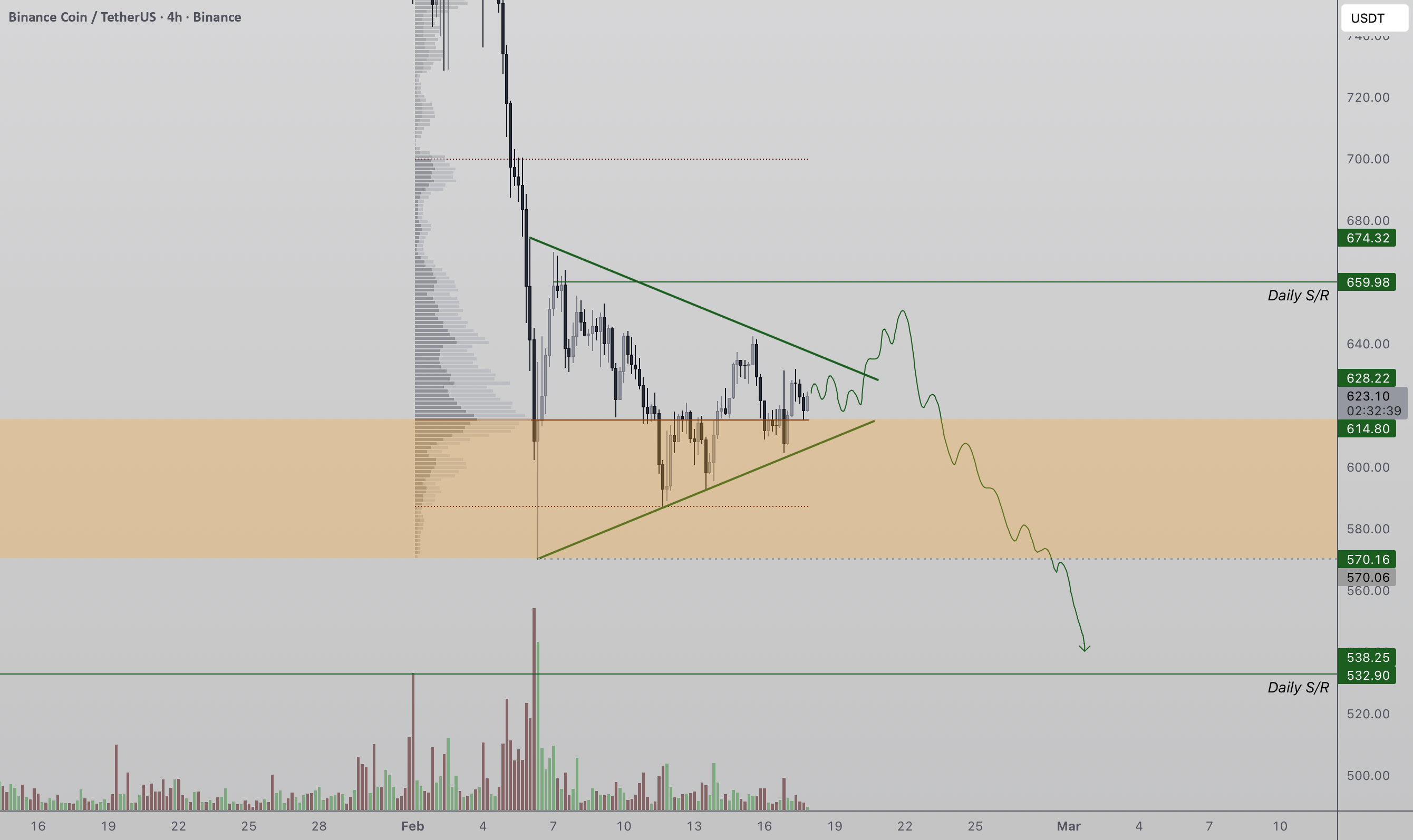

BNB price action is currently trading inside a bearish pennant formation, a continuation pattern that typically develops after a strong downside impulse. Following the recent sell-off, price has moved into a tightening consolidation phase marked by lower highs and higher lows, signaling temporary balance rather than trend reversal.

From a structural perspective, the broader trend remains bearish. The pennant has formed after a downside expansion, which statistically favors continuation lower once price breaks from compression. As BNB approaches the apex of this structure, the probability of a volatility expansion increases.

On the upside, $659 stands out as the key resistance level. This zone represents the top of the current trading range and a prior rejection area. Any short-term push into this level without strong bullish volume would likely be a false rally, designed to clear liquidity before continuation lower.

If the bearish pennant resolves to the downside, the next major target sits near $532–$537, which aligns with high-timeframe support and a measured-move projection from the prior impulse leg. This region is where buyers may attempt to step in.

Until BNB reclaims resistance with acceptance and volume, rallies should be viewed as corrective. From a technical and market structure standpoint, downside continuation remains the higher-probability outcome.