In a market dominated by noise, professional traders don't follow the crowd—they follow the blueprint. By focusing on quantitative metrics like momentum velocity and trend integrity, we identify high-probability setups before the mass volume arrives.

Our latest scan has isolated three non-stable assets currently showing extreme structural compression.

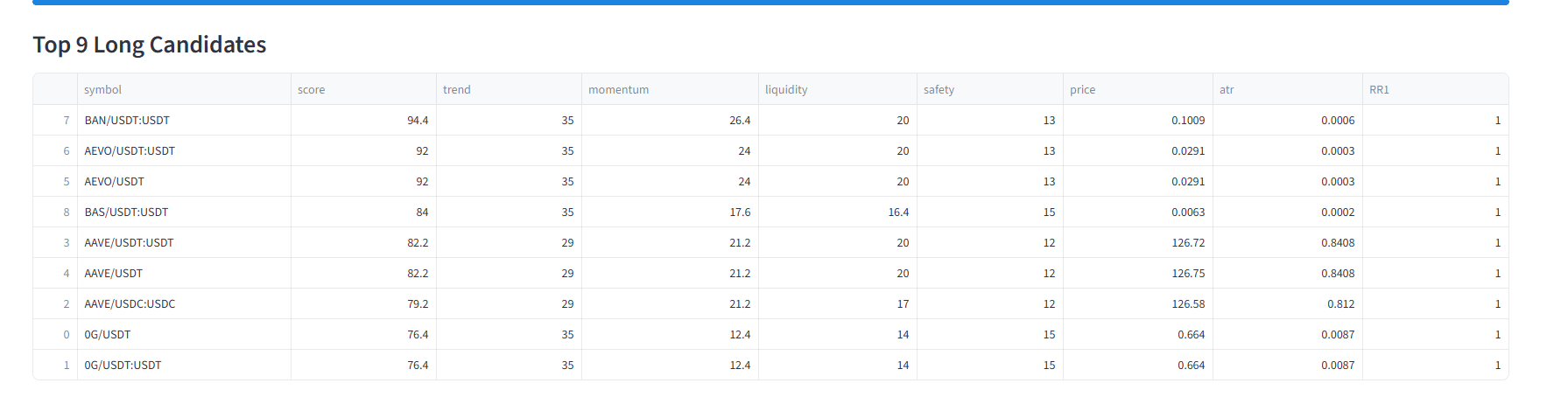

The Quantitative Watchlist

BANUSDTΔιην.0.11736+8.20%

BANUSDTΔιην.0.11736+8.20%

Leading the sector with an elite score of 94.4. With a maxed trend score of 35.0 and momentum at 26.4, the price action at 0.1009 suggests a high-velocity expansion phase is imminent. AEVOUSDTΔιην.0.0268-4.86%

AEVOUSDTΔιην.0.0268-4.86%

Demonstrating exceptional consistency with a score of 92.0. Holding a perfect trend rating of 35.0 at 0.0291, this asset is displaying the classic "coiling spring" effect before a structural breakout. AAVEUSDTΔιην.122.4-3.30%

AAVEUSDTΔιην.122.4-3.30%

A standout in the large-cap category with a score of 82.2. Currently positioned at 126.75, its momentum of 21.2 indicates that institutional accumulation is reaching a tipping point.

The Edge: Trade the data, not the drama. If you can't see the structure, you're just guessing.

Which of these structural setups is on your primary monitor today? Let’s break down the targets! 👇