I've been reflecting on how blockchain adoption still stumbles at the basics. Someone new tries a dApp maybe a simple game or yield tool and hits the wallet creation screen: "seed phrase," backups, approvals. Confusion sets in, tab closes, and that's another potential user lost. It happens constantly, yet most projects respond with better tutorials or UI tweaks rather than removing the friction entirely. VanarChain ($VANRY) took a different path: design the system so users never encounter those hurdles in the first place.

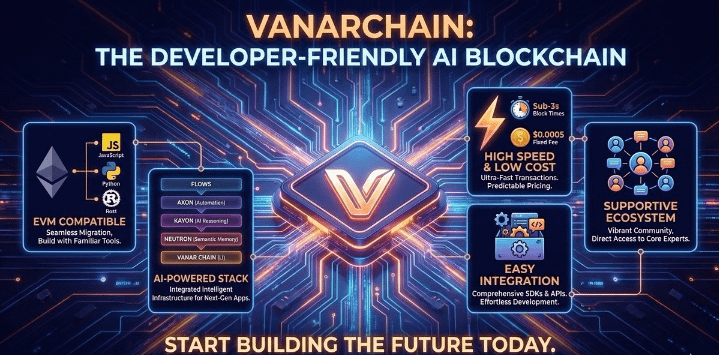

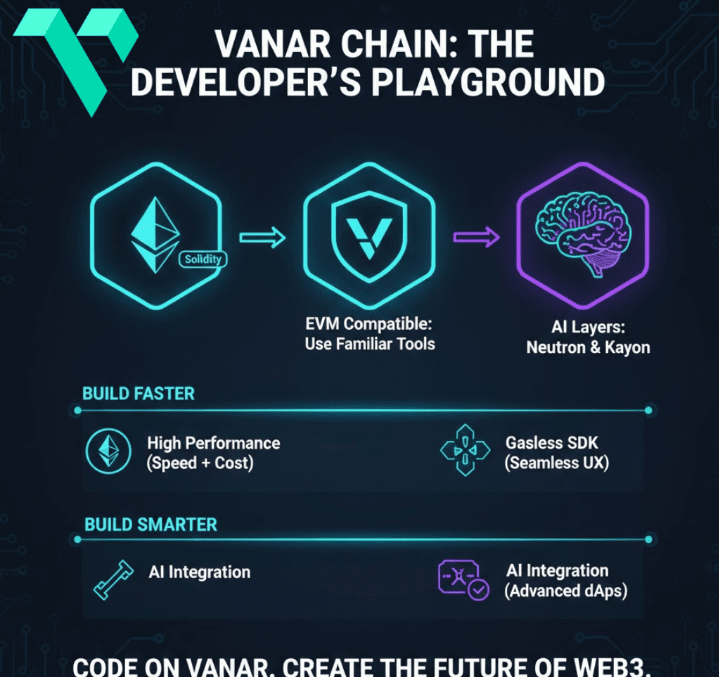

Instead of competing on raw specs like speed or proofs, VanarChain focuses on making blockchain invisible to everyday users. Account abstraction (built on ERC-4337) lets applications create and manage wallets behind the scenes no seed phrases, no extensions, no confusing transaction popups. Logging in feels like any web app: email or social sign-in, and you're in. Developers pay gas or bundle costs transparently in the background, so the chain handles it without interrupting the experience. I've experimented with their SDK on testnet; the flow is clean and predictable—exactly what you'd want when onboarding non-crypto natives.

This approach stands out because it targets the masses who won't study wallets or gas. Other chains push advanced cryptography for scalability and security valuable work but often for audiences already committed to the space. VanarChain builds for those who never will be, prioritizing seamlessness over spectacle.

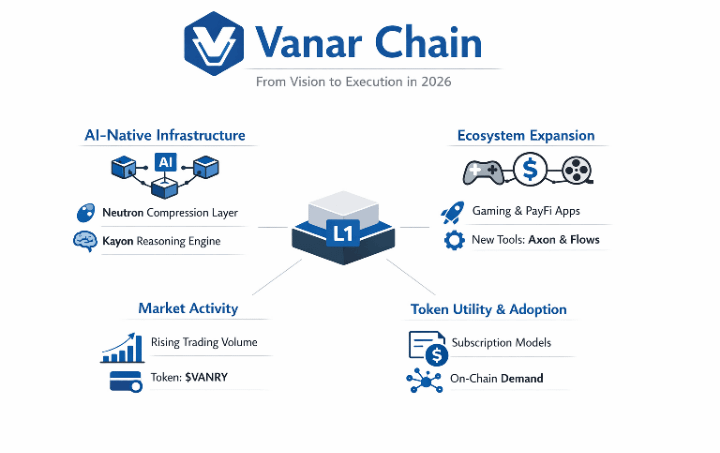

EVM compatibility is the practical enabler here. Developers from Ethereum, Arbitrum, or similar ecosystems can migrate contracts by updating the RPC endpoint no code rewrites, no new tools to learn. It lowers barriers: show better cost predictability and user retention through easier onboarding, and projects move. The Google Cloud partnership bolsters this providing reliable, green infrastructure with strong uptime. When evaluating for brands, studios, or high-traffic apps, the key question is stability under real load, not just theoretical metrics. Google Cloud's backing gives VanarChain a credible answer there.

Under the hood, this reliability shows in handling relentless stablecoin volume: near-zero fees (around $0.0005), fiat-fixed costs that stay steady regardless of demand, fast settlements without congestion. High load reveals the mechanics: fair sequencing (no priority queues favoring large players), dependable paymasters for sponsored transactions, efficient liquidity routing to prevent stuck funds.

What stands out to me is how it performs in production. Recent capital inflows into savings and lending vaults similar to Aave-style or yield integrations drawing significant amounts quickly processed without issues: settlements prompt, fees consistent, no routing breakdowns or pauses. Audits are important, but their true test is live stress; VanarChain's track record here feels earned.

The Bitcoin anchoring adds a subtle security layer periodically writing transaction roots to BTC for external finality, helping stabilize during volatility spikes and reducing risks from internal consensus pressures. The team's communication during any turbulence stays straightforward: clear explanations, fixes outlined, no overpromising. That's transparency that builds quiet trust.

Compare to chains I've watched falter when payments take over gas surges, delays, bridges bottlenecking. VanarChain prioritizes consistent behavior over peak claims, acting like dependable plumbing.

The ecosystem remains early activity modest on the explorer, docs improving but with gaps, APIs sometimes sparse. Yet solid infrastructure often precedes explosive usage; past successes started with foundations ready when demand arrived. VanarChain's goal is clear: let hundreds of millions interact without ever noticing blockchain stable, cheap, hidden.

When volume surges 5x overnight, does your chain still feel like infrastructure or just another bottleneck?