Most people buy gold expecting it to skyrocket the moment inflation hits. But if you look at 450 years of data, you’ll find that gold doesn’t actually "chase" inflation in the short term. In fact, it often leaves investors disappointed during the initial wave. 📉

Most people buy gold expecting it to skyrocket the moment inflation hits. But if you look at 450 years of data, you’ll find that gold doesn’t actually "chase" inflation in the short term. In fact, it often leaves investors disappointed during the initial wave. 📉

Here’s the reality of the "Yellow Metal" that every $PAXG or gold holder should know:

🕰️ The 450-Year Reality Check

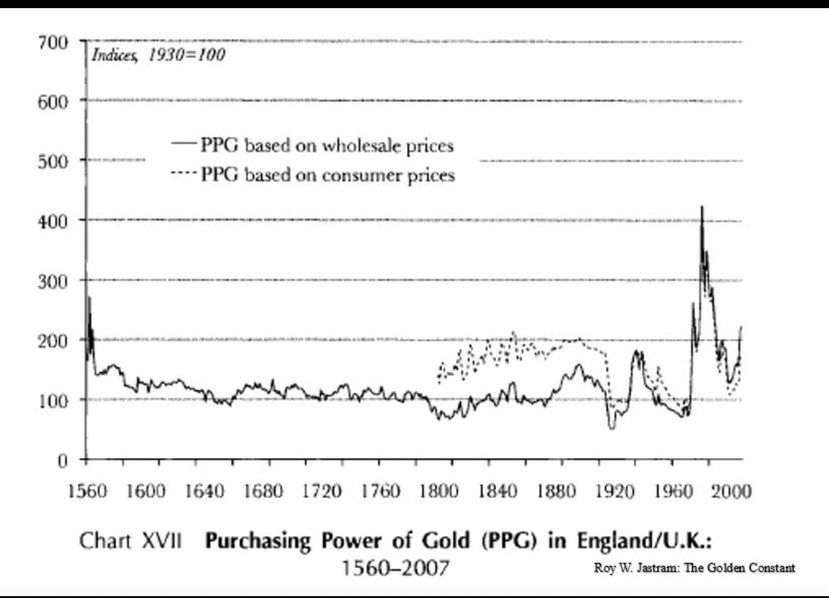

Data from 1560 to today shows a consistent pattern: Gold isn't a tactical tool; it’s long-term insurance.

Short-Term Lag: During high inflation, gold's price often lags behind. It doesn't always spike immediately when the CPI does.

The Reversion: Gold "works" because other commodities eventually revert to its value. Once the inflation wave settles, gold tends to regain its purchasing power while paper currencies stay devalued. 💸

The Nebuchadnezzar Rule: An ounce of gold bought roughly 350 loaves of bread in ancient Babylon—and it still buys roughly that many today. That is zero real return, but 100% wealth preservation.

🛠️ The Correct Role for Your Portfolio

Gold is often miscategorized. To use it correctly, you must understand what it is NOT:

❌ Not a Growth Asset: It doesn't produce cash flow or dividends.

❌ Not a Speculative Flier: It's not meant for "mooning" like a low-cap altcoin.

❌ Not an Instant Hedge: It doesn't always move tick-for-tick with monthly inflation reports.

🛡️ When Does Gold Actually Shine?

Gold functions best when the system itself is under fire. It is your "break glass in case of emergency" asset for:

Severe Deflationary Crashes 🧊

Total Currency Collapses 💵➡️🧻

Loss of Institutional Trust 🏛️

Systemic Monetary Failures ⚠️

The Lesson: Don't buy gold because you think it will make you rich tomorrow. Buy it because it has survived every war, empire collapse, and hyperinflation episode for centuries. It’s not about the price—it’s about the value. 💎