While the broader market is leaning bearish and many traders are calling for another leg down, SOL is quietly telling a different story on lower timeframes. Intraday momentum is flipping, and the 15-minute structure is starting to favor a tactical long — even against a bearish daily backdrop.

This is a counter-trend opportunity, not a blind buy — and the data is lining up.

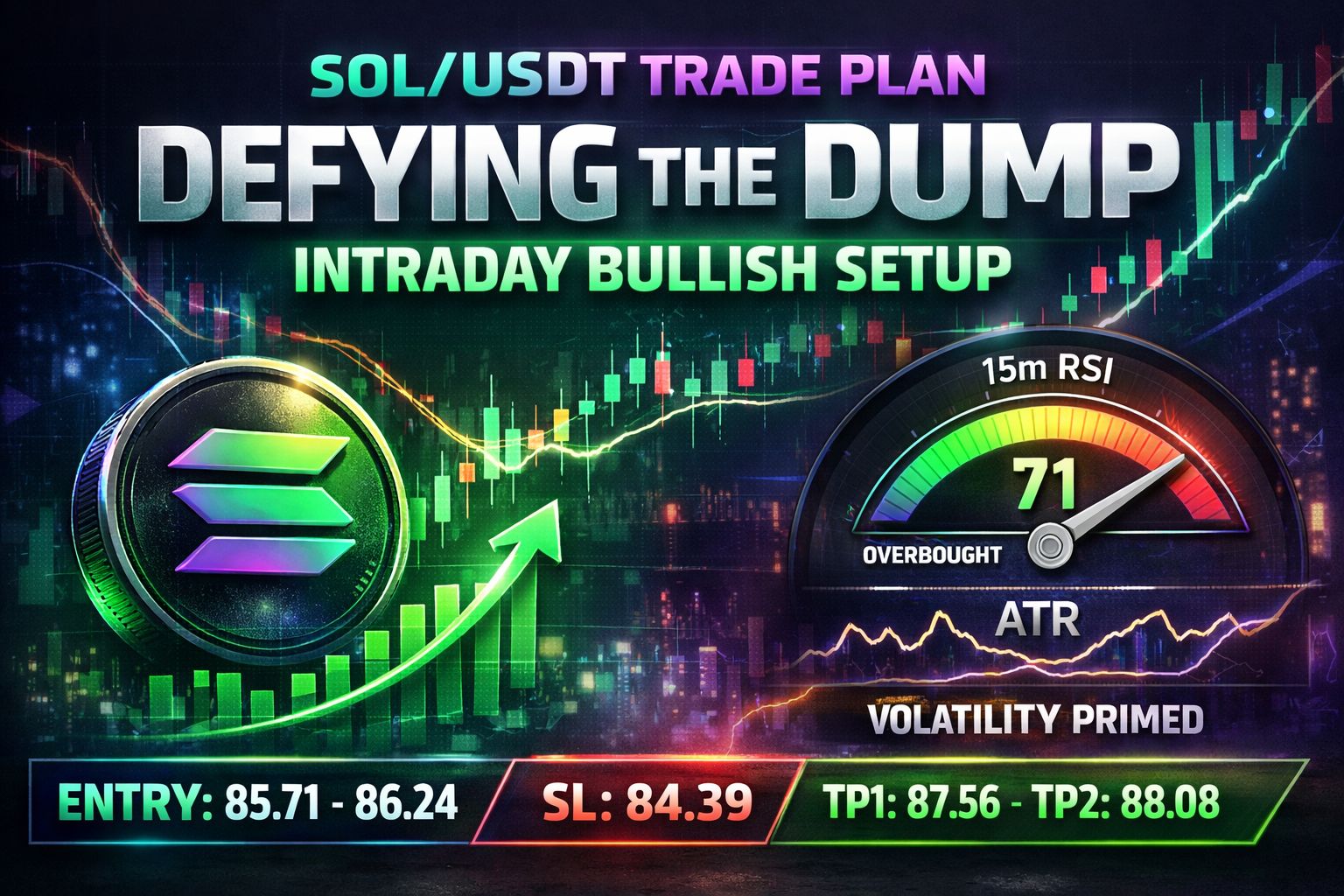

$SOL / USDT — Long Trade Setup

Entry Zone:

85.710517 – 86.238847

Stop Loss:

84.389691

Take Profit Targets:

TP1: 87.559674

TP2: 88.088004

TP3: 89.144665

Why This Setup Works

🔹 Daily Trend: Bearish — But That’s Not the Full Story

Yes, the higher-timeframe structure remains bearish. However, markets don’t move in straight lines. Counter-trend rallies often start with sharp intraday momentum shifts — exactly what we’re seeing now.

🔹 15-Minute RSI Shows Real Strength

The 15m RSI pushing to 71 is not random noise. It signals active bullish momentum, suggesting buyers are stepping in aggressively despite the larger trend. This is typically how short-term reversals or relief rallies begin.

🔹 Key Invalidation Level Is Holding

Price continues to hold above the critical local invalidation level at 84.93. As long as this level remains intact, the bullish intraday thesis stays valid. A clean hold here keeps the long bias alive.

🔹 Volatility Is Ready to Expand

ATR readings indicate volatility compression, often followed by a strong directional move. When momentum, structure, and volatility align — the market tends to move fast.

This setup is armed.

Final Thoughts

This is not a trend-reversal call — it’s a momentum-based intraday long designed to capitalize on short-term strength while respecting higher-timeframe risk.

If SOL holds above invalidation and momentum continues to build, the upside targets remain firmly in play.

If invalidation breaks, the trade is off — simple and disciplined. $SOL