Crypto markets don’t react to information – they react to the speed at which humans and computers can respond to it.

Crypto markets don’t react to information – they react to the speed at which humans and computers can respond to it.

After having lived through several cycles – from the DeFi summer of 2020 to the AI-powered on-chain automation revolution we’re witnessing today – I’ve observed a subtle shift:

The window between noticing an opportunity and acting on it is shrinking.

This is what I call decision latency, and it’s quietly becoming one of the most decisive factors in Web3.

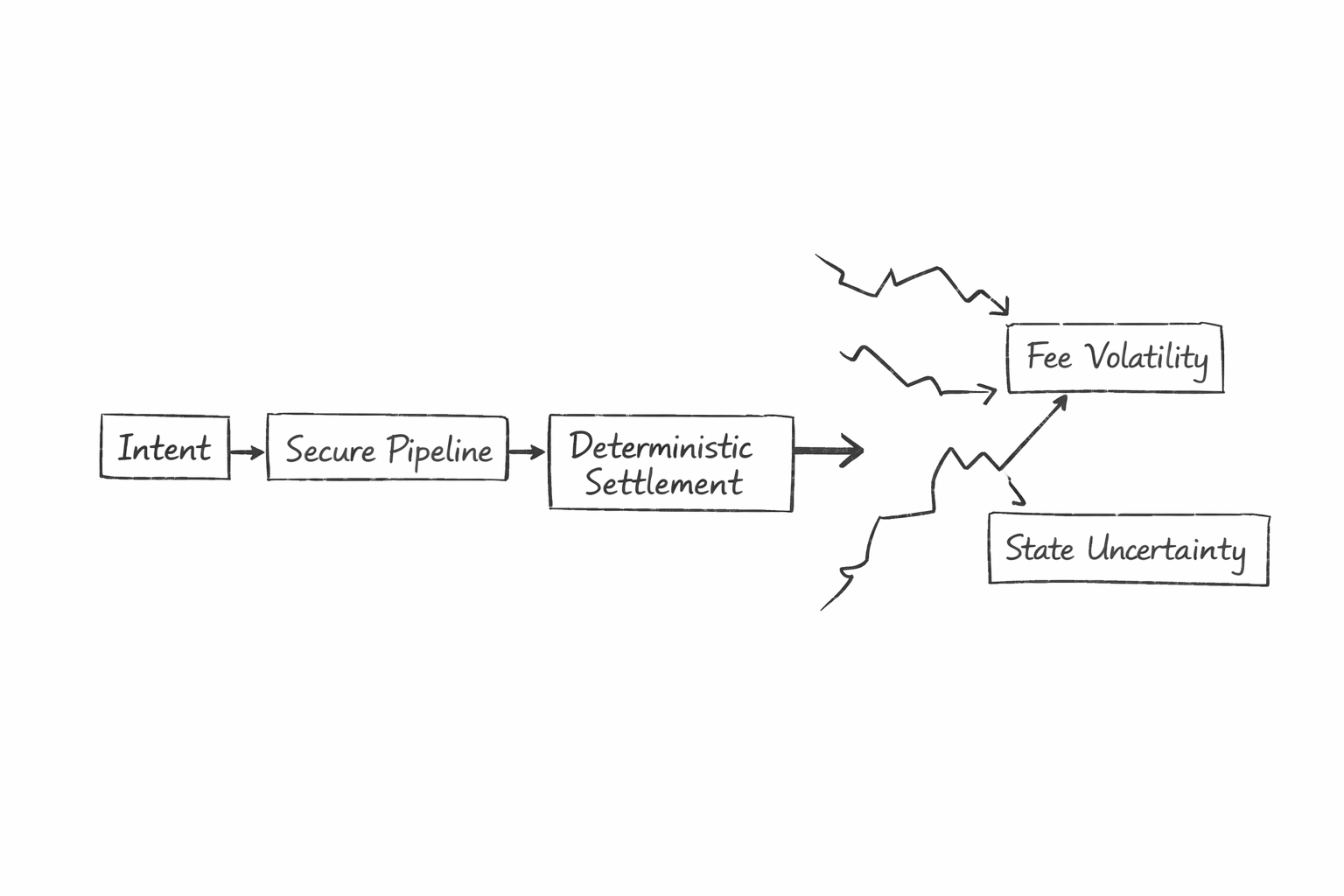

The Hidden Cost of Slowness

In traditional blockchain systems, traders and gamers pay more than just transaction fees.

They pay in latency.

When block times are slow, the time to finality is uncertain, and gas prices fluctuate unpredictably, users no longer act on impulse. They pause. They second-guess. They hold off.

This pause translates to friction:

Traders miss market entries

Gamers experience lag

AI bots slow down execution

Liquidity dries up during market volatility

Slow blockchains don’t just process fewer transactions –

they process fewer decisions.

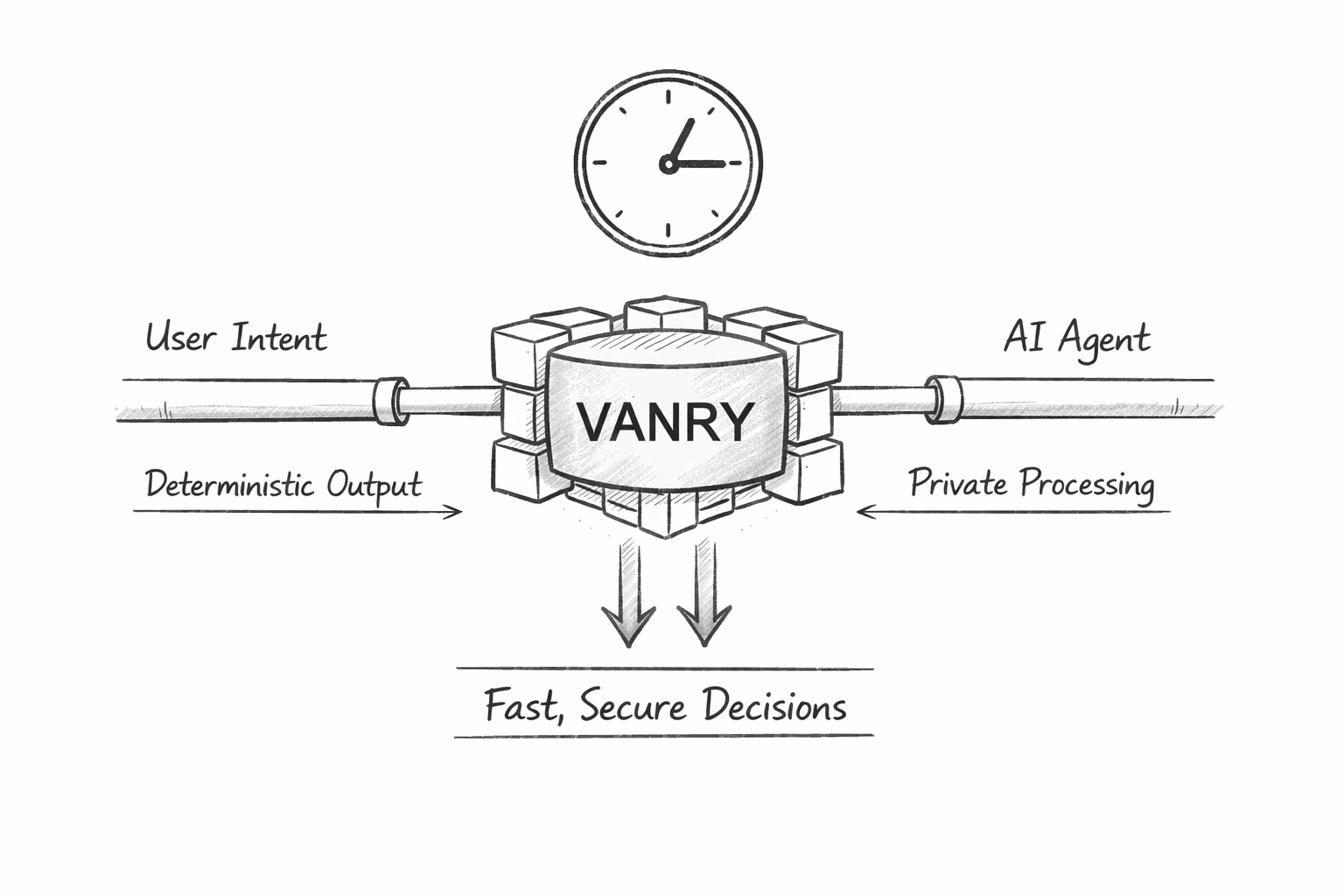

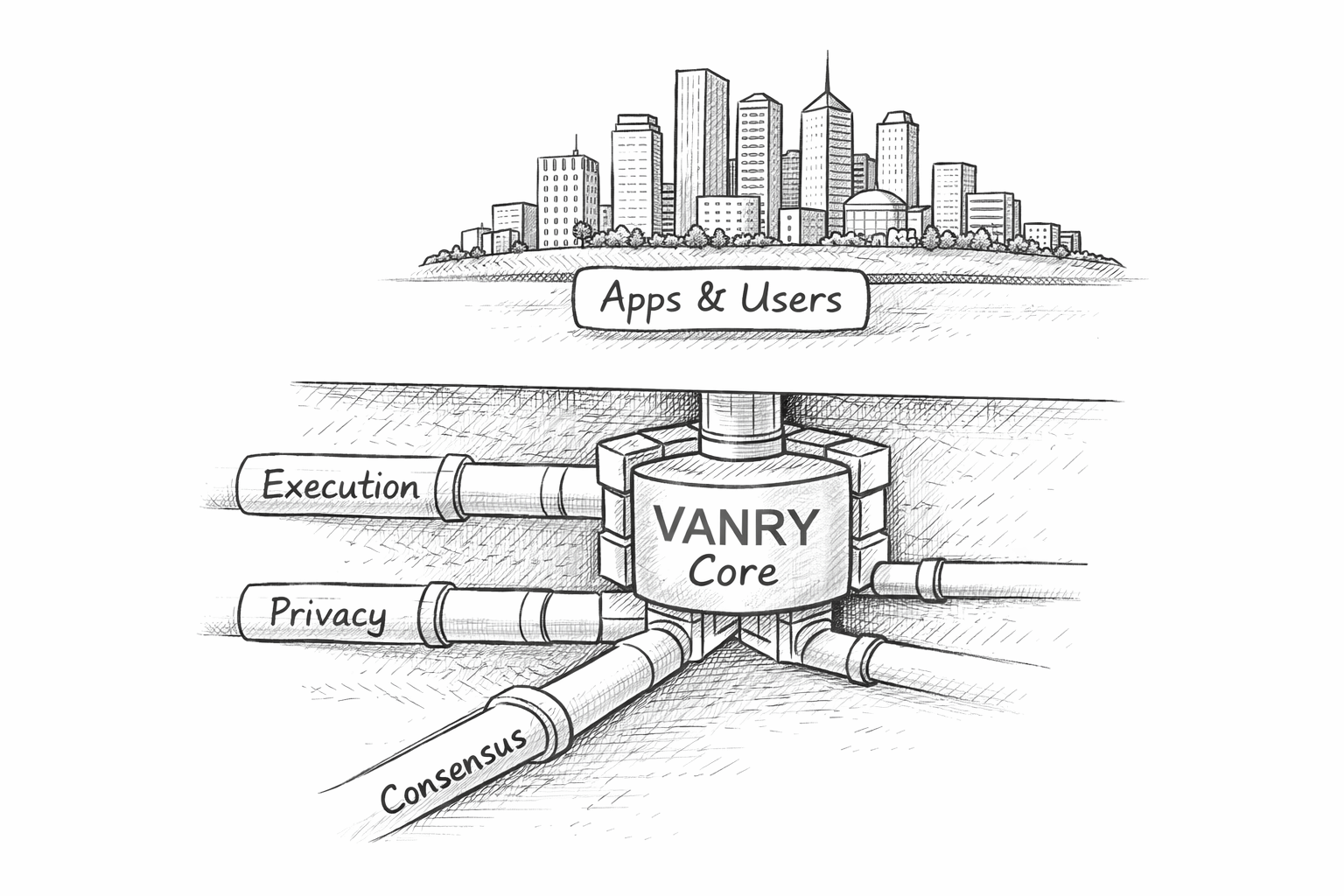

VANRY and the Psychology of Instant Execution

This is where Vanar Chain feels different.

VANRY wasn’t built purely for throughput.

It’s built for something much more nuanced: behavioral compression.

When the finality of transactions is fast and the cost is stable, humans behave in a more natural way.

They don’t think about the chain; they think about their game.

This is incredibly powerful.

In gaming environments, this means that players will no longer treat on-chain actions as “special events” and instead as part of real-time gameplay.

In DeFi, this means that traders can perform multi-step trades without worrying about being stuck in the middle of a trade.

In AI systems, this means that agents can act in real-time rather than batching actions.

This isn’t a technical improvement.

This is a psychological one.

From Web3 to Machine-Native Finance

One of the most significant shifts I’ve noticed in recent times is the use of blockchains by AI agents.

AI doesn’t wait for gas prices to go down.

It doesn’t like uncertainty.

It needs predictable and fast execution.

That’s where the design of Vanar is very interesting.

If Web3 is all about trust decentralization,

AI is all about time compression.

And VANRY is right in the middle of this, a settlement layer that can handle machine-speed decision loops without compromising the user experience.

This is exactly what high-frequency on-chain gaming, autonomous trading, and digital identity infrastructure require.

Why This Feels Like an Inflection Point

Each and every major crypto cycle has been fueled by the removal of a new limitation:

Bitcoin: removed trust

Ethereum: removed intermediaries

DeFi: removed banks

NFTs: removed distribution

AI: will remove human bottlenecks

The next frontier isn’t simply decentralization —

it’s execution velocity.

Blockchains that minimize decision latency will simply absorb:

more trades

more games

more automated agents

more real economic activity

Not because they tout better —

but because they feel easier to use.

And ecosystems that feel easy will grow faster than those that simply look good on paper.

Final Thought

I’m not observing VANRY for the hype.

I’m observing it for behavioral metrics:

Is the user clicking faster?

Are the games playing smoother?

Are the AI agents running more frequently?

Are transactions becoming invisible?

That’s where real adoption appears.

In this cycle, speed isn’t simply a metric —

it’s a mentality.