Endowments Meet Ethereum: Why Harvard’s ETH Exposure Actually Matters

When folks heard Harvard had exposure to Ethereum through venture funds and crypto plays, it wasn’t just another headline. It was a real signal—one of the world’s biggest endowments quietly getting serious about Ethereum. This isn’t about chasing hype or rolling dice on crypto. It’s about staking a claim in what might end up as the new backbone for finance and tech.

Endowments Play the Long Game

University endowments don’t gamble. Their job is to protect and grow wealth for the long haul—sometimes, literally for centuries. Hedge funds might chase quick wins, but endowments hunt for game-changers: railroads, oil, venture capital, tech. They’re always scanning for what reshapes the landscape.

Seen in that light, picking up Ethereum makes sense. Ethereum isn’t just another coin. It’s the plumbing for a whole new ecosystem—DeFi, stablecoins, NFTs, tokenized assets, and a ton of on-chain data. If you’re thinking decades ahead, ignoring this kind of infrastructure actually feels riskier than getting involved.

Ethereum Isn’t Some Wild Bet—It’s a Core Layer

That’s what makes Harvard’s ETH exposure interesting. Big endowments don’t usually jump into volatile stuff head-first. They go through venture funds or specialized managers, backing the “picks and shovels” instead of chasing gold directly. That says Harvard sees Ethereum less as a lottery ticket and more like the early internet or cloud computing—a platform, not a gamble.

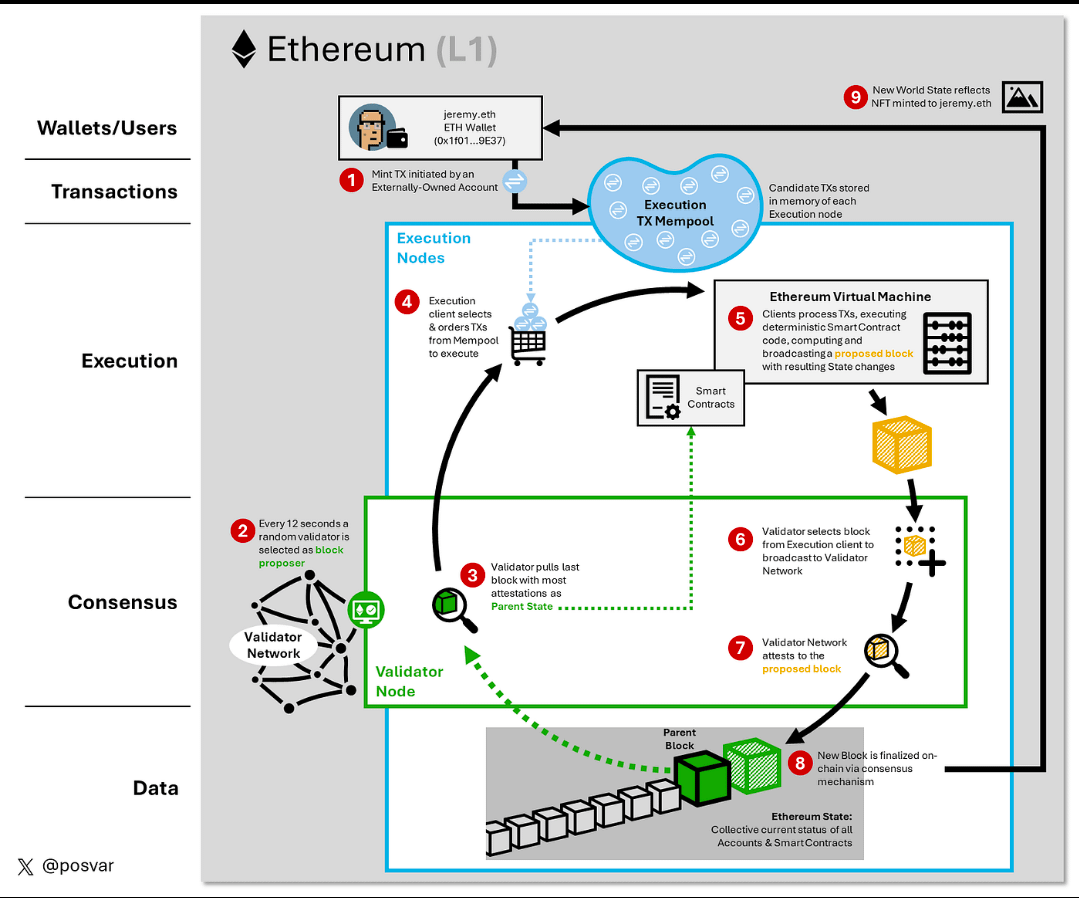

Look at what’s happened on Ethereum lately: they switched to proof-of-stake, started fee burning (EIP-1559), and now underpin trillions in on-chain value. These aren’t just upgrades. They create yield, boost security, and lock in network effects—all things that big institutions understand and care about. At this point, ETH starts looking less like a speculative token and more like a productive digital commodity.

Harvard Sets the Tone

There’s another angle here. Big institutions hate being first, but nobody wants to be left behind either. They keep an eye on each other. When Harvard steps in, with all its clout, it makes everyone else take notice. Pension funds, sovereign wealth funds, insurance giants—they all watch and, honestly, Harvard gives them cover. It’s social proof in action.

That’s how venture capital went mainstream. Ivy League endowments got involved, suddenly VC was legit. Ethereum looks like it’s riding that same wave.

Academia, Finance, and Open Networks Cross Paths

There’s some symbolism, too. Universities are built on research, open knowledge, and thinking way past the next quarter—values that line up with Ethereum’s open-source spirit. No one owns Ethereum. Progress comes from global teams, academic breakthroughs, and real-world incentives.

Harvard’s move hints at something bigger: universities are starting to see open, decentralized networks as a key piece of tomorrow’s economy. That means more blockchain research, new classes, and students aiming their careers at Web3.

It’s Bigger Than Just Harvard

It’s not about the size of the investment. It’s about the message. Ethereum just got upgraded from a retail trading fad to a legit building block for institutions. As endowments hunt for inflation protection, global liquidity, and fresh alternatives to old-school settlement, Ethereum suddenly fits right in.

History never remembers who bought the first coin on an exchange. It remembers when the heavyweights stepped in. Harvard’s ETH exposure might be that moment—the point where endowments stopped seeing decentralized networks as experiments and started treating them as essential infrastructure.

Bottom line: When endowments meet Ethereum, it’s not just noise. It’s history in motion, unfolding right in front of us.#HarvardAddsETHExposure