Ever chased a trade in a crypto pump, only to watch your order fill at a price miles away from what you aimed for? That's slippage, the sneaky thief that steals profits in volatile DeFi markets, where prices swing wildly in seconds. In traditional DeFi setups, like those on Ethereum or even faster chains like Solana, slippage hits hard during high volatility because of delayed executions, fragmented liquidity pools, and outdated price feeds. It's like trying to catch a falling knife in slow motion, you end up cut. But in 2026, with DeFi volumes exploding amid institutional adoption and tokenized real world assets, Fogo flips the script. This Layer 1 blockchain, optimized for real time trading, slashes slippage through ultra low latency and smart architectural choices, making on chain trades feel as precise as centralized exchanges. As someone who's lost sleep over botched arbitrage plays in past bull runs, I believe Fogo's approach isn't just incremental, it's a game changer for anyone serious about high stakes DeFi.

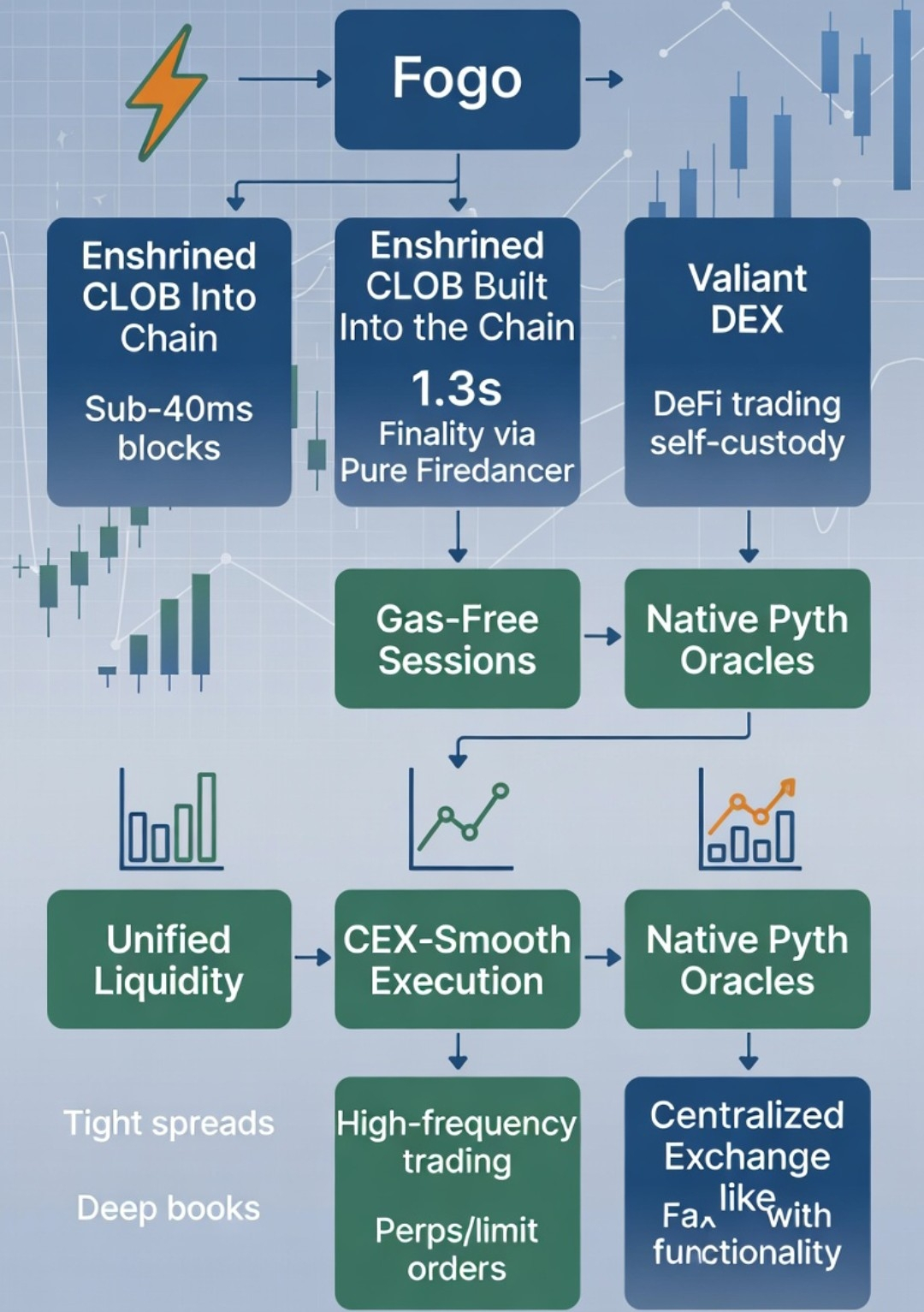

Slippage basics first, for context. In DeFi, it occurs when the executed price differs from the expected one, often due to market movement between order submission and confirmation. In volatile periods, like a sudden meme coin frenzy or macro news drop, this gap widens because blocks take too long to produce, liquidity is spread thin across multiple DEXs, and oracles lag in updating prices. Think of it as ordering a pizza during rush hour, by the time it arrives, the toppings have shifted, and it's not what you wanted. Fogo tackles this head on with its core tech stack. Powered by a pure Firedancer client, originally developed by Jump Crypto, Fogo achieves sub 40 millisecond block times, meaning transactions propagate and confirm almost instantly. This deterministic low tail latency ensures that even in stressed, high volume scenarios, your order doesn't hang in limbo, reducing the window for price shifts. Data from early mainnet tests in January 2026 shows Fogo maintaining 1.3 second finality under load, compared to Solana's occasional spikes beyond 2 seconds during congestion. By clustering validators in multi local consensus zones, like Tokyo or New York hubs, Fogo minimizes physical data travel time, cutting ping delays that exacerbate slippage in global networks.

What really sets Fogo apart is its enshrined central limit order book, or CLOB, baked directly into the protocol. Unlike typical DeFi where liquidity fragments across AMMs like Uniswap clones, Fogo's CLOB consolidates orders chain wide, creating deeper books and tighter spreads. This unified liquidity means larger trades execute with minimal impact, even in volatile markets where a big sell could otherwise tank the price mid fill. Pair that with native Pyth oracles delivering sub second price updates, and you get executions pegged to real time data, not stale quotes. For example, in a high volatility scenario like a flash crash in perps, Fogo's gas free sessions allow rapid, fee less adjustments without compounding costs. Early metrics from Valiant DEX, one of Fogo's flagship dApps, indicate slippage rates under 0.1 percent on average trades, versus 0.5 to 1 percent on competing SVM chains during similar stress. In my experience trading across ecosystems, this level of precision opens doors for strategies like high frequency arbitrage, where every basis point counts.

[Here, insert a line graph comparing average slippage rates during volatility spikes on Fogo versus Solana, Sui, and Ethereum L2s, using data from 2026 testnets and mainnet launches to visually demonstrate Fogo's edge.]

Of course, no innovation is flawless. Risks include the network's reliance on a single client variant, which, while speeding things up, could lead to bugs or centralization if Firedancer hits unforeseen issues. With Fogo's market cap around 85 million dollars and price at about 0.023 dollars as of mid February 2026, volatility remains high, amplified by upcoming token unlocks that might flood supply if adoption lags. Competition from Solana's own Firedancer integrations or Monad's parallel execution could erode Fogo's niche if they match the latency without the specialization risks. Still, opportunities shine bright in a year where DeFi narratives pivot to real time finance, with catalysts like regulatory nods for on chain derivatives drawing institutions. Fogo's focus on slippage reduction positions it as a settlement layer for apps needing CEX like reliability, potentially capturing billions in TVL as tokenized assets surge.

Looking forward, if Fogo scales its hyperscaling roadmap and secures more oracle partnerships, it could dominate latency sensitive DeFi by 2027, turning slippage from a bug into a relic. From my viewpoint, this isn't hype, it's infrastructure solving a pain point I've felt firsthand in choppy markets. Yet, broader crypto downturns or technical hiccups could stall momentum.

[Here, insert a bar chart showing Fogo's key metrics like block time, finality, and slippage reduction versus competitors, overlaid with projected TVL growth in high volatility DeFi sectors for visual emphasis on future potential.]

For investors, here's the distilled advice: treat Fogo as a high conviction play on execution efficiency, not a meme bet. Stake tokens for yields around 7 to 10 percent to offset volatility, monitor on chain volume on platforms like Valiant as a health signal, and enter post unlock dips for better risk reward. Avoid over allocating amid competition, but recognize the upside in a maturing DeFi landscape where reduced slippage means preserved alpha. Ultimately, Fogo makes volatile markets tradable without the usual compromises, and that's a thesis worth exploring.