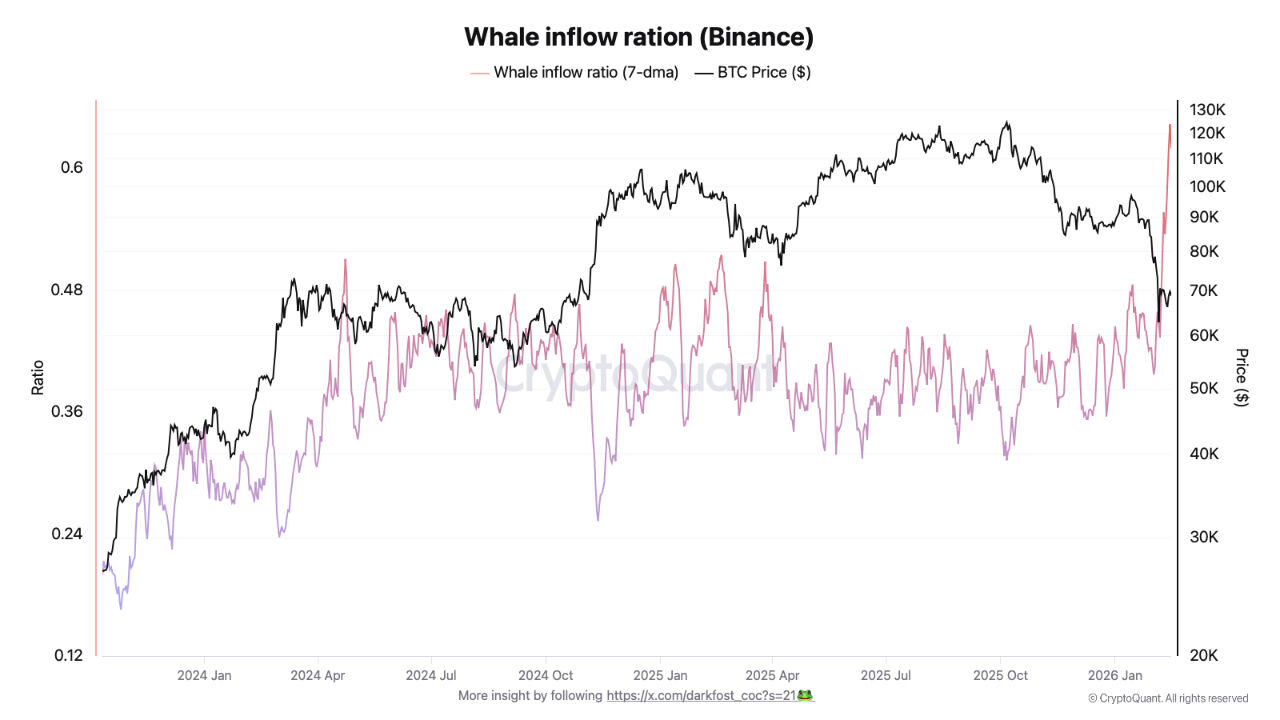

The crypto ocean is getting turbulent 🌊 as the Whale Inflow Ratio on Binance jumps from 0.40 ➡️ 0.62 — a massive spike that signals one thing: large $BTC holders are making moves 🧠💰

When the Whale Inflow Ratio rises, it means that a bigger share of Bitcoin deposits on exchanges is coming from whales 🐋 — wallets holding substantial amounts of BTC. And right now, those whales are sending more coins to Binance 🏦📊

⚠️ What does this mean?

A surge like this often suggests increased selling pressure. Whales typically move BTC to exchanges when they’re preparing to sell or rebalance positions. With the market correction deepening 📉, this spike could indicate:

🔹 Profit-taking after previous highs

🔹 Risk-off positioning amid volatility

🔹 Strategic liquidity moves before the next big swing

Bitcoin thrives on liquidity cycles 🔄 — and whales are usually several steps ahead of the crowd. When their inflows rise sharply, it’s a signal traders closely monitor 👀

However, context matters. Not every whale deposit equals a sell-off. Sometimes it’s:

✨ OTC desk transfers

✨ Margin collateral positioning

✨ Strategic accumulation plays

Still, a move from 0.40 to 0.62 is significant 📊 — it shows concentration of large holders increasing activity during a fragile market phase.

🔥 Key takeaway:

Whales are active. Volatility may intensify. Risk management is crucial.

Are we seeing the calm before a bigger storm… or the setup for the next opportunity? 🌩️🚀

Stay alert. Watch on-chain metrics. Follow the flow.

Because when whales move… the market listens 🐋🎯

#MarketRebound #BTCFellBelow$69,000Again #OpenClawFounderJoinsOpenAI