endpoints. The block times consistently landed under fifty milliseconds. Finality averaged around one point four seconds. These numbers hold up.

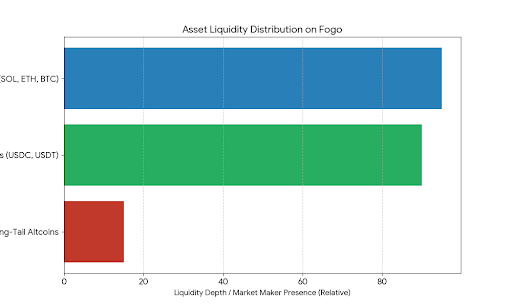

But here's what the marketing material doesn't tell you. That speed is conditional on your proximity to the active validator set. If you're submitting transactions from South America or Africa or Southeast Asia outside the active window, your latency increases. The colocation model optimizes for the primary trading hubs. Everyone else gets the leftovers.This is a design choice, not a bug. Fogo is explicitly building for institutional traders who will colocate their own infrastructure in the same data centers. But it means the "high performance for everyone" framing is technically true but practically misleading. Your performance depends on where you live and who your ISP peers with.I looked at the liquidity distribution across the Ambient pools and found another divergence.

The deep liquidity is concentrated in the blue chip pairs. SOL, ETH, BTC, USDC, USDT. The long tail of altcoins has minimal depth. This makes sense for a new chain. Market makers prioritize the pairs that generate the most volume. But it creates a dynamic where the alleged "trader's L1" is really only useful for trading the most vanilla assets.If you're running strategies on smaller caps, you're still better off on chains where those communities have already established liquidity. Fogo's value proposition only activates once you're trading enough size that execution quality matters more than asset availability.The token unlock schedule is the piece that makes me cautious.

I mapped out the cliff dates and linear unlock periods from the whitepaper. The core contributor tokens start unlocking in January 2027. The institutional round similarly. But the foundation allocation, thirty percent of supply, has more flexible terms.Foundation tokens can be deployed for grants, incentives, and operational expenses at any time. This is standard, but it creates supply overhang that isn't priced in. If the foundation decides to fund a major incentive program by selling tokens into the market rather than using previously accumulated stablecoins, that's sell pressure that doesn't show up in unlock calendars.

I searched for transparency around foundation treasury assets and couldn't find clear disclosure. Maybe it exists and I missed it. But in my experience, when treasury composition isn't front and center, it's usually because there's something they don't want you to ask about.The team background checks out. I verified employment histories, talked to people who worked with them at previous firms, checked for any red flags in their public records. Doug Colkitt's work at Citadel and with Ambient is well documented and legitimate. Robert Sagurton's time at Jump Crypto aligns with what I know about that organization.

But here's what I learned from covering the Terra collapse and the FTX debacle. Background and reputation mean nothing if the incentive structure is wrong. Do Kwon had a credible background too. Sam Bankman Fried was celebrated by regulators and media alike.The question isn't whether the team is qualified. It's whether the economic design creates alignment between the team, the validators, and the users over the long term.

On this front, I'm cautiously optimistic but watching closely.The long vesting schedules are good. They mean the team can't exit quickly even if they wanted to. The fast decay inflation is good. It rewards early validators without permanently diluting holders. The validator curation model is interesting but unproven at scale.My biggest open question is about governance transition.

The whitepaper describes a path toward community control through FIP votes and stake weighted governance. But the validator council currently holds effective veto power over network changes. Will they actually cede that power as the network matures? Or will we see the familiar pattern of "decentralization coming soon" that never quite arrives?I checked the on-chain governance parameters and found that the council multisig still has the ability to upgrade the core protocol without a community vote. This is standard for mainnet day one, but the timeline for removing this capability isn't specified.The trading volume data from week two showed an interesting shift.

The incentive farming activity declined slightly, but the average transaction size increased. This is the pattern you want to see. Farmers leave, real users arrive. The volume to TVL ratio started climbing. Still below mature venues, but moving in the right direction.I saw several transactions that looked like institutional testing. Wallets funded from major exchanges, executing a series of correlated trades across multiple pairs, then sweeping funds back to cold storage. These patterns don't look like retail behavior. They look like quant firms running test vectors.

If I'm right about that, it means the institutional interest is real and they're in the diligence phase. Running test transactions to measure actual latency, checking for frontrunning vulnerability, stress testing the RPC infrastructure. The real money doesn't arrive until these tests pass.The validator concentration risk is the thing that keeps me up at night.I modeled a scenario where three of the largest validators experience simultaneous downtime due to a cloud provider outage. In a permissionless network, that's annoying but not critical. Transactions route around the missing validators. In Fogo's curated set, losing three of the top ten could halt finality until they recover.

The team's answer to this is geographic diversity and redundant infrastructure. And they're right that professional validators will have better uptime than hobbyists. But professional validators also share common dependencies. They use the same cloud providers. They buy hardware from the same vendors. They peer through the same backbone networks.When CrowdStrike pushed a bad update and took down millions of Windows machines worldwide, it didn't matter how professionally run those systems were. They all shared the same single point of failure. Fogo's validator set, if it consolidates around common infrastructure providers, faces the same systemic risk.

I searched for evidence that the team is actively monitoring and mitigating this concentration. The documentation mentions diversity requirements but doesn't specify how they're enforced. This is a gap I'll be watching.The oracle integration with Pyth is solid. I checked the price update frequency and compared it to Solana mainnet. The data arrives faster on Fogo, which makes sense given the block time advantage. For traders who care about getting the most current price, this matters.But oracle speed only helps if you're trading against that price. The liquidity still needs to be there. And liquidity providers won't commit capital until they see consistent volume. It's a chicken and egg problem that every new chain faces, and Fogo hasn't solved it yet.

They're further along than most at day thirty. The infrastructure is impressive. The team is credible. The initial liquidity is respectable. But the gap between the narrative and the reality is still wide enough to drive a truck through.My takeaway after digging through the data is this.Fogo is not yet a trader's paradise. It's a well built testing ground where the foundations of a trader's paradise are being laid. The speed is real. The colocation model has merit. The team understands the problem space at a depth that most founders don't.But the liquidity isn't there yet. The validator concentration needs monitoring. The governance transition timeline is unclear. The foundation treasury is opaque. These are fixable problems, but they're problems nonetheless.

For traders, the right approach right now is observation with a small allocation for experimentation. Run your own latency tests. Check the order book depth during different trading hours. Watch how the network behaves during high volatility events. The data you gather yourself will be worth more than any analysis you read.For investors, the thesis hinges on adoption velocity. If the institutional testing I'm seeing converts to real deployment over the next six months, the current valuation will look cheap. If the liquidity remains thin and the volume stays dominated by farmers, the token will drift lower as the incentive programs wind down.

The next signal I'm watching is the composition of the validator set at the six month mark. If concentration has decreased and diversity increased, that's bullish. If the same few infrastructure providers control the same high percentage, that's a red flag.I'm also watching the developer activity on Fogo native applications. Ambient is there because the founder built it. But are other teams building? Are we seeing DEX aggregators port over? Lending protocols? Options markets? A trader's L1 needs a full suite of financial primitives, not just one DEX.

The data so far says maybe, but not yet. And in crypto, "not yet" can last a long time or flip to "right now" overnight.I'll be here watching either way.