Today we analyze HBAR #22 (coinmarketcup) the native token of Hedera.

The coin looks relatively strong and attractive because it may be used in the future in the RWA (Real World Assets) sector.

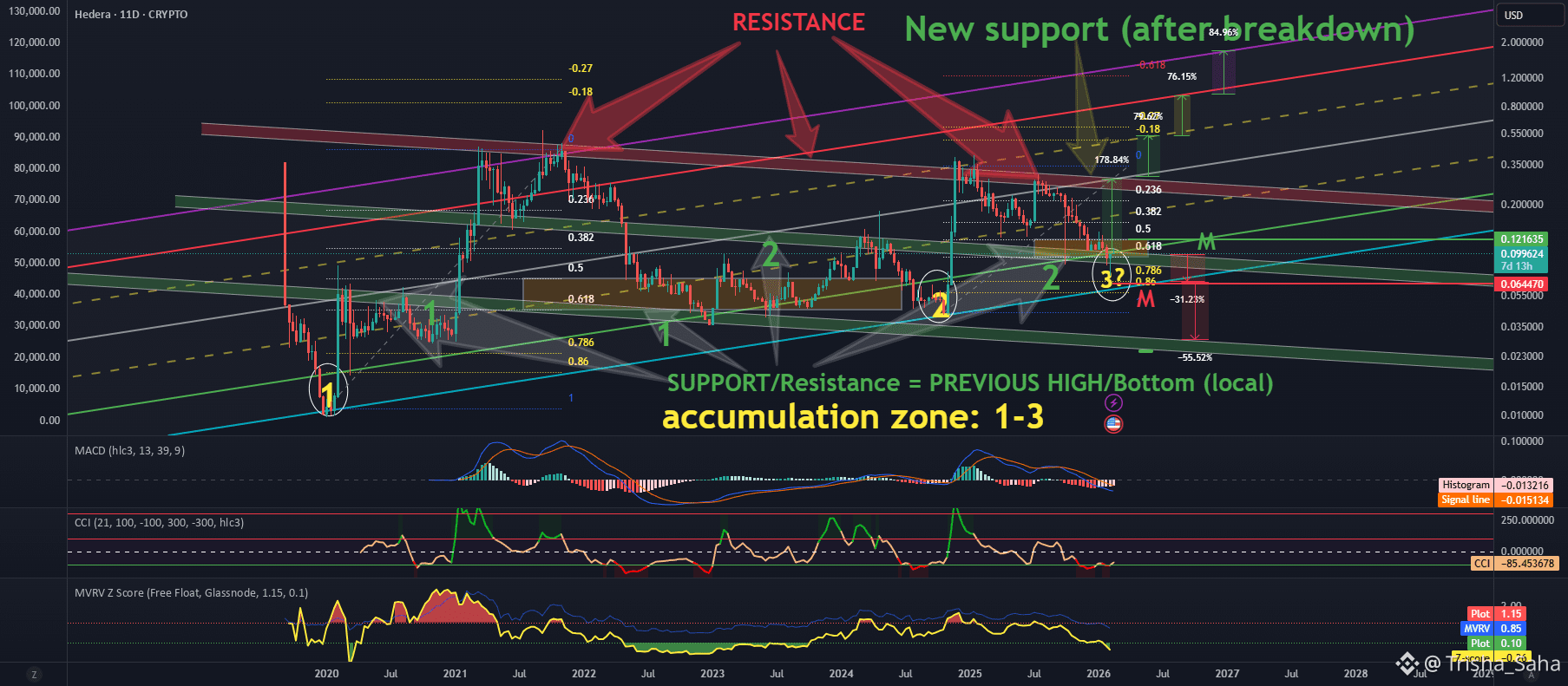

Looking at the global channel, we can see that price has entered a potential accumulation zone. A drop toward the bottom of the channel is still possible, as this has happened twice before.

According to Fibonacci, price is currently trading in the 0.5 – 0.618 golden pocket, a level from which reversals have often started in the past.

Price is sitting on a support line. The channel passes through a previous local high, which makes this a strong zone, as former resistance can now act as support.

Additionally:

CCI shows that price is near its lower levels.

MACD suggests that a trend reversal may be approaching.

Pivot levels:

0.12 — monthly level. A breakout above this level could trigger a strong move toward the previous high.

0.06 — monthly important support level. A breakdown below increases the probability of a move toward 0.02.

The chart shows key support and resistance levels that historically play an important role in price movement.