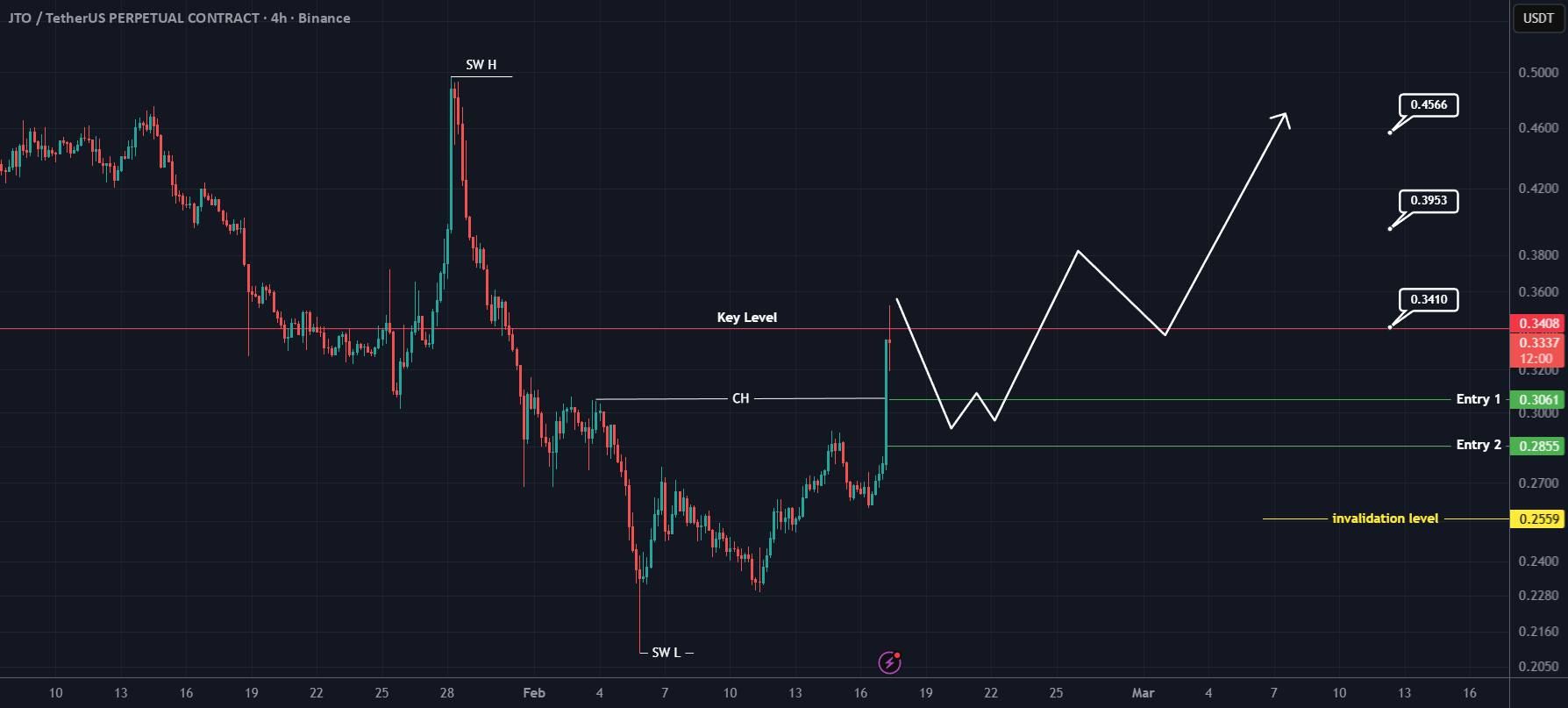

Based on the formation of a Swing Low (SW L) followed by a strong Change of Character (CH) with high momentum and powerful candles, there is a clear opportunity to look for buy/long positions during pullbacks. The reasoning is that if the Key Level is successfully reclaimed, the price could have significant room to move upward, offering a favorable risk-to-reward scenario for traders.

We have identified two entry points for this setup, which should be approached using a DCA (Dollar-Cost Averaging) strategy to manage risk and optimize position sizing. By scaling into the trade, traders can better handle potential volatility while maximizing the potential upside.

All target levels have been clearly marked on the chart for both short-term and primary objectives, allowing traders to plan exits strategically.

It is important to note that if a daily candle closes below the invalidation level, this scenario and the associated bullish signal would be considered void. Traders should then reassess the market and adjust their strategy accordingly.

This setup emphasizes disciplined entry, careful risk management, and the importance of monitoring key levels to take advantage of strong momentum shifts in the market.

If you have a coin or altcoin you want analyzed, first hit the like button and then comment its name so I can review it for you.

This is not a trade setup, as it has no precise stop-loss, stop, or target. I do not publish my trade setups here.