In trading, knowledge is everywhere.

You can study technical analysis on Binance Academy, watch macro breakdowns on CoinDesk, follow on-chain analysts on X, and memorize every candlestick pattern ever printed.

Yet… most traders still lose.

Why?

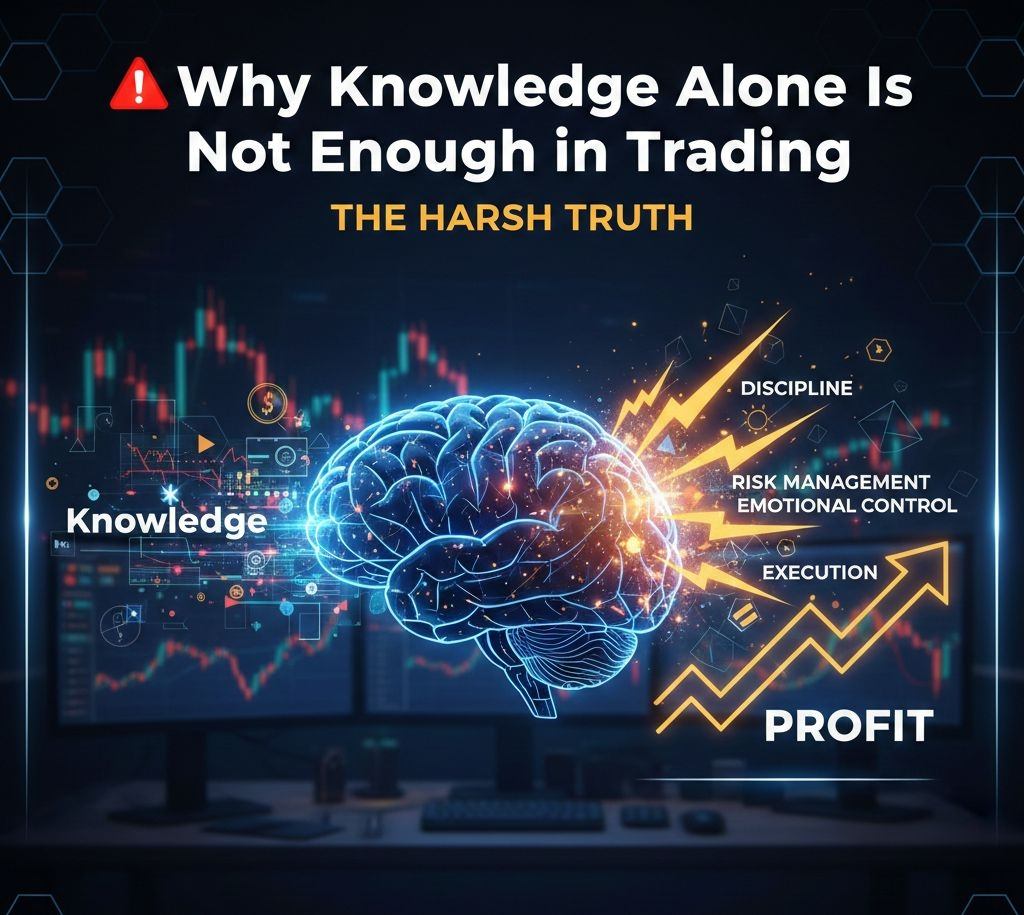

Because in trading, knowing is not the same as executing.

◆ The Harsh Truth Most Traders Ignore

You don’t lose because you lack information.

You lose because of what happens between your knowledge and your execution.

Let’s break it down:

① Knowledge Without Discipline = Chaos

You know you shouldn’t overleverage.

But when the market pumps 10% in minutes, emotions override logic.

➜ You increase position size.

➜ You remove stop-loss.

➜ You turn a trade into a hope.

✔︎ Professionals don’t trade what they feel.

✔︎ They trade what their system allows.

② Strategy Without Risk Management = Gambling

Many traders can explain:

Market structure

Liquidity sweeps

Funding rates

Order blocks

But ask them:

How much of your capital do you risk per trade?

Silence.

Knowledge gives you entries.

Risk management keeps you alive.

Without position sizing and controlled exposure, even a 60% win rate can end in liquidation.

③ Psychology Is the Real Edge

Markets are not just charts. They are emotional battlefields.

Fear at bottoms.

Greed at tops.

Revenge after losses.

The edge isn’t secret indicators.

It’s emotional regulation.

✔︎ Can you follow your plan after 3 losses?

✔︎ Can you take profit without FOMO?

✔︎ Can you sit out when there’s no setup?

That’s where real traders are built.

④ Information Overload Is a Hidden Enemy

In the age of constant updates and breaking news, traders consume more than they process.

Too many signals.

Too many influencers.

Too many opinions.

Result?

◆ Hesitation

◆ Overtrading

◆ Analysis paralysis

Clarity beats complexity.

⑤ Execution > Intelligence

Some of the smartest people fail in trading.

Why?

Because trading rewards:

➤ Consistency

➤ Emotional control

➤ Risk discipline

➤ Patience

Not IQ.

A simple system executed flawlessly will outperform a complex strategy executed emotionally.

➜ What Actually Creates Profitable Traders?

It’s the combination of:

✔︎ Structured strategy

✔︎ Strict risk management

✔︎ Emotional discipline

✔︎ Performance journaling

✔︎ Long-term mindset

Knowledge is the foundation.

But habits build the house.

Final Thought

In crypto trading, information is cheap.

Discipline is rare.

If knowledge alone made people profitable, everyone reading charts would be wealthy.

The difference isn’t what you know —

it’s what you consistently execute when money is on the line.

If this resonated with you:

◆ Comment your biggest trading weakness

◆ Share this with a trader who needs this reminder

◆ Follow for more high-level trading psychology insights

Let’s build discipline — not just knowledge.

#MarketRebound #HarvardAddsETHExposure #BTCFellBelow$69,000Again #OpenClawFounderJoinsOpenAI #PEPEBrokeThroughDowntrendLine