The first time I heard the term Fogo, people were complaining about nothing other than speed, throughput and low latency. I have observed how that cliche was repeated a million times. Fast chains are simple to define and difficult to construct. The other question that prevented me was different.

What does Fogo do when nobody is around to watch him act as an exchange backbone?

I’m not talking marketing. I mean actual operations: the rotation of leadership, area management, the maintenance of the validators, the access of the developers to the reliable assets, and the behavior of the network in the pressure. In that perspective, Fogo is not really a crypto project, but a project that uses real-time systems, which happen to be a blockchain.

This paper is my attempt to describe that angle in the simplest terms.

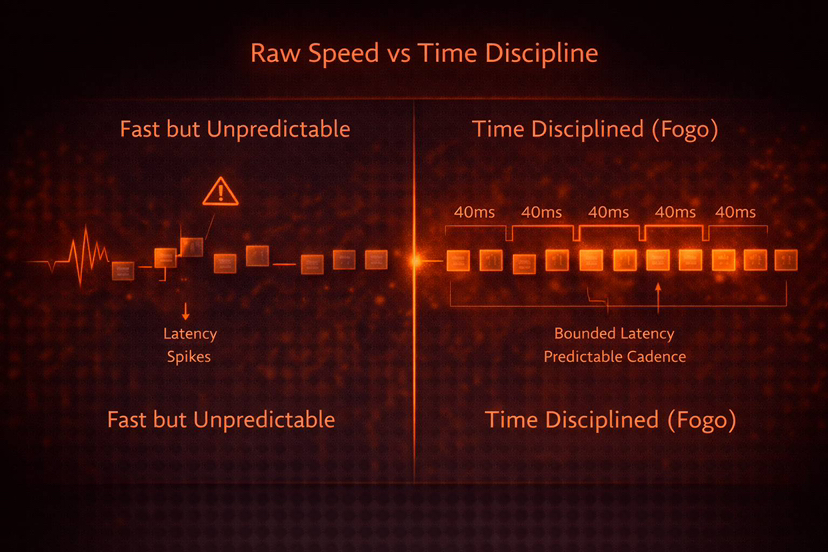

The thesis: Fogo is not only developing speed but also time discipline.

The most expensive issues in trading are not a bit slower. Their unpredictability is timing, intermittent failure, and systems which do not under load behave in the same way that they do during tests.

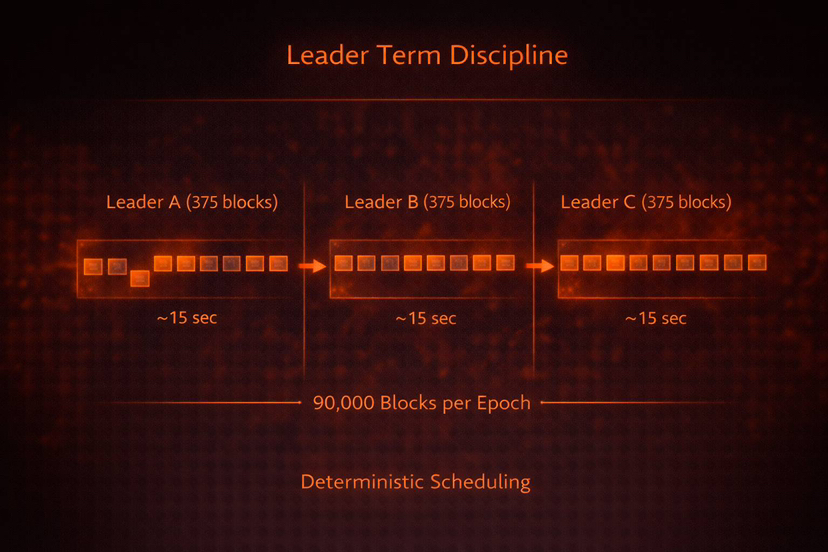

The fundamental design decisions that Fogo makes are based on what I would call time discipline: block production and leadership are predictable, network latency is controlled, and performance is not an open network, but a controlled environment.

Fogo clearly spells out timing parameters even in its testnet setting. The docs established an objective of 40-milliseconds blocks and 375 block leader (one leader generates blocks of approximately 15 seconds and then relinquishes leadership).

That might not be much, but it is an indication of something definite: “we want timing that you can plan upon.

Zones: the exchange concept that crypto does not speak much of.

There is an ugly secret of traditional finance that co-located infrastructure is the best execution strategy. You put systems physically near hardware limits of cut latency.

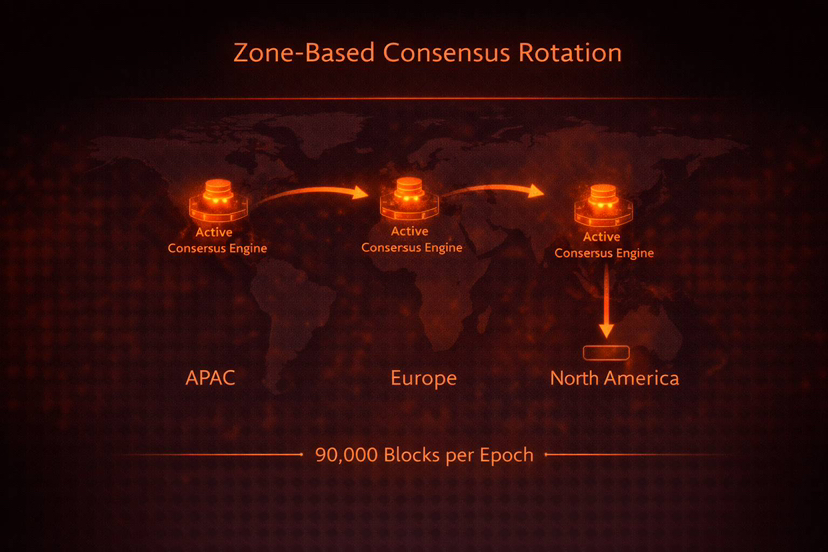

Fogo realizes that fact. It is documented as a zone-based architecture in which validators are run close to each other in order to maximize performance. The objective is ultra-low consensus latency, where zones are represented by geographical span and preferably single data centers.

That’s why I think it matters.

The majority of chains pursue such a slogan as global decentralization, and years later fill performance gaps with quick fixes. Fogo begins by accepting the fact that performance-sensitive markets require co-location, and devises a mechanism to re-distribute that benefit geographically.

Even in the testnet documentation, it is explained that epochs may relocate consensus to other zones with such names as APAC, Europe, and North America.

It is not the story that we are centralized. It is we are serious about the trade-off, and we switch it around.

Why hourly zone rotation is not a mere technical gimmick.

The testnet epochs of Fogo are 90,000 blocks approximately one hour and each epoch shifts consensus to another zone.

An hour is a substantial heart, in relation to trading infrastructure. It is long enough to have a consistent performance monitoring, but not too long to demonstrate that you can work in the regions without one of them becoming a monarch.

This to me is the dark secret: Fogo is conducting an operations rhythm. It is as though to say, we can run this system elsewhere, we can do it again, on time.

That is the most common crypto-network reliability practice disregarded at the outset. It is what exactly institutions appreciate.

Infrastructure layer: RPC reliability and developer access: The boring part.

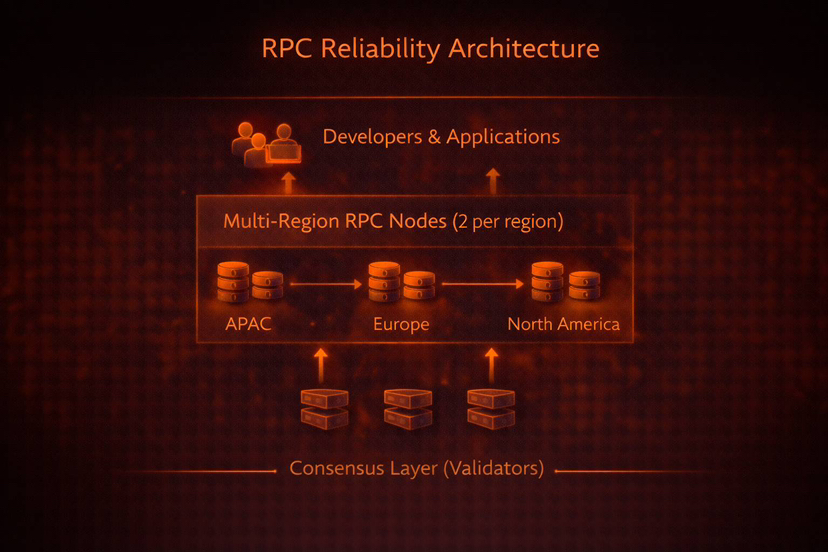

Here is another item that I look into: who invests in the foundations developers actually use.

With spotty RPC access, a chain can spend its time fast but be unusable. It is consensus rather than failed requests, low response times, and broken endpoints that are perceived by most users.

One practical signal I discovered here is the ecosystem team discussions on Fogo. xLabs published that in testnet, it operated six RPC nodes in various regions (two per region) to enhance the access to developers and stability.

This is important as it indicates that the ecosystem has thought in terms of production: multi-region access, redundancy and in the best case, accessibility to developers is in the first-class, rather than the second-class, needs.

I like the fact that xLabs makes it clear that these RPC nodes were not part of consensus and were not validators. They only were to render the network useful.

Such maturity sign can be important. People construct real systems and are concerned with endpoints and not ideology alone.

FOGO as an activity: gas, staking, and validator discipline.

The other angle that is not loud but is significant is the way that Fogo presents its token. The token is used by the validators in its MiCA-oriented whitepaper to process transaction: a gas requirement, as well as a staking requirement: validators need to stake in order to secure the network and receive rewards, and delegators can stake by delegating to validators.

I am not repeating some general token utility. I concentrate on the operational implication.

When your agreement is based on co-location areas and narrow schedule, you must have validators who are professional in their behavior. One of the limited resources of a network to practice discipline is staking: with governance and incentives, bad behavior can be penalized.

The whitepaper on MiCA also categorises the token as a utility token needed to access and interact with the protocol and is stated, there is no issuer in the meaning of MiCA.

No matter, as to whether you pay attention to EU frameworks or not, the longer indication is this: Fogo is thinking in formal system terms, and not in crypto-native language.

The part I come back to is this one.

Everybody can guarantee pace in a smooth demo. The actual test is how the system will remain stable when the network is not idle, when the nodes crash, when regions change and when developers abuse it.

The design decisions that Fogo made, including zoning, deterministic leaders rotation, short leaders terms, and a scheduled epoch rotation are essentially an effort to make the behavior of a public-chain more like an exchange-behavior.

It is not aiming at faking the perfection of the world, but it is trying to control the sources of chaos.

Provided that the network has a consistent execution of execution between the zone switches, it may probably be able to support actual trading volumes. In case it cannot, it might be quick but would not be reliable.

So it should not be Fogo is fast but Fogo is training to become predictable.

In my opinion, the meaning of a performance chain is wrongly perceived by most people.

They tend to believe that performance is bragging rights - in the form of performance poster, benchmark screen shots or viral charts.

Valuable chains are long-term in that they promise performance as a service level.

This is in terms of predictable timing, predictable accessibility, predictable behavior amidst stress, and predictable operation parameters. The test-net documentation provided by Fogo can be seen as an example of this, as it is written by the people who would like to see the system being measured and checked not to be admired.

The fact that the independent infrastructure teams are talking about multi-region RPC deployment and validator testing, demonstrates that the ecosystem is adopting this attitude.

Fogo tries to change the mindset of taking chains as narratives to considering chains as systems.

My verdict: Operational honesty is the most special bet by Fogo.

The new story which I perceive can be as follows:

Fogo tells the truth about the requirements of real-time markets: co-location-like behaviour, limited latency, predictable leadership and infrastructure which can be used as load increases. It attempts to design these conditions and at the same time rotate geography, with the use of staking and validators, and is compatible with the SVM environment.

This is not a simple avenue to take, and it is not the most trending topic on crypto Twitter, since it does not have flashiness.

But when Fogo is successful, it will not have a reputation of being another fast chain. It will be remembered instead as one of the earliest chains to take market performance as an operational discipline, that which is run, watched over, changed and tested, and not just proclaimed.