The debate around $XRP is reaching a fever pitch! While day traders are sweating over short-term "red candles," big banks are looking at a much longer—and much greener—horizon.

The debate around $XRP is reaching a fever pitch! While day traders are sweating over short-term "red candles," big banks are looking at a much longer—and much greener—horizon.

📉 THE 2026 REALITY CHECK

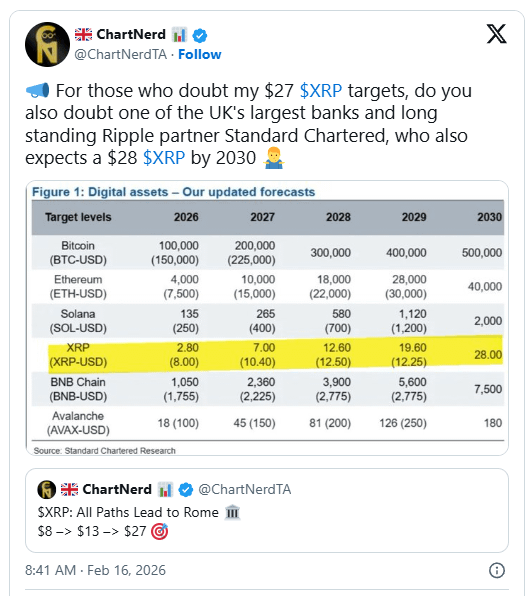

It's true: Standard Chartered recently adjusted its near-term expectations. Following a rocky February 2026, analysts slashed their year-end target for XRP by 65%, moving it from $8 down to $2.80.

The Reason: Slower-than-expected ETF inflows and macro "headwinds" (basically, the global economy being a bit moody).

The Context: They did the same for Bitcoin and Ethereum—it’s a market-wide recalibration, not an XRP-specific exit.

🚀 THE 2030 MEGA-TARGET

Here is the part that’s making the "XRP Army" hold tight: the bank’s 2030 projection remains effectively intact, with some analysts pointing toward $27–$28 based on long-term Fibonacci extensions and structural adoption.

Why the massive gap? Standard Chartered views XRP as financial infrastructure, not just a trading coin.

Bridge Asset: Betting on XRP’s role in cross-border settlement.

Tokenization: As commodities move onto the XRP Ledger (XRPL), the utility-driven demand could decouple price from retail speculation.

Institutional Patience: Banks play the 5–10 year game. They aren't looking at the 4-hour chart; they’re looking at the future of global value transfer.

🎯 THE "SENTIMENT DIVIDE"

We are currently in a "Maturing Market."

The Skeptics: See the 2026 downgrade as a sign of fading momentum.

The Visionaries: See a stablecoin-like floor forming, viewing any price under $2 as a massive accumulation zone for the 2030 "endgame."

The Bottom Line: Standard Chartered isn't saying XRP will "moon" tomorrow. They’re saying it’s a marathon, not a sprint. If you can stomach the 2026 volatility, the decade-end horizon looks incredibly bright. 🌟