Most people watch price.

Very few watch dominance.

And that’s why they get blindsided when altcoins suddenly stop moving — or explode without warning.

Bitcoin dominance isn’t just a chart. It’s a capital flow map.

It tells you where money feels safest inside crypto.

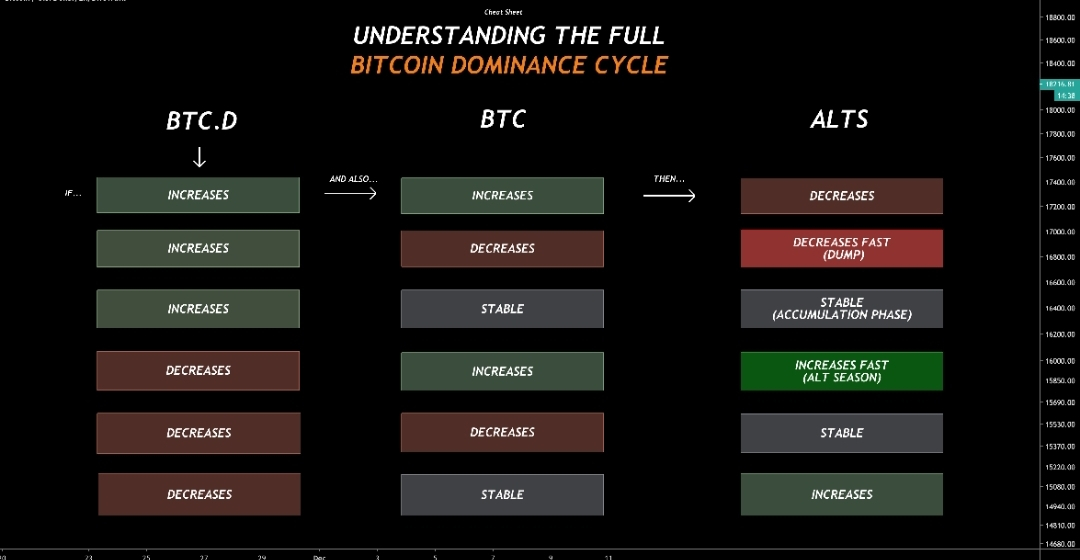

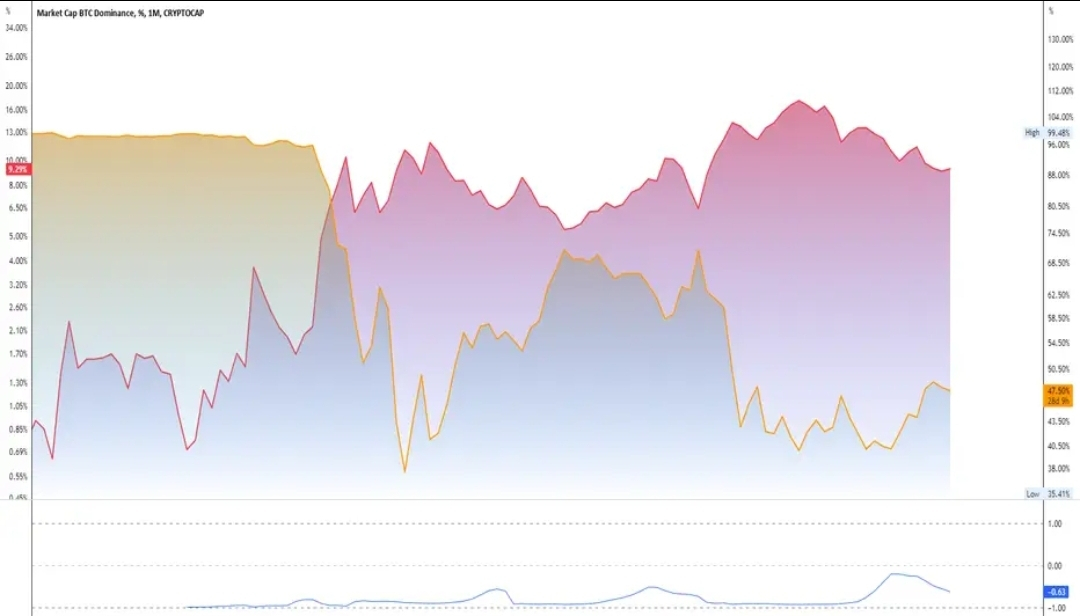

When dominance is rising, capital is concentrating. That usually means one of two things: either the market is defensive, or institutions are positioning primarily into Bitcoin.

In both cases, altcoins struggle.

Retail often makes the mistake of thinking, “If Bitcoin goes up, alts will go up more.”

Sometimes that’s true.

But not in early stages.

Early in a cycle, money flows into Bitcoin first. It’s the most liquid. The most trusted. The cleanest exposure. If large capital is entering through ETFs, custody platforms, or regulated rails, it’s almost always touching Bitcoin before anything else.

Dominance rises quietly during that phase.

Altcoins might move slightly, but they underperform. Traders get impatient. They rotate too early. They bleed against BTC pairs.

Then something shifts.

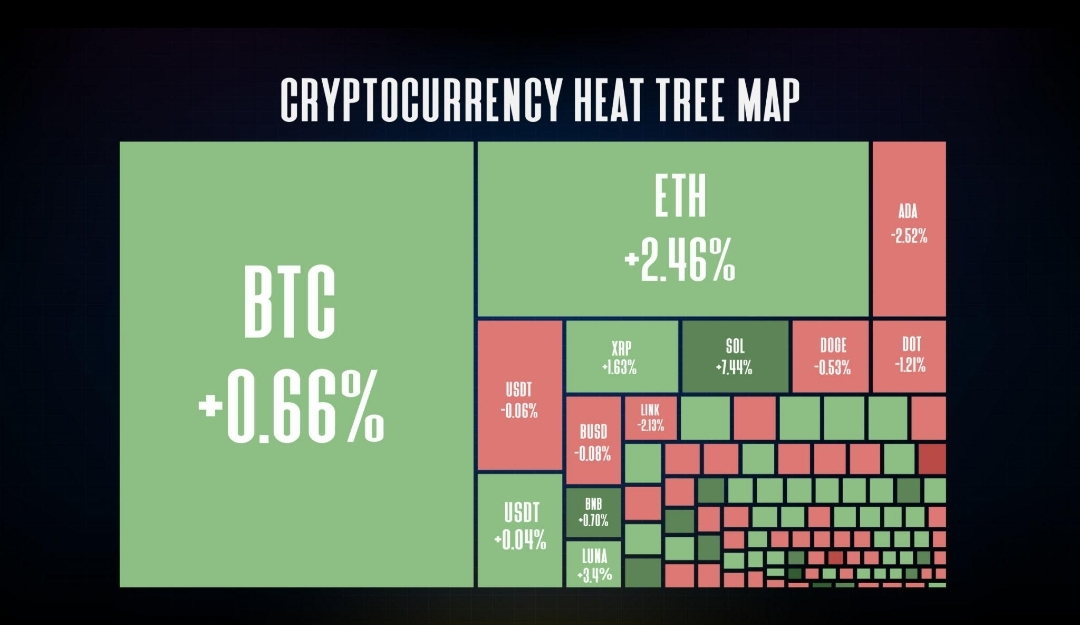

Once Bitcoin has expanded enough and volatility stabilizes, excess profit begins looking for higher beta. That’s when capital starts rotating into large caps — ETH, majors, then mid caps.

Dominance stalls.

Then it rolls over.

That rollover is not random. It’s a signal that risk appetite inside crypto is increasing.

But here’s where it gets dangerous.

Most traders wait until altcoins are already vertical before they realize dominance is falling. By then, the easy part of the move is gone. They chase late, enter crowded trades, and confuse mid-cycle rotation with fresh opportunity.

Dominance also matters in bear markets.

When panic hits, dominance often rises again. Capital flees from illiquid alts back into Bitcoin — or into stablecoins entirely. That concentration effect accelerates altcoin drawdowns.

It’s not manipulation.

It’s liquidity preference.

Another layer most ignore is how dominance interacts with narratives. During strong alt cycles, dominance drops aggressively because speculative capital spreads thin across hundreds of tokens. That environment feels euphoric.

Everything pumps.

Even low-quality coins move.

But that fragmentation of liquidity isn’t sustainable long-term. Eventually capital reconsolidates.

The sharpest traders don’t just ask “Is price going up?”

They ask “Where is money flowing?”

Is it consolidating into strength?

Is it spreading into risk?

Is it exiting the ecosystem?

Dominance helps answer that.

It doesn’t predict exact tops or bottoms. Nothing does consistently. But it tells you the environment you’re trading in.

If dominance is climbing hard, fighting for alt outperformance is usually low probability.

If dominance is breaking down after a strong BTC run, that’s when alt exposure starts making more sense.

Capital rotates in waves.

Bitcoin first.

Then majors.

Then mid caps.

Then speculation.

Then it reverses.

Ignoring dominance is like trading equities without knowing whether the S&P is risk-on or risk-off.

Structure matters more than excitement.

And dominance is structure.