Most people don’t care about infrastructure until it breaks.

Until a trade slips.

Until a liquidation executes late.

Until a network slows down exactly when volatility spikes.

That’s the lens I use when I look at Fogo.

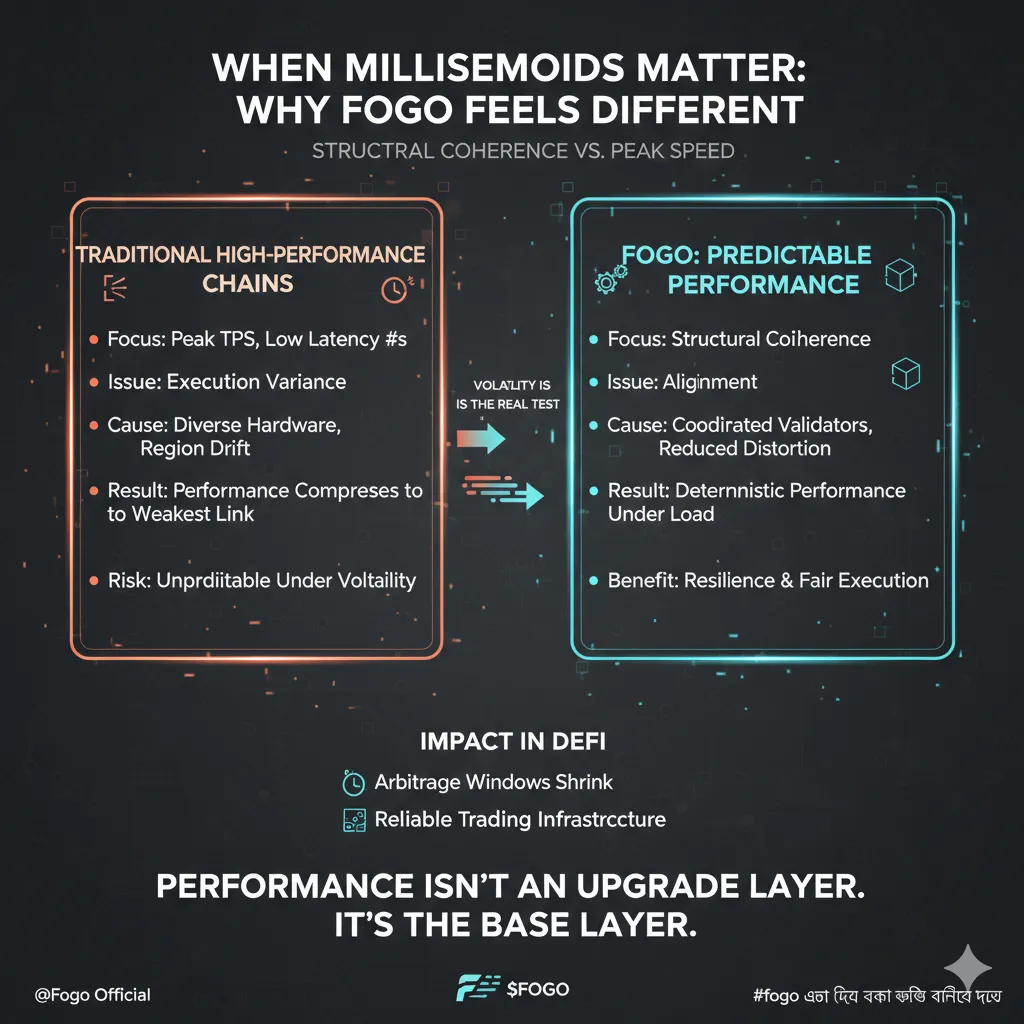

In crypto, “low latency” gets thrown around like a marketing stat — TPS, block time, millisecond finality. But latency isn’t just a number. It’s a structural condition. It defines fairness, execution order, and how predictable a system feels when pressure rises.

Fogo isn’t trying to win the loudest narrative.

It seems more focused on something quieter — structural coherence.

At surface level, yes, it’s SVM-compatible. That matters for developers. Parallel execution, familiar tooling, high throughput environments — all good.

But compatibility isn’t the interesting part.

The deeper issue most high-performance chains face isn’t peak speed. It’s execution variance. Different validator hardware. Different regional propagation speeds. Slight drift in coordination. Over time, performance compresses toward the weakest link.

That’s where Fogo’s design feels intentional.

Instead of chasing theoretical ceilings, it appears focused on alignment:

Coordinated validator assumptions

Reduced propagation distortion

Network topology that compresses delay

That distinction matters. Peak speed looks good in benchmarks. Predictable speed survives volatility.

And volatility is where real systems are tested.

In DeFi:

Arbitrage windows close in milliseconds

Liquidations cascade fast

Execution order defines fairness

If block production remains stable under load, risk windows shrink. That changes how serious trading infrastructure can be built on-chain.

Of course, there are trade-offs.

Performance-oriented networks often demand stronger hardware. Validator sets can narrow. Client diversity can become a structural risk. There’s always tension between latency optimization and decentralization margins.

Technology alone also doesn’t

create liquidity. Markets reward resilience, not whitepapers.

The real test for Fogo won’t be benchmark screenshots.

It will be composure during stress.

If performance remains deterministic during demand spikes, confidence compounds.

If not, narrative strength fades quickly.

That’s why Fogo feels less like a hype play and more like a thesis:

Performance isn’t an upgrade layer.

It’s the base layer.

And in a market crowded with incremental “faster than X” claims, structural coherence might be the real differentiator.