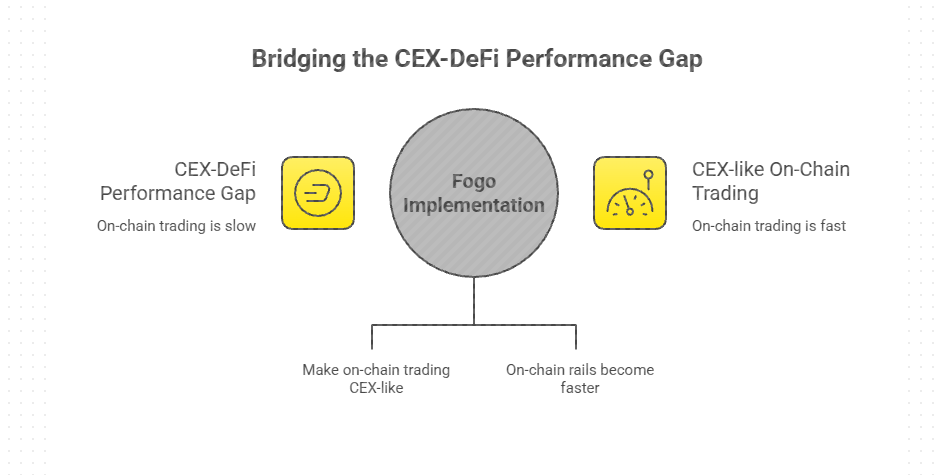

Fogo is mainly trying to narrow the CEX–DeFi performance gap and make on‑chain trading feel CEX‑like, not “kill exchanges outright.” But its longer‑term vision is clearly that if on‑chain rails get fast enough, they can start to replace a lot of what CEXs do.

What @Fogo Official explicitly says it’s doing

Fogo’s own messaging frames it as an execution layer that lets on‑chain trading compete with centralized exchanges in speed and responsiveness, not a general “CEX killer” from day one.

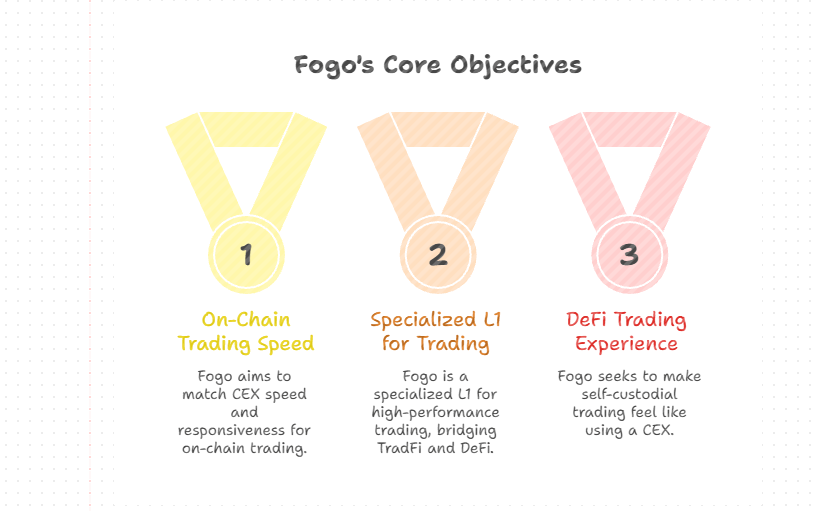

Articles and explainers describe it as a specialized L1 for high‑performance trading, “bridging TradFi speeds (NASDAQ‑like) with DeFi’s openness,” rather than trying to be a do‑everything chain or a full CEX replacement immediately.

So near term, the project is solving: “DeFi feels slow, fragile and fragmented compared to Binance/Bybit; how do we make self‑custodial trading feel like using a CEX?”

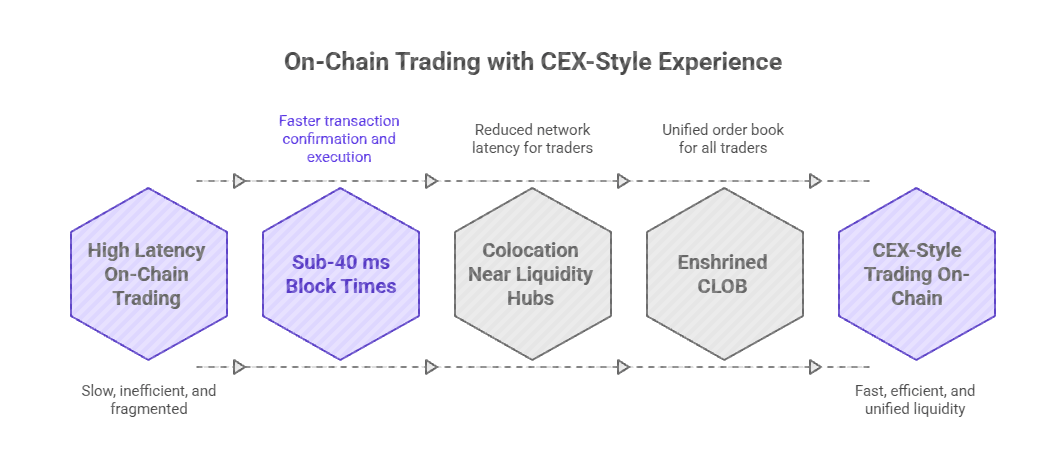

How it narrows the gap

Sub‑40 ms block times, colocation near major liquidity hubs, and an enshrined CLOB aim to give CEX‑style latency, cancel‑priority and unified liquidity, but with self‑custody and open infrastructure.

The team explicitly talks about “replicating CME/Binance‑grade trading on‑chain” and “leveling the playing field” between on‑chain and centralized venues.

In other words, the concrete product is: a chain where trading feels like Binance, but your assets stay in your wallet.

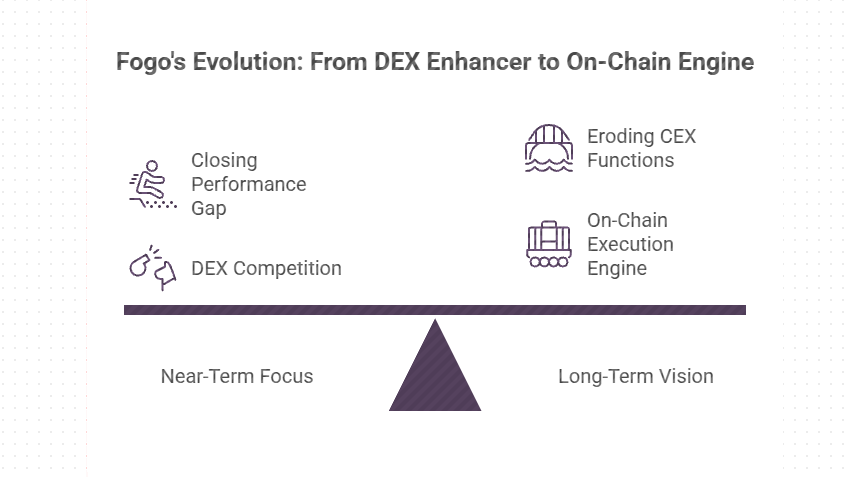

Long‑term ambition: CEX replacement or coexistence?

Some community and Binance Square pieces phrase it as “onchain trading replacing traditional systems” if the infrastructure is good enough, and present Fogo as that candidate foundation.

At the same time, they emphasize Fogo “isn’t trying to be everything” but to be the best execution venue, a specialized layer that could sit alongside or underneath CEXs, bridges, and other L1s.

So a fair summary:

Near term: Fogo is very clearly about closing the performance and UX gap so DEXs can realistically compete with CEXs.

Long term: if that works, it naturally erodes the need for some CEX functions (especially matching/clearing), but the project’s messaging is more about being the on‑chain execution engine than outright destroying centralized venues.

If you like analogies: $FOGO is trying to be the “on‑chain NASDAQ matching engine,” not necessarily the entire brokerage stack, though over time, if everyone routes through that engine, a lot of what CEXs do starts to look redundant.