Markets have a way of humbling you when you least expect it.

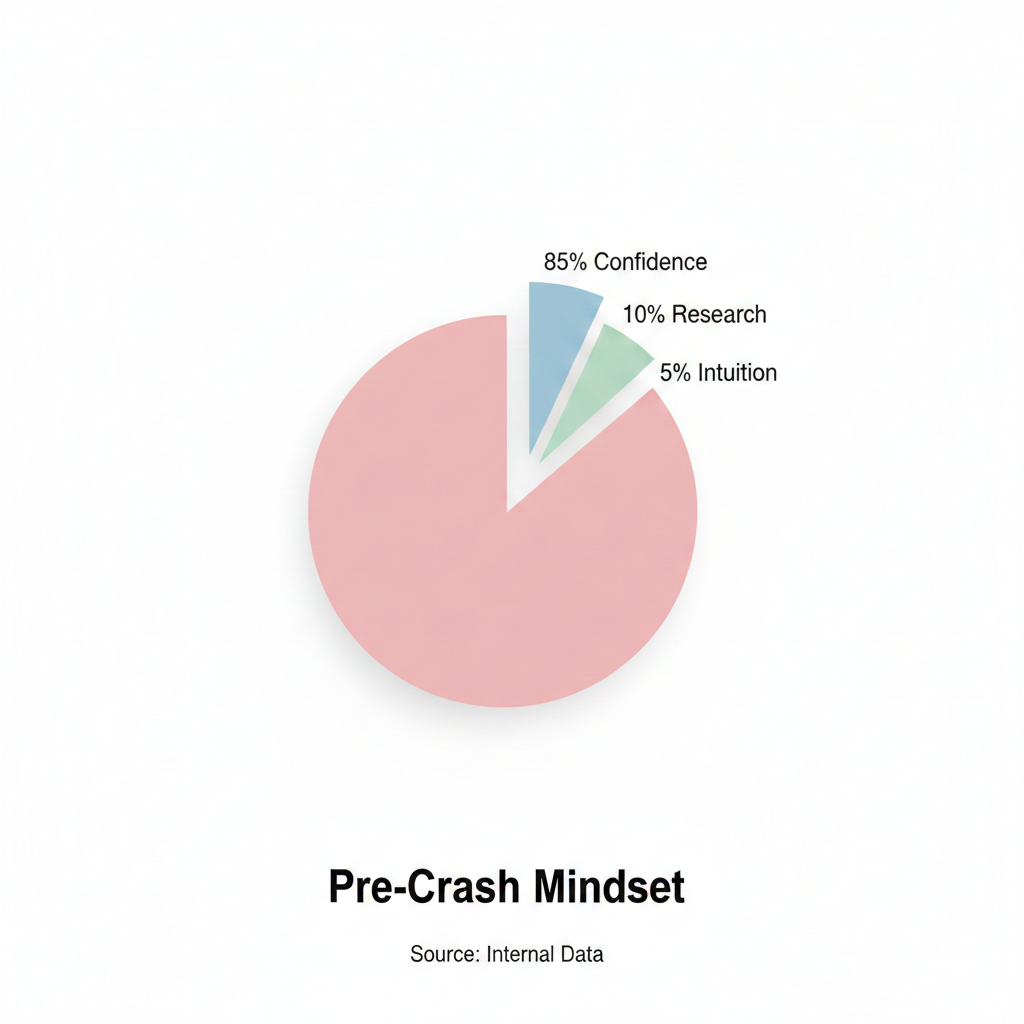

One moment you are confident, tracking charts, watching levels, believing you understand the rhythm. The next moment, everything collapses at once. Prices fall faster than your reactions. Liquidity disappears. Screens turn red. And suddenly, the problem is no longer the market it is your own state of mind.

That day, the market had crashed hard. Not just a small pullback, but the kind of move that shakes people. I wasn’t sitting at a desk or scrolling endlessly through charts. I was outside, sitting quietly by the road, trying to process what had just happened. It wasn’t only about losses. It was about confusion. About not knowing which direction to trust anymore.

While I was sitting there, lost in thought, a familiar figure passed by. It was a friend someone who has also spent years watching markets closely. He didn’t say much at first. He simply placed a hand on my shoulder and said, “Brother, don’t worry. Today I want to tell you about a blockchain that shows a path for people like us.”

That sentence alone was enough to pull me out of my thoughts. I stood up immediately and asked him, almost impatiently, “Tell me quickly. Which blockchain are you talking about?”

That sentence alone was enough to pull me out of my thoughts. I stood up immediately and asked him, almost impatiently, “Tell me quickly. Which blockchain are you talking about?”

He smiled and said one word: Fogo.

At first, I reacted like most people would. In markets, we hear new names every week. New chains, new promises, new narratives. But something about the way he said it felt different. There was no excitement, no urgency, no pressure. Just calm certainty.

I suggested we go to my house and talk properly. He agreed, but with one condition. “Before that,” he said, “you should first understand what Fogo actually is.”

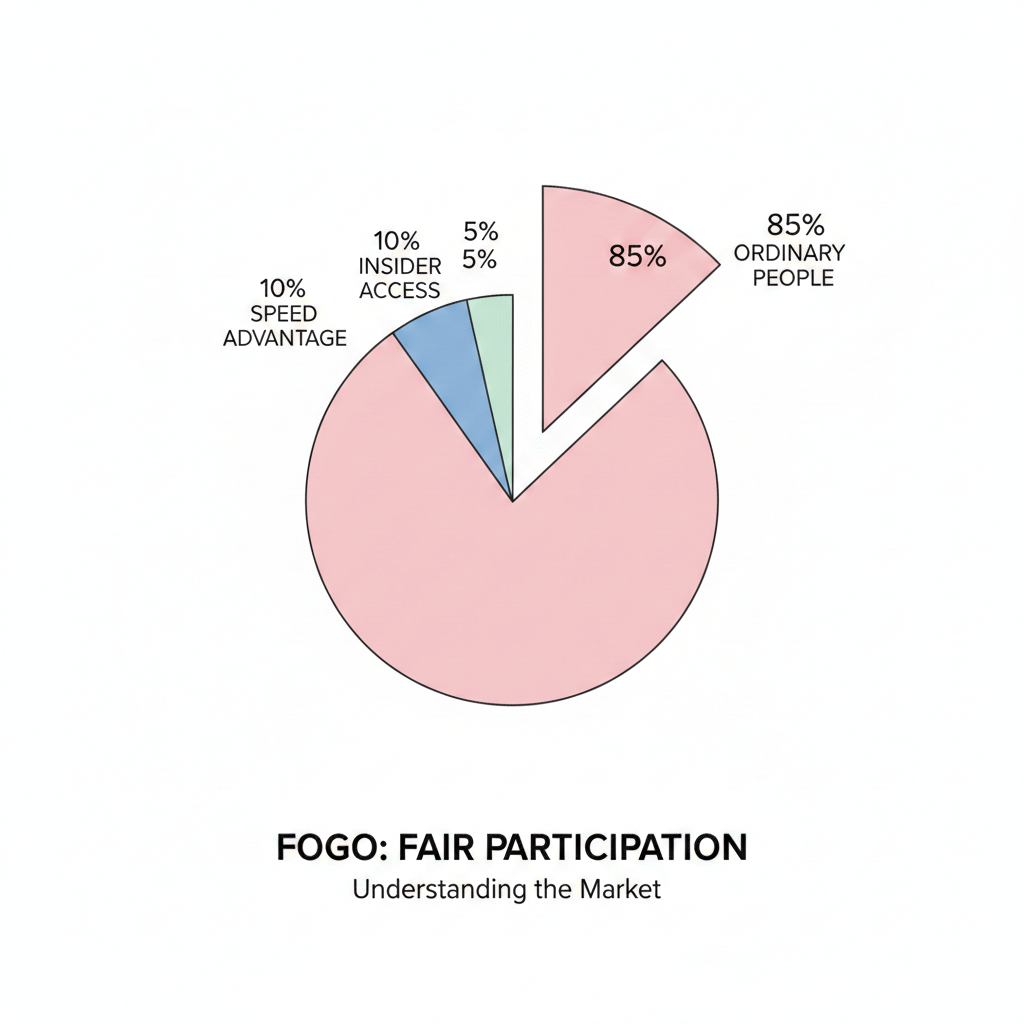

He explained it simply. Not as a shortcut to wealth, and not as a guarantee of profit. He said Fogo is a system where ordinary people — especially those without privilege, inside access, or speed advantages — can participate more fairly if they take the time to understand how the market actually works.

That sentence stayed with me.

Later, at my place, we sat down together and shared a cup of tea. There was no rush. No charts on the screen yet. Just conversation. As we talked, I opened the market again not with excitement, but with curiosity. And that’s when I noticed something interesting. Among the chaos, a signal appeared. It wasn’t loud. It wasn’t trending everywhere. It was simply there.

Later, at my place, we sat down together and shared a cup of tea. There was no rush. No charts on the screen yet. Just conversation. As we talked, I opened the market again not with excitement, but with curiosity. And that’s when I noticed something interesting. Among the chaos, a signal appeared. It wasn’t loud. It wasn’t trending everywhere. It was simply there.

The signal was for Fogo.

That moment didn’t feel like coincidence. It felt like timing.

To understand why, you need to understand what Fogo actually represents.

Fogo is a high-performance Layer-1 blockchain that utilizes the Solana Virtual Machine (SVM). But that description alone doesn’t explain why it matters. Many chains claim performance. Many chains borrow technology. What matters is not what a system claims when conditions are easy, but how it behaves when pressure arrives.

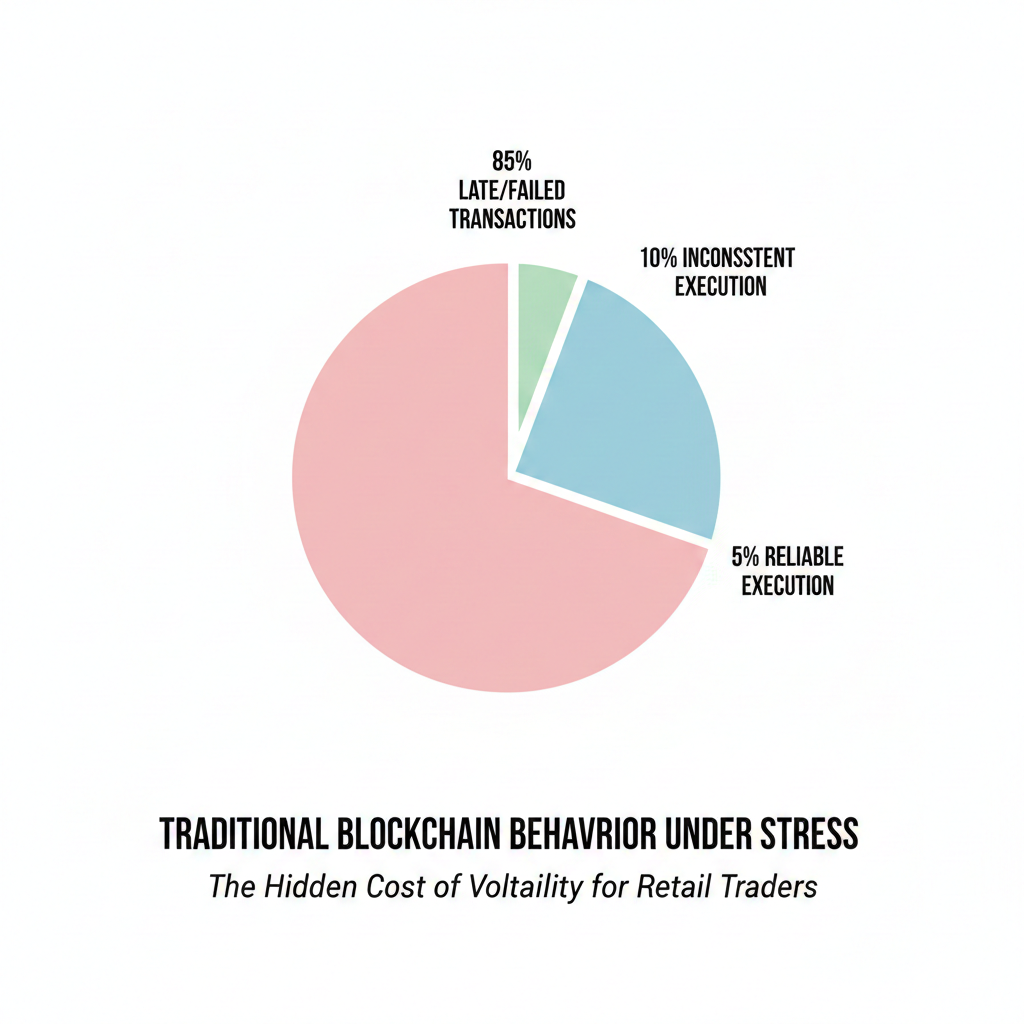

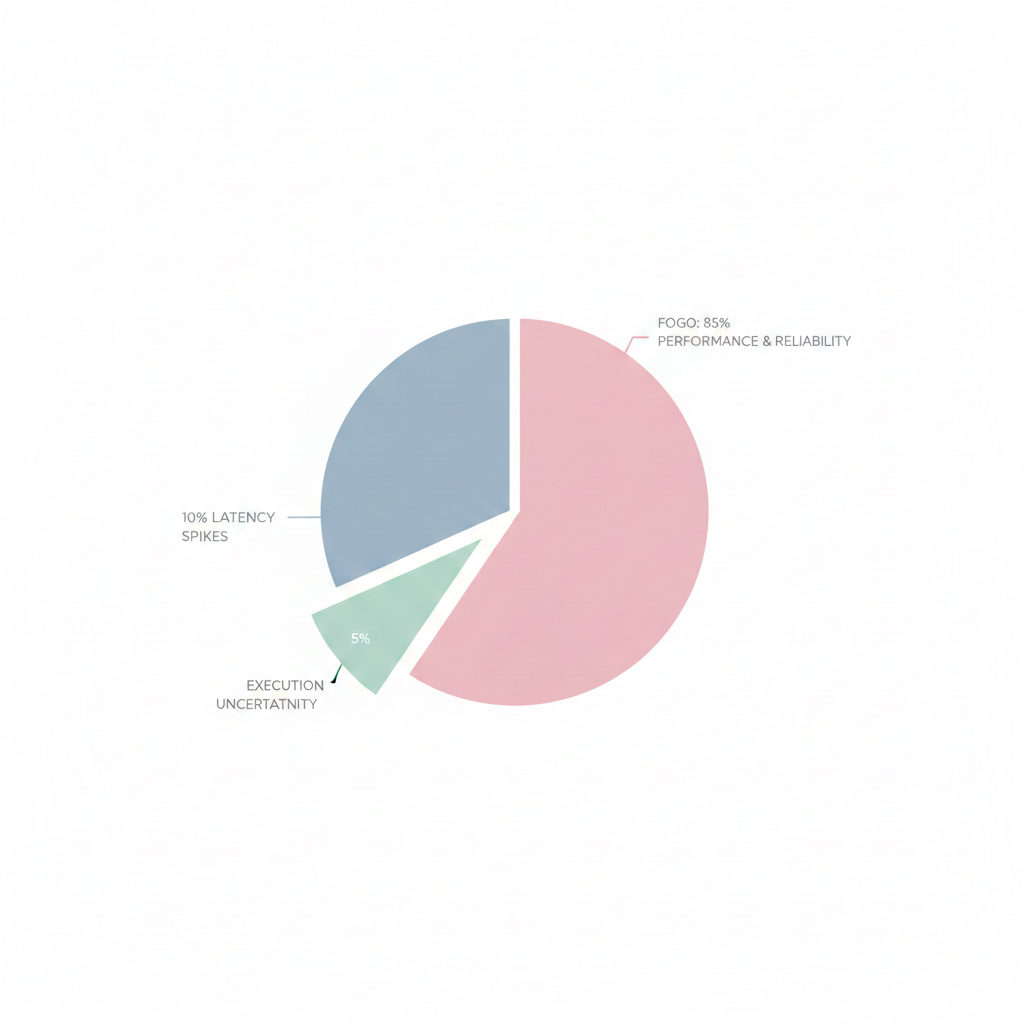

Markets do not fail politely. They fail suddenly. Latency spikes. Transactions compete. Execution becomes uncertain. And this is where most blockchains quietly reveal their weaknesses. Speed on paper means nothing when execution becomes inconsistent.

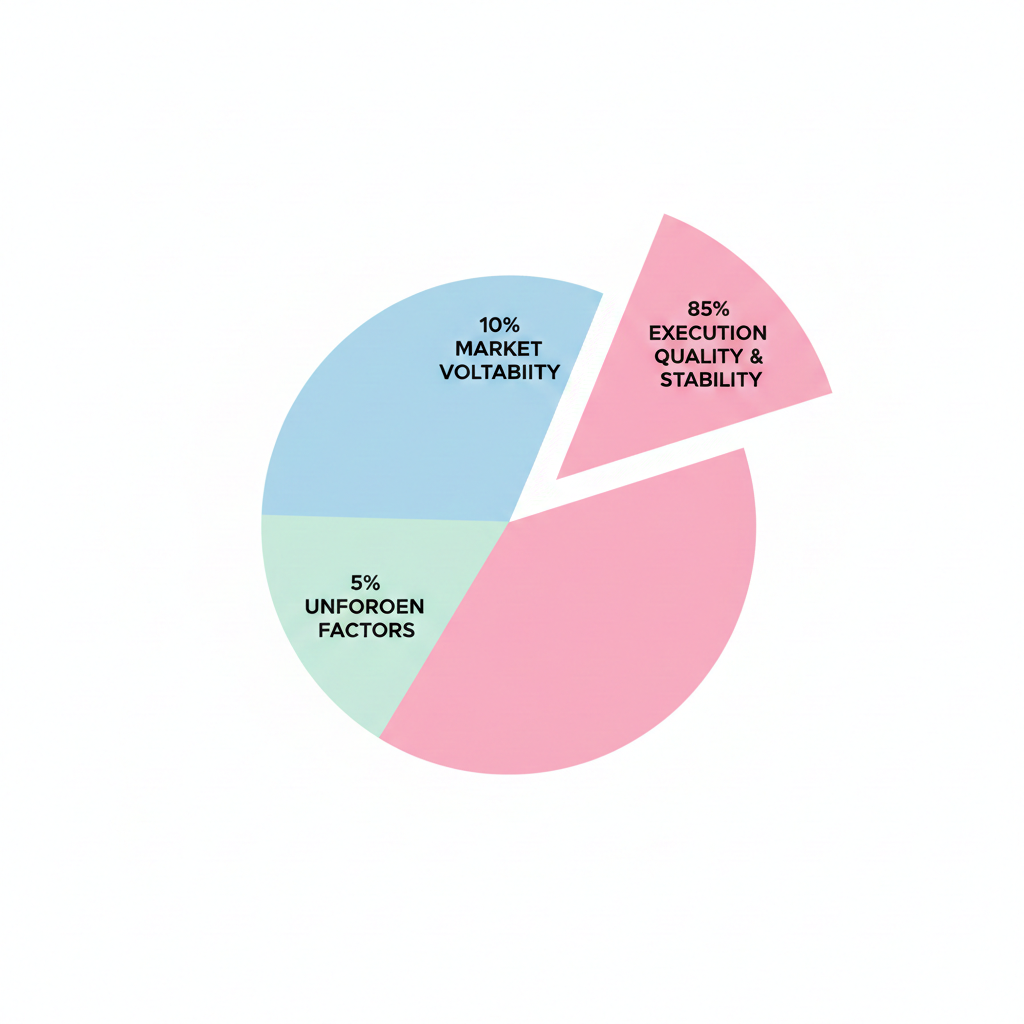

Fogo is interesting because it does not treat performance as marketing. By building on the Solana Virtual Machine, it inherits an execution model designed for parallel processing and predictable behavior under load. That matters for traders and users who are not trying to win narratives, but trying to survive volatility.

Fogo is interesting because it does not treat performance as marketing. By building on the Solana Virtual Machine, it inherits an execution model designed for parallel processing and predictable behavior under load. That matters for traders and users who are not trying to win narratives, but trying to survive volatility.

For people with limited capital, execution quality is not a luxury it is survival. A delayed transaction, a failed order, or inconsistent settlement can erase weeks of discipline in seconds. Wealthier participants can absorb that friction. Smaller participants cannot.

This is where my friend’s words began to make sense.

When he said Fogo shows a path for ordinary people, he did not mean it magically creates profits. He meant it reduces invisible disadvantages. It reduces randomness. It reduces uncertainty in execution. And when systems behave consistently, learning becomes possible.

Markets reward understanding, not hope.

Fogo does not promise easy gains. What it offers is something more subtle: a stable environment where strategy has a chance to matter. Where signals are not distorted by infrastructure failure. Where reaction time is not reserved only for insiders with privileged access.

Fogo does not promise easy gains. What it offers is something more subtle: a stable environment where strategy has a chance to matter. Where signals are not distorted by infrastructure failure. Where reaction time is not reserved only for insiders with privileged access.

That distinction is important.

During our conversation, we didn’t talk about price targets or hype cycles. We talked about behavior. About how traders act when they trust the system they are using. About how confidence doesn’t come from winning trades, but from knowing that losses are your responsibility not the platform’s failure.

As I watched the Fogo signal on my screen, it didn’t feel like an invitation to gamble. It felt like an opportunity to observe. To study. To understand how price reacts when execution remains clean, even during stress.

That is something many people overlook.

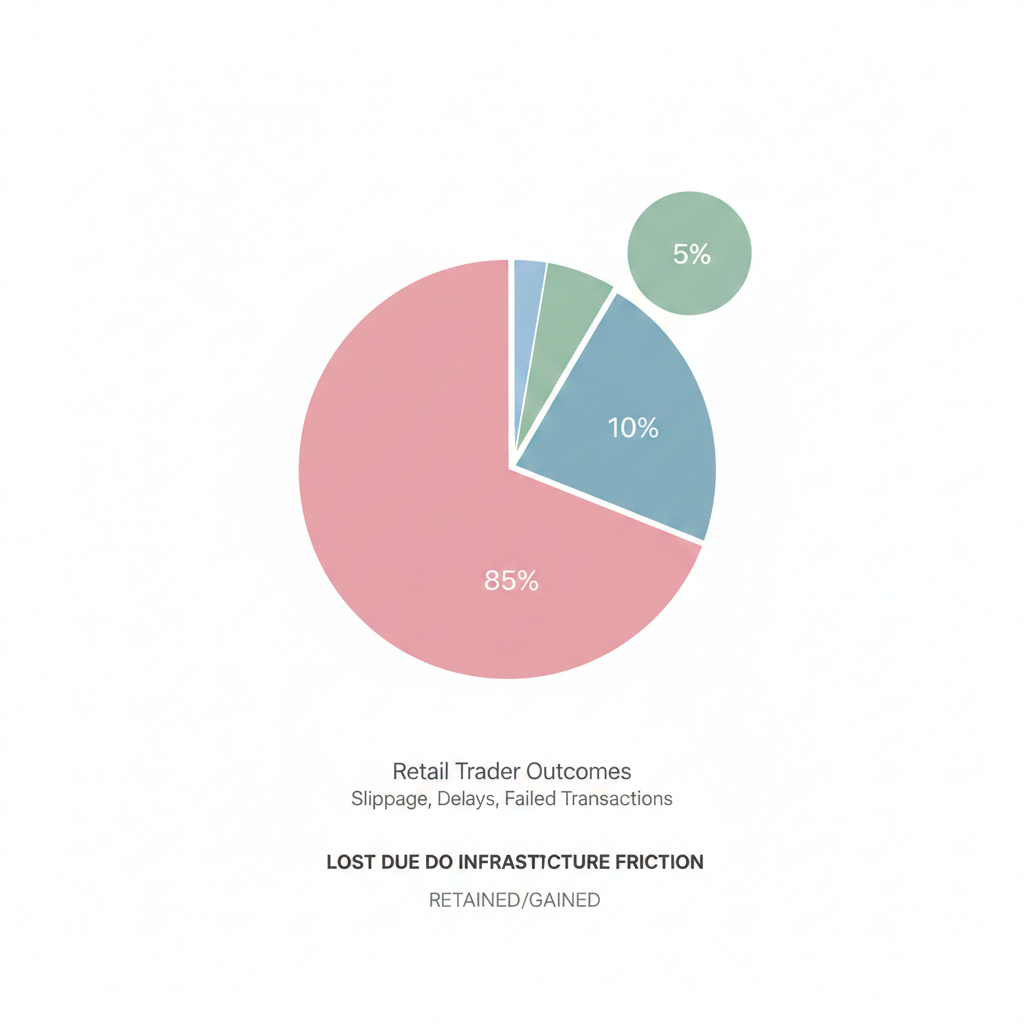

Most retail traders lose not because they are wrong about direction, but because the environment they operate in is hostile. Slippage, delays, failed transactions, and unpredictable ordering quietly drain them. Over time, frustration replaces discipline.

Fogo, by focusing on execution reliability through SVM architecture, tries to remove some of that hidden friction. Not all of it. No system is perfect. But enough to change how participation feels.

Fogo, by focusing on execution reliability through SVM architecture, tries to remove some of that hidden friction. Not all of it. No system is perfect. But enough to change how participation feels.

There are still challenges ahead. Adoption takes time. Liquidity does not appear overnight. New systems must prove themselves across multiple market cycles. Fogo is not exempt from these realities. But what matters is intent. And intent is visible in design choices.

A blockchain built during noisy markets, when attention is scarce and capital is cautious, is forced to focus on fundamentals. It cannot survive on promises alone. It must behave well, quietly, consistently.

That is what stood out to me most that day.

Not the signal itself. Not the name. But the realization that systems shaped by pressure tend to develop discipline. And discipline is what markets respect in the long run.

As we finished our tea, the market outside was still unstable. Nothing had magically improved. But my perspective had shifted. Instead of searching for the next miracle, I started paying attention to how systems behave when things go wrong.

Sometimes, that is where the real path begins.