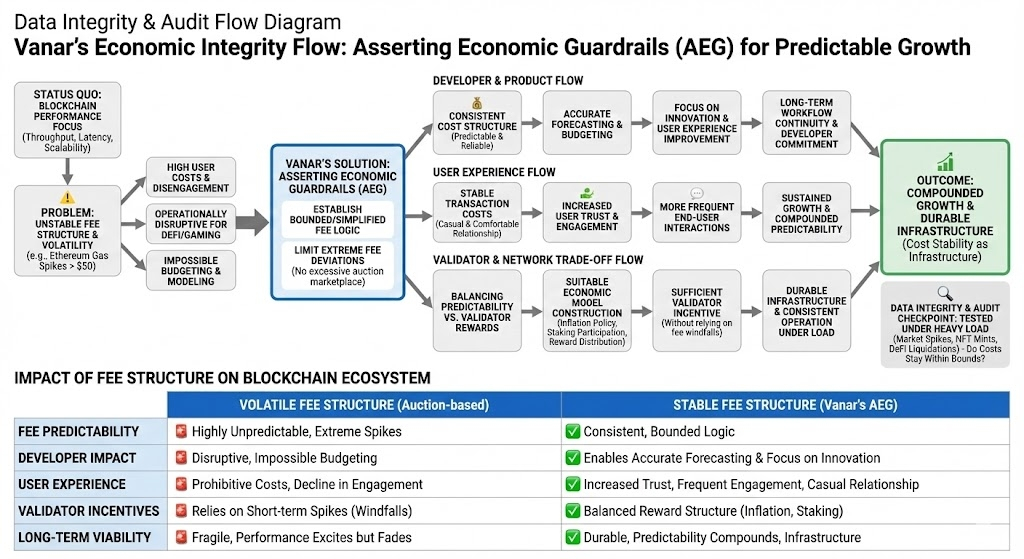

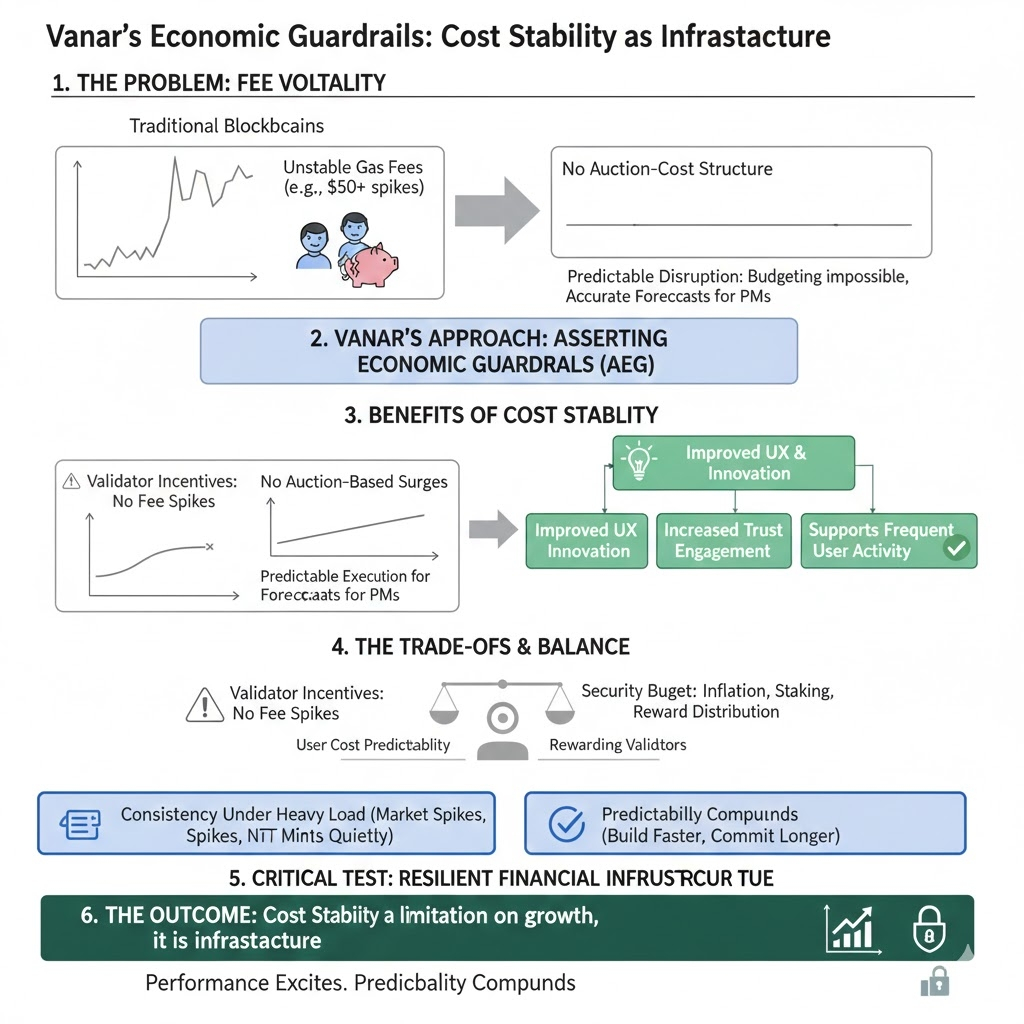

In most blockchain discussions, performance metrics dominate. Throughput, latency, scalability, these are easy to compare and easy to market. Economic structure rarely receives the same attention. Yet for developers building real applications, cost predictability often matters more than raw speed. A network that is fast but economically unstable becomes difficult to operate.

Fee volatility is not theoretical. During peak congestion cycles, Ethereum gas fees have spiked above $50 per transaction. For retail users, that is prohibitive. For DeFi protocols or gaming applications processing thousands of interactions, it becomes operationally disruptive. Budgeting user acquisition or modeling in-app economies is nearly impossible when transaction costs fluctuate wildly.

Vanar uses Asserting Economic Guardrails as its main approach. By establishing a fee structure that limits extreme deviations from the fee structure and does not rely excessively on an auction type fee marketplace that tends to surge when there is increased demand, Vanar provides users with a consistent cost structure that can be relied upon by teams executing contracts and product managers.

Stable transaction costs enable product teams to focus on improving the user experience through innovative design, provide value through technology, and establish a more casual and comfortable relationship with the end user.

The importance of having a stable fee structure is particularly significant for applications that process large numbers of transactions or for applications that are used by consumers. Stable fees result in increased trust and increased engagement by end users. Conversely, unstable fees will result in a decline in user engagement. Ultimately, a stable fee structure supports more frequent user engagement than an unstable fee structure.

However, establishing predictability has trade offs. Validators, for example, tend to benefit from a fee spike during times of congestion. Balancing fee predictability or smoothing fee dynamics may prevent validators from benefiting from short term market fluctuations. Consequently, constructing a suitable economic model requires a balance between the need for user cost predictability and the need to reward validators. Constructing the security budget to support the network's value will, for example, include inflation policy, staking participation, and reward distribution. In addition, if, for example, the percentage of supply staked is between 60%-70%, reward structures must be designed to provide validators with sufficient incentive to participate without being dependent upon the receipt of fee windfalls.

The positioning of Vanar implies that the most important factor is that it provides a consistent operation. Developers of multi chain network applications are looking increasingly at how well different networks support long term workflow continuity. Subtle differences in gas account balances, fee spikes due to unforeseen circumstances, and governance induced changes in parameters introduce friction. Consistent performance under heavy loads on a chain will make that chain more valuable when creating long term application roadmaps.

However, these attributes must demonstrate consistency when they are tested under heavy load. Market spikes, NFT mints, and DeFi liquidations are examples of a way in which this is measured. Do costs actually stay within assumed bounds? Does governance resist the temptation to alter fee mechanics opportunistically?

Economic guardrails are less visible than TPS claims. They do not generate speculative excitement. But they shape behavior quietly. Teams that can model costs accurately build faster and commit longer. Users who encounter stable pricing return more often.

Vanar’s thesis is straightforward: cost stability is not a limitation on growth, it is infrastructure. The market will ultimately decide whether that discipline is durable. In volatile systems, performance excites. Predictability compounds.