Since its mainnet launch on January 15, 2026, Fogo has continued expanding its footprint as a high-performance Layer 1 built for ultra-low latency DeFi. Beyond its technical speed, Fogo’s rapid growth has been fueled by a deeply engaged community that plays an active role in shaping the ecosystem through governance, NFTs, and incentive programs.

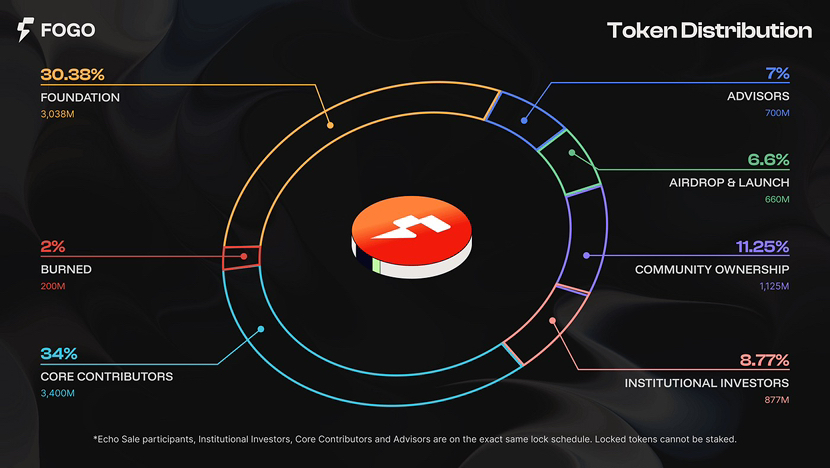

With 15.25 percent of the token supply allocated to the community, Fogo has embedded user ownership into its foundation. This structure has strengthened engagement and positioned the network as a competitive force within the evolving SVM landscape.

Community Building and Identity: The Role of LilFogees

A central pillar of Fogo’s ecosystem identity is LilFogees, the official profile picture NFT collection endorsed by the core team. More than collectible art, LilFogees serves as a symbolic identity layer for early supporters and contributors. For many participants, securing a LilFogees NFT represents alignment with the network’s long-term vision and deeper access to ecosystem incentives.

Community-driven reward programs further reinforce engagement. Flames Season 2, for example, allocates 200 million FOGO tokens to users participating in staking, lending, and other on-chain activities. Earlier airdrops distributed tokens to over 22,000 eligible participants, encouraging ecosystem exploration while extending claim windows to maintain orderly liquidity conditions.

Ecosystem Protocols and DeFi Loops

Fogo launched with more than 10 decentralized applications, including Valiant DEX for spot and perpetual trading, Pyron for lending markets, and Brasa Finance for liquid staking. Together, these protocols form interconnected “DeFi loops” designed to keep capital circulating within the network.

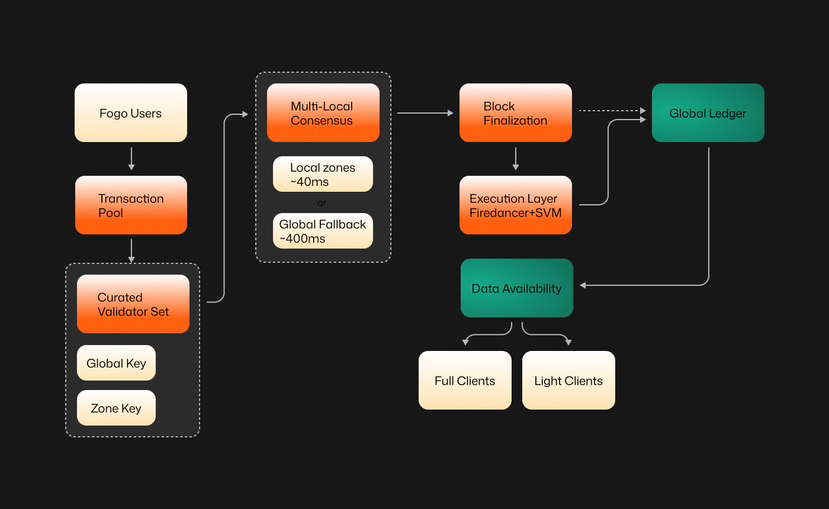

Infrastructure integrations such as Pyth price feeds and Wormhole bridging enhance cross-chain functionality, while Fogo Sessions enable gasless interactions that reduce user friction. Combined with sub-40 millisecond block times, the experience appeals particularly to active traders seeking near-instant execution.

This blend of performance and usability has helped cultivate strong conviction among early adopters despite broader market volatility.

Funding, Tokenomics, and Market Performance

Fogo has raised more than $33.5 million, including a $7 million strategic sale conducted through Binance. The tokenomics model emphasizes long-term alignment, with vesting schedules for contributors and investors to reduce immediate supply pressure.

As of mid-February 2026, FOGO trades within the $0.022 to $0.037 range, experiencing periods of strong weekly momentum amid increased exchange listings and trading pair expansions. Liquidity growth across centralized and decentralized venues has improved market accessibility for participants.

Challenges and Future Outlook

Despite strong engagement, Fogo faces typical early-stage challenges. Post-airdrop selling and scheduled token unlocks beginning later in 2026 may create intermittent volatility. Sustained ecosystem growth and user retention will be critical to maintaining long-term value stability.

Analysts suggest that if adoption accelerates and total value locked continues rising, Fogo could solidify its position as a performance-first SVM chain. Community-led initiatives such as LilFogees and seasonal reward programs may continue driving participation metrics.

Fogo’s combination of technical speed and community ownership distinguishes it within the 2026 SVM cycle. As protocols mature and incentive structures evolve, the network has the potential to become a hub for real-time decentralized finance.

If execution remains strong and community engagement persists, Fogo could emerge as one of the more dynamic ecosystems shaping the next phase of high-speed DeFi innovation.