Why I wrote this

I am a trader and an anylyst. I would like to consider the way Binance will be the best in the world in 2026. It is not a marketing analysis, but my own and is based on verifiable data at the end of 2025 to early 2026.

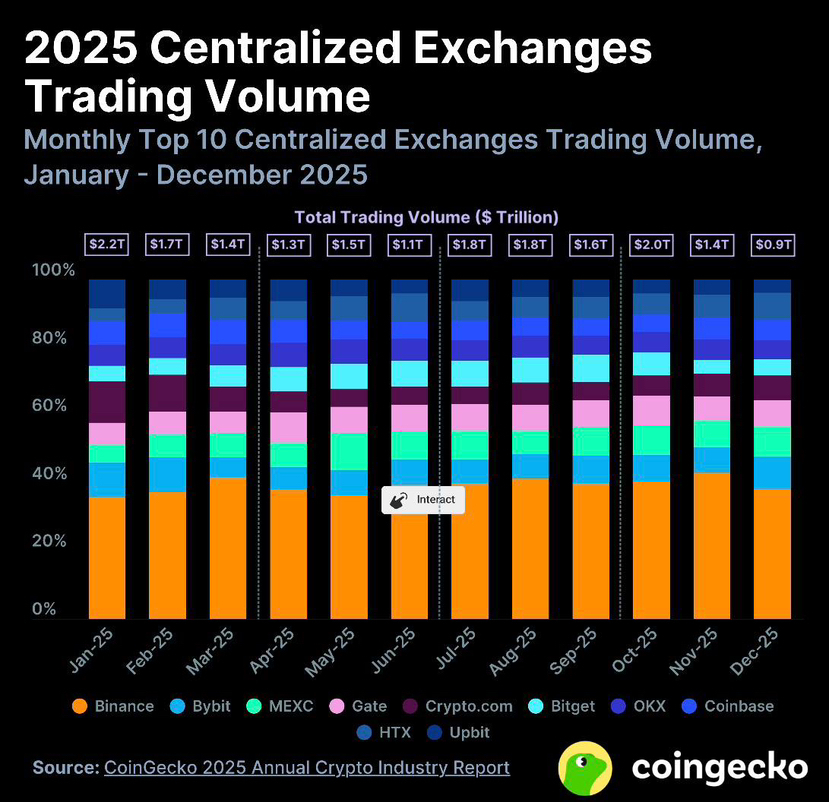

Pre-eminence of trading volumes and market share

Binance is by far the biggest centralized exchange. According to the market-share analysis carried out by CoinGecko, in December 2025 Binance will dominate 38.3 per cent of all global spot trading, equaling 361.8 billion US dollars (or less than 609 billion US dollars in November). Binance controls 39.2% of the top-10 exchange volume over the whole year of 2025 with 7.3 trillion in spot trades and the other nine exchanges with 18.7 trillion. In comparison, the closest competitor, Bybit, only acquired 8.10 of volume.

(maximum market share in 2025) According to Finance Magnates, Binance was able to maintain a 51.8% share what with a monthly volume of $583.5billion even during a downturn in March 2025. The independent statistics of CoinLaw show that by June 2025 Binance had retained 41.1% of the world spot.

1- Binance controls things till early 2026. According to an AInvest analysis of February 2026, Binance is dominating with 39.2% market share, and its competitors such as Bybit and MEXC each had about 8%. This confirms that, although there is certain erosion by new entrants, Binance remains way ahead of them.

2- The number of users is enormous and increasing. By the end of 2025, Binance had over 300000 registered users.

January 2026 report by Blockhead states that the exchange had 100 millennium more users in under 18 months suggesting the exchange is growing at a rate of approximately 180,000 new users. Another example provided by Blockhead is the Kaiko numbers that Binance processes a range of 35 to 45 percent of the world-wide bitcoin and Ethereum trade and secures more than 170 billion customer dollars.

3- Trading volume scale. In a year-end report released by Binance (summarized by multiple sources), the exchange reported total trading volume, including over 7.1 trillion in spot trading, of over 34 trillion in total trading volume of all products. Its median daily spot volume was approximately 16.3 billion dollars and this is a sign of deep liquidity.

The creation of a multi-product ecosystem.

BNB Chain: the demand expansion.

1- Massive user activity. The BNB Chain 2025 recap reveals that there were more than 700,000 unique addresses and the total BSC and opBNB networks recorded more than 4 million daily active users. Transaction activity increased consistently: the average daily transactions rose to 10.78million and to 31 million in October 2025, which is the growth of 150 per cent annually.

2- Reliability and throughput. The network was running without loss of time even during trading surges throughout 2025. When at full capacity it handled as many as 5 trillion units of gas daily. Lorentz, Pascal, and Maxwell hard forks in infrastructure provided a reduction in block time (to 0.75 seconds) at a bandwidth of more than 133 million gas per second.

3- Real-life assets and stablecoins. The market cap of BNB Chain increased to the total of 14 billion in stablecoin and became the best-regarded chain of active stablecoin users. BNB Chain real-world assets (RWA) reached more than 1.8 billion dollars with the help of such institutional investors as BlackRock and Franklin Templeton.

4- Security improvements. The protocol-level countermeasures and Goodwill Alliance have assisted in decreasing the attacks on sandwiches by 95 percent and wallet defenses, as well as MEV mitigation, heightened fairness.

Product innovation that took place attracted users.

Alpha: 2.0 (Web3 discovery platform). In the Binance 2025 report, there is a feature that stands out, Alpha 2.0, whereby users are able to engage in on-chain launches and airdrops, directly within Binance. At the end of the year it topped 17mm users, 1 trillion in trading volume, and paid out 782mm in rewards in 254 airdrops. These campaigns stopped 270,000 attempts of frauds, which were blocked by the risk-control systems.

Smart Money and Demo Trading. Its Smart Money feature, which gives signals using blockchain flows, attracted 1.2 million users, and the Demo Trading tool (to allow beginners to trade with virtual funds) reached 300,000 users.

Earn and staking products. Binance had yields in over 100 PoS coins. Its Earn program has given out 1.2 bn. in rewards in 2025. Competitive yields were offered by locked savings and dual-investment campaigns, and the fees charged on trading in BNB (up to 25 per cent off) made the platform some of the lowest cost trading in the industry.

BNB deflation through burns. The operation of dual burn of Binance suppressed the supply. By the beginning of October of 2025 the total burned had surpassed 169.7 millionBNB and only 140-145 million BNB was left in circulation. About 1.4-1.6⠻BNB was burned during quarterly auto-burns and the on-chain real-time burn with around 30,000-50,000BNB every quarter. On the whole, the average quarterly burns of 1.56 millennium Burns of BNB allow supporting long-term token economics at about 4 -5 per annual.

Peer-peer and payments growths.

Binance Pay adoption. In January 2026, the network of Binance Pay had over 20 million merchants and had paid out $280 billion in total transaction volume. By 2025, payment volumes will increase by 38 percent on the year before, and the number of users will increase by 30 percent. More than 98 per cent of B2C transactions were settled in stablecoins, which underscores the need to settle in low-volatility currencies.

Rapid merchant growth. In a November 2025 article, it is stated that the number of merchants using Binance Pay had grown 1,700-fold between 2025 and 2025, and was now up to 20 million merchants. It records domestic integrations, including the support of Brazilian Pix system, QR payments in Argentina and integration into the tourism platform in Bhutan.

Fiat & P2P trading boom. Fiat and P2P volumes grew 38 % in 2025. OTC fiat trading has grown by 210% and this is an indication of institutions and high-net-worth adopting Binance as a main source of liquidity. These fiat rails assist the users in the emerging markets to acquire crypto more conveniently.

The institutional adoption and compliance is a turning point

Institutional growth. Year-over-year institutional trading volumes on Binance were up 21 percent and VIP clients were up 18 percent. Binance Pay business allowed companies to expedite cross-border payments and tokenized collateral structures raised a lot of money.

Regulatory milestones. In November 2023 Binance rejected entry into a guilty plea and accepted over 4 billion dollars of fines as penalties on counts of anti-money-laundering and sanctions violations. The officials of the U.S. complained that the company had adopted growth at the expense of compliance. The case provoked Binance to revamp its compliance. By the end of 2025 the exchange was fully licensed in accordance with the Abu Dhabi ADGM, being the first crypto exchange to receive a global license in the region. The licence regards independent regulated entities in exchange, clearing-house and broker-dealer. The officials of ADGM complimented Binance on good standards of governance and risk-management practices. The press release also pointed out that Binance had over 300 million users and over one hundred and twenty five trillion in cumulative volume.

Compliance metrics. According to Binance, its direct exposure to key categories of illicit funds decreased by 96 per cent since 2023. By 2025 the exchange had blocked the loss of 6.69 G in potential fraudulent losses and served 5.4 users and over 71000 law enforcement requests. It reclaimed more than 131million dollars associated with illegal operations and trained over 160 military officers.

SAFU fund and Proof of reserves. The evidence-based proof-of-reserves report published by Binance indicates that the assets of users are held in 1:1 ratio, and the major coins ratio is 105–108%. In February Binance declared that its Secure Asset Fund for Users (SAFU) had been entirely changed into 15,000 bitcoin, which is approximately worth 1.005 billion, to strengthen the reserve base. One separate article reported that Binance has addressed rumours of huge outflows by referencing its on-chain proving-reserves, and has even suggested an annual “Withdrawal Day" to all exchanges.

Challenges and competition

Although it is dominant, Binance has headwinds:

Competitor market share loss. According to CoinGecko and AInvest statistics, Binance has lost market share that was more than 50 per cent at the beginning of 2025 to approximately 39 per cent at the beginning of 2026. Liberal fee offers by competitors (e.g. zero-fee promotion by MEXC), and the so-called Universal Exchange models, combining trading, payments and DeFi, are all threatening to suck the liquidity out.

Regulatory scrutiny. Current research in the U.S and Europe persists. According to CoinLaw, Binance operates in 15+ jurisdictions with a fine of 4.3bn issued by the U.S authorities and France investigations. It is expensive and cumbersome to be compliant in various jurisdictions.

Trust rebuilding. The DOJ resolution and massive fine exemplifies how the history of breaching compliance hurt trust. Binance is now spending a significant part of its resources on compliance (almost a quarter of the staffs are in this division) and is open to external audit, but it will take time to restore complete confidence.

Contest of attention between users. Other centralized exchanges and new entrants like Bitget, OKX and Gate.io are innovating rapidly as well as DeFi protocols. They frequently serve small markets (perpetual DEXs, tokenized stocks) that can eat away the volumes of Binance unless the exchange keeps innovating.

My take on the case, why Binance filed and won the charge.

In my opinion, there are a few reasons as to why Binance will still be the leader in crypto in February 2026:

1. Intensive depth and product bulk. Binance has hundreds of coins and close to two thousand trading pairs. Its deep order books enable orders of large size to be slipping slowly and this attracts professional traders and institutions. It is affordable to retail traders due to low base fees (0.1 ℻ 0.1 ) and a 25 ℛ 0 100 discount offered on payment with BNB.

2. Relentless innovation. New features (Alpha 2.0, Smart Money, Demo Trading) are constantly added to the site to maintain the interest of the users and add value to what they can get by merely trading at the spot. Through the on-chain launches, trading education and airdrops, and the same application, Binance has built a sticky ecosystem.

3. Strong network effects. Having more than 300 million users and 700 million addresses on BNB Chain, Binance is advantaged by the fact that individuals conduct trade where they have the greatest liquidity. This vicious cycle deters them to defection to smaller exchanges.

4. Worldwide coverage of payments and on-ramps. The fact that Binance Pay has expanded to reach more than 20 million merchants, as well as supported local systems of payments (Pix, QR in Argentina, Bhutan tourism) provides users with some applicable spending opportunities of crypto. Massive P2P and fiat volumes demonstrate that Binance can now be regarded as an indisputable point of contact between traditional finance and digital assets.

5. Comppliance as the result of institutional trust.

The new regulation of post-2023 and the license to ADGM indicate the shift towards transparency and regulations. Evidence -of-reserves, a capitalized SAFU fund and a 96% decrease in illicit coverage assuage institutions and regulators. Fines and investigations persist, but the fact that the company is ready to deal with regulators is peculiar to some of its peers.

6. BNB Chain ecosystem synergy. In a manner akin to integrating DeFi, NFTs and tokenization into its exchange, Binance could be able to use a high-throughput, low-cost blockchain to control. The capacity of the BNB Chain to handle tens of millions of transactions per day without downtime allows BNB Chain to settle quickly and experiment.

Conclusion and lessons

The case of Binance depicts how scale, innovation, and compliance may exist together. The platform has endured and persisted to be the largest crypto exchange with a mix of deep liquidity, extensive product suite, robust payment rails and constant compliance with regulatory requirements. The fact that it is starting to shift toward transparency, ADGM licensing, evidenced by proof-of-reserves and a fund backed by Bitcoin demonstrate, that to become the market leader currently, it takes more than mere aggressive growth; it takes institutional level trust. The rivals are gaining on and regulatory oversight will not disappear soon. But at this point Binance has assumed the lead and is bearing the brunt by becoming an essential part of the traders, investors, merchants and builders throughout the crypto ecosystem.