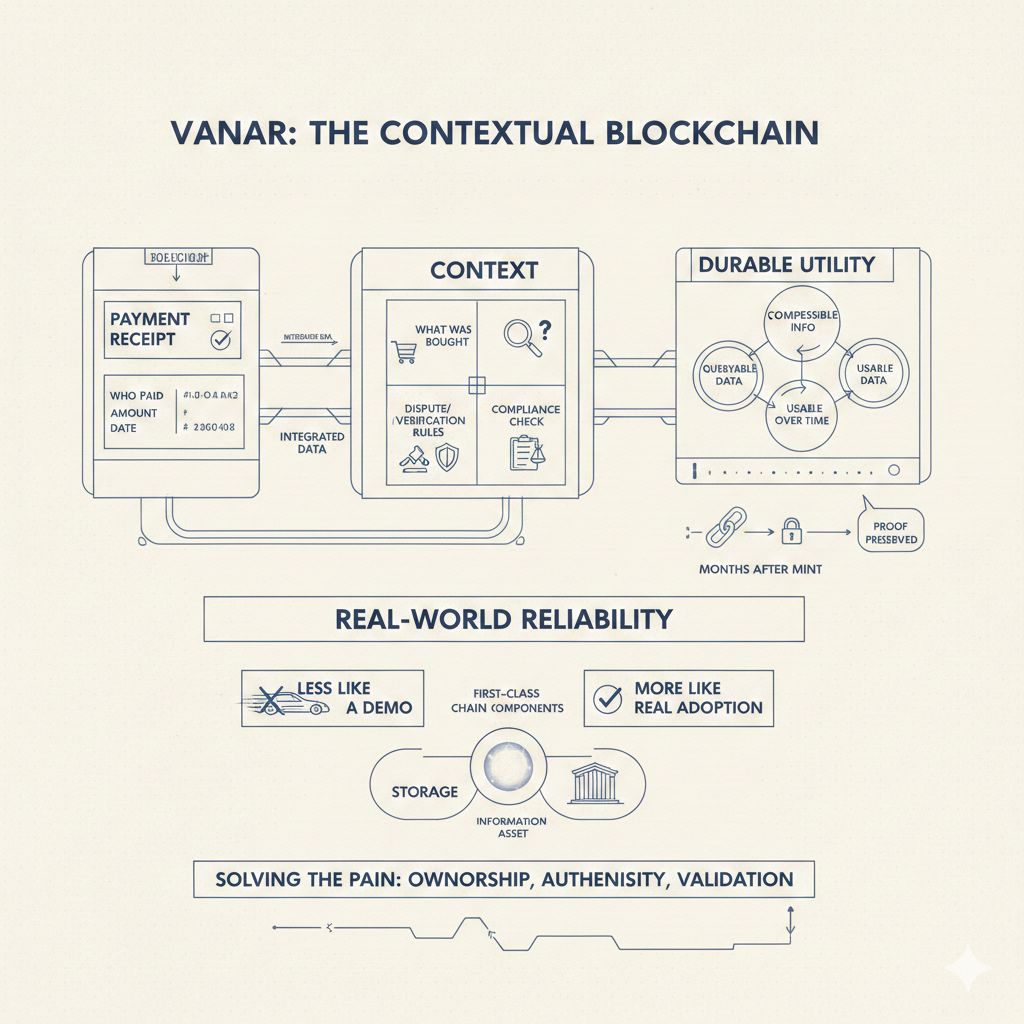

I explain Vanar best when I stop calling it “an L1” and start describing what it feels like in real life. Most blockchains act like a payment receipt. You can prove something happened, but the useful context is scattered elsewhere. Vanar is trying to keep the receipt and the context together, so the chain can hold not only who paid, but what was bought, why it matters, and what rules should apply later if there is a dispute, a verification request, or a compliance check. That is the kind of detail that makes Web3 feel less like a demo and more like something a normal person can rely on.

What pulls me in is the way Vanar talks about storage and logic as first class parts of the chain. The goal is not just to move tokens efficiently, but to make information compressible, queryable, and usable in a durable way. If you have ever tried to track ownership history, prove authenticity, or validate a digital asset months after it was minted, you already know the pain. Links break, files get moved, teams change tools, and the proof becomes harder to reconstruct than it should be. Vanar is betting that real adoption is less about flashy speed claims and more about keeping records in a form that stays useful over time.

That also makes their multi vertical approach feel more coherent. Gaming, metaverse experiences, AI workflows, eco initiatives, and brand programs all live or die on trust and continuity. Users do not wake up excited about block times. They care that their assets still make sense tomorrow, that verification is simple, and that support does not turn into a week of screenshots and guesswork. When a chain can carry context instead of forcing apps to rebuild it offchain every time, it quietly removes the weird moments that scare regular users away.

On the token side, I look at VANRY as the fuel for activity rather than a slogan. Vanar positions VANRY as the utility token for the ecosystem, and the interesting question is whether the chain can create demand that grows naturally with usage. The Ethereum contract footprint gives one hard snapshot of the asset layer. At the time of checking, the ERC 20 page shows a max total supply of 2,261,316,616 VANRY, around 7,482 holders, and about 201 transfers in the last 24 hours. Those numbers do not prove mainstream adoption, but they do show the token layer is actively moving and held by more than a tiny cluster, which matters if the ecosystem wants to scale without feeling closed or artificial.

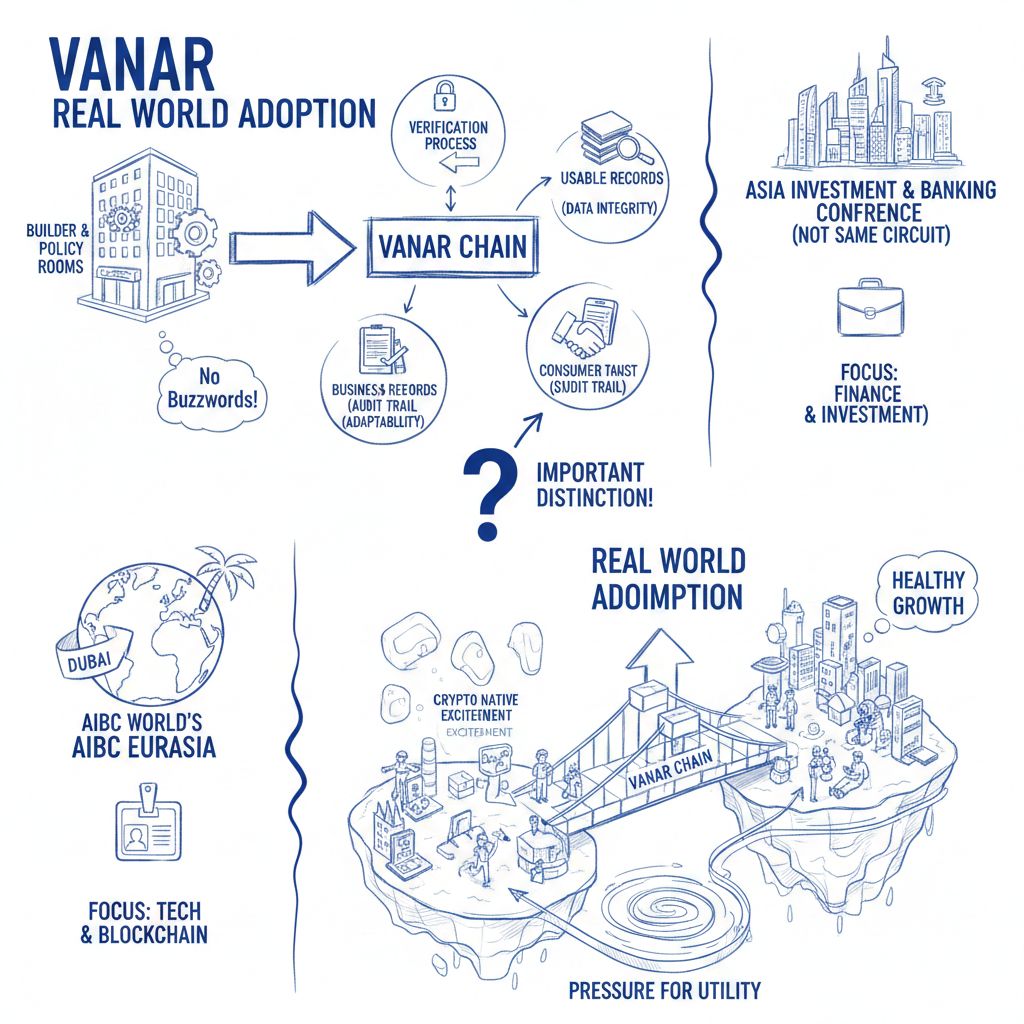

Now the Dubai and Hong Kong detail matters because February 2026 puts Vanar’s story in two serious rooms at the same time. Dubai hosts AIBC Eurasia on February 9 to 11, 2026, an event positioned around AI and blockchain industry conversations rather than purely retail hype. Hong Kong hosts Consensus Hong Kong on February 10 to 12, 2026 at HKCEC, and post event reporting cited 11,000 registered attendees from 122 plus countries or regions.

I like this timing because it forces the project into environments where people ask different questions. In builder and policy heavy rooms, you cannot hide behind buzzwords for long. You have to explain how verification works, how records stay usable, how businesses can trust the trail, and how consumer apps avoid breaking when rules change. That pressure is healthy for a chain like Vanar, because the whole pitch is real world adoption, not just crypto native excitement.

One important note is that AIBC is not a single global event name that always refers to the same organizer. The Dubai event here is AIBC World’s AIBC Eurasia, while AIBC can also refer to a separate Asia Investment and Banking Conference identity that is not the same circuit.

If Vanar does well, the win will not be a loud marketing moment. It will look like quiet reliability. It will look like consumer apps that do not lose context, assets that stay verifiable, and workflows that feel normal even when real world rules show up, which is exactly what a chain needs if it genuinely wants the next billions of users.