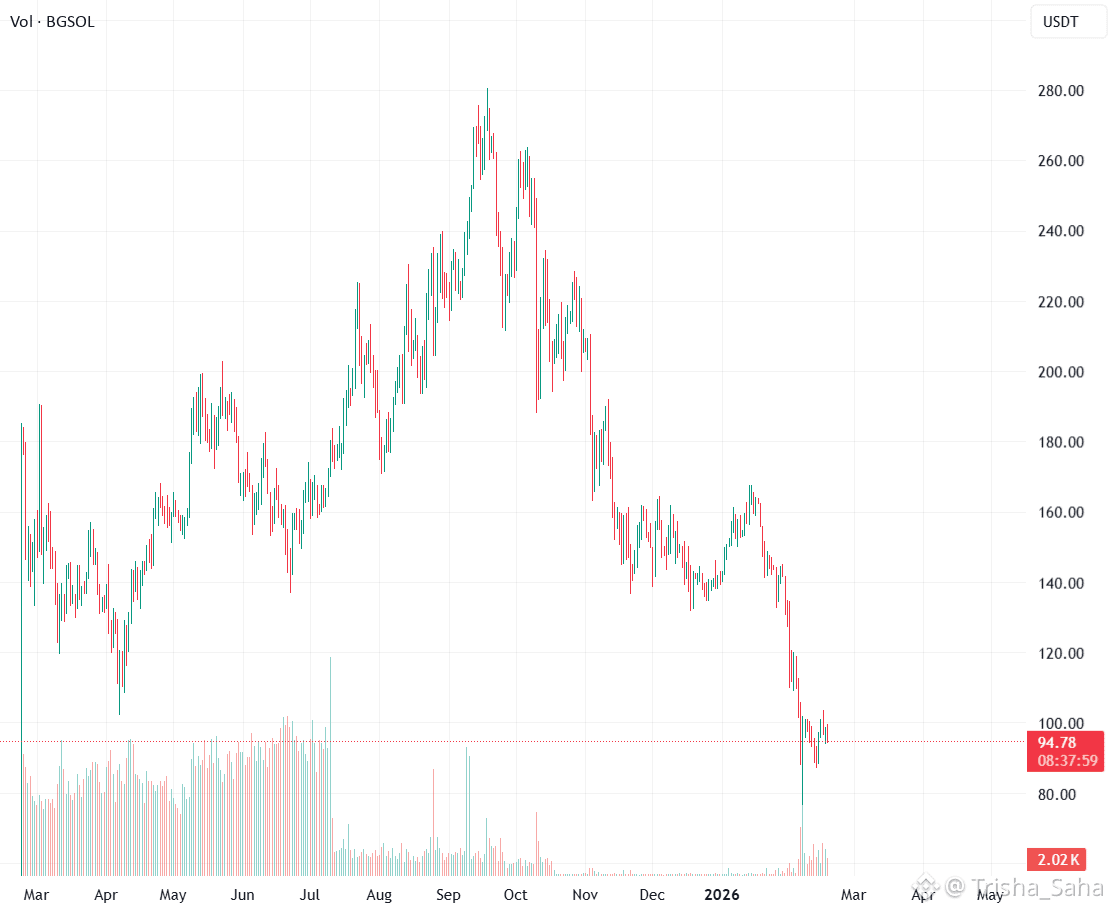

BGSOLUSDT: Pure Spot Breakdown — But OBV Says Someone's Accumulating

📊 Overview

BGSOL presents a rare pure-spot analysis — no futures market exists for this token, meaning everything here is 100% organic price action with zero derivative interference. Despite that structural advantage, the picture is Extreme Bear at 75.86% with a fired squeeze expanding downward. But a critical divergence hides beneath the surface: OBV shows inflow while price breaks down. Someone is accumulating into this sell-off. The question is whether they're early or wrong. In a market with no leverage noise, this divergence carries significantly more weight than usual.

💰 Price

Spot: $94.94

Retrace: -4.6% | Bounce: 1.2% | 0.3x Breakdown 🔴

The 0.3x bounce ratio signals failed recovery — for every dollar lost, only 30 cents came back. Below the 0.5x credibility threshold, but not the catastrophic 0.1x of total capitulation. There's minimal defense, but it's not zero. The -4.6% retrace is moderate in crypto terms — a controlled decline rather than panic. In a pure spot market, breakdowns tend to be more orderly than futures-driven collapses because there are no liquidation cascades to accelerate the move. Every sell is a real seller making a real decision, not a forced liquidation triggered by margin requirements.

📉 Bias

Extreme BEAR — 13.5 / 86.5 across all timeframes

Signals: 7🟢 : 45🔴 / 112

EMA: 0:10 swept | Candle: 3:8 bearish | Ichimoku: 3:10 bearish

C>T: 1:13 | Engulfing: 0:3 | Spread: 73.1% Extreme

Patterns: 0 bullish / 1 bearish | SS/DD: 3:10

Clarity at 46% — moderate. Bias is extreme but conviction hasn't peaked, meaning the move could intensify or be approaching a turning zone. With 7 surviving bullish signals out of 112, there's a faint pulse — unlike the 0/112 seen in total wipeouts. The 3 remaining demand zones represent the last structural support — if these break, no floor beneath. Some bullish signals persisting suggests not every timeframe has capitulated, which in extreme bear contexts can mark either continuation or early stages of a base forming.

📊 Volume — Pure Spot, No Noise

Spot Z: -0.49 Steady — slightly below average but stable. Not climactic selling, not dried up. Steady-state volume during decline suggests orderly distribution rather than panic. Sellers are methodical, not desperate.

Futures: None — no futures market exists for BGSOL. Every price movement is driven by actual buyers and sellers, not leveraged speculators. This makes technical signals here more reliable than on any futures-dominated chart where ghost markets distort reality.

Momentum: -0.42 Falling — volume impulse declining, meaning selling pressure is easing, not accelerating. Often an early signal that the current selling wave is maturing and approaching exhaustion.

F/S Ratio: 0x Spot Dominant 💜 — the purest possible reading. Zero manipulation, zero ghost market, zero leverage theater. What you see is what you get.

S/F Volume: 1.89K / 0 | $179.34K / $0

OBV Z: -0.86 Inflow ↑ — THE KEY DIVERGENCE. Price breaks down and bias reads extreme bear, but on-balance volume shows net accumulation trending upward. In a pure spot market with no futures noise, OBV divergence is one of the most reliable early reversal indicators. Someone with size is buying into this weakness — cumulative buying volume beginning to outpace selling despite bearish price action. This doesn't guarantee reversal, but it means the sell-off isn't unanimous beneath the surface.

Bull:Bear Z: 0.19 : -0.69 — bear Z at -0.69 shows bearish momentum below its own statistical average. Current pressure is actually weaker than historical norms. Combined with OBV inflow, the sell-off may be losing structural steam even as headline bias remains extreme. This internal weakness is easy to miss looking only at the 86.5% headline number.

🔥 Squeeze

Squeeze: 🔥 FIRED! — already detonated bearish

Momentum: Bear ↓ — expanding downward but losing steam

Bandwidth: 4.64% — relatively narrow, suggesting moderate stored energy was released, not extreme.

No secondary squeeze threat — without futures, no cascade risk exists. Single-squeeze market means one wave of energy, not dangerous stacking waves that amplify moves.

Contraction: ↓ 49.1% — already losing momentum rapidly. At nearly 50% contraction, bearish impulse is past peak intensity. Compare to readings above 100% where squeezes still accelerate. This is a maturing move that may have delivered most of its energy. Once contraction drops below 25%, the squeeze is effectively spent.

📐 Leverage

Not applicable — no futures means no leverage data. This eliminates the most common source of false signals in crypto. Every move funded by real capital, not borrowed money. No liquidation levels to hunt, no funding rates to pay, no open interest to unwind. What moves price here is genuine supply and demand — nothing else. Percentile: 50% baseline neutral.

💎 Premium

Not applicable — no futures means no premium/discount analysis. Spot price is the only price. Eliminates premium dislocation risk entirely but removes that informational layer available on other tokens.

🎯 Scenarios

Bearish Continuation (50%) — Fired squeeze still expanding bearish, 86.5% bear bias, 0.3x bounce shows weak recovery. If the 3 remaining demand zones fail, price enters structural free-fall with no support. Steady volume suggests orderly sellers still control the tape.

OBV Divergence Reversal (30%) — The OBV inflow is the strongest counter-signal in this entire analysis. In a pure spot market, accumulation during breakdown often signals informed buying ahead of a catalyst or fundamental shift. If OBV strengthens while price stabilizes, this becomes textbook hidden bullish divergence. The 49.1% squeeze contraction supports fading bearish impulse.

Slow Bleed (20%) — Without futures to accelerate, BGSOL could drift lower over an extended period. Steady volume and falling momentum suggest no urgency from either side. Pure spot trends persist longer but move slower, making timing particularly difficult.

👀 Watch

1. OBV direction — if inflow strengthens to positive Z, accumulation confirms

2. Squeeze contraction — below 25% means bearish impulse effectively spent

3. Bounce ratio — needs above 0.5x to signal credible buying

4. Spot Z — spike above 1.0 on green candle confirms demand stepping in

5. Demand zones — the 3 remaining are last structural support

6. Bull signal count — currently 7/112, expansion above 15 signals shift beginning

⚠️ Risk

Pure spot means no leverage risk, no cascades, no manipulation — but also no short squeeze fuel for sharp reversals. Moves tend to be gradual both directions. The OBV divergence is compelling but unconfirmed until price follows. Trading against 86.5% bear bias requires patience and defined risk — the divergence could take many bars to play out or fail entirely.