Most Layer 1s fight on the same battlefield:

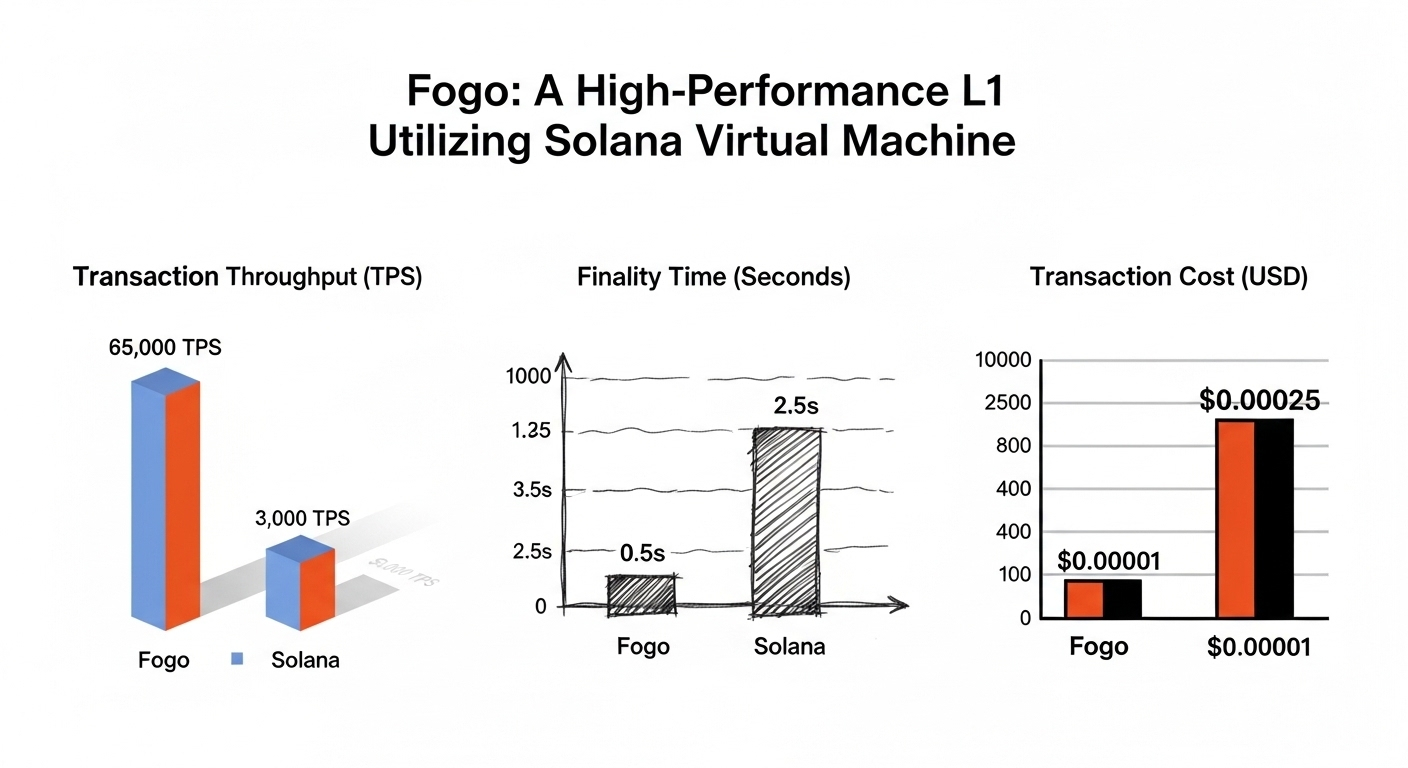

Higher TPS. Lower latency. Bigger benchmarks.Fogo refuses that game.It’s not optimizing for speed.It’s redesigning execution.And that distinction changes everything.Market Quality > Raw SpeedSpeed doesn’t protect traders.

You can have sub-second blocks and still suffer from:

• Slippage

• Order reordering

• MEV extraction

• Toxic order flow

The real tax in crypto isn’t confirmation time.It’s unfair execution.Fogo starts there.Instead of asking “How fast can we be?”It asks “How fairly can we clear?”That’s a shift from latency competition → to price competition.And that’s structural.

Dual Flow Batch Auctions (DFBA) At the center is Ambient’s Dual Flow Batch Auction model.Today’s market structure forces a compromise:

AMMs → Simple, but inefficient in volatility

CLOBs → Precise, but vulnerable to latency games

DFBA changes the rules:

• Orders are batched per block

• Cleared at a single uniform price

• Often anchored to oracle pricing

What disappears?

• Millisecond advantage

• Speed-based arbitrage

• Queue sniping

Everyone clears together.Competition moves from being faster

to pricing better.That’s mechanism design not marketing.Enshrined Exchange: Trading at the Base LayerFogo doesn’t treat trading as “just another dApp.”It embeds exchange primitives into the chain itself:

• Native oracle feeds

• Execution-optimized validators

• Unified liquidity and settlement

Less fragmentation.

Less latency arbitrage.

Less leakage between layers.

It feels less like a blockchain hoping traders show up and more like a purpose-built financial venue.Sessions: Fixing Trading UX

On-chain trading today:

Sign → Approve → Confirm → Repeat.

Fogo’s Sessions model enables:

• Scoped permissions

• Time-limited execution rights

• Sponsored fees

• Fewer wallet interruptions

For automated or professional strategies, this isn’t cosmetic.It’s structural UX reform.Ownership: The Hidden LayerTPS trends on Twitter.Token distribution determines survival.

Incentives shape behavior.If supply concentrates in short-term extractors, liquidity fades when emissions stop.

If it flows to operators, validators, and infrastructure builders, resilience compounds.A trading-first Layer 1 lives or dies on aligned participants.

Culture > throughput.

Final Take

Fogo isn’t building a benchmark.

It’s building a venue.

If DFBA proves durable and ownership stays aligned this could mark a structural evolution in on-chain markets.Speed creates headlines.

Market integrity builds institutions.

And institutions are what endure.